Vitalik unveils Ethereum 2024 Roadmap

*All on-chain data is dated as of 12:00 a.m. EST on Sunday, December 31st.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Dec.24 - 30).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #Jobless #GBTC

1 Macro Market Overview

U.S. Stocks end a topsy-turvy year near records, defying bearish predictions. According to WSJ, the S&P 500 finished the year up 24%, just 0.6% from its January 2022 record. The Dow Jones Industrial Average advanced 14% to top 37000 for the first time and set seven record closes in the final days of 2023. A mania surrounding artificial intelligence and big technology stocks sent the Nasdaq Composite soaring 43%, its best year since 2020. Initial jobless claims, considered a proxy for layoffs, were 218,000 in the week ending Dec. 23, the Labor Department said Thursday. That was slightly more than 215,000 that economists expected, and marked the latest sign that the economy is cooling at a gradual pace.

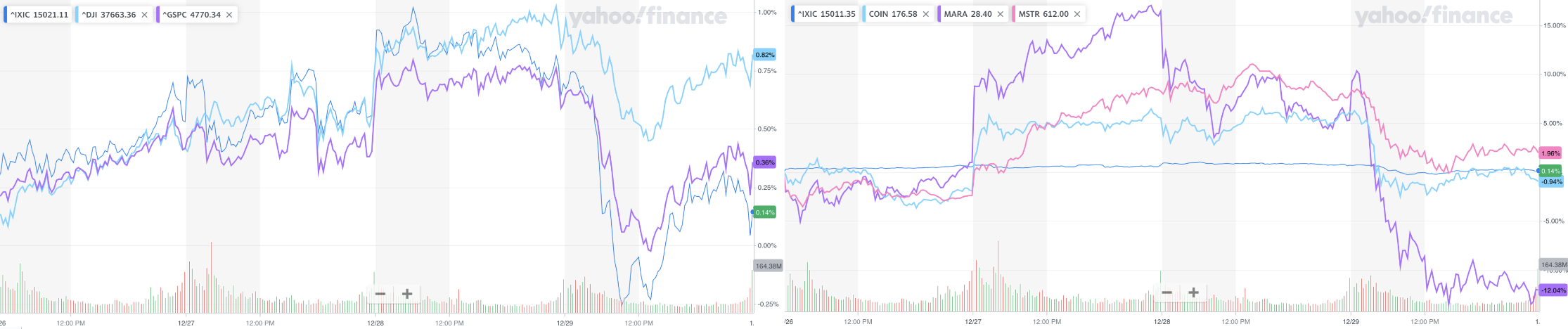

In the final week of 2023, the three major U.S. stock indices continued their upward trend. The Dow Jones Industrial Average and the S&P 500 rose by 0.82% and 0.36%, respectively, while the tech-focused Nasdaq Composite Index increased by 0.14%. Web3-related stocks, however, experienced a overall pullback, with COIN declining by 0.94%, MARA dropping by 12.04%, and MSTR rising by 1.96%. MicroStrategy, in particular, made another significant purchase of 14,620 bitcoins for $615.7 million in cash, at an average price of $42,110 per bitcoin. As of December 26, 2023, MicroStrategy holds a total of 189,150 BTC, acquired for approximately $5.9 billion at an average price of $31,168 per bitcoin.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

The U.S. Dollar Index (DXY) experienced a consecutive decline last week, closing at 101.379 on Friday, reflecting a 0.3% decrease. The U.S. Dollar Index has shown a sustained downward trend for three consecutive weeks, influenced by widespread investor expectations of a Federal Reserve interest rate cut policy in 2024.

DXY (Source: TradingView)

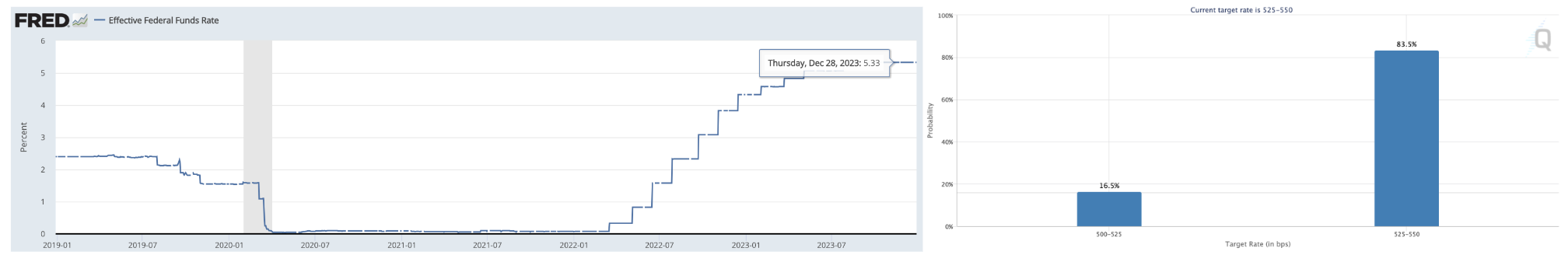

According to the Federal Reserve Watch Tool by the Chicago Mercantile Exchange Group, regarding the expectations for whether the Federal Reserve will adjust the Federal Funds Rate (EFFR) in January next year, currently, 16.5% of traders believe that the rate will be lowered to the range of 500-525 basis points. This represents an increase of two percentage points compared to the previous week. Meanwhile, 83.5% anticipate that it will be maintained between 5.25% and 5.5%.

Left: EFFR, Right: Target Tate Probabilities for 31 January 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

On last Friday, bond yields experienced a slight decrease, with the yield on the U.S. 10-year Treasury note (US10Y) falling to 3.866%, a decline of 0.9 basis points, nearing its lowest level since July.

US10Y (Source: TradingView)

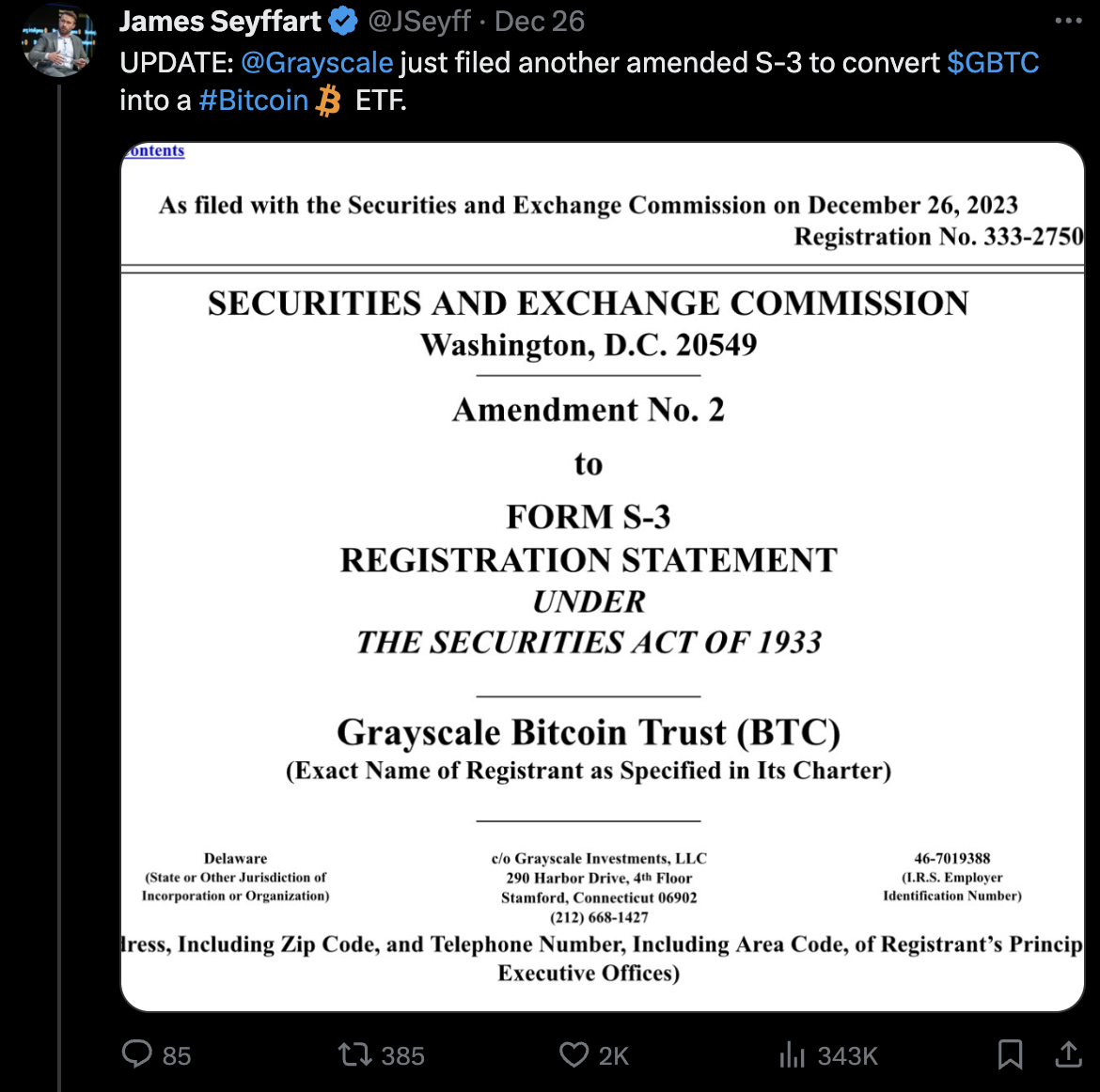

Grayscale has submitted a revised S-3 filing, and Hashdex has once again met with the SEC to discuss a Bitcoin ETF. Grayscale has submitted another amended S-3 filing, aiming to convert its GBTC (Grayscale Bitcoin Trust) into a physically-backed Bitcoin ETF. Grayscale has made concessions and is now accepting the SEC's requirement for cash-only creation/redemption. Additionally, Hashdex has once again met with the SEC to discuss an ETF. Unlike previous meetings with the "Trading and Markets" or "Corporate Finance" divisions, this meeting took place directly in the office of SEC Chairman Gensler.

(Source: Twitter@JSeyff)

2 Crypto Market Pulse

Market Data

Last week, the cryptocurrency market capitalization remained relatively stable, with the total market value currently standing at $1.66 trillion. Both Bitcoin and Ethereum prices experienced fluctuations with an upward trend. As of the early morning of December 31st, the price of Bitcoin was $42,218, representing a 2.3% decrease from the previous week. As the second-largest cryptocurrency, Ethereum saw significant growth last week, surpassing the $2,400 mark and currently priced at $2,302, reflecting a 1.4% increase. Furthermore, Bitcoin's market share decreased by two percentage points to 50%, with a market value of $827 billion. Ethereum's market share remained relatively stable at 17%, with a market value of $274 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

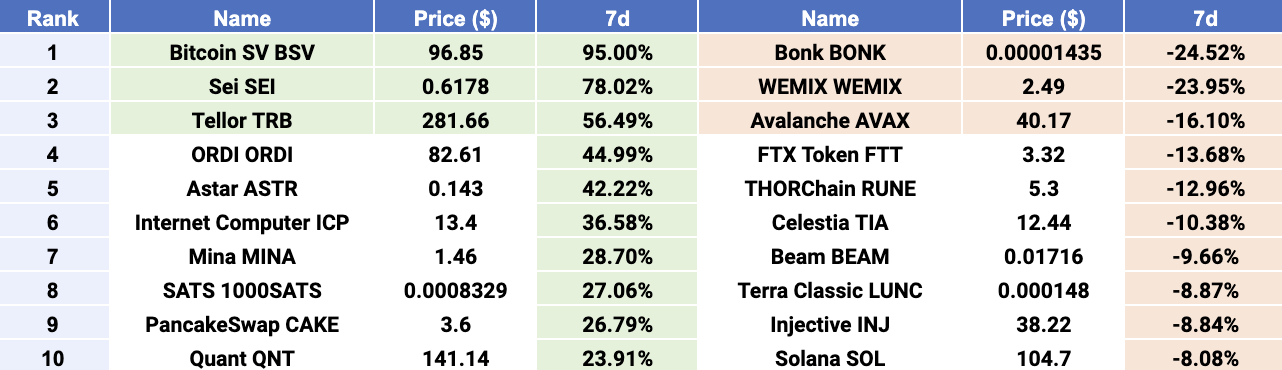

$BSV, $SEI, and $TRB emerged as Top 3 gainers, while $BONK, $WEMIX, and $AVAX were Top 3 losers. The significant surge in Bitcoin SV ($BSV) prices can be attributed to the increased trading volume on Upbit, South Korea's largest cryptocurrency exchange. Upbit accounts for an overwhelming 66.89% of the total $BSV trading volume, equivalent to over $5.03 billion. In the second position, Sei ($SEI) has recently witnessed not only a price increase but also a doubling of social activity and open interest (OI) within the same 24-hour period. One of the key reasons for Sei's growth is the optimization of the Sei Network blockchain. Developers have enhanced every layer of the stack to provide infrastructure for all types of transaction applications. Sei V2 has added support for the Ethereum Virtual Machine (EVM) to attract more developers and introduced SeiDB to optimize the platform's storage layer. $TRB, a decentralized oracle project launched in 2019, has seen an impressive 18-fold increase in the past few months, becoming a focal point in the market. The potential reason for $TRB's rapid surge is the concerted efforts of whales to manipulate the market, amplifying trading volume through self-buying and selling to attract market attention. Other large holders collaborating in this manipulation have contributed to the soaring price of $TRB.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

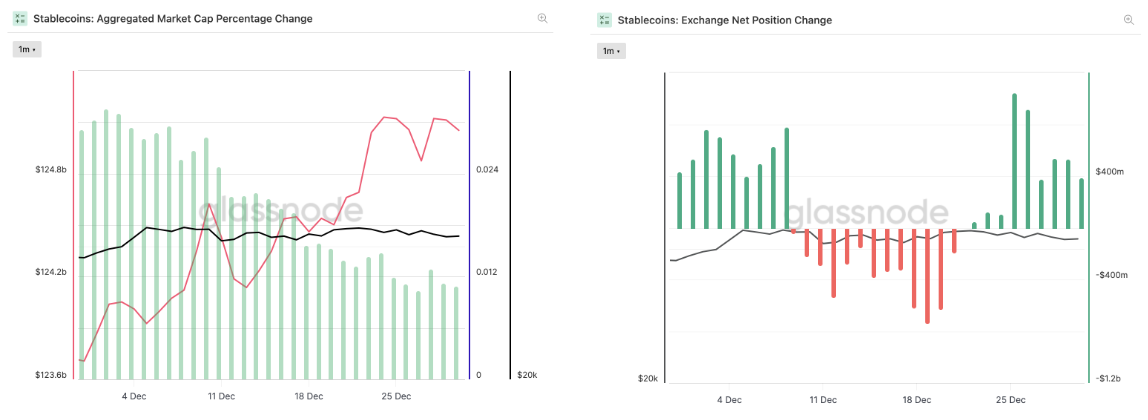

Last week, the total supply of stablecoins continued to show a significant growth trend, surpassing $125.5 billion. Over the past few weeks, the total supply of stablecoins has consistently exhibited a stable upward trajectory. Despite a slight slowdown in the pace of net supply growth last week, the demand for cryptocurrency market investments continues to rise, contributing to the ongoing increase in total supply. Meanwhile, examining the net position data of stablecoins on exchanges over the past week indicates an overall trend of net inflows, reflecting an increase in the total supply of stablecoins on exchanges in the past seven days. The overall situation still indicates a positive outlook for the future development of the market.

Stablecoins Market Cap (Data: Glassnode)

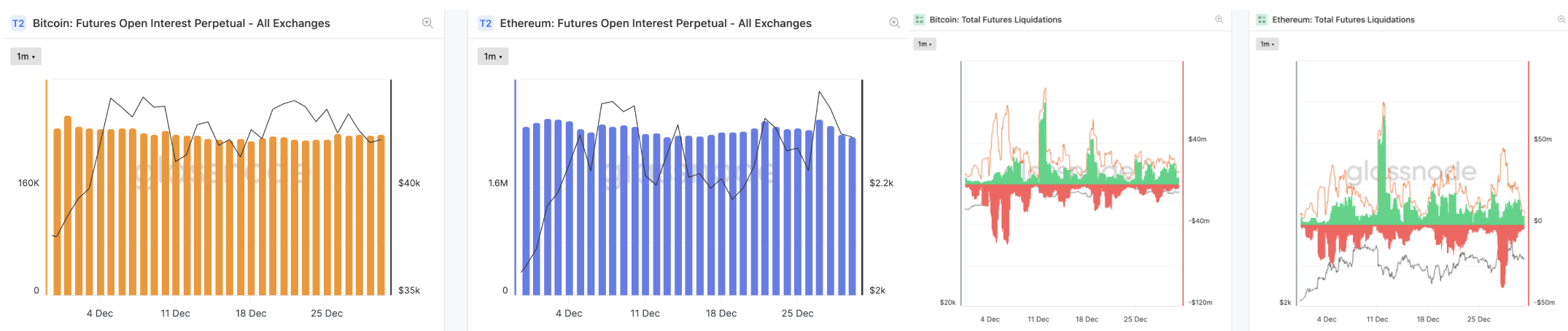

In the derivatives market, the open interest for perpetual futures contracts of Bitcoin and Ethereum has increased. The total trading volume in the futures market over the past seven days has risen in tandem with the fluctuations in the prices of Bitcoin and Ethereum. Trading activity peaked around December 26th. Clearing data from the past week indicates that Bitcoin's liquidation positions are predominantly long, while Ethereum's are mainly short, aligning closely with historical price volatility trends.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

In the DeFi market, the total locked value (TVL) experienced a slight decline last week, dropping to $53 billion. Over the past seven days, the trading volume on decentralized exchanges (DEX) increased to $35 billion, a 7% growth compared to the previous week. Notably, the market share gap between decentralized exchanges (DEX) and centralized exchanges (CEX) has significantly widened, with DEX now accounting for 14% of the total trading volume on CEX. In the past week, the TVL of most of the top ten mainstream blockchains showed a decline, but Binance Smart Chain (BSC) achieved significant growth, rising by 10% in seven days.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

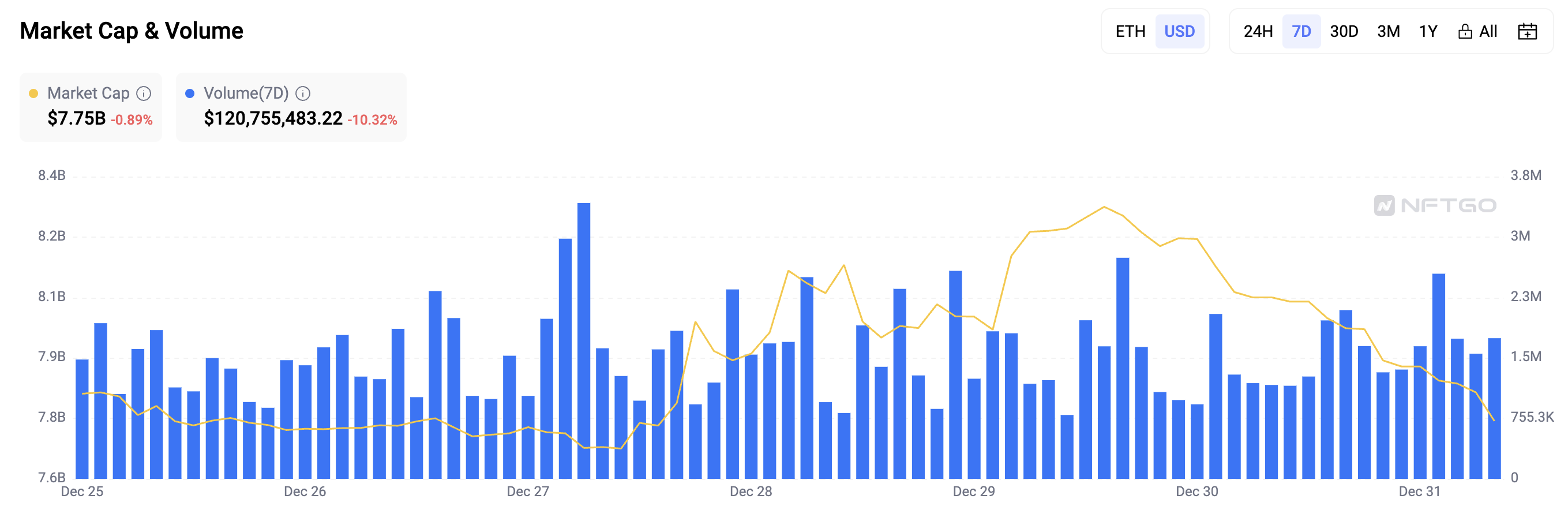

Last week, the NFT market experienced a retreat, declining by 1%, with the total value reaching $7.8 billion. Additionally, the total trading volume decreased by 10% over the past seven days. However, in the top NFT collections, both floor prices and average prices showed an overall rebound. The floor price and average price of the Bored Ape Yacht Club (BAYC) both increased by 2%. The floor price of the Mutant Ape Yacht Club (MAYC) decreased by 2%, but the average price still rose by 2%.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

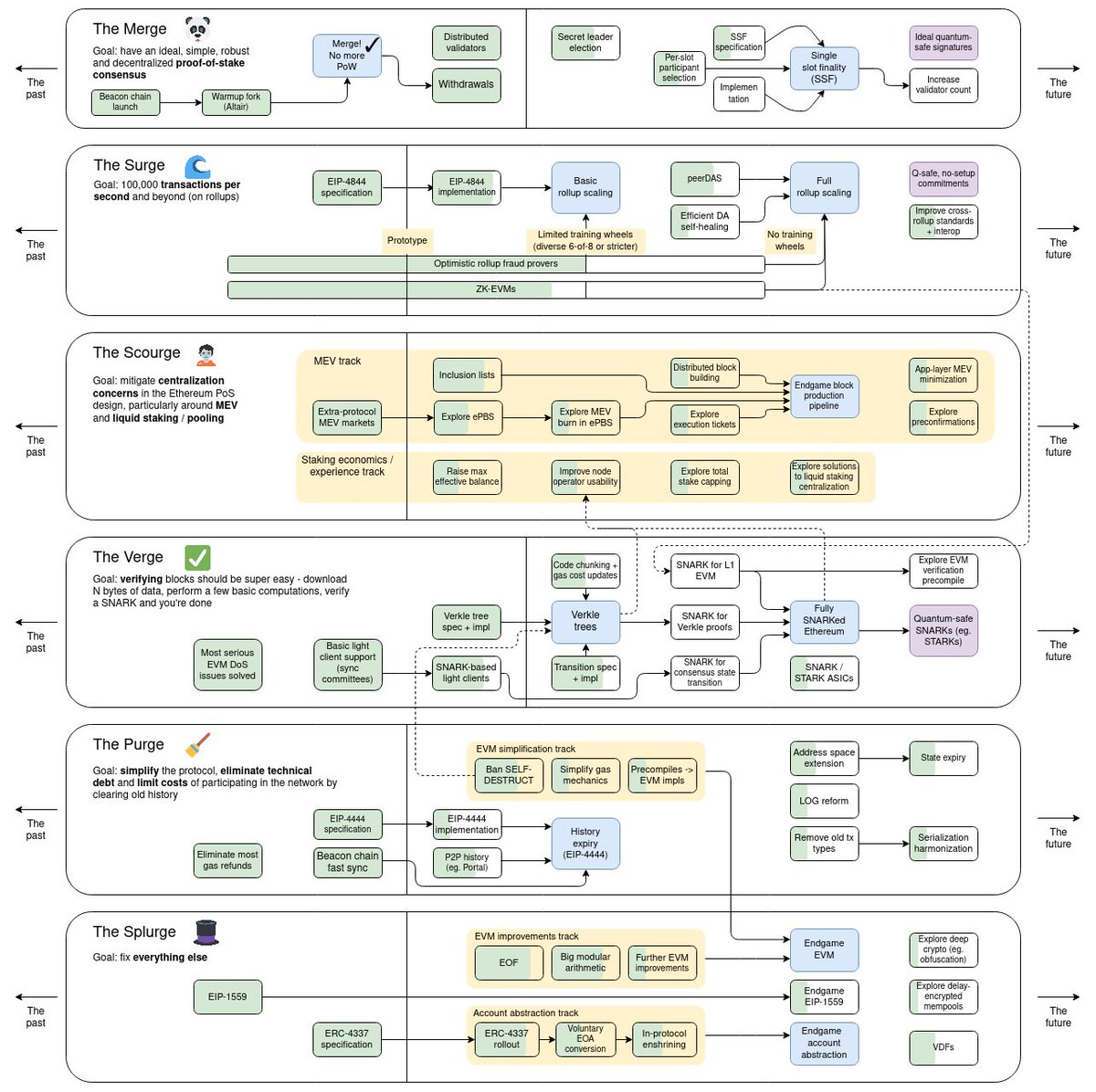

[Ethereum] Vitalik unveils Ethereum 2024 Roadmap. Ethereum founder Vitalik Buterin has revealed the development roadmap for 2024. The roadmap primarily consists of six parts: Merge, Surge, Scourge, Verge, Purge, and Splurge.

The "Merge," completed in September 2022, marks Ethereum's transition from PoW to PoS consensus mechanism, significantly reducing the network's energy consumption. Additionally, Buterin emphasizes the development of Single Slot Finality (SSF) in Ethereum to address weaknesses in the PoS design.

(Source: Twitter@VitalikButerin)

Researcher @doganeth_en stated on the X platform that the EIP-7212 proposal, introduced six months ago, has become the inaugural Rollup Improvement Proposal (RIP) set to be implemented across multiple blockchains. The primary goal of this proposal is to achieve secure and economically efficient validation of the secp256r1 (P256) elliptic curve.

The decision to use this proposal for Rollups stems from its significant impact on the account abstraction in L2, as well as the extensive use of key passing and SE-based AA wallets already present in L2. Introducing a new standard for Rollup improvements allows researchers to propose enhancements specifically for Layer 2 and sidechains, ensuring compatibility across various Rollup frameworks. Moreover, EIP-7212 becomes the first RIP to be merged into the main repository, marking RIPs as a proposal format existing outside the realms of EIPs and ERCs.

(Source: Twitter@doganeth_en)

[Solana] Solana Co-founder: Solana can function as an Ethereum Layer 2 through Wormhole EigenLayer.

Solana co-founder Anatoly Yakovenko mentioned on December 26th that Solana can function as an Ethereum Layer 2 through Wormhole EigenLayer. As Danksharding scales, there is no hindrance to submitting all Solana blocks into certain data verification bridging contracts on Ethereum.

(Source: Twitter@aeyakovenko)

[Polkadot] Gavin Wood: Polkadot to Witness Five Key Technical Breakthroughs in 2024. On December 25th, Polkadot founder Gavin Wood outlined the technical development blueprint for 2024 in his annual review. Wood highlighted that the upcoming year would be very busy for Polkadot, anticipating five significant infrastructure breakthroughs, including Agile Coretime, On-Demand Parachains, Ethereum Snowbridge, and Kusama bridging. Additionally, Elastic Scaling technology is expected to debut as the fifth major technical breakthrough in 2024. Wood expressed his anticipation for the expansion of Polkadot's DAO (Decentralized Autonomous Organization) primitives, encompassing new scholarship programs, multi-asset treasuries, expanded XCM, and some exciting new primitives currently in development. The new non-forking block generation consensus algorithm for Polkadot, Sassafras, has also taken shape and is expected to begin testing on the testnet in 2024. Parity Labs is actively developing various new technologies, and one recent Request for Comments (RFC), currently in the prototype stage with significant iterations, is named CoreJam, potentially providing clues about the direction of technical development.

(Source: medium.com)

[Avalanche] The Avalanche Foundation will support the Meme sector through the Culture Catalyst funding program. Avalanche Foundation announced via a tweet that it will support the Meme sector through the Culture Catalyst funding program. The foundation plans to recognize and encourage the culture and fun represented by the Meme ecosystem by purchasing selected Meme tokens based on Avalanche to create a collection series. This initiative aims to complement Avalanche Foundation's portfolio of investments in the ecosystem. Criteria for selecting Meme projects include the number of holders, liquidity thresholds, project maturity, fair launch principles, and overall social sentiment. The Culture Catalyst program, launched last year, previously focused on various categories of crypto assets such as Gas tokens, DeFi tokens, RWA, NFTs, stablecoins, and governance tokens.

(Source: Twitter@avax)

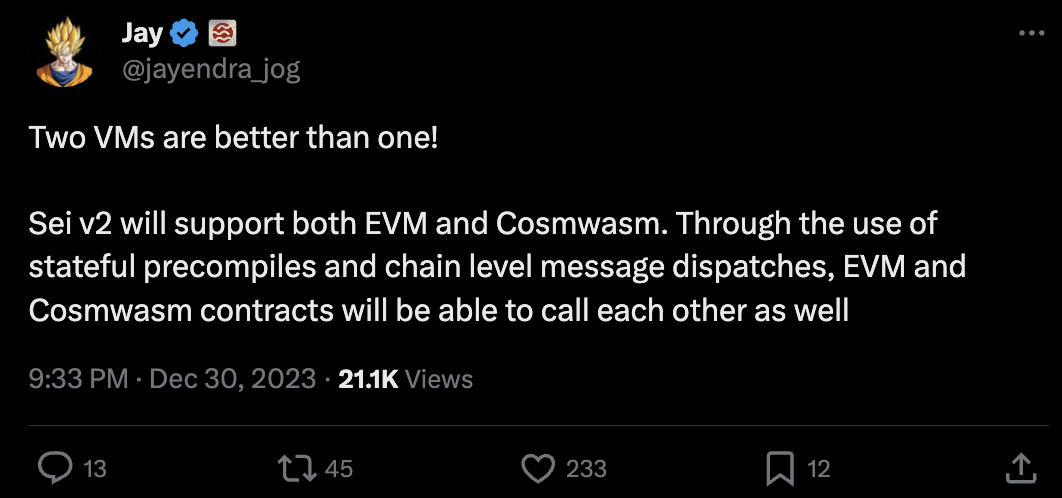

[Sei] Sei V2 version will support both the EVM (Ethereum Virtual Machine) and Cosmwasm dual virtual machines. Sei Labs co-founder Jay stated on the X platform that Sei V2 will support EVM (Ethereum Virtual Machine) and Cosmwasm. The new version enables interoperability between EVM and Cosmwasm contracts by utilizing stateful precompiles and chain-level message dispatch. He straightforwardly expressed, "Two VMs are better than one!"

(Source: Twitter@jayendra_jog)

[Cardano] Cardano: What to Look Forward to in 2024. On December 28th, EMURGO, the founding entity of the Cardano (ADA) protocol, unveiled the development roadmap for the Cardano ecosystem in 2024. The most noteworthy event in the Cardano ecosystem for 2024 is the planned implementation of the Chang hard fork. This network upgrade will signify the first step toward the minimal viable community-operated governance. It will seek the consensus of the Cardano community through the consensus mechanism introduced in this hard fork, initiating the bootstrapping period of Cardano governance.

(Source: emurgo.io)

4 Key Fundraising Data

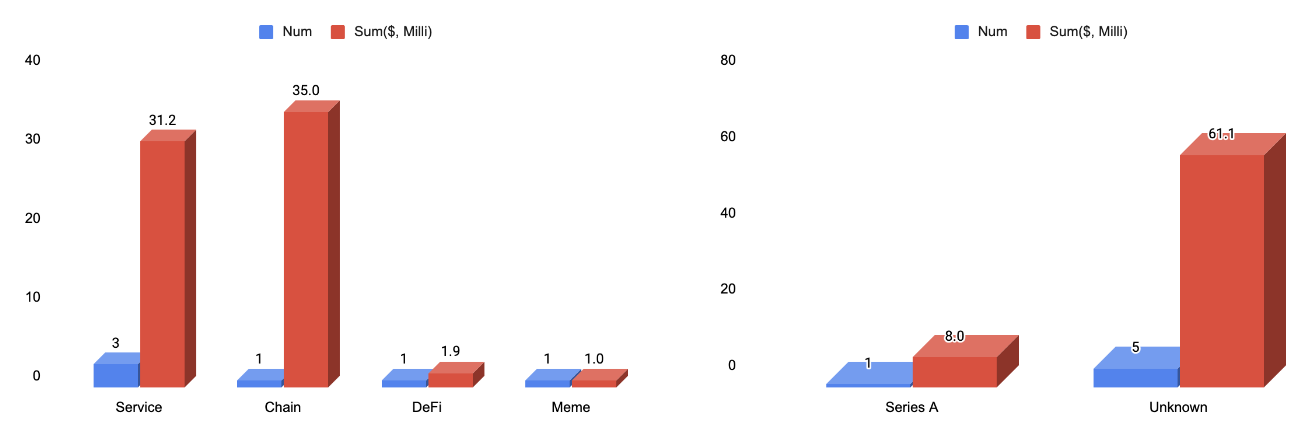

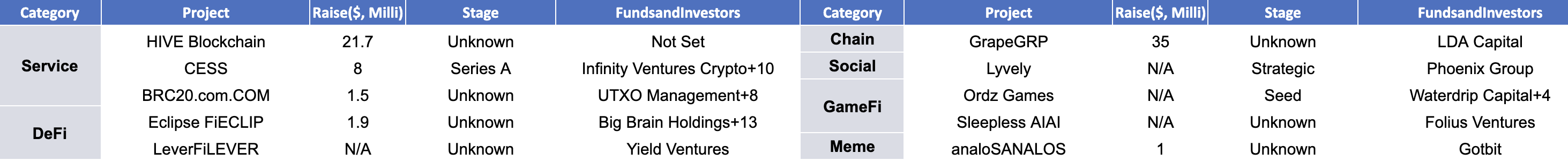

Last week witnessed a total of 10 financing events, raising a substantial amount of over $69.1 million*. Compared to last week, financing activities have seen a comprehensive decrease in both volume and total financing amount. The Service sector led with the highest number of financing events, totaling three. The Chain sector recorded the highest total financing amount, dominated by the project Grape ($GRP), which had the highest financing amount last week at 35 million, accounting for 51% of the total financing amount. Grape is a Layer1 DLT platform that combines the decentralization and security of Web3 with the user-friendliness of Web2. More detailed information is provided below.

*4 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [Chain] Grape Raises $35 Million from LDA Capital to Become Top Layer One Chain.

The Layer1 distributed ledger technology (DLT) platform, Grape, has secured a $35 million investment from the global investment group LDA Capital. The new funds will be utilized to expedite project development and conduct strategic token buybacks, reducing the circulating supply of its native token, GRP, and enhancing token value. Grape's primary features include the high-speed distributed ledger VINE, the artificial intelligence engine ANNE for simplified smart contract and DApp development, and decentralized cloud storage.

• Official Link: https://grap3.com/

HIVE Digital Technologies has announced the successful completion of a CAD 5.00 million bought deal private placement for 5,000,000 special warrants, resulting in a total funding of CAD 25.00 million. The underwriters have chosen to exercise an additional 15% of the special warrants, bringing the total financing to CAD 28.75 million. The funds raised will be used to expand Bitcoin mining operations, operational capital, and general corporate purposes. The underwriters will receive a 6.0% cash commission and broker warrants equal to 6.0% of the total number of warrants issued. Securities related to this transaction will be subject to a statutory hold period of four months and one day.

• Official Link: https://hivedigitaltechnologies.com/

3. [DeFi] Decentralized storage platform CESS raises $8M from 13 VC funds.

Decentralized storage platform Cumulus Encrypted Storage System (CESS) raised approximately $8 million from more than 13 venture capital firms, according to a Dec. 28 announcement. The funds will be used to “drive technological advancements, expand global operations, and strengthen CESS’s position in the decentralized infrastructure sector,” a CESS representative told Cointelegraph.

According to its documents, CESS is both a blockchain network and a decentralized storage system. It allows files to be stored on multiple nodes and identified by their hash. It contains four components, or “layers” — blockchain, data storage, content distribution and application layer. It uses a variety of cryptographic protocols to help ensure that data stays permanent, including proof-of-reduplication-and-recovery and multi-format data confirmation. CESS aims to be used in large-scale commercial applications.

• Official Link: https://cess.cloud/

Eclipse Fi ("Eclipse"), a modular multi-chain launch protocol built on Cosmos and integrating with leading Layer-2 protocols, has announced the closing of its $1.9 million raise and successful TGE conducted on December 22 which sold out in seconds.

The fundraise was representative of the ethos of Eclipse, creating a fair cap table with a diverse group of leading Web3 VCs, angel investors, and influencers. Participants include Big Brain Holdings, Rarestone Capital, Momentum 6, NxGen, Crypto Banter, Cogitent Ventures, Token Metrics, Kyros Ventures, Faculty Group, Master Ventures, Ivan on Tech, Brian D Evans, Danish Chaundry, Gainzy and more.

• Official Link: https://ntrn.eclipsefi.io/

See you next week!