Raydium launched in February 2021 as one of the first automated market makers on Solana. The platform brought a unique approach to decentralized trading by combining traditional AMM liquidity pools with order book integration. Today, it stands as one of the most widely distributed protocols on the Solana (SOL) blockchain.

The founding team came from algorithmic trading backgrounds in traditional finance. They entered crypto in 2017 and spent the summer of 2020 deep in DeFi activities on Ethereum. High gas fees and slow transaction times pushed them to look for alternatives. When they discovered Solana's speed and low costs, they saw an opportunity to build something better.

Review RAY Price on LBank

RAY() Price

The current price of

What Makes Raydium Different

Raydium started with a hybrid model that set it apart from other AMMs. When users added liquidity to a Raydium pool, the platform converted those tokens into limit orders on Serum's order book. This meant traders could access both AMM liquidity and order book depth in a single swap. The system would automatically find the best price between Raydium's own pools and the Serum order book.

Serum eventually deprecated, and Raydium now integrates with OpenBook instead. The platform's legacy AMMv4 pools now function as traditional constant product AMMs without the order book connection. But this evolution hasn't slowed Raydium down. The team has continued building new pool types and features to serve different trading needs.

Three Types of Liquidity Pools

Raydium offers three distinct pool architectures. Each serves specific use cases and trading strategies.

Concentrated Liquidity Market Maker (CLMM) pools let liquidity providers allocate their capital within specific price ranges. This creates deeper liquidity around the current market price. LPs can use more sophisticated strategies and earn higher fees on their capital. CLMM works best for less volatile trading pairs where prices stay within predictable ranges.

Constant Product Market Maker (CPMM) pools represent Raydium's latest iteration of the classic K=XY formula. These pools support Token-2022 standards and offer multiple fee configurations. Projects launching new tokens often prefer CPMM for price discovery. The flexibility makes these pools ideal for tokens without established markets.

AMMv4 pools are Raydium's battle-tested legacy pools. They remain the most widely distributed program on Solana. Many established trading pairs still use AMMv4 because of its proven reliability and deep existing liquidity.

The Team Behind Raydium

Three pseudonymous co-founders lead Raydium. Their backgrounds in algorithmic trading and low-latency systems gave them the technical skills to build on Solana from day one.

AlphaRay handles strategy, operations, product direction, and business development. He worked in algorithmic trading for commodities before moving to crypto market-making in 2017. His DeFi experiences in 2020 led directly to the concept for Raydium.

XRay serves as Chief of Technology and leads the development team. He brings eight years of experience building trading systems and low-latency architectures in both traditional finance and crypto markets.

GammaRay leads marketing and communications while contributing to strategy and product decisions. His background in data analytics and market research helps shape how Raydium presents itself to users and partners.

Early Challenges on Solana

Building one of the first protocols on Solana meant facing unique obstacles. The team had limited reference code to work from. Only Serum existed on Solana when they started. They built most of their codebase from scratch.

Solana's rapid development created constant maintenance challenges. Blockchain updates frequently broke working code. The team had to stay flexible and adapt quickly to keep the platform running smoothly.

The small number of early Solana projects created another problem. Raydium had few unique tokens to populate its pools. This threatened to make the platform less interesting to users. The team needed a solution that would bring new projects and tokens to the ecosystem.

AcceleRaytor: Building the Ecosystem

The AcceleRaytor launchpad launched in April 2021 to address the token shortage problem. The platform helps new projects raise capital and establish initial liquidity in a decentralized way. Projects get advisory support from the Raydium team and guaranteed liquidity for trading.

AcceleRaytor offers two pool types. Community Pools give broad access to token sales. RAY Pools reward users who hold and stake the platform's native token. This structure incentivizes long-term community participation while supporting new project launches.

The first AcceleRaytor project brought unprecedented traffic to Solana. The team had to scale their infrastructure quickly to handle the surge. This early success validated the launchpad concept and helped establish Raydium as a key gateway for new projects entering Solana.

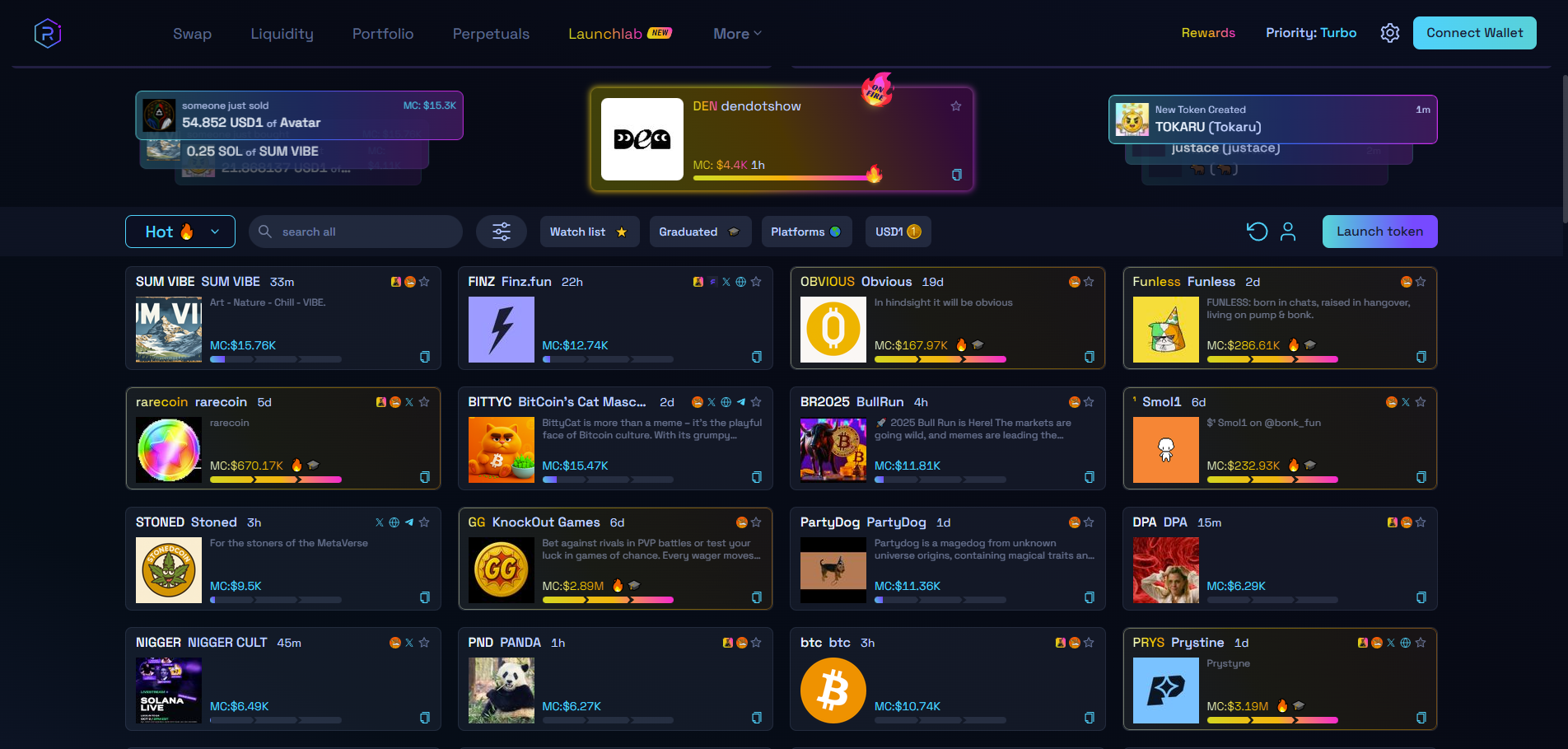

LaunchLab: Competing for Memecoins

On April 16, 2025, Raydium launched LaunchLab. This community-powered token launch platform targets the memecoin market. It competes directly with services like Pump.fun.

Image source: Raydium

LaunchLab gives token creators customizable bonding curves with no migration fees. When a token raises 85 SOL, the platform transitions it instantly to Raydium's AMM. This leverages Raydium's established liquidity infrastructure and gives new tokens immediate access to deep markets.

The platform recognizes that memecoins drive significant trading volume on Solana. LaunchLab positions Raydium to capture more of this market segment. It also gives the platform a natural pipeline for new tokens that can eventually graduate to standard trading pools.

RAY Coin Tokenomics

The RAY token has a maximum supply of 555 million tokens. The distribution reflects a long-term approach to ecosystem development.

| Allocation | Percentage | Amount (millions) | Lock Period |

| Mining Reserve | 34% | 188.7 | Variable |

| Partnership & Ecosystem | 30% | 166.5 | N/A |

| Team | 20% | 111.0 | 1-3 years |

| Liquidity | 8% | 44.4 | N/A |

| Community Pool / Seed | 6% | 33.3 | 1 year |

| Advisors | 2% | 11.1 | 1-3 years |

The team and seed allocations represented 25.9% of total supply. These tokens locked for 12 months after the token generation event. They then unlocked linearly over the following 24 months. This vesting schedule completed on February 21, 2024. All team and seed tokens are now fully unlocked.

How RAY Coin Creates Value

RAY serves multiple functions within the Raydium ecosystem. Token holders can stake RAY to earn yield from protocol trading fees. This creates a direct connection between platform usage and token holder rewards.

Staked RAY provides voting power in Raydium's governance system. The platform uses a limited governance model for community proposals. This gives long-term holders influence over protocol development.

Liquidity mining programs use RAY as incentive rewards. These farming opportunities encourage users to provide liquidity to specific pools. The platform can direct liquidity to new or strategic trading pairs through RAY incentives.

AcceleRaytor requires RAY holdings for participation. Users need to stake RAY to access token sales through the launchpad. This creates additional demand for the token beyond trading and governance.

Fee Structure and Revenue Distribution

Raydium generates revenue through trading fees. The fee structure varies based on pool type.

Standard AMMv4 pools charge 0.25% per trade. Of this total, 0.03% goes to RAY buybacks. The remaining fees go to liquidity providers.

CPMM and CLMM pools use multiple fee tiers ranging from 0.01% to 4%. These pools split fees three ways. Liquidity providers receive 84% of fees. RAY buybacks get 12% of fees. The protocol treasury receives 4% of fees.

The platform uses buyback fees to purchase RAY from the open market at regular intervals. This creates constant buy pressure for the token. It also reduces circulating supply over time. Creating a standard AMM or CP-Swap pool costs 0.15 SOL. This fee prevents spam pool creation. It ensures only serious projects and traders create new markets.

Image by: @RaydiumProtocol

Raydium vs Jupiter: Different Roles

Raydium and Jupiter both play important roles in Solana DeFi. But they serve fundamentally different functions.

Raydium is an AMM DEX. Users trade directly with its liquidity pools. The platform owns and manages its liquidity. Traders swap tokens using Raydium's pools and pay fees to Raydium's LPs.

Jupiter is a DEX aggregator. It routes trades across multiple DEXs to find the best prices. Jupiter searches Raydium, Orca, and other platforms simultaneously. It then executes the trade through whichever venue offers the best deal.

Many Jupiter trades actually execute through Raydium's liquidity pools. Jupiter's smart routing often determines that Raydium has the best price for a specific swap. The two platforms complement each other rather than compete directly.

Review JUP Price on LBank

JUP() Price

The current price of

Trading Features Comparison

Raydium offers direct pool trading and OpenBook integration for limit orders. Jupiter provides advanced tools like dollar-cost averaging and perpetual futures. These additional features give Jupiter users more ways to execute complex trading strategies.

Raydium charges variable swap fees based on pool type. Fees range from 0.01% to 4% depending on the pool. Jupiter charges 0% platform fees for its core swap service. Jupiter users only pay the fees of the underlying DEXs in their trade route.

Liquidity and Earning Opportunities

Raydium maintains its own significant liquidity pools. The platform incentivizes these pools through yield farming programs. LPs earn fees from traders plus additional RAY token rewards.

Jupiter taps into aggregated liquidity across the entire Solana ecosystem. This gives Jupiter access to a much larger total liquidity pool. But Jupiter doesn't manage or incentivize its own liquidity.

Raydium offers multiple earning paths. Users can provide liquidity to pools, stake RAY tokens, or participate in farming programs. Each option provides different risk-reward profiles.

Jupiter's JUP token primarily serves governance functions. Token holders vote on Jupiter DAO proposals. JUP doesn't currently offer direct yield or fee-sharing for stakers.

Raydium: Security Measures

Raydium prioritizes smart contract security. The platform's contracts have undergone audits from Kudelski Security and other firms. These third-party reviews help identify potential vulnerabilities before they become problems.

The platform runs an ongoing bug bounty program. Security researchers can report vulnerabilities and earn rewards. This creates financial incentives for skilled developers to help secure the protocol.

Users should understand that all DeFi protocols carry inherent risks. Smart contract bugs, economic exploits, and other issues can occur even with strong security measures. Proper risk management remains essential for anyone using decentralized platforms.

Future Development Plans

AlphaRay has outlined several potential directions for Raydium's growth. Cross-chain expansion remains on the table. The team is open to building on blockchains like Avalanche, Cosmos, and Polkadot. But Solana remains the primary focus for now.

Interoperability features could enhance Raydium's utility. The team is exploring tools like the Wormhole bridge for cross-chain interactions. Partnerships with platforms like SushiSwap could bring additional liquidity and users to the ecosystem.

NFT integration represents another potential growth area. The team is considering NFT features and markets. Solana's NFT ecosystem has grown significantly since Raydium's launch. Integration could open new revenue streams and use cases for the platform.

What Raydium Means for Solana DeFi

Raydium established itself as foundational infrastructure for Solana's DeFi ecosystem. The platform provides essential liquidity for thousands of trading pairs. New projects often launch on Raydium first because of its deep liquidity and established user base.

The AcceleRaytor launchpad helped bootstrap the early Solana ecosystem. It gave new projects a clear path to launch tokens and establish markets. This infrastructure attracted more developers and projects to build on Solana.

LaunchLab shows Raydium continues innovating to meet market needs. The platform adapts to new trends like memecoin launches while maintaining its core trading infrastructure. This flexibility helps Raydium stay relevant as Solana DeFi evolves.

The protocol's fee generation and RAY buyback mechanism create sustainable economics. Trading volume directly benefits RAY holders through staking rewards and reduced supply. This alignment between platform success and token value gives stakeholders long-term incentives to support the ecosystem.