FTX was approved using the "bankruptcy price" to repay customer assets

1. Review of hot topics this week:

1.1. Powell: Doesn’t think the Fed may cut interest rates in March

On Wednesday, January 31, the Federal Reserve announced its January interest rate decision. The Federal Reserve remained unchanged as scheduled and continued to maintain the target range of the federal funds rate at 5.25% to 5.50%.

Federal Reserve Chairman Powell said at a press conference that FOMC interest rates may be at the peak of this cycle, but more evidence is needed to prove that inflation has been contained. Most members expect that interest rates may be cut multiple times this year, but do not believe that interest rate cuts will start in March. , plans to start in-depth discussions on balance sheet issues in March.

In his speech, Powell said the Fed remains focused on its dual responsibilities of achieving full employment and maintaining price stability. The current FOMC interest rate policy is clearly in restrictive territory, economic activity is expanding at a steady pace, activity in the real estate sector has been suppressed in the past year, and Higher interest rates are already affecting fixed investment by businesses.

As for whether the U.S. economy has achieved a soft landing, Powell said it is not yet possible to declare victory because core inflation is still high and there is still some way to go before a soft landing. He said that the supply chain has not yet returned to its original state, the recovery of the supply chain may still be a tail risk, and further economic growth should be attributed to the recovery of the supply chain. The greater risk is that U.S. inflation may stabilize above 2%. Fed officials believe that recent inflation data are not caused by those one-time factors and hope to maintain a strong labor market while completing the task of fighting inflation.

1.2. ADP employment in the United States increased by 107,000 in January, and wage growth hit a two-year low.

On January 31, the U.S. ADP employment report showed that the U.S. ADP employed 107,000 people in January, the smallest increase since November 2023. It was expected to be 150,000 and the revised previous value was 158,000. The report said that the slowdown in hiring continued into January this year, and wage pressure continued to ease. Salary premiums for job hoppers fell to new lows last month.

The report stated that at a time when employment numbers were significantly lower than expected, wage growth continued to slow in January. Employment wages increased by 5.2% year-on-year in January, down from 5.4% in December last year. For those who are job hopping, the wage growth rate is 7.2%, This is the lowest growth rate since May 2021.

ADP chief economist Nela Richardson said that despite the slowdown in hiring and wages, progress on inflation has made the economic outlook brighter, with inflation-adjusted wages improving over the past six months. The U.S. and global economies appear to be heading for a soft landing.

1.3. FTX: gave up relaunching the platform, and the judge approved using the "bankruptcy price" to repay customer assets

At a court hearing in the United States on January 31, the FTX bankruptcy reorganization team stated that it had given up its plan to relaunch the platform. The bankruptcy judge also dismissed customers' complaints about the liquidation currency price and allowed FTX to repay customer assets at the price at the time of bankruptcy. FTX's native token FTT subsequently fell by 15.5%.

Unfortunately for creditors at large, Liquidation team calls recovery of cryptocurrency client assets, It is calculated based on the currency price when FTX actually filed for bankruptcy. In other words, if a user owned 1 Bitcoin when FTX went bankrupt, the future compensation amount would be approximately $16,800 instead of the current $42,000.

FTX’s plan caused strong dissatisfaction among many creditors, who believed that it was simply a theft. Well-known creditor Sunil Kavuri previously tweeted calling on creditors to stand up and resist!

1.4. Standard Chartered Bank: SEC may approve spot Ethereum ETF on May 23

On January 30, Standard Chartered Bank predicted that the SEC would approve a spot Ethereum ETF on May 23. Geoffrey Kendrick, head of FX at Standard Chartered Bank, said: We expect pending applications to be approved on May 23. These are the first ones being considered that ETF final deadline and Equivalent to January 10th for spot Bitcoin ETFs.

The bank also predicted that if ETH mimics BTC’s pre-approval performance, it could potentially target $4,000.

1.5. Celsius begins distributing more than $3 billion in cryptocurrency and fiat currencies to creditors

On January 31, bankrupt crypto lending platform Celsius announced that the company had completed transactions under a confirmed restructuring plan. The plan includes the distribution of more than $3 billion in cryptocurrency and fiat currencies to Celsius creditors, as well as the creation of a new Bitcoin mining company, Ionic Digital, Inc., which will be owned by Celsius creditors. And mining operations are managed by mining company Hut 8.

According to Celsius, start of today, according to the MiningCo Transaction, The company has begun distributing more than $3 billion in liquid cryptocurrency and fiat currencies to creditors, Ionic Digital is created as a new Bitcoin mining company. It will continue to provide recovery to creditors. It is reported that the MiningCo Transaction includes a US$225 million cash capitalization of the new entity (NewCo), and transfer certain mining assets to NewCo, excluding Core Rhodium, Mawson and Luxor assets.

1.6. OPNX will cease operations and close down. Customers need to withdraw funds before February 14th.

On February 2, according to a notification on the OPNX website, OPNX, an exchange founded by the founder of the crypto hedge fund Three Arrows Capital, will close this month. The company recommends that customers settle their positions before 08:00 UTC on February 7 and close their positions by 2 Withdraw funds before February 14th. It is reported that the exchange was created for bankruptcy debt trading and was established last year by Kyle Davies and Su Zhu.

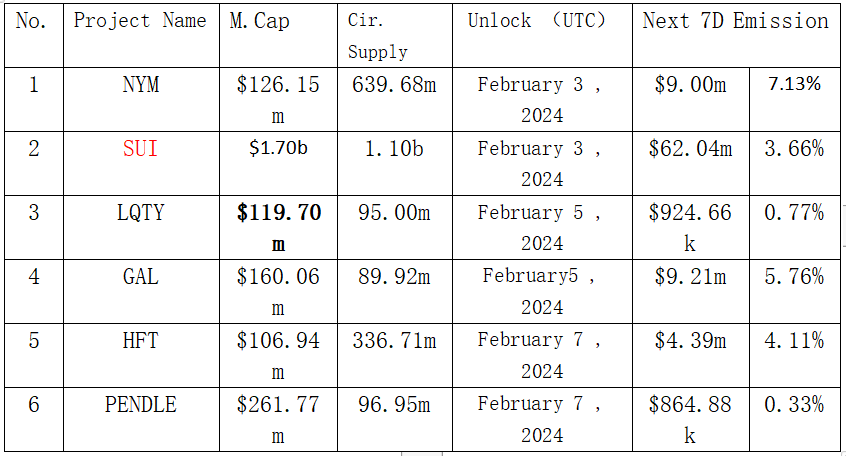

2. Projects to be unlocked next week:

3. Recent key events:

February 5 (Monday)

U.S. ISM non-manufacturing index in January;

February 7 (Wednesday)

2025 FOMC Voting Committee and Cleveland Fed President Mester delivered a speech

U.S. Treasury announces the first quarter’s bond issuance plan

February 8 (Thursday)

Number of people applying for unemployment benefits for the first time in the week of February 3 in the United States (10,000 people);