What Is Polkadot and Why It Matters

Polkadot is a multi-chain blockchain platform that solves one of crypto's biggest problems. Most blockchains can't talk to each other. They exist in isolation. Polkadot changes this by creating a network where different blockchains can share data and assets securely.

The platform runs on a nominated proof-of-stake consensus mechanism. It provides smart contract functionality. But its real innovation is the architecture. Polkadot allows specialized blockchains to connect and work together. This creates what the founders call Web3 - a decentralized internet where users control their own data.

The network's design assumes the future will have many blockchains. Each blockchain will serve different purposes. Some will handle payments. Others will run games or social networks. Polkadot gives these chains a way to communicate without relying on centralized exchanges or bridges. This approach reduces security risks and improves efficiency.

Review Polkadot Price (DOT) on LBank

DOT() Price

The current price of

The People Who Built Polkadot

Dr. Gavin Wood: The Visionary

Wood's resume in blockchain is hard to match. He co-founded Ethereum (ETH) and wrote its Yellow Paper. He created the Solidity programming language. He also coined the term "Web3." After leaving Ethereum, Wood founded Parity Technologies with Jutta Steiner. This company now develops Polkadot's core technology.

Robert Habermeier: The Technical Architect

Habermeier is a Thiel Fellow and blockchain researcher. As a founding engineer of Polkadot, he wrote significant portions of the consensus code. His technical contributions shaped the network's underlying infrastructure.

Peter Czaban: The Foundation Builder

Czaban brought fintech industry experience to Polkadot. He co-founded the Web3 Foundation with Wood. As Technology Director, Czaban helped establish the organizational structure supporting the network.

Key Organizations

Two organizations drive Polkadot's development. Parity Technologies handles the technical work. The company develops the Polkadot SDK and core protocol. The Web3 Foundation operates as a non-profit. It provides funding and promotes the broader ecosystem.

The Evolution of Polkadot: From White Paper to 2.0

Polkadot's story starts with Ethereum. Dr. Gavin Wood co-founded Ethereum and served as its CTO. He wrote the Ethereum Yellow Paper and created Solidity. But Wood saw limitations in Ethereum's design. He wanted to build something more scalable and flexible.

2016-2017: Foundation Years

Wood published the Polkadot white paper in 2016. The document outlined a heterogeneous multi-chain framework. In 2017, Wood and Peter Czaban established the Web3 Foundation in Switzerland. The foundation raised $144.3 million through an Initial Coin Offering in October 2017.

The project hit a major setback right after the ICO. A vulnerability in Parity Technologies' multi-signature wallets froze $150 million in Ethereum. This affected over 500 wallets. A significant portion of Polkadot's raised funds was locked in these wallets.

2019-2020: Launch and Transition

Polkadot raised another $43 million through a private token sale in 2019. The mainnet launched in May 2020 under a proof-of-authority model. The Web3 Foundation controlled this initial phase. By June 2020, the network transitioned to its intended Nominated Proof-of-Stake consensus. Token holders could now secure the network.

2021-2024: Major Milestones

December 2021 marked a turning point. Polkadot introduced parachain functionality. Multiple blockchains could now run in parallel and connect to the main Relay Chain. This was the core vision coming to life.

In 2023, Wood announced Polkadot 1.0 at the annual Decoded event. The final codebase represented the original white paper's vision fully realized. The network had achieved strong decentralization with a Nakamoto coefficient of 93.

By May 2024, the community voted on Referendum #747. This referendum defined Polkadot 2.0's key technical advancements. July 2024 saw the 1000th on-chain governance proposal. The network had fully shifted to community-led development.

Polkadot Timeline: Evolution

White Paper Published

Gavin Wood releases the Polkadot white paper, outlining a heterogeneous multi-chain framework.

Web3 Foundation & ICO

Web3 Foundation is founded, raising $144.3M in ICO. A Parity wallet bug later froze ~$150M ETH, affecting funds.

Private Sale

Polkadot raises $43M in a private token sale to continue funding development.

Mainnet Launch

Polkadot mainnet goes live under Proof-of-Authority, controlled by Web3 Foundation.

NPoS Transition

Network shifts to Nominated Proof-of-Stake, letting token holders secure and govern the system.

Parachains Activated

Polkadot enables parachains, allowing multiple blockchains to run in parallel on the Relay Chain.

Polkadot 1.0

Gavin Wood announces Polkadot 1.0, completing the original white paper vision with decentralization achieved.

Referendum #747

Community passes referendum defining Polkadot 2.0’s key technical upgrades.

Governance Milestone

1,000th on-chain governance proposal submitted, showing strong community-led development.

Native DOT Stablecoin Proposal

A proposal to launch a native DOT-backed algorithmic stablecoin called pUSD received majority support.

How Polkadot's Architecture Works

Polkadot's design differs from traditional blockchains. The network has layers. Each layer serves a specific purpose.

The Relay Chain and Parachains

The Relay Chain is Polkadot's main blockchain. It doesn't handle applications directly. Instead, it provides security and coordination. Application-specific blockchains called parachains connect to the Relay Chain. These parachains run in parallel. They can process transactions simultaneously.

Blockchains can also operate as "solochains." These chains function independently but can still interact with the network when needed.

Three Core Properties

Polkadot offers three fundamental benefits to connected chains:

- Sovereignty - Each parachain sets its own rules. One chain's governance doesn't limit another chain's functionality.

- Shared Security - The Relay Chain protects all parachains. Projects don't need to recruit their own validators.

- Interoperability - Parachains exchange assets and data through the Cross-Consensus Message Passing (XCM) protocol. Bridge transfers typically complete in under one minute.

Consensus Mechanism Explained

Polkadot uses Nominated Proof of Stake. The system combines two engines. BABE handles block production. GRANDPA ensures finality. This dual approach balances speed with security.

Token holders nominate validators they trust. Validators produce blocks and maintain consensus. This structure creates economic incentives for honest behavior.

OpenGov: On-Chain Governance

Every DOT holder can propose changes to the network. They can also vote on existing proposals. The OpenGov system divides decisions into different "tracks." Each track has its own voting requirements and timelines.

The Polkadot Fellowship guides technical upgrades. This group consists of recognized experts. Their input helps the community make informed decisions on complex changes.

Understanding the DOT Token and Tokenomics

DOT serves three main functions in the Polkadot ecosystem. Each function plays a critical role in network operations.

Governance Rights

DOT holders vote on all network changes. They can propose new features. They can adjust parameters. They can allocate treasury funds. The voting weight depends on how many tokens a holder stakes and how long they lock them.

Network Security Through Staking

Users stake DOT to secure the network. They nominate validators they trust. In return, stakers earn rewards. This creates economic security. Bad actors risk losing their stake through slashing penalties.

Accessing Network Resources

Projects use DOT to purchase Coretime. Coretime represents computational resources on the network. This replaced the older parachain slot auction model. The new system offers more flexibility.

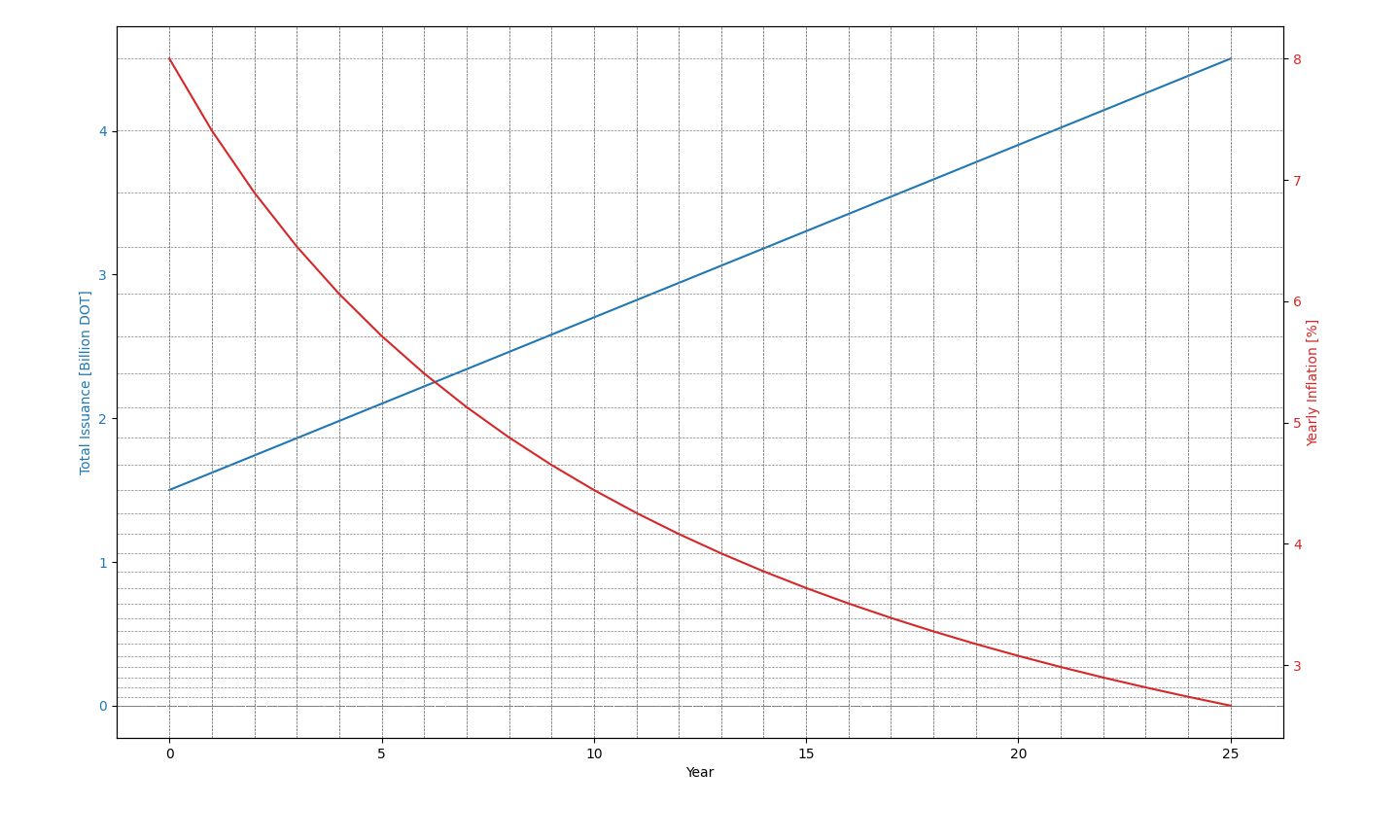

25-year prediction of DOT gross annual inflation (red line) and DOT total issuance (blue line), image by: Polkadot

The New Inflation Model

Polkadot changed its tokenomics in November 2024. The network now adds 120 million DOT per year. This is a fixed amount. As the total supply grows, the inflation rate decreases over time.

The new DOT splits between two destinations. Stakers receive 85% of new issuance. The on-chain Treasury gets the remaining 15%. The Treasury funds ecosystem projects through community votes.

Some tokens get burned. Treasury spending burns tokens. Coretime sales burn tokens. These burns reduce net inflation below the gross rate.

The smallest unit is called a Planck. One DOT equals 10 billion Planck. This precision allows for micro-transactions and accurate calculations.

Polkadot 2.0: Major Technical Upgrades

Polkadot 2.0 isn't a single upgrade. It's a series of improvements that transform how the network operates. These changes make Polkadot faster, more flexible, and easier to access.

Async Backing: Speed Improvements

Async Backing went live on Polkadot mainnet. This upgrade cut block time in half. Blocks now generate every 6 seconds instead of 12 seconds. Transaction throughput increased significantly. The technology allows validators to work on multiple blocks simultaneously. More data fits into each block. The network processes transactions faster without sacrificing security.

Agile Coretime: Flexible Resource Access

Agile Coretime is operational on Kusama. This feature replaces the rigid parachain slot auction system. Projects can now buy or lease computing resources for shorter periods. They can adjust their resource usage based on actual needs.

The old model required long-term commitments. Projects had to lock significant DOT for two years. Agile Coretime lowers the barrier to entry. Small projects can test their applications without massive upfront costs.

Polkadot 2.0, image by: Polkadot

Elastic Scaling: On-Demand Growth

Elastic Scaling is expected later in 2024. This feature works with Agile Coretime. Projects can lease additional cores when demand spikes. They can scale down during quiet periods. This efficiency reduces costs and improves resource utilization.

Real-World Impact

These upgrades attracted major players. Mythical Games chose Polkadot for NFL Rivals. Frequency built its decentralized social media protocol on the network. The technical improvements made Polkadot competitive with newer chains.

The community also drives a rebranding effort. The goal is clearer messaging. The website and documentation are being updated. This makes Polkadot more accessible to new developers. The roadmap includes JAM (Join-Accumulate Machine) as the next evolution. JAM will further expand the network's capabilities beyond the Polkadot 2.0 framework.

Ecosystem Funding and Growth Strategy

Polkadot's funding model reflects its decentralized philosophy. The community controls most financial decisions through on-chain governance.

The On-Chain Treasury

The Treasury receives 15% of all new DOT issuance. This amounts to 18 million DOT per year under the current model. Community members submit proposals for funding. DOT holders vote on these proposals through OpenGov. Approved projects receive their allocation directly from the Treasury.

This system funds development teams, marketing initiatives, infrastructure projects, and educational programs. The decentralized approach ensures the community decides which projects deserve support.

Web3 Foundation Programs

The Web3 Foundation runs two major initiatives:

The Decentralized Futures Program allocated $20 million worth of DOT. This equals approximately 5 million DOT. The program provides seed funding to teams building on Polkadot. It helps new projects launch without immediate revenue.

The Decentralized Voices Program takes a different approach. It gives DOT allocations to community advocates. These advocates amplify their participation in governance. The program strengthens community engagement and spreads voting power.

Private Investment

Investment firms are launching dedicated Polkadot funds. Scytale Digital announced the Polkadot Ecosystem Fund. These private investments complement community funding. They provide capital for larger projects that need professional investment structures.

Polkadot vs Cardano: A Technical Comparison

Both networks aim to improve on earlier blockchain designs. They take different approaches to similar problems. Advanced users often compare these platforms when choosing where to build.

Philosophy and Design

Polkadot emphasizes interoperability and developer flexibility. The multi-chain design lets each parachain specialize. Developers can customize their blockchain for specific use cases. The architecture supports experimentation.

Cardano focuses on academic rigor. Every upgrade goes through peer review. The network prioritizes predictability and formal verification. This approach appeals to projects that value stability over rapid innovation.

Scaling Approaches

Polkadot scales horizontally through parachains. Multiple chains process transactions in parallel. Async Backing and Agile Coretime enhance this capability. The network can add more parachains as demand grows.

Cardano is a Layer-1 blockchain. It addresses scaling through Hydra, a Layer-2 protocol. Base-layer optimizations also improve throughput. This approach keeps the main chain simple while moving complex operations to Layer 2.

Interoperability

Polkadot has a clear advantage here. The XCM protocol enables native cross-chain communication. Parachains share security and can exchange assets seamlessly. This functionality is built into the core protocol.

Cardano explores interoperability through bridges and sidechains. The Midnight sidechain represents this strategy. These solutions work but aren't as deeply integrated as Polkadot's native approach.

Governance Models

OpenGov on Polkadot is highly active. Over 1000 proposals have passed through the system. Any DOT holder can vote. Different tracks handle different types of decisions. The system moves quickly.

Cardano is implementing its Voltaire era. This phase introduces community proposals and on-chain voting. The system is newer and still developing. Cardano's approach tends toward more deliberate, slower decision-making.

Trade-offs for Users

Polkadot offers higher staking yields. The governance system is more mature. Native cross-chain functionality is superior. But the tokenomics are more complex. Inflation affects holdings. Slashing risks exist for validators and nominators.

Cardano has a fixed supply of ADA. Staking is straightforward with no slashing. The grassroots community is active and engaged. But the network still faces scaling challenges. Layer-2 solutions are still rolling out.

Review ADA Price on LBank

ADA() Price

The current price of

Risks and Controversial Proposals

No blockchain project is without risks. Polkadot faces technical challenges and controversial governance decisions.

The pUSD Stablecoin Debate

A recent proposal suggests creating a native algorithmic stablecoin. The stablecoin would be called pUSD. DOT tokens would exclusively back it. The proposal has strong early community support. Backers argue it reduces reliance on centralized stablecoins like USDT and USDC.

This proposal carries significant risk. Algorithmic stablecoins have a troubled history. TerraUSD (UST) collapsed spectacularly in 2022. The collapse destroyed its entire ecosystem. Luna tokens became worthless. Investors lost billions.

The decentralized nature of pUSD creates regulatory concerns. "Dark stablecoins" could emerge. These might not comply with sanctions or regulations. Governments could target Polkadot if bad actors abuse the system. The community must weigh potential benefits against these serious risks.

The Frozen ICO Funds

The 2017 Parity wallet vulnerability remains part of Polkadot's history. $150 million in Ethereum got frozen. This affected over 500 wallets. A large portion of Polkadot's ICO funds was locked. The project had to raise additional capital in 2019. This event delayed development and changed the project's trajectory.

Tokenomics Complexity

Polkadot's inflation model confuses some holders. New DOT enters circulation constantly. Staking rewards must offset this inflation. Slashing penalties add another layer of risk. Validators can lose tokens for misbehavior. Nominators who back bad validators also face penalties.

This complexity creates a steeper learning curve than fixed-supply tokens. Users must actively participate to maintain their relative holdings. Passive holders see their percentage of total supply decrease over time.

What This Means for Advanced Users

Polkadot represents a bet on a multi-chain future. The network's architecture assumes no single blockchain will dominate. Instead, specialized chains will work together through shared infrastructure.

The technical upgrades in Polkadot 2.0 address real limitations. Faster block times and flexible resource allocation make the network more competitive. Agile Coretime particularly lowers barriers for new projects. This could accelerate ecosystem growth. The governance model gives the community real power. Over 1000 proposals have shaped the network's direction. This level of decentralization is rare. But it also means proposals like pUSD can gain traction quickly. Users must stay informed and participate actively.

Polkadot's interoperability advantage is substantial. Projects building on Polkadot can interact with other parachains natively. This creates network effects. Each new parachain adds value to existing ones. Compare this to isolated blockchains that require external bridges.

The comparison with Cardano highlights different philosophies. Polkadot moves faster and takes more risks. Cardano moves deliberately with academic backing. Neither approach is objectively better. The choice depends on project requirements and risk tolerance. For developers, Polkadot offers flexibility. The Polkadot SDK allows custom blockchain creation. Teams can optimize every aspect of their chain. This freedom comes with complexity. The learning curve is steep. But the technical capabilities are impressive.

The next evolution, JAM, promises even more capabilities. The roadmap extends beyond 2025. Polkadot isn't a finished product. It's an evolving platform. Users should expect continued changes and upgrades.