1 . Review of hot topics this week:

1.1. Rumor: Qatar’s sovereign wealth fund may be interested in buying $500 billion in Bitcoin

On December 5, the well-known Bitcoin blogger @maxkeiser said on X, “Rumors suggest that Qatar’s sovereign wealth fund may be interested in buying $500 billion in Bitcoin. Bitcoin (BTC) is facing increasing competition from “Qatar’s sovereign wealth fund and other Middle Eastern investors.”

Although this is regarded as a rumor, after all, the assets of the Qatar Investment Authority are US$475 billion, but this contains the driving force of the bull market-the super purchasing power from the Middle East world.

1.2. The U.S. SEC delays its decision on “Grayscale’s Ethereum ETF spot proposal”

Grayscale first applied for Ethereum ETF spot on October 2. Day 45 of the proposal was originally scheduled for December 11, 2023, but the SEC said it hopes it will take longer to truly understand everything. As a result, the new deadline for the SEC's decision has been pushed back to January 25, 2024.

In addition, there are currently seven spot Ethereum ETF applicants waiting for SEC permission: VanEck, 21Shares & ARK, Hashdex, Grayscale, Invesco & Galaxy, BlackRock, and Fidelity.

The table above shows that the next Ethereum ETF deadlines for VanEck, Ark Invest, and Invesco & Galaxy are December 23-26, Hashdex is January 1st. Since a Bitcoin ETF spot is unlikely to be approved by then, delaying the SEC's filing is likely.

The next closing dates for BlackRock’s iShares and Fidelity Ethereum funds are January 25 and January 21, 2024, respectively. These dates are crucial as they may involve extensions, requests for more information or final decisions.

Things won’t get really tight until the final deadline arrives for all Ethereum ETF applicants. VanEck will make a decision on May 23, 2024, ARK Invest will make a decision on May 24, 2024, And other notable filers like the Hashdex Nasdaq Ethereum ETF and Grayscale’s Ethereum Trust Exchange (ETHE) Decisions are scheduled for May 30, 2024, and June 18, 2024, respectively, with timelines for potential approvals taking shape.

1.3. ADP employment data fell short of expectations for four consecutive months, adding new evidence of the cooling of the U.S. labor market again.

On Wednesday, December 6, the U.S. ADP employment report showed that U.S. ADP employment increased by 103,000 in November, which was lower than the expected 130,000 and also lower than the previous revised value of 106,000.

While employment has slowed, wage growth has also cooled further. In November, wages for those who stayed employed rose 5.6% year-on-year. The growth rate declined for the 14th consecutive month, falling to the weakest growth level since September 2021.

This Friday, the U.S. Department of Labor will release the more closely watched non-farm employment data, and the two reports may be very different. The market generally expects that the number of new non-agricultural employment will rebound to 189,000 from 150,000 in October, the unemployment rate is expected to stabilize at 3.9%, and the average hourly wage will slow down from 4.1% to 4% year-on-year, but from 0.2% month-on-month, accelerate to 0.3%.

1.4. Sotheby’s first auction of Bitcoin Ordinals series BitcoinShrooms

Sotheby’s Digital Art Department has announced the auction of Bitcoin Shrooms, a Bitcoin Ordinals project designed by anonymous artist Shroomtoshi. The Bitcoin Shrooms series was originally minted on-chain on October 22. Both the BitcoinShroom website and the X account claim this is the “first ever Ordinals series.”

It is reported that the auction will be held from December 6 to 13. There are currently three works available for bidding. Sotheby's accepts cryptocurrency bids. The three works are expected to sell for approximately US$20,000 to US$30,000.

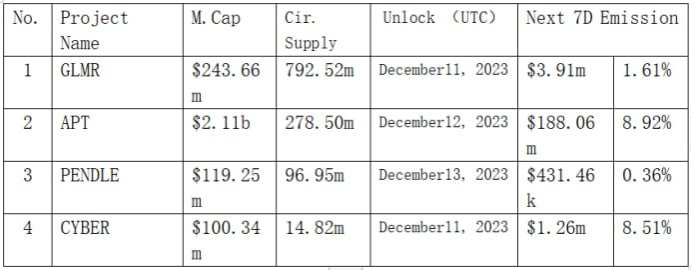

2 . Projects to be unlocked next week:

3. Recent key events:

December 12 (Tuesday)

U.S. November core CPI year-on-year data

U.S. November CPI year-on-year data

December 13 (Wednesday)

U.S. core PPI year-on-year data for November

U.S. November PPI year-on-year data

December 14 (Thursday)

U.S. FOMC interest rate decision meeting

Number of people applying for unemployment benefits for the first time in the United States in the week of December 9 (10,000 people)

December 15 (Friday)

US December Markit Comprehensive PMI Initial Value

U.S. Markit services industry PMI preliminary value in December