Sepolia Hard Fork Scheduled for Jan 30th, Holesky Hard Fork on Feb 7th

*All on-chain data is dated as of 12:00 a.m. EST on Sunday, January 21st.

Here we list all you need to know about crypto market in the past week(Jan.14-20).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #Layer2

1 Macro Market Overview

U.S. Stocks End Rough Week on High Note After Jobs Report. According to WSJ, the S&P 500 rose 1.2% to 4839.81, breaking a streak of more than 500 trading sessions without a new record. The Dow Jones Industrial Average gained 395 points, or 1.1%, to close at 37863.80, also a record. The tech-heavy Nasdaq Composite climbed 1.7%. Meanwhile, a measure of U.S. consumer confidence reflected improving sentiment. The preliminary reading Friday of the University of Michigan’s consumer-confidence index climbed to 78.8 points in January from 69.7 in December, beating consensus economist expectations. Inflation expectations for next year fell to 2.9% from 3.1% in December, the lowest since the final month of 2020.

Initial jobless claims were 187,000 last week, the Labor Department said Thursday, the lowest since September 2022. That was the latest data point to paint a picture of a resilient economy, following upbeat reports on employment, inflation and retail sales earlier this month. Retail sales rose a seasonally adjusted 0.6% in December from a month earlier, according to data released on Wednesday, a larger increase than economists expected. The sign of economic strength could lessen the chance that central bank officials will cut interest rates as much as markets had previously expected, some investors said.

Last week, the three major U.S. stock indices saw various increases, with the Dow Jones Industrial Average and the S&P 500 rising by 0.7% and 1.2%, respectively. The tech-heavy Nasdaq Composite Index, centered around technology stocks, experienced a 2.2% increase. Web3-related stocks continued to perform poorly last week, with COIN and MSTR dropping by 4.6% and 1.1%, respectively, while MARA saw a significant decline of 14.9%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

Last week, the U.S. Dollar Index (DXY) continued to strengthen, reaching a high point near 103.700 on Wednesday and closing at 103.239 on Friday. This marked a 0.8% increase compared to the previous week.

DXY (Source: TradingView)

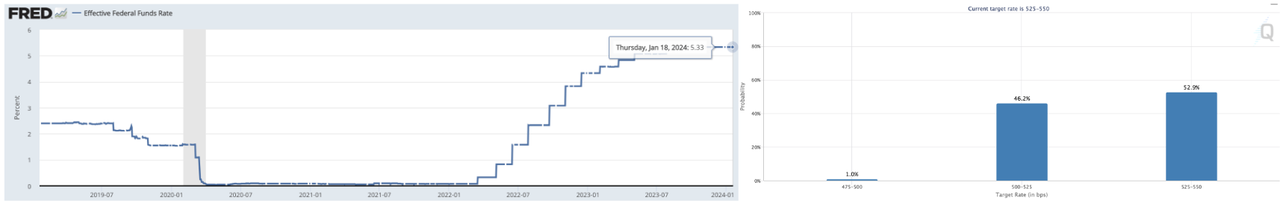

According to data from the Chicago Mercantile Exchange (CME) Group, interest rate futures indicate that close to 50% of investors believe the Federal Reserve may cut interest rates at its meeting in March. This data represents a decrease from the previous week when it was at 80%.

Left: EFFR, Right: Target Rate Probabilities for March 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

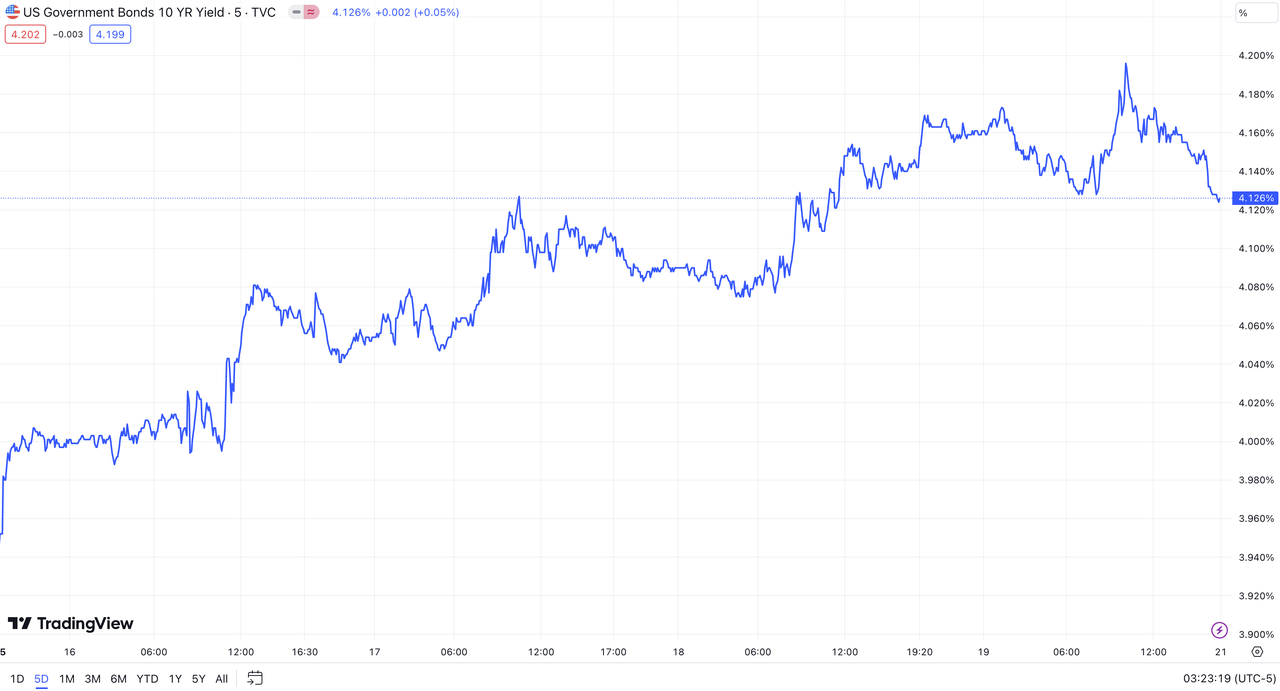

Last week, the yield on the 10-year Treasury note (US10Y) continued to strengthen, approaching a high point of 4.200% on Friday and ultimately closing at 4.126%. This represented a 4.7% increase compared to the previous week.

US10Y (Source: TradingView)

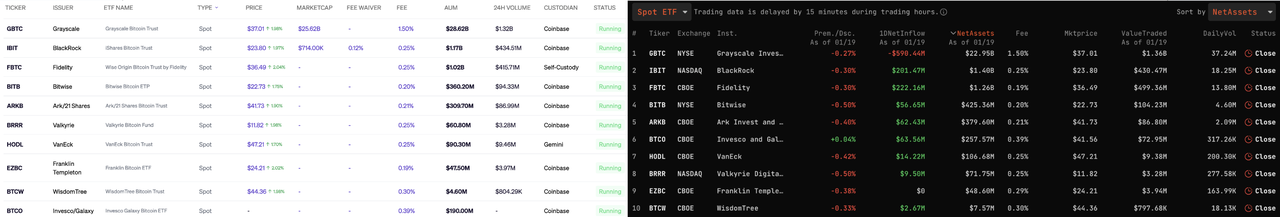

The Bitcoin spot ETF saw a total net inflow of $42.24 million last Friday.

According to SoSo Value, among them, the Grayscale Bitcoin Trust (GBTC) ETF experienced a net outflow of $590 million. Excluding Grayscale, other ETFs recorded a total net inflow of $632 million. The Bitcoin spot ETF with the highest single-day net inflow was Fidelity's FBTC, with a net inflow of $222 million. Currently, the Grayscale Bitcoin Trust (GBTC) ETF still holds net assets worth $22.95 billion, and the total net asset value of Bitcoin spot ETFs is $26.91 billion.

Left: Bitcoin Spot ETF Overview, Right: Daily Trading Activity of Bitcoin Spot ETF

(Source: Blockworks, SoSo Value)

2 Crypto Market Pulse

Market Data

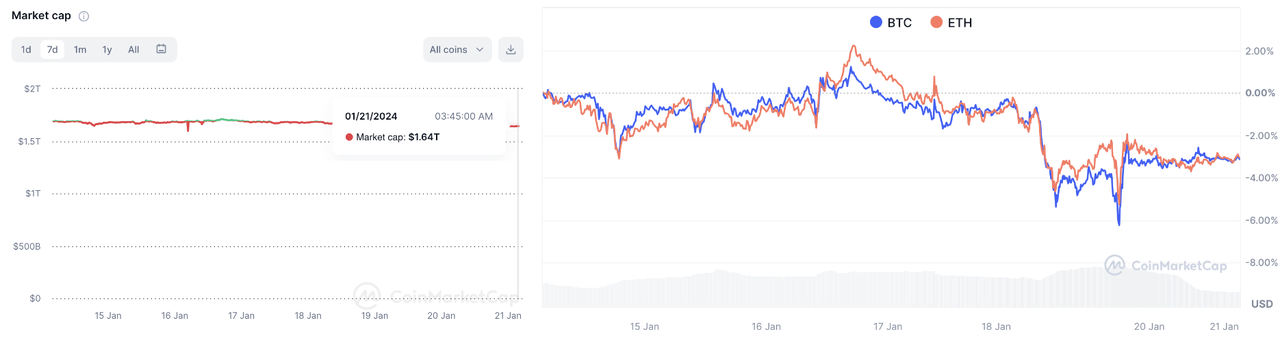

Last week, the cryptocurrency market experienced an outflow of $500 billion, causing the total market capitalization to drop to $1.64 trillion. Both Bitcoin and Ethereum saw a pullback on Thursday, with prices dropping 6% from the beginning of the week to the lowest point on Friday. As of the early morning of January 21st, the spot price of Bitcoin retreated to $41,626, marking a 2.9% decrease from the previous week. Ethereum, the second-largest cryptocurrency, saw its price fall to $2,466, reflecting a 2.7% decline. Additionally, Bitcoin's market share remained unchanged at 50%, with a market capitalization of $814.8 billion. Ethereum's market share also held steady at 18%, with a market capitalization of $296.9 billion.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

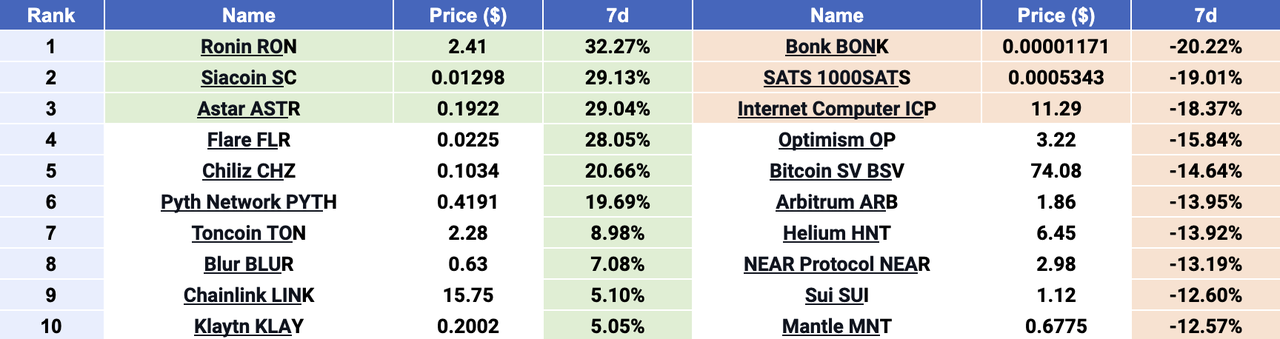

$RON, $SC, and $ASTR emerged as Top 3 gainers, while $BONK, $1000SATS, and $ICP were Top 3 losers. Among the top 100 cryptocurrency projects by market capitalization, $RON emerged as the top gainer with a weekly increase of over 32%. Ronin is an EVM (Ethereum Virtual Machine) blockchain specifically designed for gaming. Ronin was launched by Sky Mavis, the creator of the Web3 game Axie Infinity. The active user count has seen an increase following the recent launch of the Pixels game. Siacoin ($SC) is a blockchain platform focused on providing decentralized storage solutions, launched in 2015. The Sia blockchain is currently supported by its utility token, $SC, playing a crucial role in enhancing the ecosystem for essential network activities. Siacoin recently announced potential collaborations with other networks, a positive development that may have contributed to the $SC token breaking new highs. Ranked third, $ASTR is the token of Astar Network, a parallel chain within the Polkadot ecosystem. The price increase of $ASTR is attributed to continuous user adoption and ecosystem development. Astar Network is preparing to launch a major rebranding initiative called Astar 2.0, aimed at enhancing its network capabilities.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

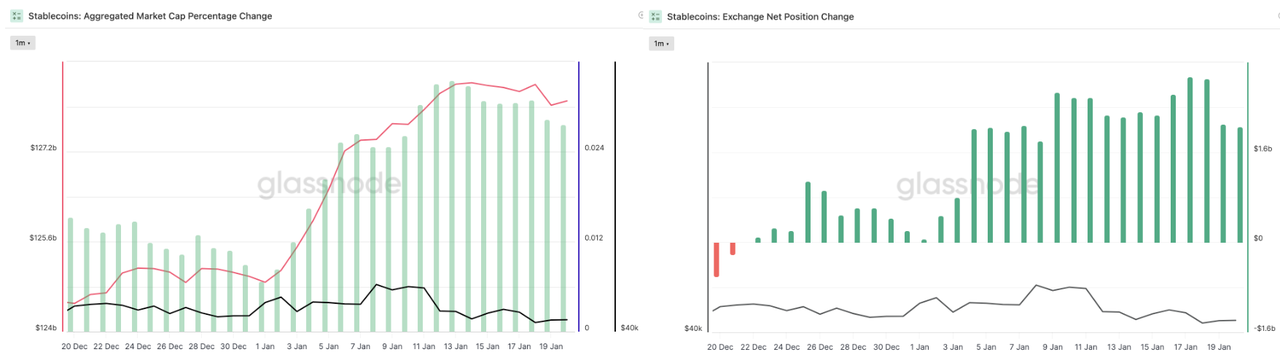

Last week, the total supply of stablecoins remained relatively stable, currently standing at $128.1 billion. The net position change in the supply of stablecoins has consistently shown positive values over the past seven days, indicating a continuous expansion in investor demand for the cryptocurrency market. Additionally, when observing the net position data of stablecoins on exchanges over the past week, the overall trend continues to indicate a net inflow. This reflects an increase in the total supply of stablecoins on exchanges over the past seven days, suggesting a positive outlook for the market's future development.

Stablecoins Market Cap (Data: Glassnode)

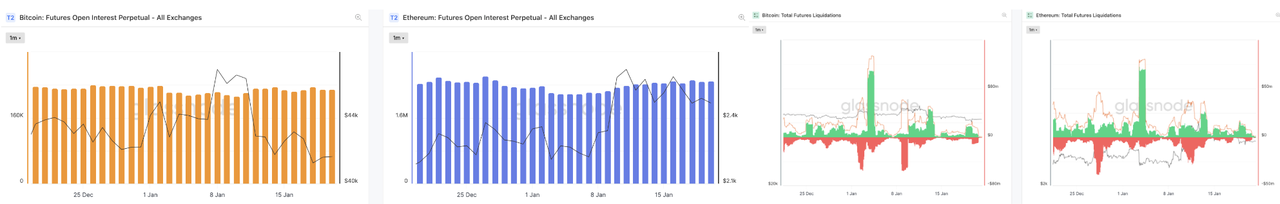

In the derivatives market, the open interest for Bitcoin and Ethereum perpetual contracts saw a slight increase. Over the past seven days, the total open interest in the futures market was influenced by a short-term pullback in the prices of Bitcoin and Ethereum, reaching its peak on Friday. Liquidation data indicates that the pullback observed on Thursday led to a wave of liquidations for long positions in both BTC and ETH. A series of data suggests that the current market is in a phase of correction, characterized by ongoing volatility.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

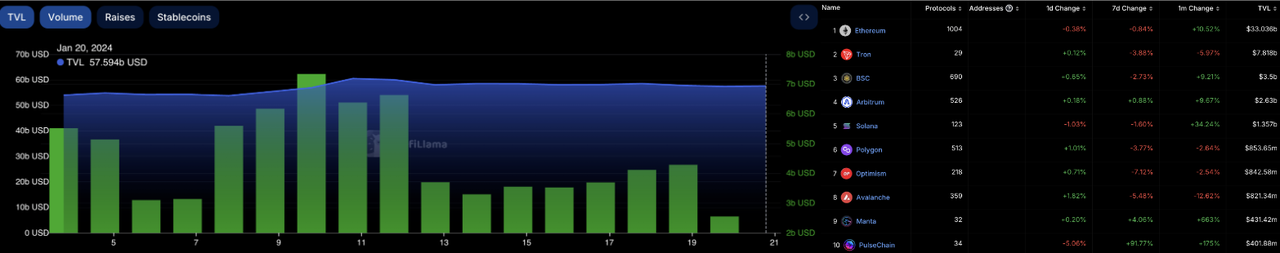

In the DeFi (Decentralized Finance) market, the total value locked (TVL) increased last week, reaching $575.9 billion. Over the past seven days, the trading volume on decentralized exchanges (DEX) decreased to $250 billion, a 36% reduction compared to the previous week. The market share gap between decentralized exchanges (DEX) and centralized exchanges (CEX) continued to widen, with DEX now accounting for 11% of the total CEX trading volume. In the past week, due to a correction in the cryptocurrency market, the TVL for most of the top ten mainstream blockchains decreased. PulseChain saw a surge of over 90% in the seven-day period, securing a spot in the top ten, while Optimism experienced a decline of over 7%.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

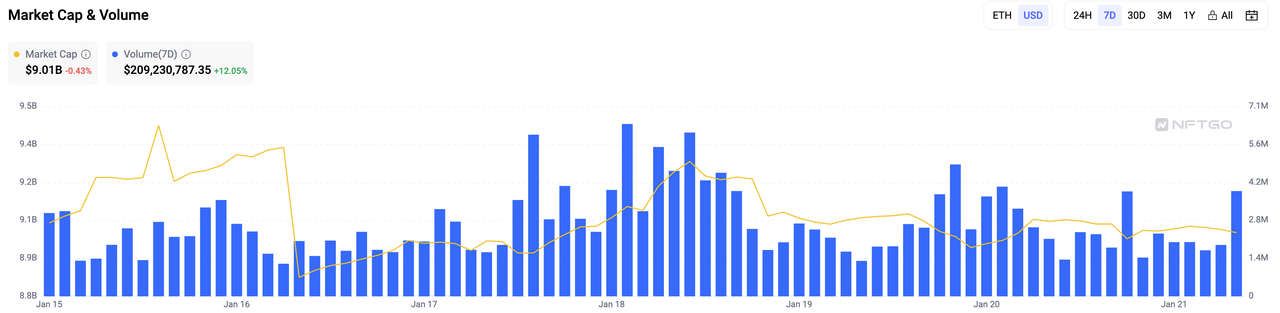

Last week, the market capitalization of NFTs (Non-Fungible Tokens) remained relatively stable, currently standing at $9 billion. Meanwhile, the total trading volume continued to rise, experiencing a 13% increase over the past seven days. Additionally, in the top NFT collections, both floor prices and average prices showed an upward trend. The floor price of the Bored Ape Yacht Club (BAYC) increased by 1%, and the average price grew by 5%. The Mutant Ape Yacht Club (MAYC) maintained a steady floor price, while the average price increased by 6%. The Blue Chip Index, calculated by using the weighted market value of a set of blue-chip stocks (ETH/USD), rose from 5364 to 5678.

Market Cap & Volume, 7D (Data: NFTGo)

LBank Labs Recap

The market witnessed a sustained week of selling pressure emanating from Grayscale BTC, with a notable impact on investors, particularly those who entered during the mid-last-year price discount period. The daily average selling pressure from Grayscale BTC alone currently stands at approximately 9,000 BTC. Anticipating a continuation of this trend, given the substantial profits in their holdings, it is projected that Grayscale's BTC holdings could be entirely liquidated in the next two months, coinciding with the BTC halving. While a further decline in price is expected, it is unlikely to reach the lows observed last year. This is partly due to a greater influx of funds into the Nine BTC ETFs compared to outflows. Additionally, growing buying interest from retail investors is anticipated. Close attention will be paid to Coinbase's premium next week to closely monitor Grayscale's selling activity.

CHZ, the fans token, has resurged in popularity, with CHZ maintaining its status as a tier 1 fans token and experiencing a nearly 20% increase in price.

Regarding X, Twitter has unveiled a new account, https://twitter.com/XPayments , triggering speculation among traders about the potential selection of one or several OG meme coins, such as $DOGE, $FLOKI, $PEOPLE, and $MEME, as payment methods.

MANTA, a newly listed token with an ambitious roadmap, is generating interest despite rumors of the team locking investors' tokens while simultaneously selling their own. The token's price has remained resilient for now.

On the other hand, ORDI in the BRC20 sector is witnessing a decline in trading volume, coinciding with BTC's downtrend in price. This shift indicates a potential reevaluation of market preferences within the sector.

- BTC price optimistic: $42500 - $44500

- BTC price neutral: $40500-$42500

- BTC price pessimistic: $39000 - $40500

3 Major Project News

[Ethereum] Latest Ethereum ACDE Meeting: Sepolia Hard Fork Scheduled for January 30th, Holesky Hard Fork on February 7th. Tim Beiko, a core developer of Ethereum, summarized the latest Ethereum All Core Developers Execution Layer (ACDE) meeting. He stated that client teams are willing to adhere to the testnet deployment schedule. Sepolia is set to hard fork on January 30th, while Holesky is scheduled for February 7th, with new client versions expected to be released next week.

The meeting also discussed proposals, including EIP-7251, which increases the maximum effective balance from 32 ETH to 2048 ETH, and the introduction of EIP-7547, which involves the inclusion of lists.

(Source: Twitter@TimBeiko)

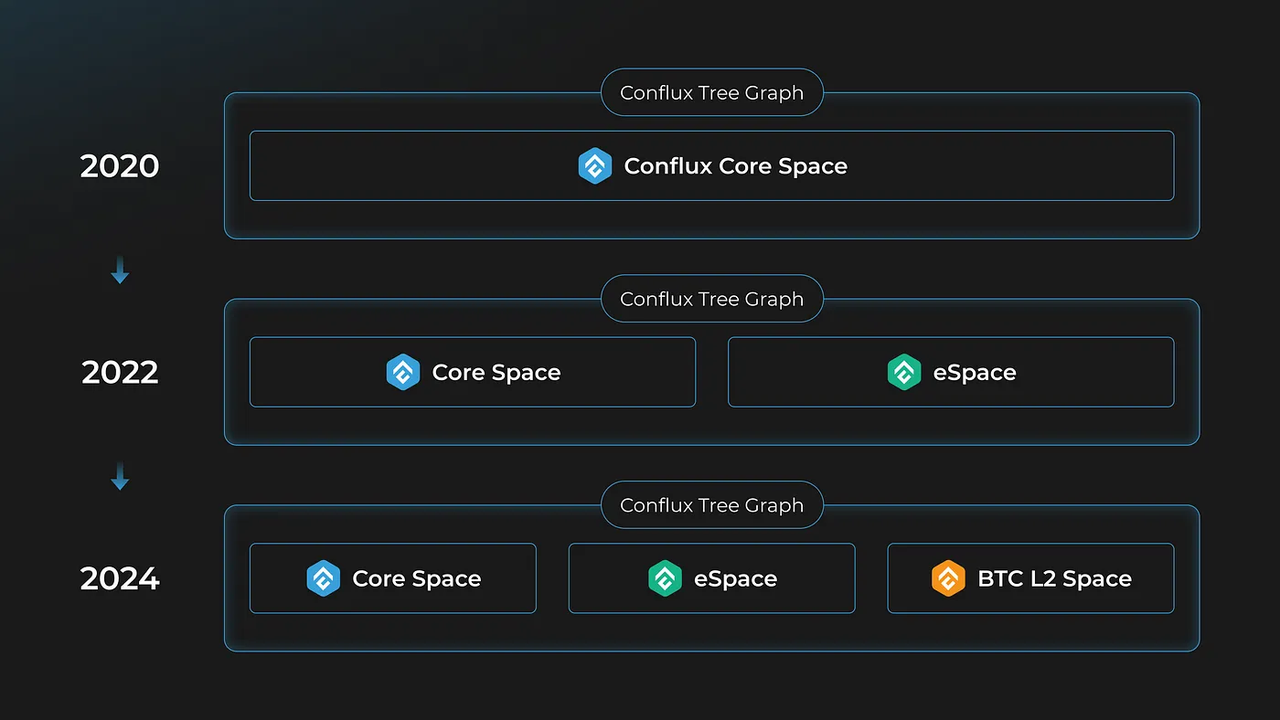

[Layer2] Conflux announces the launch of an EVM-compatible Bitcoin Layer 2, utilizing BTC as gas fees. Conflux has announced the launch of an EVM-compatible Bitcoin Layer 2 solution, utilizing BTC as gas fees. The testnet is expected to commence in February-March 2024, followed by the mainnet launch in May 2024. The introduction of this solution marks a significant development for developers and innovators in the blockchain industry. The integration enables developers to create decentralized applications that seamlessly interact across the realms of Conflux, Ethereum, and Bitcoin. This not only unlocks new possibilities for cross-chain functionality but also contributes to the creation of a more interconnected and dynamic blockchain landscape.

(Source: medium.com)

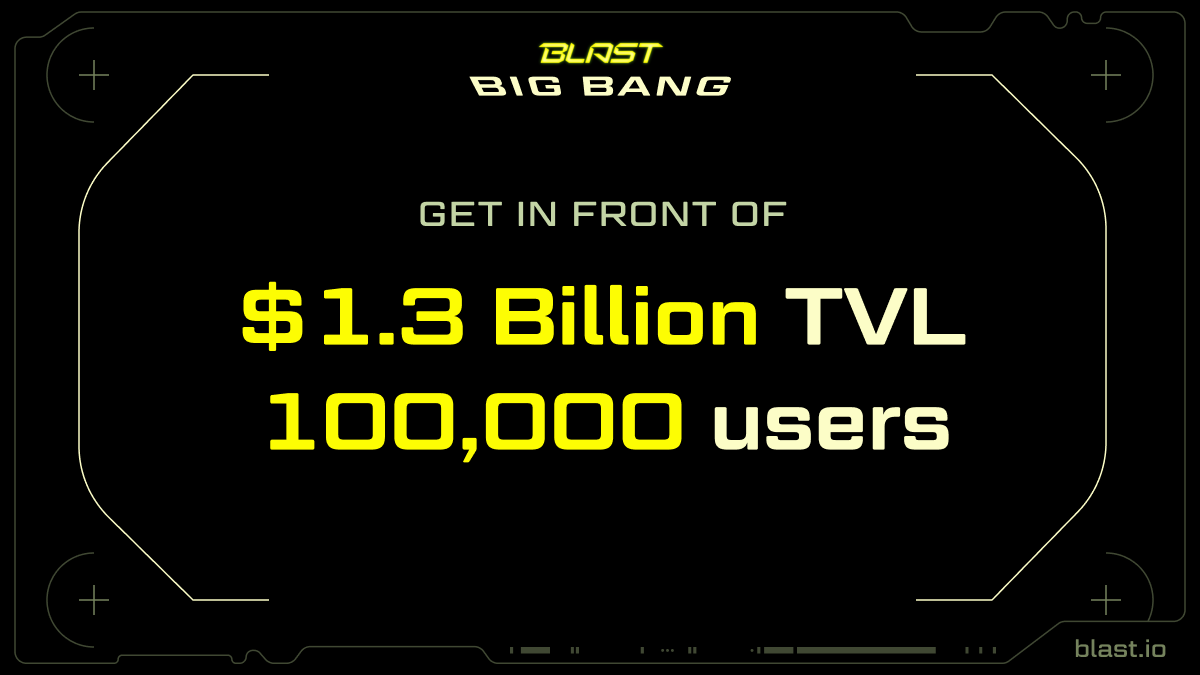

[Layer2] Blast has announced the official launch of its testnet and the introduction of the Blast BIG BANG competition. The winning dapp from the competition will be promoted to Blast users after the mainnet launch at the end of February. Additionally, 50% of the Blast airdrop has been allocated to developers, while the remaining 50% is distributed to Blast staking users (100k+). Blast will also assist the winning dapp team in establishing connections with investors. According to data from DeBank on the 16th, Blast's Total Value Locked (TVL) has reached $1.368 billion, including 478,089.7353 ETH held in Lido and 125,748,186.1242 DAI in MakerDAO.

(Source: Twitter@Blast_L2)

[Layer2] zkSync has introduced the zkSync Era plugin for the Remix IDE. The zkSync team has announced the release of the zkSync Era plugin for Remix IDE. This plugin is designed to streamline the development process, providing developers with a smooth and intuitive experience on the zkSync platform. The new tool facilitates seamless transitions between different zksolc versions, simplifies compilation, enables flexible deployment, and allows for easy interaction and transaction tracking.

(Source: Twitter@zkSyncDevs)

[Sui] Move Adds Enums and Macros in 2024 Edition. The public blockchain project Sui Network has announced in its official blog that the Move programming language will undergo updates this year, providing developers with new methods for defining data and calling functions. These significant new features make building applications on Sui more flexible and align with expectations for the latest programming languages. The Move 2024 update introduces features such as Enums, macro functions, method syntax, and many other enhancements, making it more powerful. As an open-source project, Move and Sui allow the community to continuously improve. The mentioned features will initially be tested in the alpha version, followed by release candidate versions and the final version. Some planned updates to Move may impact existing code.

(Source: blog.sui.io)

[Cosmos] Tabi will launch the first Layer1 designed for Game in Cosmos and launch the test network in February. According to official news, Tabi will launch Tabi Chain, a blockchain designed specifically for games and compatible with EVM, in the Cosmos ecosystem. It will fully invest in the Cosmos ecosystem and strive to achieve large-scale adoption of Web3 games. Tabi Chain focuses on solving the following pain points: global computing: improving gaming experience through millions of TPS; expanding influence: encouraging free-style Web3 development, allowing developers to program using any familiar language and framework.

Tabi Chain is also actively recruiting early game developers. High-quality projects that join the Tabi Chain ecosystem will receive huge traffic support and early ecological construction benefits. In addition, Tabi Chain’s testnet is expected to be launched in February.

(Source: Twitter@Tabi_NFT)

4 Key Fundraising Data

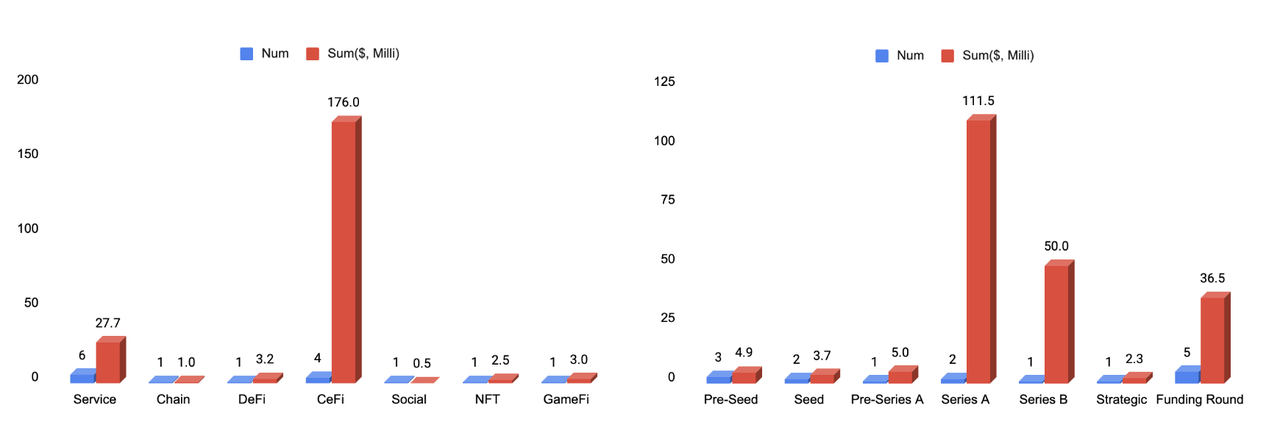

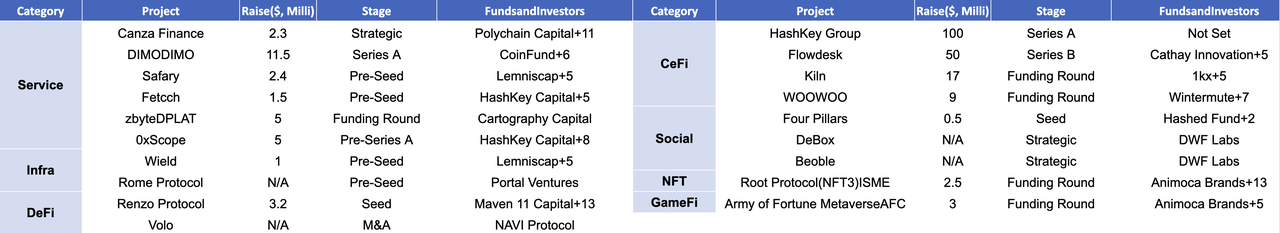

Last week witnessed a total of 19 financing events, raising a substantial amount of over $213.9 million*. Compared to the previous week, financing activities experienced an increase in both trading volume and total financing amount. The Service sector led with the highest number of 6 financing events. The CeFi (Centralized Finance) sector recorded the highest total financing amount, raising a total of $176 million, constituting 82% of the overall financing amount. The largest financing event was led by HashKey Group, successfully securing $100 million in funding. Established in 2018, HashKey Group is Asia's leading digital asset financial services group with a strong emphasis on compliance. More detailed information is provided below.

*4 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [CeFi] HashKey Group Raises Nearly US $100M in Series A Financing Round.

HashKey Group ("HashKey" or "the Group"), a leading end-to-end digital asset financial services group in Asia, announced the completion of a Series A financing round of nearly US $100 million at a pre-money valuation above US $1.2 billion. In addition to the active participation and strong commitment of existing shareholders, this financing round attracted new investors, including prominent institutional investors, leading Web3 institutions, and strategic partners.

The newly raised capital will be used to solidify HashKey's Web3 ecosystem, accelerate the product diversification of its licensed business in Hong Kong, and drive the Group's compliant and innovative development globally.

- Official Link: https://group.hashkey.com/en/

2. [CeFi] Kiln raises $17 million in latest funding round to expand crypto staking platform.

Institutional crypto staking platform Kiln has closed a $17 million funding round led by 1kx, with participation from Crypto.com, IOSG, Wintermute Ventures, KXVC and LBank. According to The Block, the round also included further contributions from all its existing investors, such as Kraken Ventures, GSR and Avon Ventures — a venture capital fund affiliated with FMR LLC, the parent company of Fidelity Investments. This latest investment brings Kiln’s total funding to $35 million, having previously raised $17.6 million in 2022 from Illuminate Financial, LeadBlock Partners, Sparkle Ventures, Alven and Blue Yard Capital, among others.

Kiln would not disclose a valuation for the round. However, the platform has increased its staked assets under management by more than five times in 2023 to reach $4.2 billion, the spokesperson said, having integrated with multiple custody solutions, wallets and exchanges over the past year. Kiln plans to use the capital to fund its global expansion plans, including growing its APAC division following the opening of its regional headquarters in Singapore in Q1, according to a statement.

- Official Link: https://www.kiln.fi/

3. [CeFi] Flowdesk Raises $50m Series B, led by Cathay Innovation.

Flowdesk, a full-service digital asset trading technology firm, last week announced its $50 million Series B, led by Cathay Innovation along with the participation of Cathay Ledger Fund, Eurazeo, ISAI, Speedinvest, BPI and Ripple.

The funds raised will be used to consolidate their position as a leading market-making service provider and expand their OTC offering. In addition, Flowdesk plans to expand regulatory coverage in Singapore and in the US. The raise will also be invested into expanding offices in financial hubs and key hires, like Charles TIGHE, CFO who will help Flowdesk roll out their development plan.

- Official Link: https://www.flowdesk.co/

Digital Infrastructure Inc, a startup specializing in decentralized physical infrastructure networks, raised $11.5 million in Series A funding. The crypto investment firm CoinFund led the round, which had additional participation from Slow Ventures, ConsenSys Mesh, Borderless Capital, Bill Ackman's Table Management and former General Motors CEO G. Rick Wagoner Jr., among others. CoinFund's managing partner and chief investment officer Alex Felix will join Digital Infrastructure Inc's board of directors. According to The Block, the Series A raise brings the startup's total funding to $22 million. "This round of funding is a pivotal step in solidifying DIMO's position as a foundational DePIN network. With over 36,000 cars connected to our network, which represents over $1 billion USD in assets, we've built a valuable utility for developers and will be enhancing their ability to build on the network with new tools over the course of the year," Andrew Chatham, CEO of Digital Infrastructure Inc and co-founder of DIMO, said in an email to The Block.

- Official Link: https://dimo.zone/