1. Review of hot topics this week:

1.1. El Salvador Volcano Bond will be launched in the first quarter of 2024

On December 11, according to Bitcoin Magazine, El Salvador’s Bitcoin Volcano Bond received regulatory approval and will be launched in the first quarter of 2024.

El Salvador’s main Bitcoin office released news on Tuesday that the country’s long-planned Bitcoin Volcano Bond has received regulatory approval and will be issued in early 2024. The bonds will be issued by Bitfinex Securities. Salvadoran President Bukele confirmed the approval, on X. Bukele aims to raise $1 billion through the issuance of Bitcoin-backed volcano bonds to foster a Bitcoin mining industry that relies entirely on renewable energy, including energy generated by the country’s active volcanoes.

1.2. S&P Global Ratings Stablecoin Assessment Report, DAI and USDT are “restricted”

On December 13, S&P Global Ratings, a world-renowned rating company(S&P Global Ratings)announced its stability assessment of stablecoins, covering DAI, FDUSD, USDT, FRAX, TUSD and USDC, USDP, and GUSD.

Analysts are primarily focused on “the quality of the assets backing the stablecoin.” Overall quality is measured by custody risk, creditworthiness and market value. According to its analysis, USDC, USDP and GUSD top the list, all receiving strong ratings, USDT, DAI and FDUSD are in the middle or "constrained", and FRAX and TUSD are rated "weak". Analysts said that none of the stablecoins listed in the first review received a "very strong" rating, which is the highest rating, and four of the stablecoins were affected by "negative adjustments."

1.3. KuCoin paid a settlement of US$22 million and exited New York, USA.

On December 12, New York State Attorney General Letitia James announced a major victory in the field of cryptocurrency regulation.

Exchange KuCoin was ordered to pay more than $22 million. The reason comes after New York regulators accused KuCoin of breaching its legal obligations. Specifically, the company is not registered as a securities and commodities broker and promotes itself as a legitimate cryptocurrency exchange.

As part of the settlement, KuCoin has agreed to a series of actions with significant consequences. First, the company will block access to its platform to all users based in New York. The move comes in response to the outcome of the lawsuit and KuCoin’s settlement. In addition, the terms of the settlement include a $5.3 million fine, underscoring the seriousness of KuCoin’s inadequate regulatory oversight.

1.4. Bloomberg Analyst: In the past few days, four issuers have met with the SEC regarding ETF applications.

On December 13, Bloomberg analyst James Seyffart said on the X platform, Four issuers have met with the SEC in the past few days regarding spot Bitcoin ETF applications, with BlackRock meeting with the SEC for the third time in a few weeks.

Grayscale, Franklin and Fidelity have all spoken to the SEC over the last week, with each meeting attended by the Division of Trading and Markets and the Division of Corporate Finance, which will ultimately decide whether and when to approve or deny 19B-4 and S-1. In addition, analysts pointed out that ARK Invest/21Shares has only held one formal meeting with the SEC since November 20, but this does not mean that they have not had dialogue.

1.5. The US CPI growth rate expanded month-on-month in November, and the core CPI increased by 4% year-on-year and did not cool down again.

On December 12, data released by the U.S. Bureau of Labor Statistics showed that the U.S. CPI rose by 3.1% year-on-year in November, slower than the 3.2% in October, in line with expectations; the month-on-month growth rate rose to 0.1%. Higher than previous value and expected 0%.

Core inflation, which excludes food and energy costs, which the Fed is more concerned about, grew at 4% year-on-year, which was the same as the previous value and expectations, but still higher than the Fed's 2% target level. The month-on-month growth rate rebounded from 0.2% to 0.3%. The same as expected.

On December 13, data from the U.S. Department of Labor showed that the U.S. PPI increased by 0.9% year-on-year in November, which was lower than the expected 1%. It fell further from the 1.3% in October and was the lowest level since June this year.

Excluding volatile food and energy, core PPI increased by 2% year-on-year in November, which was lower than expected at 2.2%. It also slowed down from 2.4% in October and was the lowest level since January 2021. Core PPI increased by 0% month-on-month, the same as expected.

1.6. The Federal Reserve continues to remain on hold, acknowledging that inflation is slowing, and is expected to cut interest rates three times next year.

On December 13, after the FOMC meeting, the Federal Reserve announced that it would remain on hold and lowered its interest rate forecast for the end of 2024 from 5.1% to 4.6%, releasing a "dovish" signal for next year's monetary stance.

Federal Reserve Chairman Powell, who has been trying to curb the market's "interest rate cut expectations", no longer suppressed, saying that the prospect of interest rate cuts was discussed at this meeting, saying that interest rate cuts are "obviously a topic of discussion."

After the release of the Federal Reserve's blockbuster resolution and interest rate forecast, market expectations for the Federal Reserve to start cutting interest rates next spring have further increased.

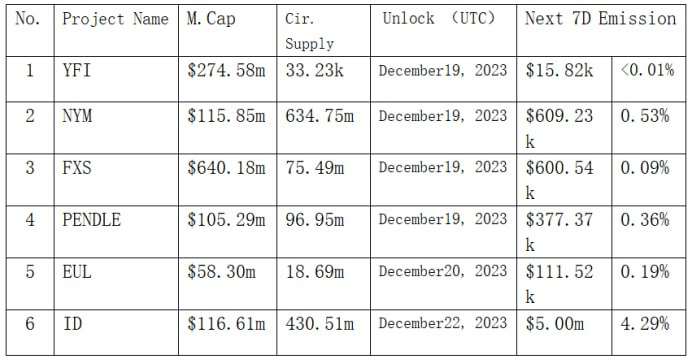

2. Projects to be unlocked next week:

3. Recent key events:

December 19 (Tuesday)

Euro zone November core reconciled CPI final year-on-year value

Eurozone November reconciled CPI final month-on-month value

U.S. new housing starts in November month-on-month.

U.S. new housing starts in November (10,000 households)

December 20 (Wednesday)

U.S. Conference Board Consumer Confidence Index for December

U.S. Existing Home Sales Total Annualized Month-over-Month in November

Annualized total number of existing home sales in the United States in November (10,000 households)

December 21 (Thursday)

Number of people applying for unemployment benefits for the first time in the United States in the week of December 16 (10,000 people)

The final value of annualized quarter-on-quarter real GDP in the United States in the third quarter

December 22 (Friday)

U.S. core PCE price index in November year-on-year