Economic data dampened expectations of interest rate cuts, and U.S. stocks and bonds continued to decline in consecutive days

1. Review of hot topics this week:

1.1. Economic data dampened expectations of interest rate cuts, and U.S. stocks and bonds continued to decline in consecutive days.

After Fed Governor Waller stated on Tuesday that he was in no rush to cut interest rates, the data further dampened market expectations for a recent interest rate cut by the Fed.

On Wednesday, January 17, data released that day showed that the U.S. economy was stronger than expected: retail sales in December increased by 0.6% month-on-month, the largest increase in three months; industrial output in December increased by 0.1% month-on-month, higher than November's Growth slowed by 0.2%, but growth did not stall as analysts expected.

After the data was released, swap contracts showed that investors expected the probability of the Fed to cut interest rates as early as March fell to about 50% from about 80% last Friday. At the same time, money markets have postponed their expectations for the timing of the European Central Bank's first interest rate cut, pricing fully incorporates the postponement of the interest rate cut from April to June, the first time since the end of November last year.

U.S. stock and U.S. bond prices fell further. The yield on the benchmark 10-year U.S. Treasury note stood at 4.10%, continuing to hit the highest level since the Federal Reserve's interest rate meeting a month ago.

The MSCI Inc. emerging market stock index fell 2.3% at one point, the largest intraday drop since August 2 last year, and the cumulative decline since the beginning of the year has reached more than 6%. Financials, consumer discretionary and information technology sectors led the decline.

1.2. SEC delays Ethereum spot ETF application

On Thursday, January 18, the U.S. Securities and Exchange Commission (SEC) prematurely delayed Fidelity’s application for an Ethereum spot ETF, according to filings. The SEC wrote in the filing:

"The Commission believes it is appropriate to specify a longer period for taking action on the proposed rule changes to allow sufficient time to consider the proposed rule changes and the issues raised therein."

The next key date will be May, At that time, the SEC must make a ruling on whether to approve or disapprove three Ethereum ETFs.

The potential approval of an Ethereum ETF has fueled the recent rebound in the ETH/BTC exchange rate, but CoinShares researcher Luke Nolan said in an interview that the probability of an Ethereum spot ETF being approved in 2024 is about 70%. However, Luke Nolan added that he believes the market may have reacted a little too early, and approval may not occur until the fourth quarter of 2024 at the earliest, and the likelihood of approval before then is not high.

1.3. TUSD is decoupled in the short term and Poloniex cannot withdraw coins.

On the evening of January 15, the stablecoin TrueUSD (TUSD) began to fall, quoting at $0.9880, with a decoupling rate of 1.2%. Other reports indicate that TUSD is having difficulty issuing instant reserve certificates, and the exchange Poloniex has been unable to withdraw TUSD.

In addition, the Manta Network mining (Launchpool) launched on Binance Exchange on January 16 excluded TUSD, which also made the community suspicious.

On January 18, two whales bought TUSD to bring TUSD back to anchor. According to Lookonchain monitoring, whale TT2T17 (suspected to be Justin Sun) destroyed 104 million TUSD after decoupling, then deposited 200 million USDT into Binance and withdrew 139.56 million TUSD from Binance. And after decoupling and depositing it into JustLend. Then borrow 18.97 million SDT from JustLend and deposit it into Binance.

1.4. Solana Mobile plans to launch a second smartphone

On January 16, CoinDesk reported, citing people familiar with the matter, that Solana Mobile plans to launch a second smartphone. The upcoming phone will have the same basic functions as its predecessor Saga: a built-in encryption wallet, customized Android software and A "dApp store" for crypto applications - But the price is cheaper and the hardware configuration is different.

Previously, Solana Mobile released its first mobile phone --- Solana Saga. Saga is a blockchain-oriented smartphone designed to enhance the Web3 experience. It integrates Seed Vault for secure digital asset custody and a dedicated dApp Store, and is based on Solana Mobile Stack (SMS), enabling seamless interaction with Web3. Originally priced at $1,000, it has since undergone significant price cuts and retails for $599 on the official website. In December 2023, the Saga mobile phone was resold for more than $5,000 on eBay and other platforms.

1.5. Blast announced the official launch of the test network and launched the Blast BIG BANG competition

On January 17, Blast announced the official launch of the testnet and launched the Blast BIG BANG competition. The winning dapp will be promoted to Blast users after the mainnet is launched at the end of February. Additionally, 50% of the Blast airdrop has been allocated to developers and the other 50% to Blast staking users (100k+). Blast will also help the winning dapp team connect with investors. DeBank data shows that Blast TVL reaches $1.368 billion, including 478,089.7353 ETH stored in Lido and 125,748,186.1242 DAI in MakerDAO.

1.6. Within three days of listing, the Bitcoin spot ETF attracted less than US$900 million.

As of January 17, data from digital asset management company CoinShares showed that Bitcoin spot ETFs including BlackRock, Franklin Templeton and Invesco had a net inflow of $871 million in the first three days of trading.

Among them, BlackRock topped the list with an inflow of $723 million, followed by Fidelity with an inflow of $545 million, but asset management company Grayscale’s Bitcoin ETF saw an outflow of $1.18 billion.

Since the adoption of the BTC spot ETF on January 10, Grayscale’s address has been in the opening hours of the US stock market for three consecutive trading days starting from January 12. A total of 31,638 BTC (approximately $1.366 billion) has been transferred to Coinbase Prime.

The media quoted Ilan Solot, co-head of digital assets at Marex Solutions, as saying that the approval of the Bitcoin spot ETF is by no means a large-scale success. The overall performance of the Bitcoin spot ETF was not as good as the Bitcoin futures ETF launched by ProShares in October 2021, which attracted $1 billion in gold in the first two days.

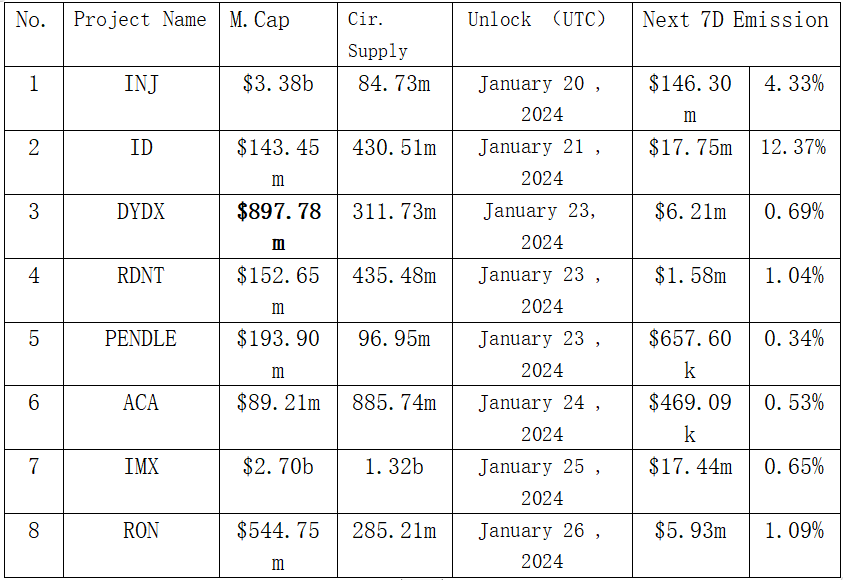

2. Projects to be unlocked next week:

3. Recent key events:

January 24 (Wednesday)

US January Markit comprehensive PMI initial value;

The initial value of the Markit service industry PMI in the United States in January;

IBM and Tesla released Q4 financial report for fiscal year 2023;

January 25 (Thursday)

The number of people applying for unemployment benefits for the first time in the United States in the week of January 20 (10,000 people);

The preliminary annualized quarter-on-quarter real GDP value of the United States in the fourth quarter;

U.S. new home sales in December (10,000 households);

The European Central Bank announces its interest rate decision;

European Central Bank President Christine Lagarde held a monetary policy press conference;

January 26 (Friday)

U.S. December core PCE price index year-on-year data;

U.S. real personal consumption expenditures (PCE) month-on-month data in December;

U.S. December existing home contracted sales index year-on-year data;