Derivatives DEX SynFutures raises $22 million

*All on-chain data is dated as of 12:00 a.m. EST on Sunday, October 15th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Oct.15–21).

Author: LBank Labs Research team — Hanze, Johnny

Keywords: #Fed #ETF #Ripple #Layer2

1 Macro Market Overview

Stocks Fall in Strong Week for U.S. Treasury Yields. According to WSJ, stocks fell Friday, capping a week of losses for U.S. markets. Investors grappled with a sharp increase in borrowing costs and the possibility of worsening violence in the Middle East. “Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully,” Powell said Thursday. He cited the bevy of data showing that labor-market tightness and price pressures are easing, giving the Fed room to stand pat, but said the central bank would be willing to raise rates further if strong economic activity sparked worries of an inflation revival.

Stock investors were also gauging newly released third-quarter earnings results. About 11% of the companies in the S&P 500 have reported third-quarter earnings last Wednesday, according to FactSet. Of those, about 81% have topped analyst expectations, compared with the five-year average of 77%. Netflix shares leapt 16% after reporting it added 8.8 million net new paid subscribers, the biggest jump since early 2020, and raised prices. Tesla stock, meanwhile, went in reverse following its third-quarter results. Shares of the electric-car maker slid 9.3% after the company said it is struggling to scale production of the Cybertruck, and it lost more money than analysts expected.

The latest retail-sales report showed spending online, at stores and in restaurants rose a stronger-than-expected 0.7% in September from a month earlier. Treasury yields jumped afterward, with the benchmark 10-year bond yield rising to 4.846%, up from 4.709% Monday. Higher yields make borrowing more expensive for companies and households. Elevated rates also make stocks look less attractive because they represent an essentially risk-free return, raising the bar for riskier assets such as equities.

All three major indexes finished the week in the red. The technology-heavy NASDAQ Composite declined by 3.2%, while the S&P 500 and Dow Jones indices fell by 2.4% and 1.6%, respectively. In contrast, web3-related stocks had a strong performance last week, as Bitcoin spot prices surged throughout the week. COIN and MARA saw increases of 1.6% and 0.6% respectively, while MSTR, which had previously made significant Bitcoin investments, rose by an impressive 9.4%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

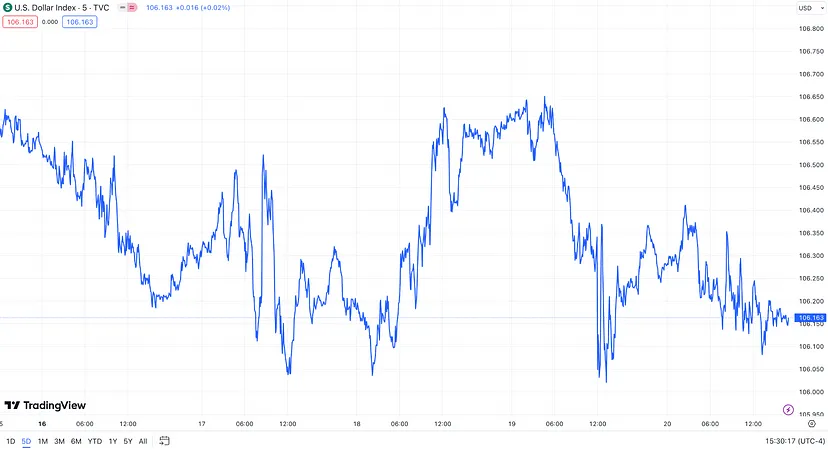

Macro indexes The US Dollar Index (DXY) saw a slight decline last Friday, ending the week in negative territory at 106.163, marking a 0.5% decrease compared to the previous week. With an increasing number of investors holding onto the US dollar, the potential for a significant dollar rebound may face some obstacles.

DXY (Source: TradingView)

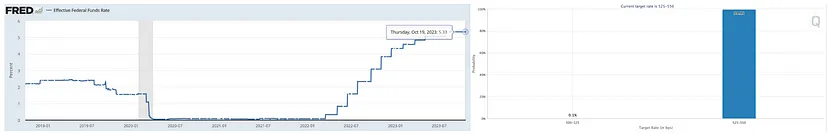

According to WSJ, Jerome Powell, chair of the central bank, suggested Thursday that those higher yields could lead the Fed to pause its campaign of interest rate increases. Traders in interest-rate derivatives are pricing in a 99.9% chance that the Fed leaves its policy rate unchanged at its November meeting, according to CME Group’s FedWatch tool.

EFFR (Source: Federal Reserve Bank of New York, CME Group’s FedWatch Tool)

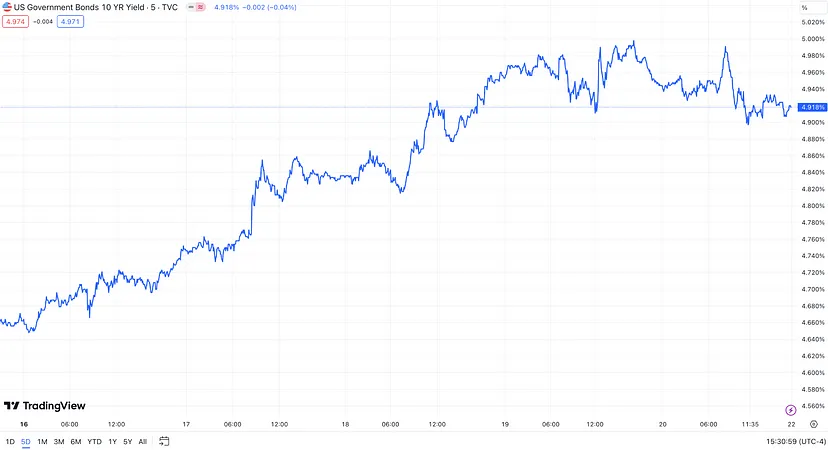

Bond prices rose and yields declined. The 10-year U.S. Treasury yield (US10Y) settled at 4.918%, down from 4.987% Thursday. The 10-year Treasury yield has risen more than a full percentage point since the Federal Reserve last raised rates at the end of July, an unusually large jump in such a short time frame.

The 10-year Treasury yield reached as high as 4.991% during last week’s trading, nearly hitting 5% for the first time since 2007. Weak manufacturing data from the Philadelphia area and later Powell’s comments sapped the bond selloff and boosted prices.

US10Y (Source: TradingView)

Grayscale submits new filing to SEC in attempt for spot bitcoin ETF approval following pivotal court ruling. Grayscale Investments filed a new registration statement with the Securities and Exchange Commission in its ongoing attempt to convert its Grayscale Bitcoin Trust into a spot bitcoin ETF after a D.C. circuit court’s ruling directing the regulator to re-review the firm’s application. The asset manager on Thursday morning submitted an S-3 filing, a shortened version of the typical S-1 filing used to offer new shares. Grayscale’s latest move comes as other big name asset managers including BlackRock and Fidelity are seeking approval for spot bitcoin ETFs from the SEC.

GBTC intends to list the shares on NYSE Arca under the symbol GBTC, and issue the shares on an ongoing basis upon approval of NYSE Arca’s application on Form 19b-4 to list the shares and effectiveness of the form S-3 to register the shares, Grayscale said in a statement.

(Source: Twitter@JSeyff)

The U.S. SEC has dropped its charges against Ripple’s CEO and Executive Chairman. According to a publicly available legal document, the SEC has withdrawn its charges against Ripple’s CEO, Brad Garlinghouse, and Executive Chairman, Chris Larsen. Ripple has stated that this marks the third victory for Garlinghouse, Larsen, and Ripple, following a court ruling in July 2023 declaring “XRP itself is not a security,” and the SEC’s mid-October appeal request being denied.

2 Crypto Market Pulse

Market Data

Cryptocurrency market capitalization continued to rise last week. Following Grayscale’s submission of a new application for a Bitcoin exchange-traded fund (ETF) to the U.S. Securities and Exchange Commission (SEC), Bitcoin briefly reclaimed the $30,000 level within a day. Bitcoin reached a nearly three-month high at $30,100 on the 21st. As of 12:00 AM on October 22, the price of Bitcoin was $29,920, marking an 11.3% increase compared to the previous week. Ethereum, the second-largest cryptocurrency, saw a 4.9% increase last week, with a current price of $1,631. The total market capitalization of the entire cryptocurrency market is now at $1.14 trillion, reflecting an almost 8.6% increase from the previous week. Additionally, Bitcoin’s market share within the entire market continued to rise, reaching 51.2% with a market cap of $584 billion, while Ethereum’s market share dropped to 17.2%, currently at $196 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

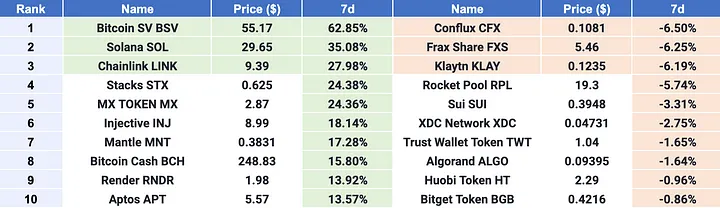

$BSV, $SOL, and $LINK emerged as Top 3 gainers, while $CFX, $FXS, and $KLAY were Top 3 losers. In the top 100 cryptocurrencies by market capitalization, the biggest gainer last week was $BSV. Following Binance’s announcement of a new “USD-M BSV Perpetual Contract” last Thursday, $BSV briefly surged by 63%. Meanwhile, the price increases of $SOL and $LINK occurred after the recent overall market surge, with gains of 35% and 28%, respectively. Another key factor driving the rise of $SOL is the rapid expansion and progress of the Solana ecosystem, particularly in the DeFi sector. Despite a strong overall market performance this week, some cryptocurrencies underperformed, with $CFX, $FXS, and $KLAY all experiencing losses exceeding 6% last week.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

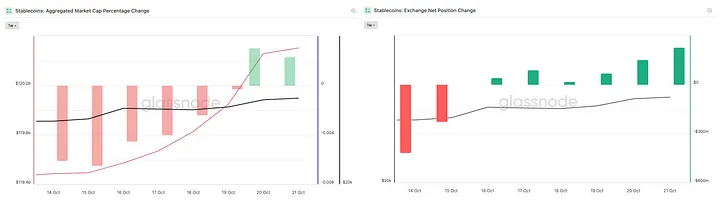

The total supply of stablecoins continued to increase last week, reaching $120.5 billion. The supply of stablecoins shifted from contraction to expansion during the past week, and the net supply of exchange-based stablecoins also changed from a net outflow to a net inflow. This phenomenon indicates an increased demand and capital inflow into the crypto market, aligning with the overall market performance.

Stablecoins Market Cap (Data: Glassnode)

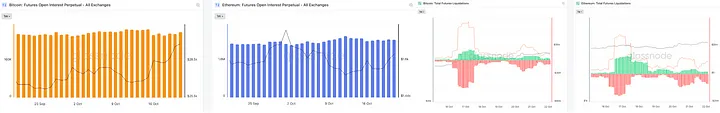

In the derivatives market, the total open interest for Bitcoin and Ethereum futures contracts showed a decreasing trend last week, indicating an outflow of capital from the derivatives market. Market trading activity significantly declined after last Sunday. In the case of Bitcoin, liquidation results indicated that shorts worth over $60 million were liquidated around the 17th, while Ethereum’s liquidation results reflected an ongoing battle between longs and shorts in the market, with the total liquidation amount significantly lower than that of Bitcoin. The future direction remains uncertain.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Future Liquidations (Data: Glassnode)

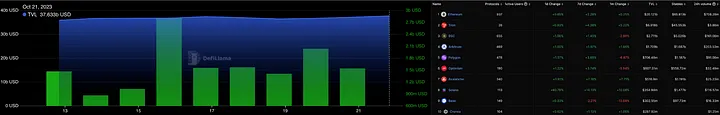

In the DeFi market, the Total Value Locked (TVL) increased slightly by 0.8% last week, reaching $37.6 billion. Over the past seven days, decentralized exchanges (DEXs) saw a trading volume of $12 billion, marking a 13.2% increase compared to the previous week. Additionally, the market share gap between DEXs and centralized exchanges (CEXs) further narrowed, with the current DEX vs CEX dominance at 18.7%. Furthermore, among the top ten blockchain platforms in TVL rankings, all of them experienced an increase in TVL over the past 7 days, with the exception of Base, which saw a 2.2% decrease. Notably, Solana witnessed a 14.1% increase in TVL last week.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

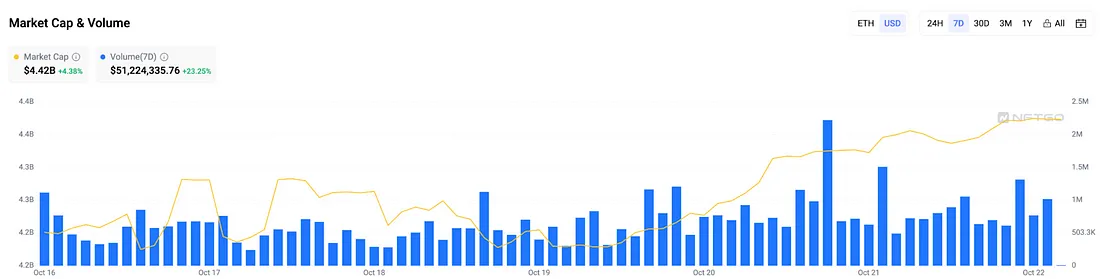

The NFT market saw a turnaround last week, with both market capitalization and trading volume on the rise. The current NFT market capitalization stands at $4.4 billion, marking a 4.4% increase within a week. Additionally, the trading volume increased by 23% in the past seven days. Blue-chip NFT collections like the Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) experienced a pullback in their floor prices and average prices. Both collections saw floor prices rise by more than 6%, and average prices increased by 0.4% and 2.7%, respectively.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] Ethereum All Core Developers Consensus Call #120 Writeup. Christine Kim, Vice President of Research at Galaxy, posted a summary of the 120th Ethereum All Core Developers’ Meeting (ACDE). Developers discussed and coordinated changes to the Ethereum Consensus Layer (CL) during the meeting. This week, they discussed CL Specification Version 1.4.0-beta.3, the conditions for launching Devnet-10, and a blob delay analysis conducted by software developer Gajinder Singh, who maintains the Lodestar and EthereumJS clients.

Furthermore, Ethereum core developer SmartProgrammer.eth tweeted about submitting a new EIP (Ethereum Improvement Proposal) request aimed at introducing a new version of the Ethereum peer-to-peer network handshake protocol (eth/69). This new protocol allows Ethereum nodes to communicate their available block ranges, optimizing connection options. This can be seen as a step towards EIP-4444 (historical data pruning). The EIP falls under the Networking EIPs category, which focuses on optimizing the Ethereum peer-to-peer network.

(Source: galaxy.com Github)

[Layer2] Scroll announces the official launch of the zkEVM mainnet.On October 17th, Scroll officially announced the launch of its mainnet. Scroll stated that its unique bytecode-level, EVM-compatible zkEVM provides an experience almost identical to Ethereum. Scroll previously completed over 55 million transactions on Alpha and Beta testnets, ultimately confirming nearly 1 million batches of transactions on L1. The next milestone on Scroll’s roadmap involves building a decentralized proof network and decentralized sequencer, indicating that, similar to zkSync’s approach, airdrops and token issuance may take some time.

Additionally, LayerZero announced its integration on the native zkEVM Scroll mainnet, allowing projects integrated with LayerZero to quickly expand their applications to Scroll. Developers building on Scroll can extend their applications to over 40 different blockchains supported by LayerZero.

(Source: Twitter@Scroll_ZKP)

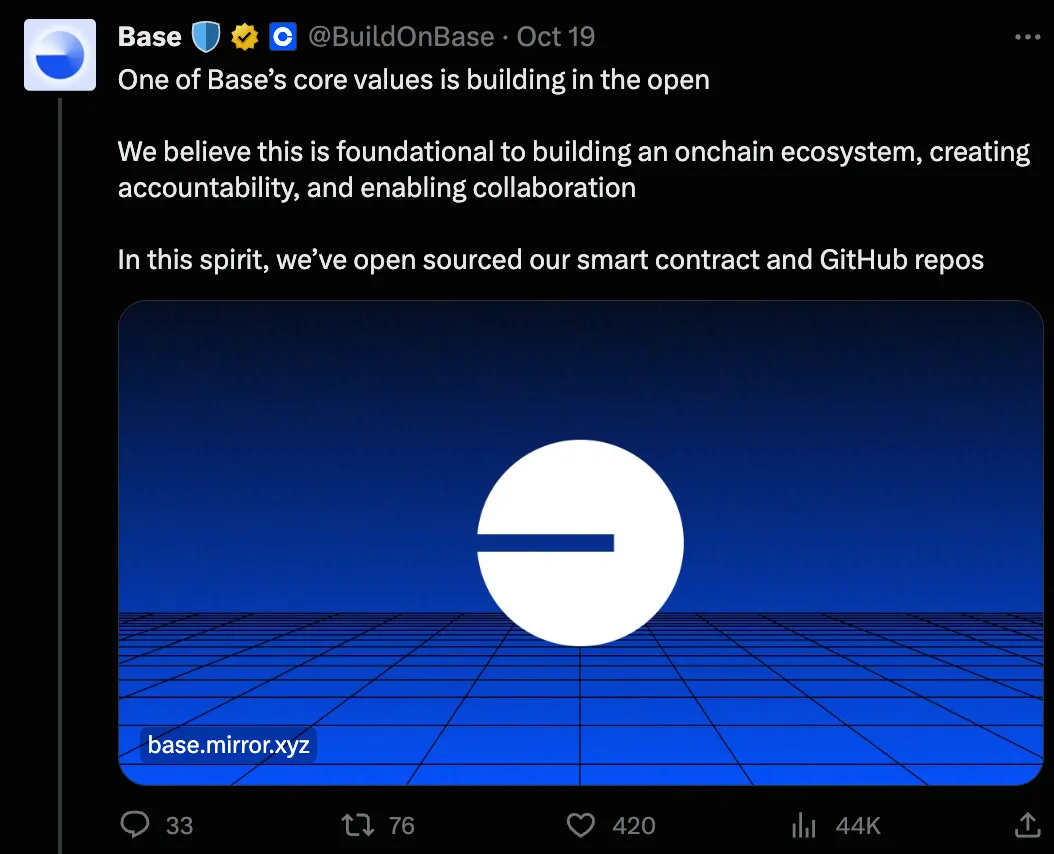

[Layer2] Coinbase-incubated Layer 2 Base open-sources code to enhance transparency. Coinbase-incubated Layer 2 network Base has open-sourced its code repositories to enhance transparency and open the project to public contributions. As of today, developers can access the underlying code enabling various Base processes including contracts and other deployments, according to a statement.

“By sharing our work openly, we enable the community to track our progress and ensure that we’re living up to our commitments,” Base said in the announcement. “This transparency also serves as a catalyst for collaboration, as it allows developers to tap into our knowledge base, building upon and refining what’s already in place. Further, it provides a channel for valuable community feedback, whether it’s about improving documentation or spotting an overlooked bug.”

(Source: Twitter@BuildOnBase)

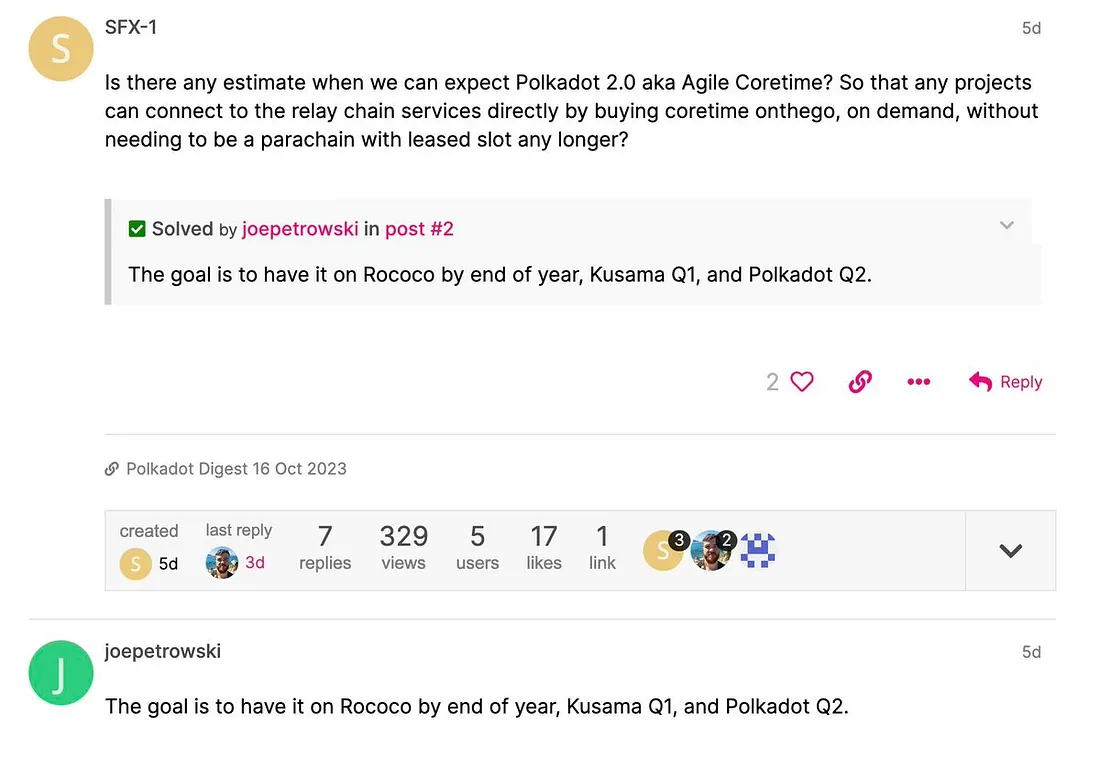

[Polkadot] Polkadot 2.0 is expected to launch its testnet by the end of this year, with the mainnet scheduled for Q2 of next year. Parity research analyst Joe Petrowski, while responding to questions in the Polkadot governance forum, mentioned that Agile Coretime (which is Polkadot 2.0) is expected to launch on the Rococo testnet by the end of the year, on the Kusama canary network in the first quarter of next year, and on the Polkadot mainnet in the second quarter. This means that projects will soon have direct access to Polkadot relay chain services without the need for lengthy lease of parachain slots.

(Source: Twitter@polkaworld_org)

[BNB] The BNB Greenfield mainnet has officially launched. BNB Chain announced on X platform that the decentralized data storage network, BNB Greenfield mainnet, has officially launched. The test phase completed over 200,000 transactions and reached 150,000 interactive wallets. BNB Greenfield features high performance, built-in access control, cross-chain programmability, and more.

(Source: Twitter@BNBCHAIN)

[LBank] LBank Labs collaborates with Blockchain Builders Fund and Collab+Currency to jointly host an online Demo Day. LBank Labs, in collaboration with its investment partners, Blockchain Builders Fund and Collab+Currency, jointly organized an online Demo Day to provide a platform for projects that continue to build even in bear markets. The six projects introduced in this event are DwellFi, an all-in-one fund data platform; Hinkal, an Ethereum zero-knowledge privacy solution; Rainbow, an Ethereum wallet; Sleepagotchi, a “sleep to earn” app; Dope, a Web3 NFT music aggregator; and QED, the first Ethereum Layer 2 network to achieve super-scalability.

(Source: ON-LINE DEMO DAY)

4 Key Fundraising Data

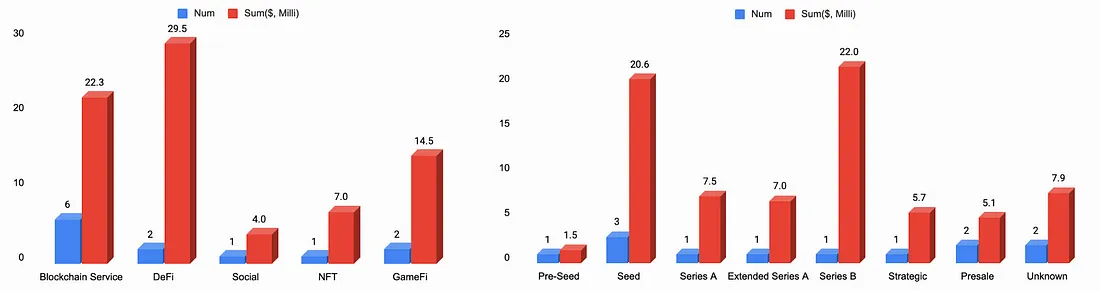

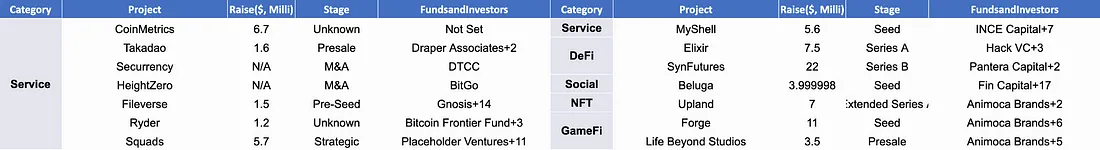

Last week witnessed a total of 14 financing events, raising a substantial amount of over $77.3 million*. Compared to last week, both the number of funding activities and the total funding amount have seen a slight increase. The DeFi and Service sectors attracted the most attention with a total of 8 funding events, accounting for 57.1% of the total fundraising activities, with an amount of $51.8 million, making up 67.0% of the total funding. The largest fundraising event this week occurred in the DeFi sector, led by the SynFutures project, which raised $22 million. SynFutures is a decentralized derivatives exchange focused on trading crypto perpetual futures. More detailed information is provided below.

*2 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events (Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1.[DeFi] Derivatives DEX SynFutures raises $22 million, open to token launch idea.

SynFutures, a decentralized derivatives exchange focused on trading crypto perpetual futures, has raised $22 million in a Series B funding round. Pantera Capital led the round, with HashKey Capital, SIG DT Investments (a unit of the Susquehanna International Group) and others participating, SynFutures said Thursday.

The firm started raising for the Series B round last year and closed it about two months ago, Rachel Lin, co-founder and CEO of SynFutures, said in an interview. She declined to comment on valuation and structure of the round but said SynFutures is open to the idea of a native token launch in the future. Any decision would depend on market conditions and regulatory landscape, she added.

- Official Link: https://www.synfutures.com/

2. [GameFi] Forge Announces $11 Million in Seed Funding.

Forge, the first video game platform that connects and rewards gamers for their gaming achievements and ongoing play, opens to players last week in beta. The platform announced a $11 million seed funding round, led by Makers Fund, BITKRAFT Ventures, and Animoca Brands, with participation from Hashkey Capital, Polygon Ventures, Formless Capital and Adaverse. Forge’s existing investors include industry-leading strategics such as Griffin Gaming Partners, Riot Games, and Sony Innovation Fund. Forge’s angel investors include gaming industry leaders Riot Games founder Marc Merrill, Twitch founders Emmett Shear and Kevin Lin, TSM founder Dan Dinh, Kabam founders Kevin Chou and Holly Liu, YouTube founder Steve Chen, Krafton CEO CH Kim, former Discord CMO Eros Resmini (The Mini Fund), and ESL founder Ralf Reichart.

Founded by gaming pioneer Dennis “Thresh” Fong, Crunchyroll founder Kun Gao, and Cyence founder George Ng, Forge originated as a project within GGWP, an AI-powered game moderation platform that the team launched in 2020, and has since been spun off as a new company. Forge’s mission is to help gamers unlock the value of their gaming profiles and be rewarded for their contributions to gaming communities.

- Official Link: https://forge.gg/

3. [DeFi] Elixir Protocol secures $7.5 million Series A funding at $100 million valuation.

DeFi protocol Elixir has closed a $7.5 million Series A fundraising round at a $100 million valuation, designed to help it improve liquidity across decentralized order book exchanges. Hack VC led the round, with participation from NGC Ventures, AngelList Ventures, Bloccelerate and angels from Ledger Prime, Genesis Trading and Hudson River Trading, among others, according to a statement.

“Hack VC is keen to invest in new primitives pushing space forward and are proud to have led Elixir’s Series A raise,” Hack VC Managing Partner Ed Roman said. “Exchange liquidity has always been a problem, especially for order book DEXs and token projects where capital is highly inefficient: dependent on a small handful of firms. Elixir’s adoption by order book exchanges across space, paired with the strong technology it’s been developing for over two years, positions them to be among the leaders for order book liquidity on exchanges.”

- Official Link: https://elixir.finance/

4. [NFT] Metaverse Super App Upland Secures Additional $7M in Extended Series A Round.

Upland has secured an additional $7 million in an extended Series A round. Open-source blockchain developer EOS Network Ventures joined the round as a new investor with participation from existing investors C3 Venture Capital, Animoca Brands and angel investors.

The fresh funding follows the company’s $18 million fundraising in 2021, bringing the total raised to $25 million. Upland plans to use the funds to accelerate the development of its open-metaverse platform and strengthen its position in the blockchain gaming space.

- Official Link: https://www.upland.me/

See you next week! 🙌

🎙Forum: Feel free to leave your comments on our official LBank Labs Twitter account, and don’t hesitate to ask questions about the tokens or projects that interest you. We will diligently gather them and discuss them in the recap section of our weekly digest!

📢 Disclaimer: The weekly crypto market insights are provided for informational purposes only and should not be considered as financial advice. The cryptocurrency market is highly volatile and unpredictable. Prices and trends can change rapidly, and past performance is not indicative of future results. Always conduct thorough your own research and consult with a qualified financial professional before making any investment decisions.