Cryptocurrency continues to evolve at a breakneck pace, with innovations addressing the fundamental challenges of digital payments and financial infrastructure. Among the most promising developments is STABLE, a groundbreaking Layer 1 blockchain specifically designed to handle stablecoin transactions at scale.

As the digital economy matures and stablecoins become increasingly integral to global commerce, STABLE emerges as a purpose-built infrastructure for the world's most-used digital asset: USDT.

In this comprehensive guide, we explore what STABLE is, how its technology works, its market performance, and why it represents a significant step forward in blockchain infrastructure.

Whether you're a crypto trader, developer, or someone interested in the future of digital payments, understanding STABLE is essential.

What is STABLE?

StableChain is a high-throughput, USDT-native Layer 1 blockchain designed specifically for real-world financial applications, institutional settlement, and consumer-scale transactions. Unlike general-purpose blockchains that attempt to serve multiple use cases, STABLE focuses exclusively on what matters most for payments and commerce: speed, reliability, and cost-effectiveness for stablecoin transactions.

The project was developed with backing from prominent investors, including PayPal Ventures, Tether, and Bitfinex, giving it a strong foundation of trust and credibility within both the crypto-native and traditional finance communities. Under the leadership of Founder and CEO Joshua Harding, STABLE has positioned itself as essential infrastructure for the next generation of digital payments.

What sets STABLE apart from other blockchain platforms is its singular focus on USDT, the world's most widely used stablecoin. Rather than treating stablecoins as just another token type, STABLE built its entire architecture around optimising USDT transactions. This means users pay transaction fees in USDT rather than a native gas token, eliminating the complexity and friction that typically comes with blockchain interactions. Learn more about what STABLE is and why it's capturing attention across the industry.

How STABLE Works

Understanding how STABLE works reveals why it's positioned to handle the demands of global payment infrastructure:

Layer 1 Blockchain Architecture

At its core, STABLE operates as an independent Layer 1 blockchain rather than a Layer 2 solution built on top of another network. This gives STABLE complete control over its consensus mechanism, transaction processing, and network parameters. The blockchain utilises a validator architecture focused on reliability, transparency, and sustainable rewards, ensuring consistent network performance even during periods of high transaction volume.

The network's high-throughput capability means it can process thousands of transactions per second, far exceeding the capacity of many earlier blockchain networks. This scalability is essential for STABLE's vision of serving as the primary settlement layer for USDT transactions globally.

USDT-Native Gas Model

Perhaps the most innovative aspect of STABLE's design is its USDT-native gas model. In traditional blockchains, users must acquire and manage a separate native token to pay transaction fees. This creates unnecessary complexity, especially for newcomers or businesses simply wanting to move stablecoins.

With STABLE, users pay all transaction fees directly in USDT. This dramatically simplifies the user experience. If you hold USDT, you can immediately transact without needing to acquire any other tokens.

Tokenomics and Network Economics

The STABLE token has a maximum supply of 100 billion tokens, with approximately 17.6 billion currently in circulation. The token captures value through several mechanisms, including validator economics, staking incentives, protocol governance rights, and treasury-driven ecosystem programs.

Validators stake STABLE tokens to secure the network and earn rewards for their participation. This creates alignment between token holders and network health, as validators have a vested interest in maintaining reliable, high-quality service. The governance function allows STABLE token holders to participate in decisions about protocol upgrades, parameter changes, and ecosystem development.

Enterprise Features

STABLE provides advanced capabilities designed specifically for institutional needs. Guaranteed blockspace allocation ensures that enterprise clients can count on transaction processing capacity when they need it most, eliminating concerns about network congestion. Transfer aggregation allows for efficient batching of multiple transactions, reducing costs for high-volume users.

The platform's confidential transfer features represent a particularly sophisticated approach to privacy. Rather than choosing between complete transparency and complete anonymity, STABLE enables transactions that protect sensitive commercial information while maintaining necessary regulatory compliance. This balanced approach makes STABLE practical for real-world business applications where both privacy and accountability matter.

Key Features and Benefits

STABLE's feature set directly addresses the pain points that have historically limited blockchain adoption for payments and commerce. Each capability was designed with real-world use cases in mind, from individual peer-to-peer transfers to enterprise-scale settlement.

Instant Finality and Low Costs

Transaction finality in under one second means STABLE can support use cases that require immediate confirmation, such as point-of-sale payments, cross-border remittances, and real-time settlement between financial institutions. This speed, combined with minimal transaction costs, makes STABLE economically viable even for small-value transactions that would be impractical on higher-fee networks.

Intuitive User Experience

STABLE's wallet interface simplifies the often-intimidating process of cryptocurrency transactions. Sending and receiving USDT becomes as straightforward as using a traditional payment app, with easy integration of debit and credit cards for on-ramp and off-ramp functionality. This user-friendliness is critical for driving mainstream adoption beyond crypto-native audiences.

Optimised for Real-World Commerce

The blockchain's design prioritises the specific requirements of payment processing and financial settlement. Large-scale USDT transfers benefit from optimised routing and processing, while the network's architecture ensures consistent performance regardless of transaction size. Whether moving $50 or $50 million, users experience the same reliability and speed.

Benefits for Different User Segments

For individual users, STABLE offers a faster, cheaper way to send and receive stablecoins globally. The near-instant settlement and low fees make it practical for everyday transactions, cross-border payments, and peer-to-peer transfers without the delays and costs associated with traditional banking.

Traders benefit from STABLE's high throughput and quick finality when moving funds between exchanges or executing arbitrage strategies. The reduced friction and costs of transactions can meaningfully impact profitability, especially for high-frequency trading strategies.

Institutional users gain access to guaranteed blockspace, privacy features, and the reliability needed for large-scale operations. The ability to process high volumes of transactions efficiently, combined with institutional-grade security measures, makes STABLE suitable for financial institutions, payment processors, and enterprises managing substantial transaction flows.

Partnership Ecosystem

STABLE's recent partnership with Standard Chartered's Libeara and Wellington Management demonstrates the project's credibility within traditional finance. The initiative includes a $100 million allocation to ULTRA, a tokenised U.S. Treasury strategy rated AAA by Particula, bringing regulated real-world assets onto the StableChain. These strategic partnerships signal growing institutional confidence in STABLE's infrastructure and its potential to bridge traditional finance with blockchain technology.

The STABLE Token - Market Analysis

Understanding STABLE's market performance provides insight into investor sentiment and the project's traction within the broader cryptocurrency ecosystem. The token's price action reflects both the overall crypto market conditions and STABLE-specific developments.

As of today, STABLE is trading at approximately $0.019 USD, with a market capitalisation of around $339 million, ranking it as the #211 cryptocurrency by market cap. The token has a circulating supply of 17.6 billion STABLE out of a maximum supply of 100 billion tokens, representing approximately 17.6% of the total supply currently in circulation.

The 24-hour trading volume of over $53 million demonstrates significant market interest and liquidity. This healthy trading volume relative to market cap (approximately 15.67% volume-to-market-cap ratio) indicates an actively traded asset with sufficient liquidity for both retail and institutional participants.

It's worth noting that STABLE recently experienced its all-time high of $0.04565 on December 8, 2025, showing considerable volatility typical of newer cryptocurrency projects. The token has also seen its all-time low at $0.01871 on the same day, reflecting the dynamic price discovery phase as the market evaluates STABLE's long-term value proposition.

For real-time price data and detailed market statistics, you can track STABLE's current price on LBank, which offers comprehensive market data and trading pairs for the token.

Historical Price Performance

As a relatively new project, STABLE's historical price data provides valuable context for understanding its market trajectory. The token's price movements reflect several factors, including overall market sentiment toward infrastructure projects, developments in the stablecoin sector, and STABLE-specific announcements such as partnerships and mainnet launches.

The recent price volatility is not unusual for new blockchain projects during their initial trading periods. As the project matures, market participants gather more information about adoption metrics, transaction volumes on the network, and the success of strategic initiatives. This information gradually leads to more efficient price discovery and potentially reduced volatility over time.

Trading Characteristics

STABLE exhibits trading characteristics common to mid-cap cryptocurrency projects with strong fundamentals and institutional backing. The token's liquidity across multiple exchanges provides opportunities for traders to enter and exit positions with relatively low slippage, while the active trading community contributes to price discovery and market efficiency.

The tokenomics structure, with only 17.6% of total supply currently circulating, means that future token unlocks and distribution events could impact supply dynamics. Investors should be aware of the token release schedule and how it might affect market prices as additional tokens enter circulation.

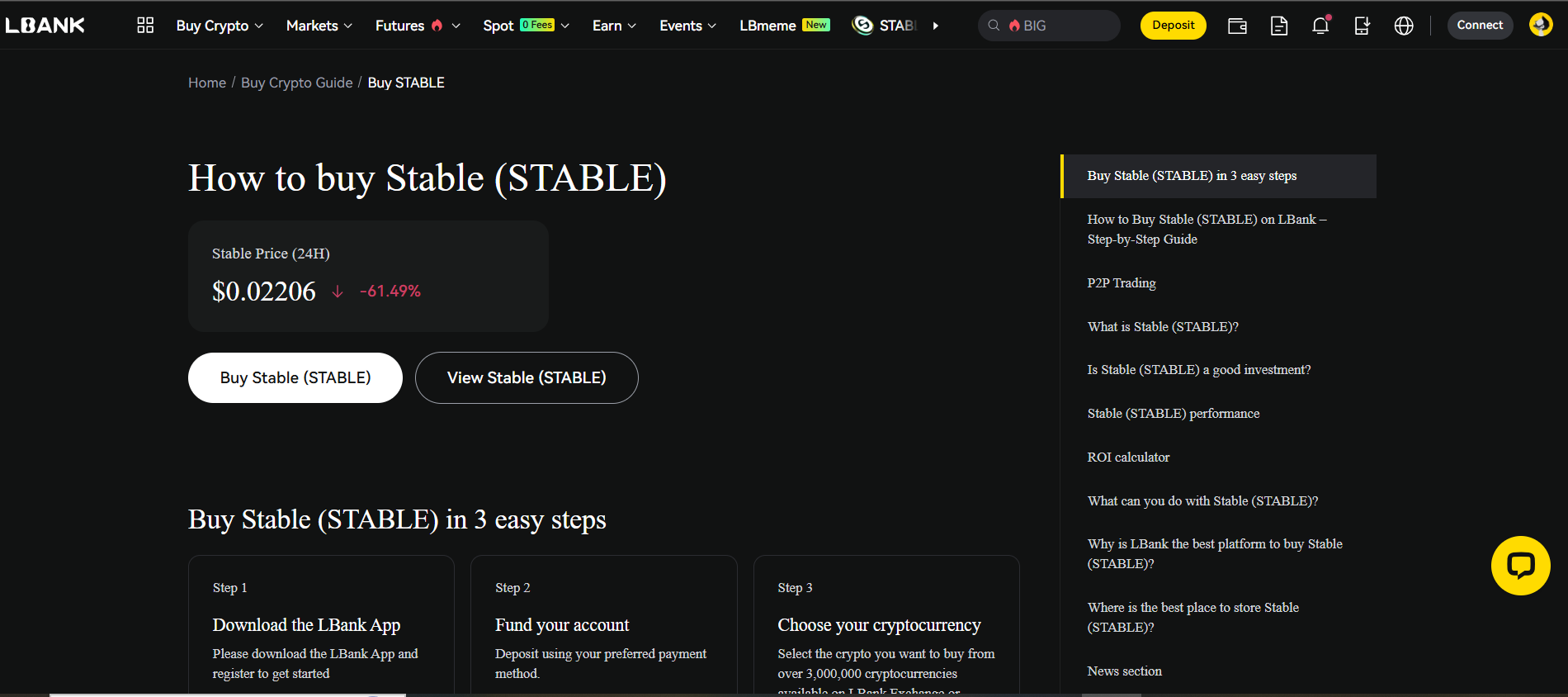

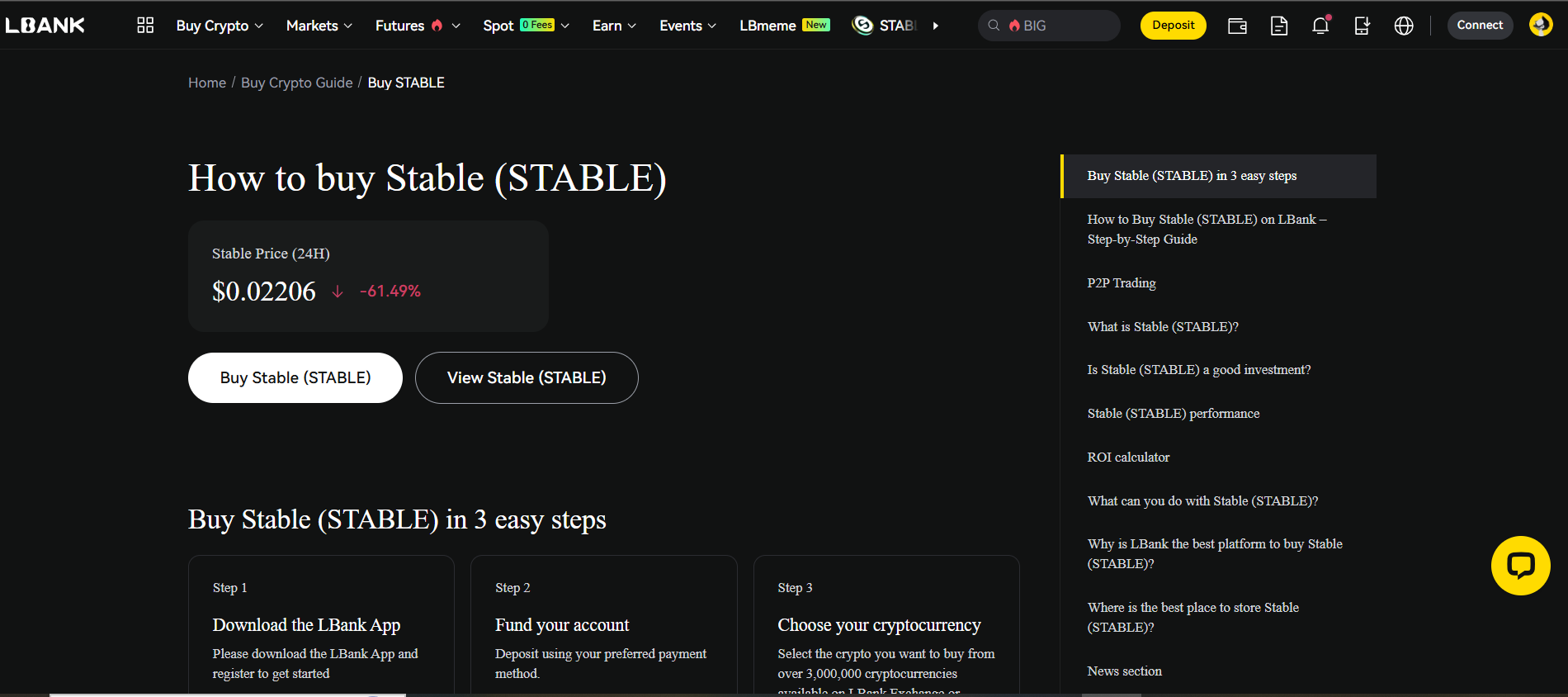

How to Buy STABLE on LBank

Getting started with STABLE is straightforward, especially through LBank, one of the leading exchanges offering STABLE trading pairs. Whether you're an experienced crypto trader or new to digital assets, LBank provides an accessible platform for acquiring STABLE tokens.

Step 1: Create Your LBank Account

If you don't already have an LBank account, begin by visiting LBank's website or downloading the LBank mobile app from the App Store or Google Play. The registration process requires basic information, including an email address and a secure password. Follow the account verification steps to ensure full access to trading features and higher withdrawal limits.

Step 2: Deposit Funds

Before purchasing STABLE, you'll need to deposit either cryptocurrency (such as USDT, USDC, or BTC) or fund your account using fiat currency through LBank's various payment methods. For the most straightforward experience, depositing USDT allows you to trade directly into STABLE without additional conversion steps.

LBank supports multiple funding options, including bank transfers, credit/debit cards, and peer-to-peer transactions, depending on your location. Choose the method that best suits your preferences and complete the deposit process.

Step 3: Navigate to STABLE Trading

Once your account is funded, navigate to LBank's spot trading section and search for STABLE. The primary trading pair is STABLE/USDT, which offers the most liquidity and typically the tightest spreads. For comprehensive information on the trading process, visit the how to buy STABLE guide on LBank.

Step 4: Place Your Order

LBank offers several order types to suit different trading strategies. Market orders execute immediately at the current market price, ideal for users who prioritise speed and certainty of execution. Limit orders allow you to specify your desired purchase price, with the trade executing only when STABLE reaches that price point.

Enter the amount of STABLE you wish to purchase and review the order details, including any applicable fees. Once confirmed, submit your order, and it will be processed according to your selected order type.

Step 5: Secure Your STABLE

After your purchase completes, your STABLE tokens will appear in your LBank spot wallet. For enhanced security, consider transferring your STABLE to a personal cryptocurrency wallet where you control the private keys. This "not your keys, not your crypto" principle provides maximum security for longer-term holdings.

How to buy STABLE, source: LBank

STABLE Price Predictions and Outlook

Predicting crypto prices is uncertain, but STABLE’s fundamentals and market position offer clues about its direction. Based on historical performance models, STABLE could reach around $0.024 by 2026, reflecting steady growth from current levels.

Key Value Drivers

STABLE’s long-term value depends on adoption. Higher daily users, transaction volume, and total value transferred all strengthen the network and support token demand. Increased institutional usage and stablecoin transactions further enhance its ecosystem.

Partnerships are another major catalyst. Recent collaborations with Standard Chartered’s Libeara and Wellington Management validate STABLE’s institutional-grade infrastructure and open the door for deeper integration into traditional finance.

Catalysts and Roadmap Milestones

STABLE’s mainnet launch on December 8, 2025, is a major turning point, enabling real-world usage and providing early performance data that investors will closely watch. Upcoming milestones—new exchange listings, wallet integrations, merchant programs, and protocol upgrades—could all trigger increased adoption and price movement.

Stablecoin Market Trends

STABLE’s growth is tied to the broader stablecoin ecosystem, which now processes over $1.25 trillion in monthly transfers. As stablecoins expand into global payments and commerce, demand for efficient, purpose-built infrastructure like STABLE increases.

Regulatory clarity will also influence growth. Supportive stablecoin regulations could accelerate adoption, while restrictive policies may create headwinds.

For updated projections, refer to LBank’s STABLE price prediction page.

Risks to Consider

Investors should remain aware of key risks:

- Strong competition from other stablecoin-focused and general-purpose blockchains

- Technical risks such as security vulnerabilities or scaling challenges

- Market volatility, regulation changes, and macroeconomic uncertainty

- Token unlock schedules and inflation, which affect supply over time.

Understanding these factors helps build a realistic outlook on STABLE’s future performance.

Price Outlook and Future Potential

According to historical price performance models, STABLE's price could reach approximately $0.024 by 2026. Several factors could drive value appreciation, including network adoption metrics such as daily active users, transaction volumes, and total value transferred.

The recent mainnet launch on December 8, 2025, marks a pivotal milestone, enabling real-world usage and demonstrating the network's capabilities at scale. Future roadmap milestones, additional exchange listings, wallet integrations, merchant adoption programs, and protocol upgrades serve as potential catalysts for growth.

STABLE's prospects are tied to broader stablecoin adoption trends. The stablecoin market has grown dramatically, with these assets now facilitating over $1.25 trillion in monthly transfers globally. As stablecoins become increasingly integrated into global commerce, infrastructure optimised for these transactions becomes more valuable.

For detailed analysis and ongoing forecasts, visit the STABLE price prediction page on LBank.

Latest Developments and Community Growth

The mainnet launch on December 8, 2025, represents the most significant recent milestone, marking STABLE's transition from development to operational infrastructure. The partnership with Standard Chartered's Libeara, Wellington Management, and Theo Network showcases institutional confidence, with the $100 million ULTRA allocation bringing high-quality tokenised U.S. Treasuries onto StableChain.

STABLE's social media presence continues to expand, with over 160,000 followers on X as of early 2025. This growing community represents users, developers, and investors interested in transforming stablecoin infrastructure. For ongoing updates, check the STABLE news section on LBank.

Conclusion

STABLE represents a focused evolution in blockchain infrastructure, purpose-built for stablecoin transactions at a global scale. The project's key strengths, sub-second finality, USDT-native gas payments, institutional-grade features, and strong backing from established players position it well to capture a meaningful share of the growing stablecoin infrastructure market.

For traders, STABLE offers a liquid asset with growth potential tied to fundamental adoption metrics. For users seeking efficient stablecoin transactions, STABLE provides a practical solution that eliminates friction points associated with traditional blockchain networks.

As with any cryptocurrency investment, conduct thorough research, understand the associated risks, and only invest amounts you can afford to lose. To learn more about STABLE's developments, visit the official website at https://www.stable.xyz and review the project's whitepaper for technical details.