Understanding how different futures order types work is crucial for any trader on LBank. This guide explores the core concepts and usage of market orders, limit orders, trigger orders, and post-only orders, helping you grasp the differences between various order types and trade more efficiently.

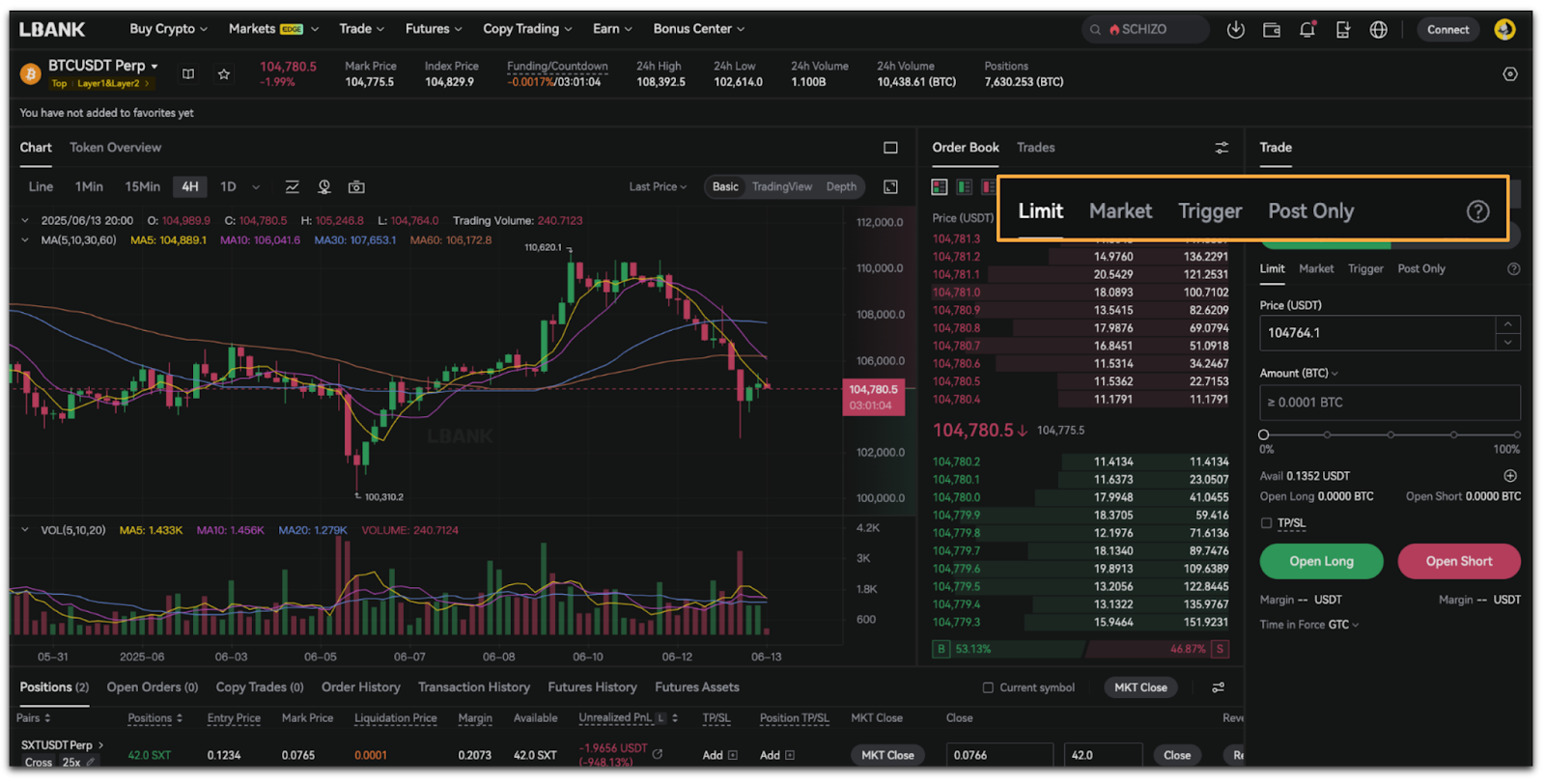

LBank Futures offers four order types: Market Order, Limit Order, Trigger Order, and Post Only.

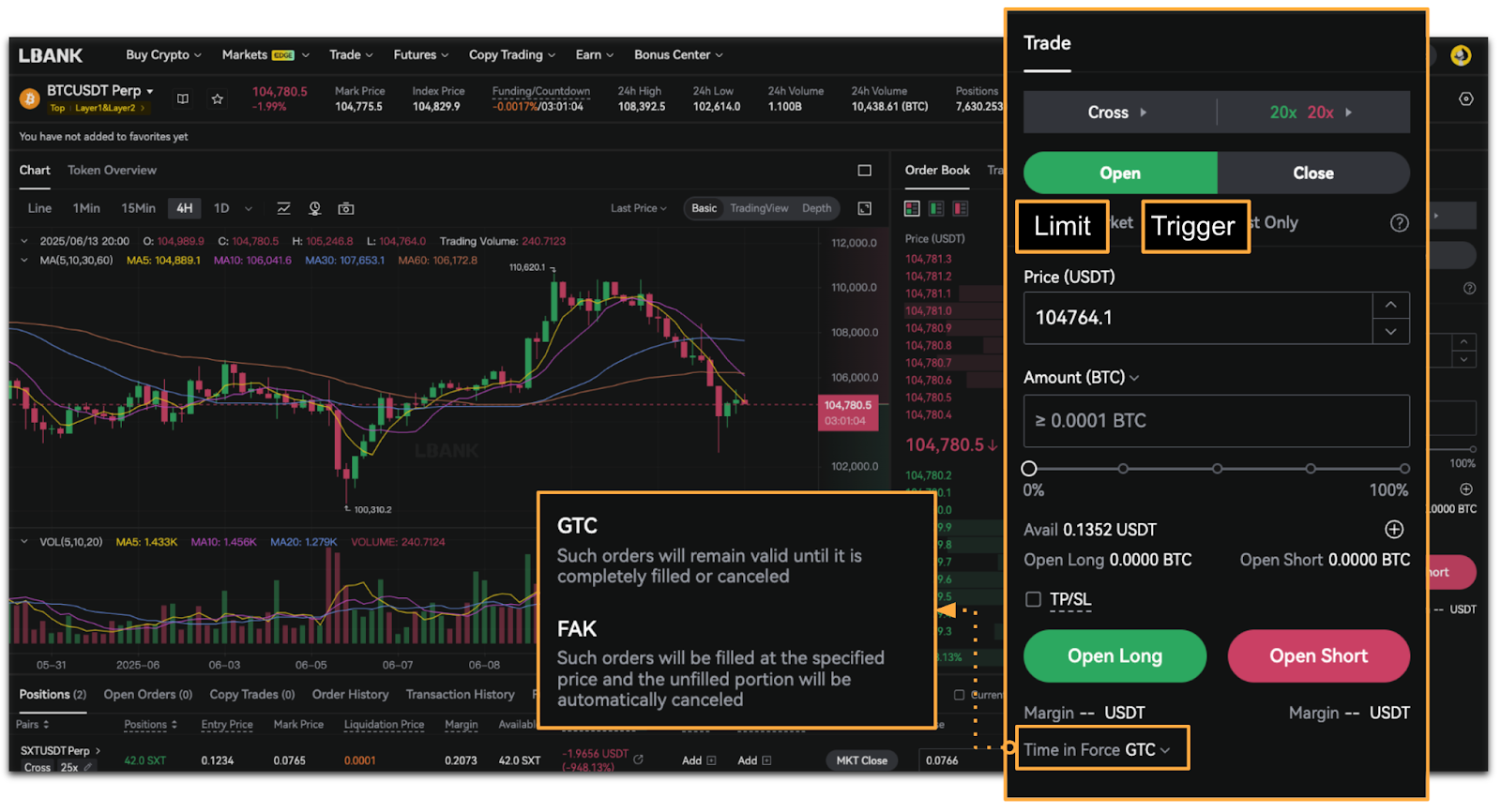

- Note: You can select different order validity times according to your needs.

Quick Summary: Market Order vs. Limit Order

| Aspect | Market Order | Limit Order |

Execution Speed |

Once submitted, the LBank system automatically matches your order with the best available price in the order book, resulting in immediate execution. | This order is not executed instantly. Instead, it is placed in the order book and will only be filled when the market price meets or exceeds your specified price. |

Price Control |

When placing the order, you can reference the current mark price or the latest traded price, but you cannot set a specific price. The final execution price is determined by the market depth at the time of execution. | You can specify your targeted buy or sell price based on the current mark price or the latest traded price, enabling more precise control over your trading costs. |

Use Case |

Ideal for users who value rapid execution and aim to buy or sell instantly. | Ideal for users seeking to trade at a precise price with greater control over pricing. |

Risk |

Influenced by the current order book liquidity, which may impact execution if liquidity is limited. | If your limit price is significantly distant from the current market price, execution is not assured. With limited market depth or large position sizes, the order may only be partially filled. |

Market Order

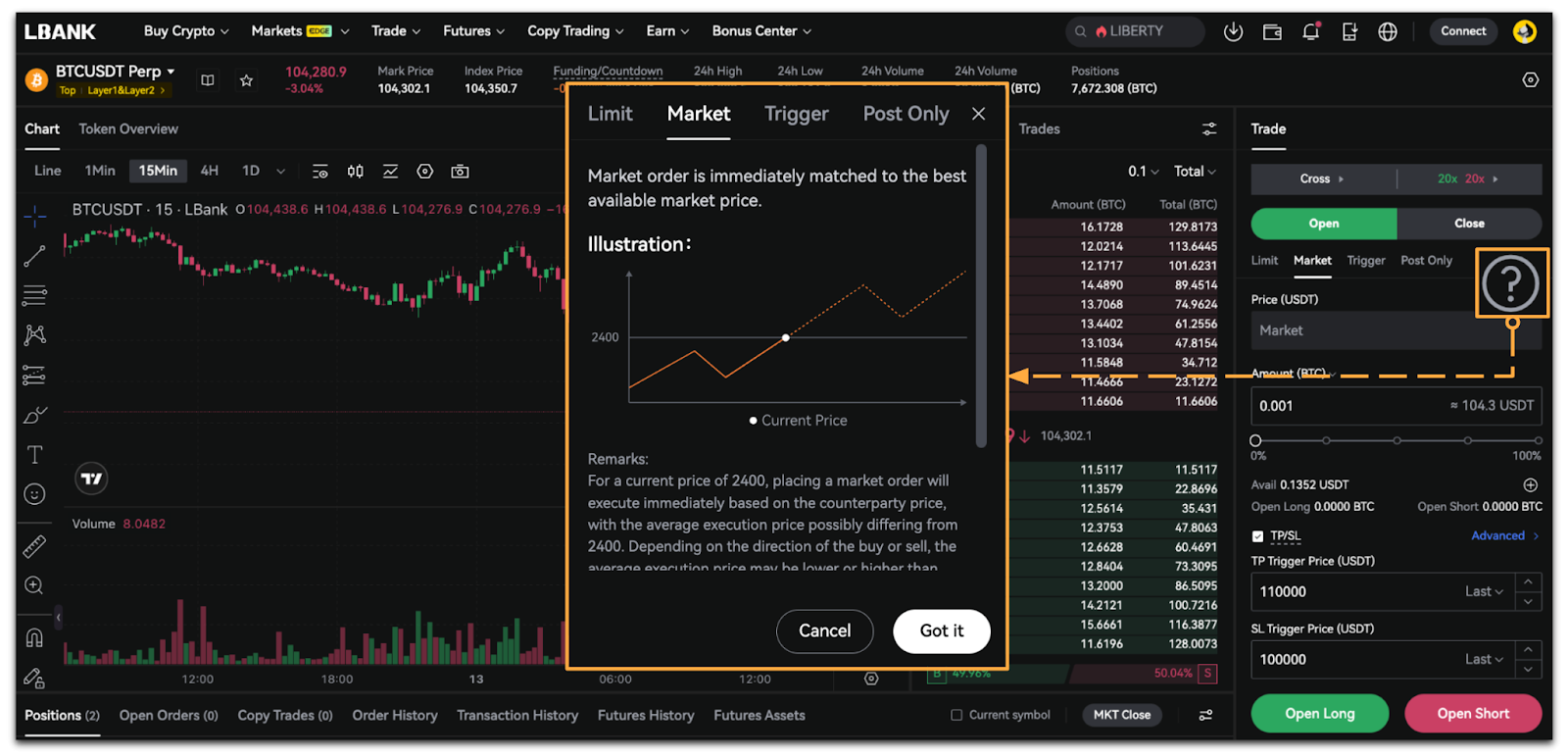

Market order is immediately matched to the best available market price.

- Tap [More Info] to view more about Market Order.

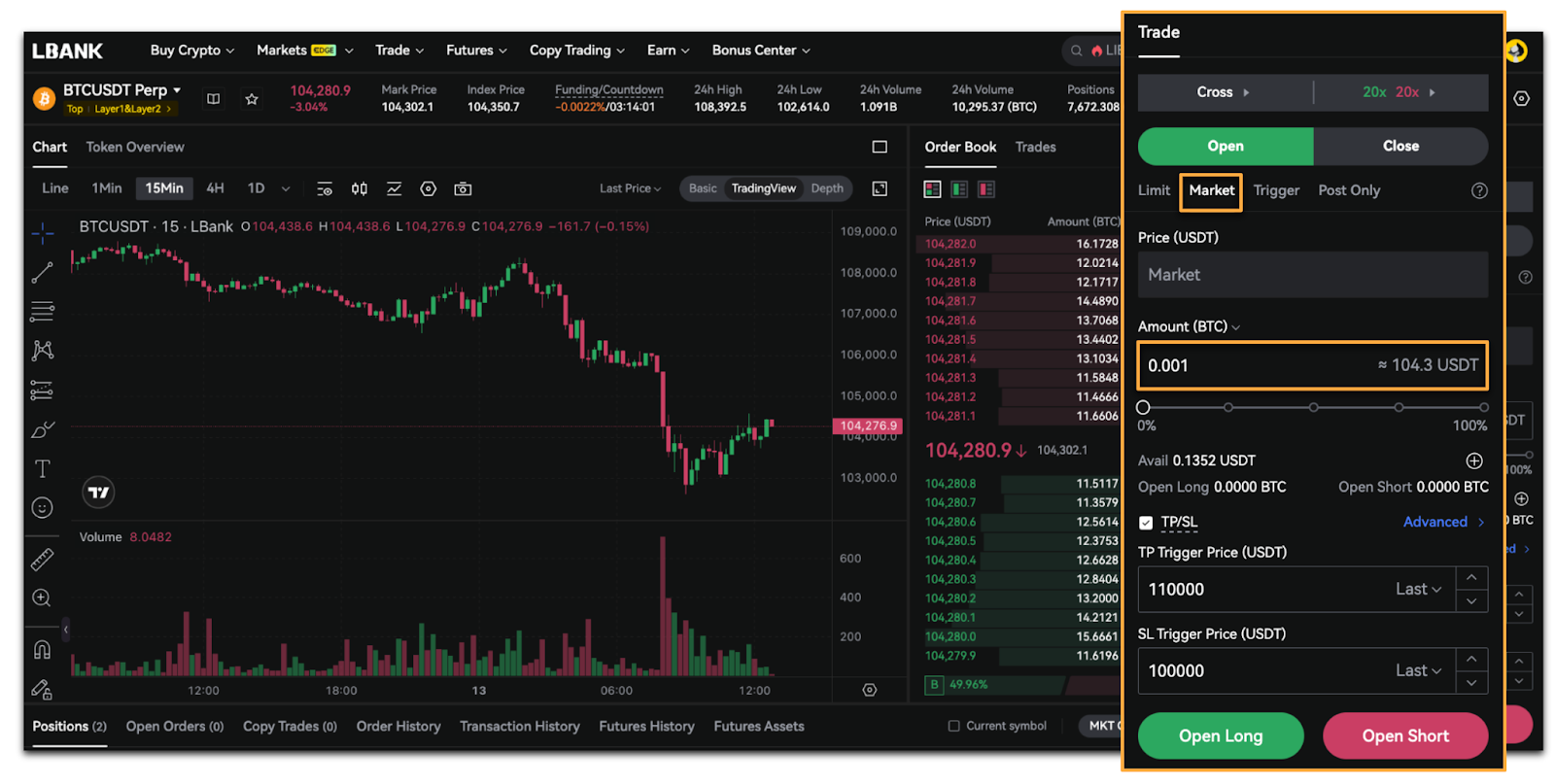

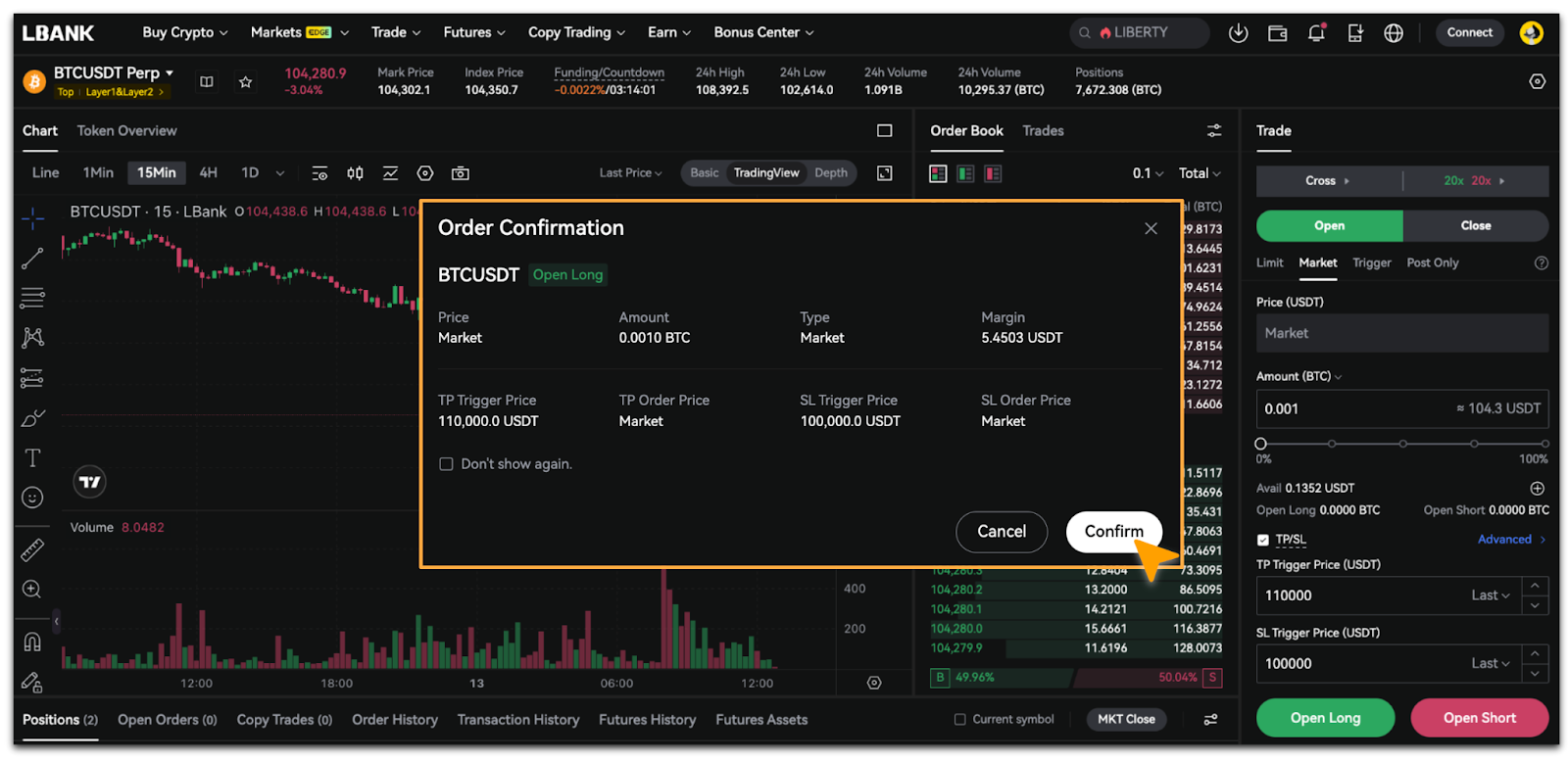

How to place a Market Order?

1. Select [Market], enter the [Amount], and tap [Open Long] or [Open Short].

2. In the [Order Confirmation] pop-up, verify that the amount information is correct, then tap [Confirm].

Limit Order

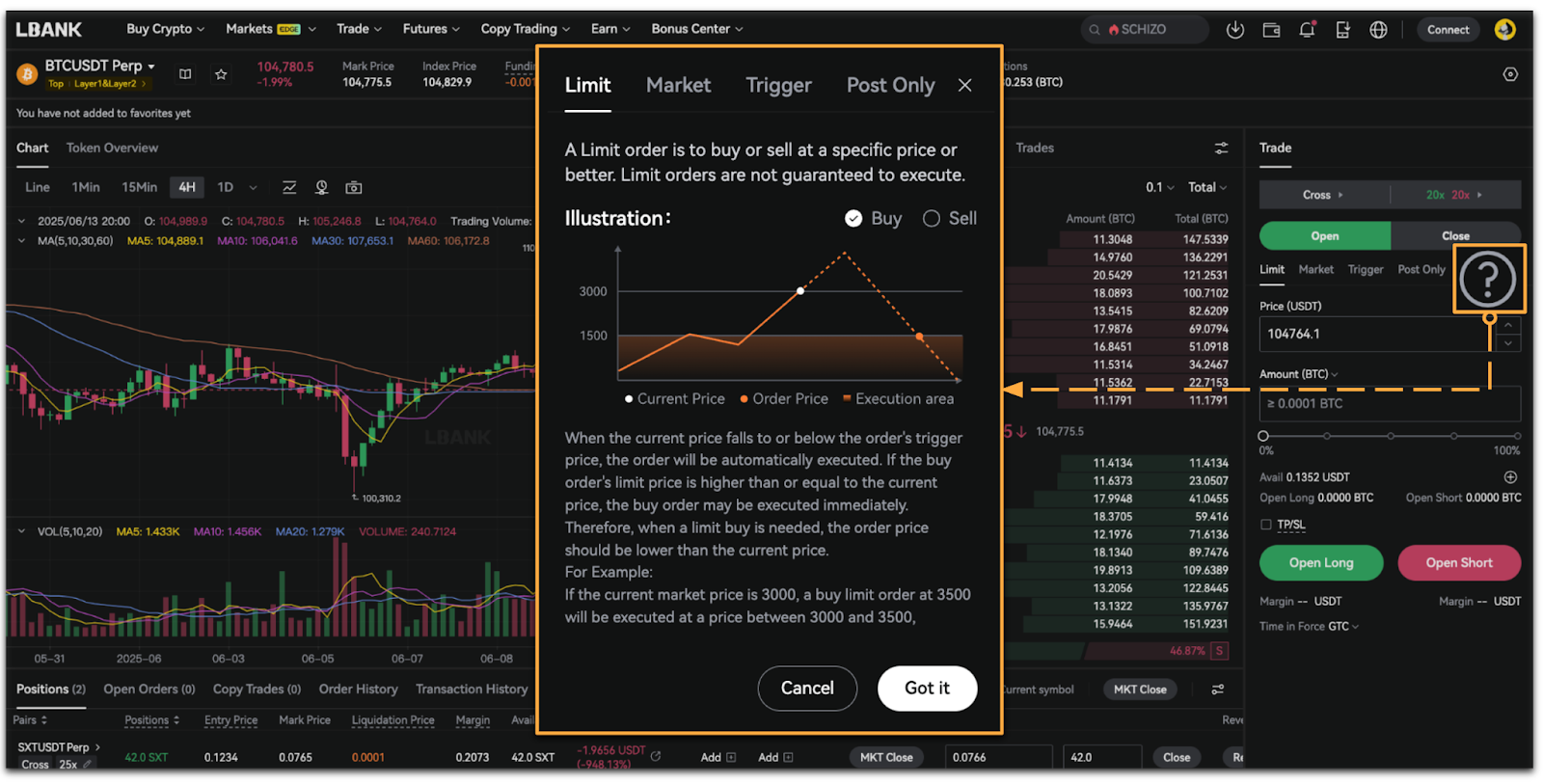

A Limit order is to buy or sell at a specific price or better. Limit orders are not guaranteed to execute.

- Tap [More Info] to view more about Limit Order.

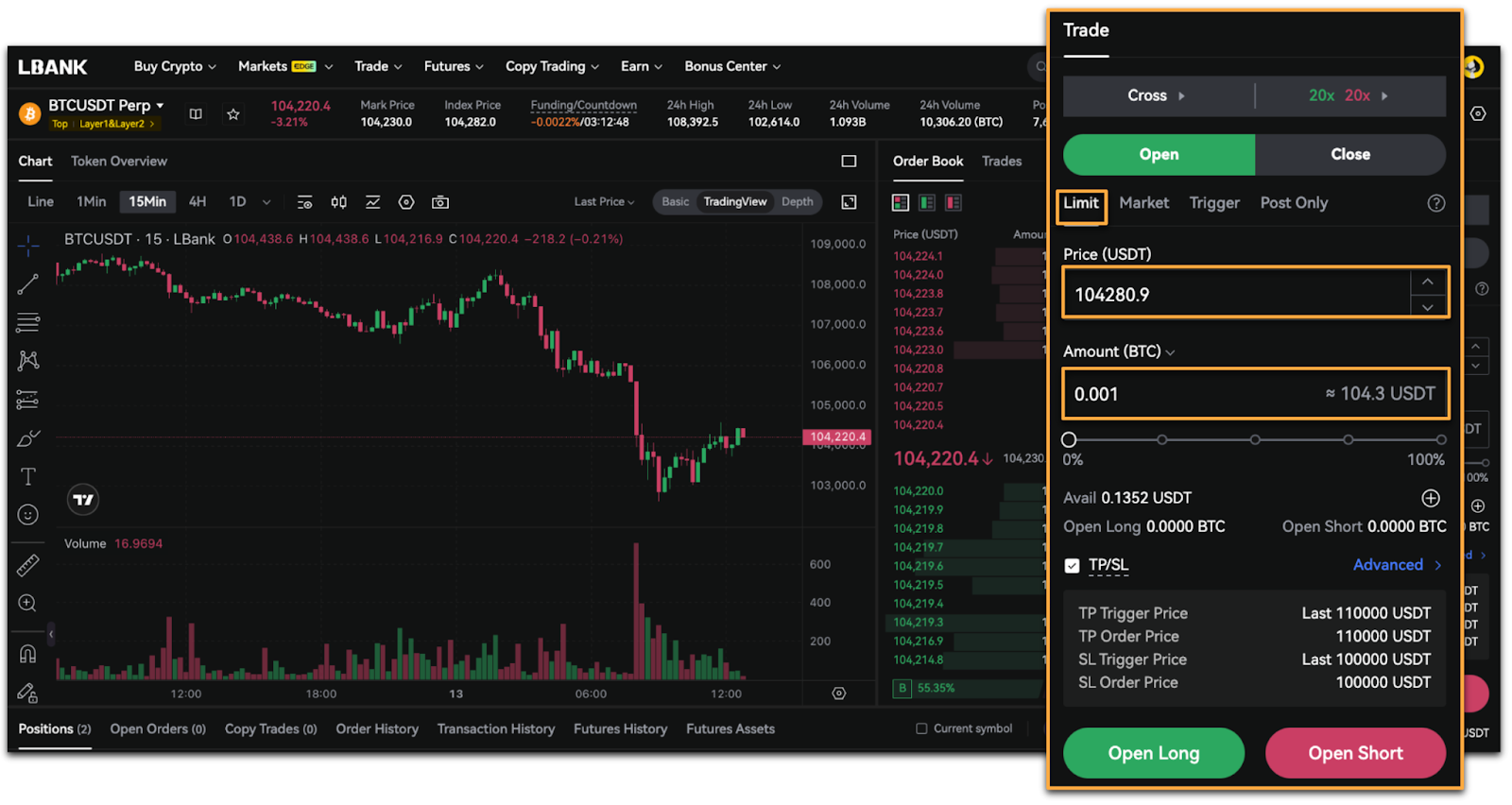

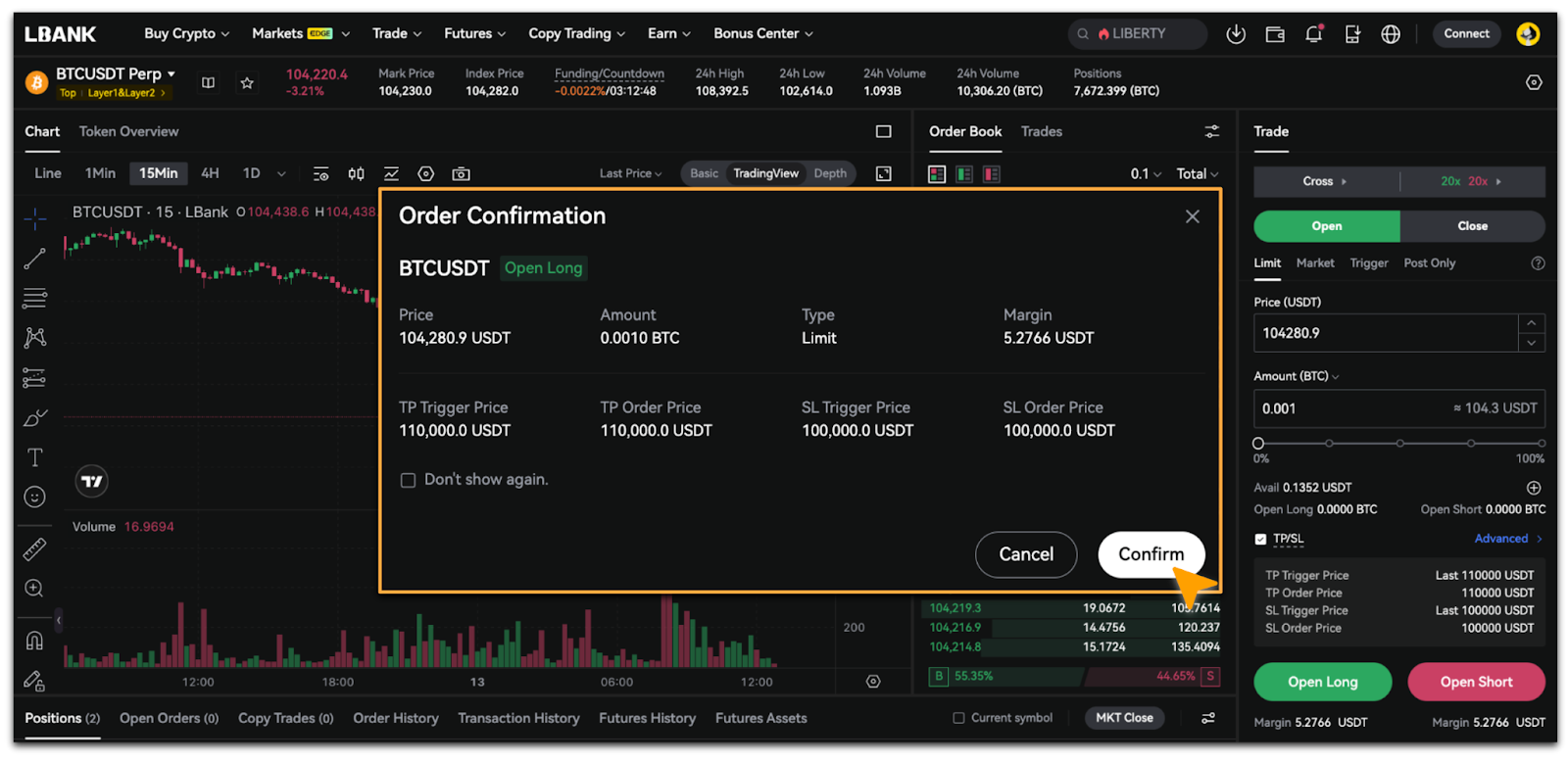

How to place a Limit Order?

1. Select [Limit], enter the [Price] and [Amount], then tap [Open Long] or [Open Short].

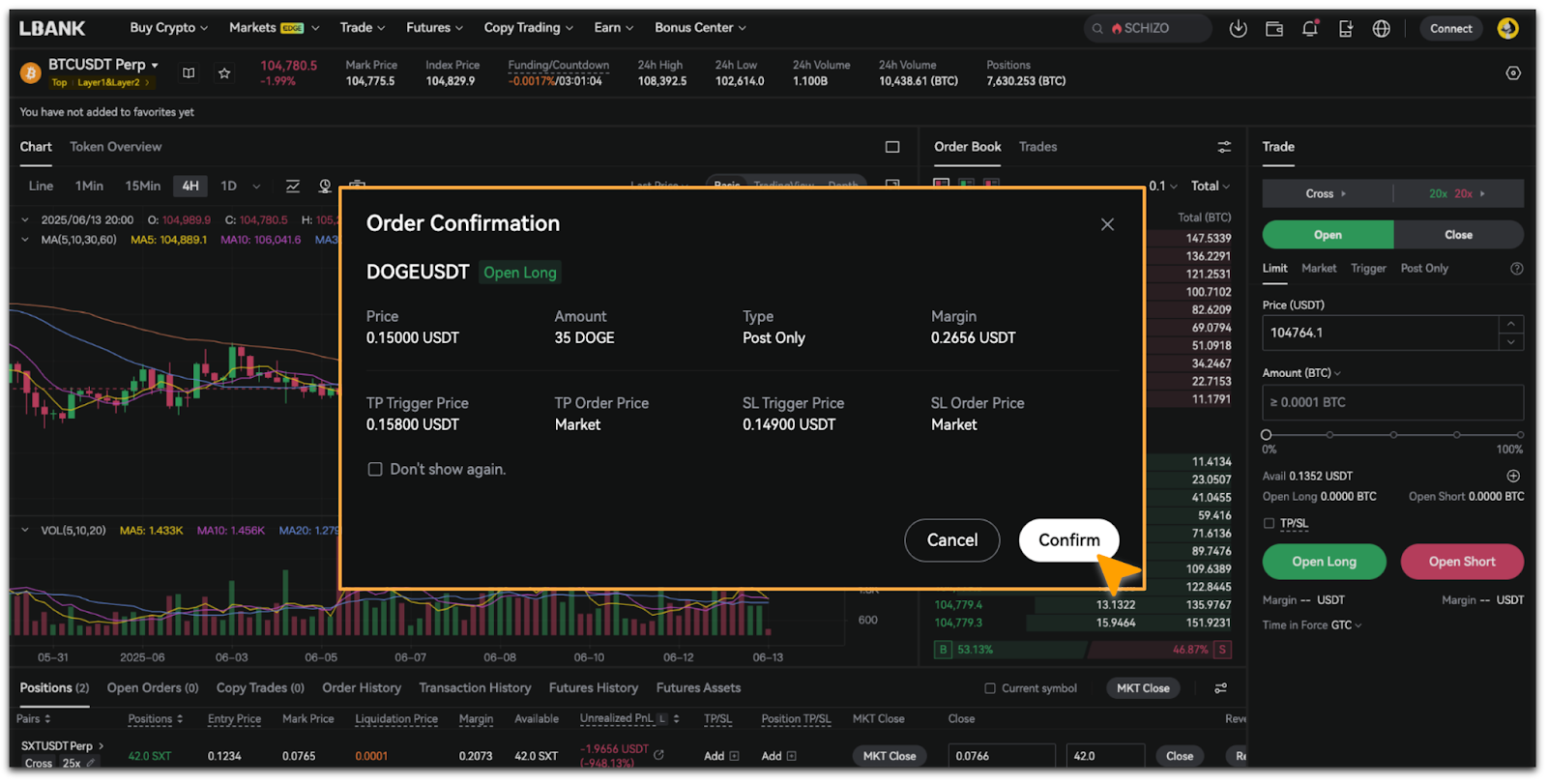

2. In the [Order Confirmation] pop-up, verify that the price and amount information are correct, then tap [Confirm].

Quick Summary: Trigger Order vs. Post Only Order:

| Aspect | Trigger Order | Post Only Order |

Trigger Condition |

Requires a preset trigger price. The order will only be submitted when the market price reaches the trigger condition. | The order is placed directly in the order book. If it is executed immediately, it will be automatically canceled to ensure it only remains as a maker order. |

Use Case |

Suitable for strategies like take profit, stop loss, auto-entry or exit. Allows automated trading in response to price breakouts or pullbacks. | Suitable for providing liquidity without immediate execution. Commonly used in market-making strategies to benefit from maker fee discounts. |

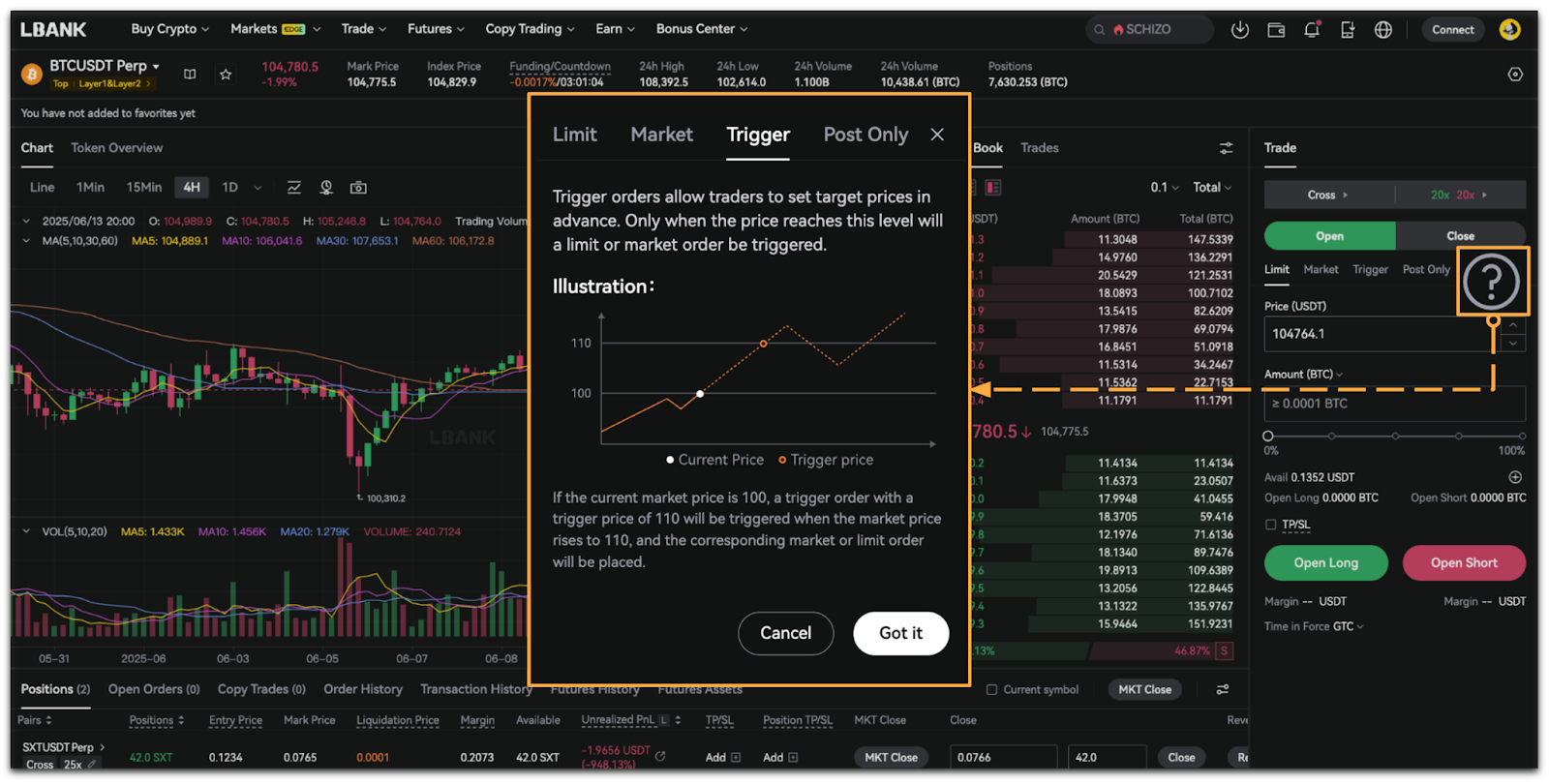

Trigger Order

Trigger orders allow traders to set target prices in advance.Only when the price reaches this level will a limit or market order be triggered.

- Tap [More Info] to view more about Trigger Order.

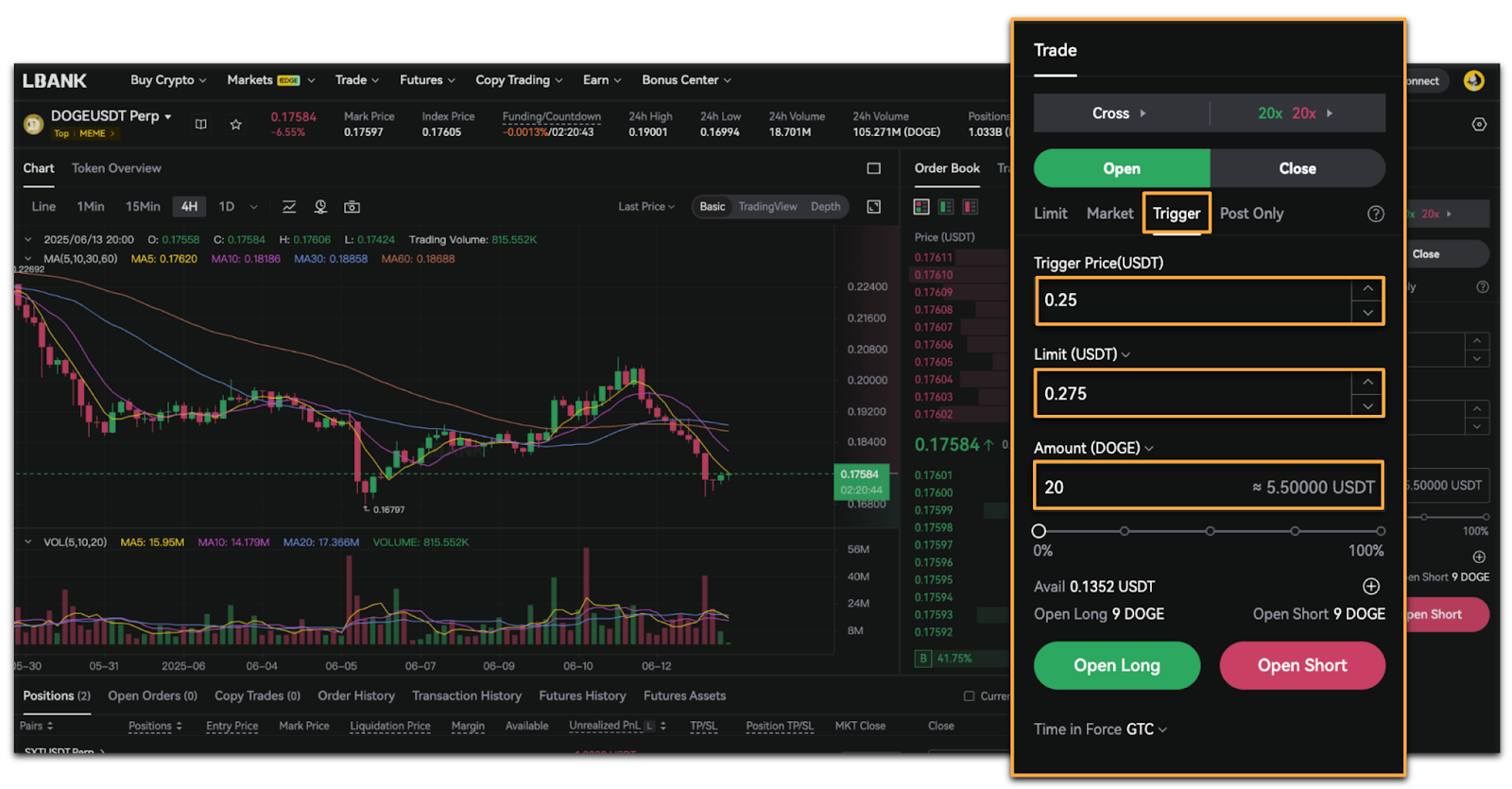

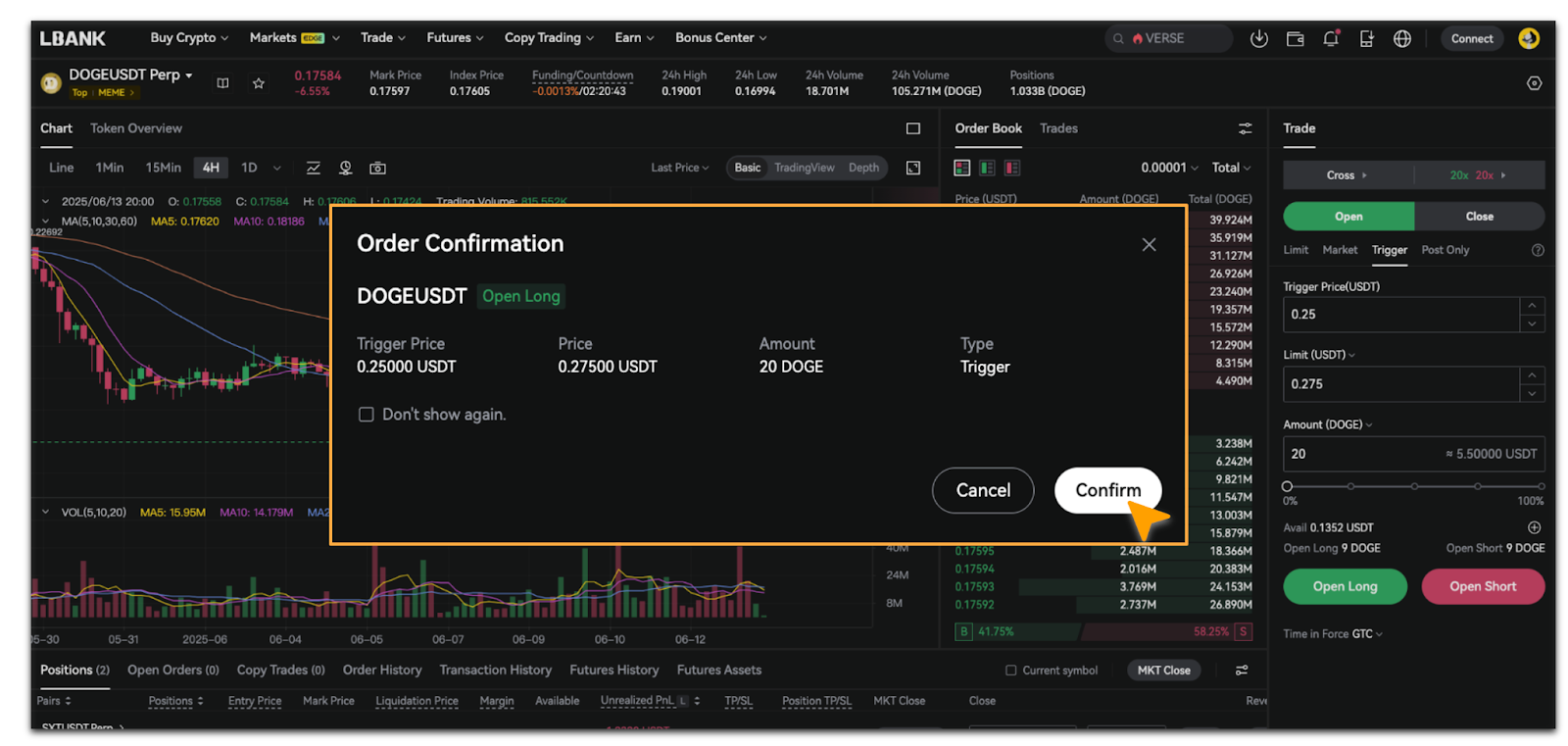

How to place a Trigger Order?

1. Select [Trigger], enter the [Trigger price], [Limit] and [amount], then tap [Open Long] or [Open Short].

2. In the [Order Confirmation] pop-up, verify that the price and amount information are correct, then tap [Confirm].

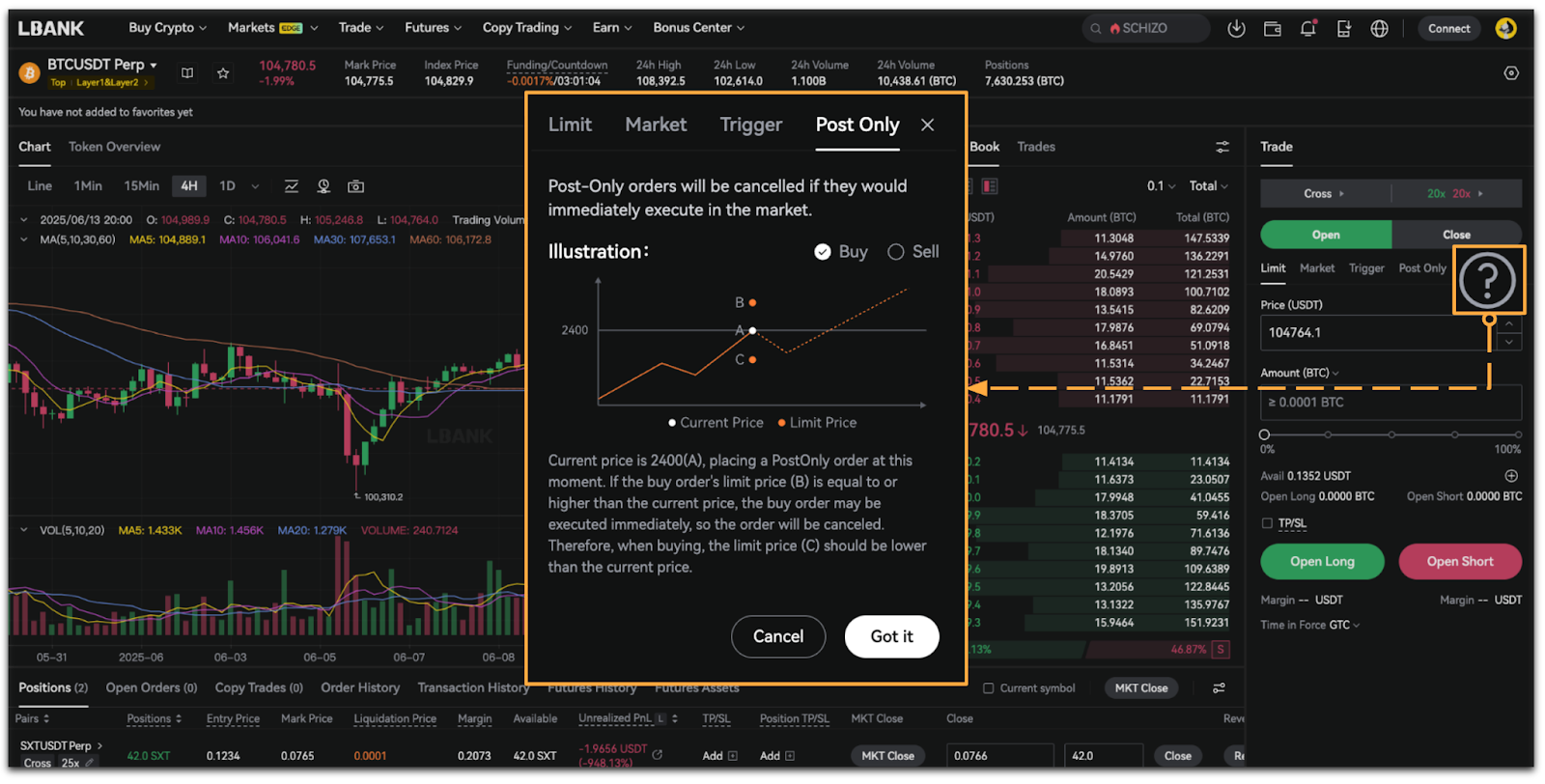

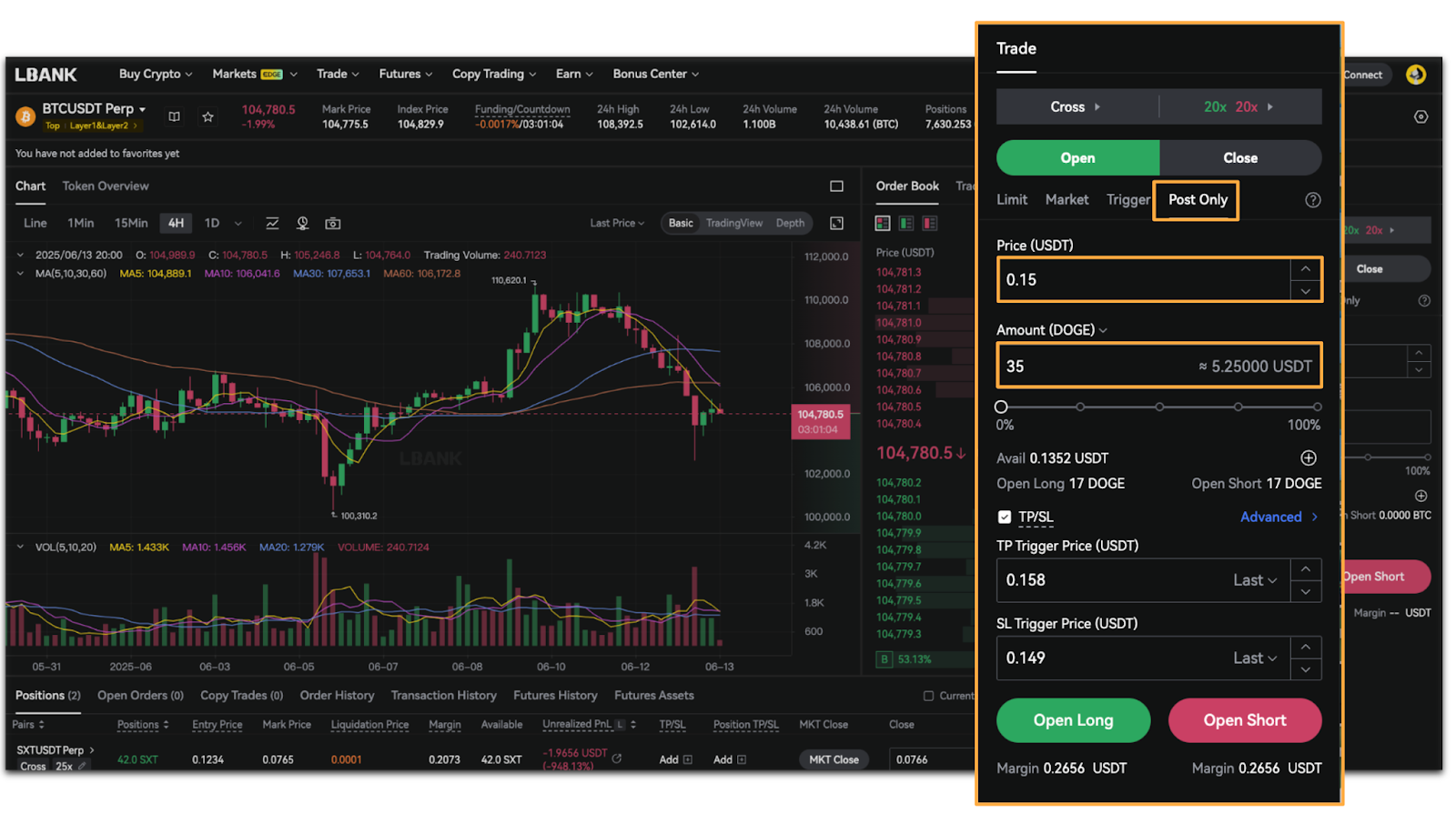

Post Only Order

Post-Only orders will be cancelled if they would immediately execute in the market.

- Tap [More Info] to view more about Post Only Order.

How to place a Post Only Order?

1. Select [Post Only], enter the [Price] and [Amount], then tap [Open Long] or [Open Short].

2. In the [Order Confirmation] pop-up, verify that the amount information is correct, then tap [Confirm].