The stablecoin market has a new heavyweight contender. Plasma launched its mainnet in September 2025 with over $2 billion in initial liquidity and backing from Peter Thiel and Tether. The project calls itself the first Layer 1 blockchain built specifically for stablecoins. Most existing blockchains were designed for general purposes. Plasma wants to fix the problems that come with running high-volume stablecoin payments on networks that weren't built for them.

TRON has dominated stablecoin settlement for years. The network held $6.10 billion in Total Value Locked (TVL) when Plasma launched. Within one week, Plasma reached $5.6 billion in TVL. This rapid growth signals a real challenge to TRON's position. The battle between these two networks will shape how stablecoins move across the globe in the coming years.

Review XPL Price on LBank

XPL() Price

The current price of

Price Performance and Market Outlook for XPL

XPL launched with strong price performance. The token debuted at over $2.4 billion in market cap. It held above $1.20 immediately after listing. The price climbed to $1.88 at its peak during the launch weekend. After the initial surge, it settled around $1.30.

The token is considered "low-float" for now. Most team and investor tokens remain locked until 2026. Only 8% of the ecosystem allocation unlocked at launch. US public sale participants can't sell until July 2026. This limited circulating supply creates price support. It also means major unlocks could bring selling pressure next year.

Analysts point to several factors that could drive XPL higher. The network's rapid TVL growth shows real usage. DeFi protocols are building on Plasma and bringing liquidity. The zero-fee structure for Tether gives the network a clear value proposition. Some price predictions target $2.50 based on continued adoption.

Risks exist too. The network is brand new and unproven over time. Major token unlocks starting in 2026 will increase selling pressure. Competition from TRON and other chains remains fierce. The broader crypto market conditions will also impact XPL's price regardless of Plasma's fundamentals.

Trading volume remains high weeks after launch. Open interest on derivatives platforms stays elevated. This suggests sustained trader interest beyond just launch hype. The token's performance over the next few months will reveal whether the initial momentum can continue.

What Makes Plasma Different from Other Blockchains

Plasma is a Proof-of-Stake Layer 1 blockchain with full EVM compatibility. Developers can use familiar tools like MetaMask, Hardhat, and Foundry. The network processes over 1,000 transactions per second with sub-second block times. These technical specs are solid but not revolutionary.

The real difference is in the features Plasma built specifically for stablecoins. The network offers zero-fee transfers for Tether (USD₮) through a specialized paymaster system. Transaction costs drop to nearly nothing for both settlement and transfers. This feature directly targets the main use case that made TRON popular.

Plasma also includes a native Bitcoin bridge that uses a trust-minimized design. Users can move BTC directly into the EVM environment without centralized custodians. The network launched with integrated infrastructure for card issuance, global on/off-ramps, and compliance tooling. These features let developers build payment apps without piecing together third-party services.

The Team and Funding Behind Plasma

Paul Faecks and Christian Angermayer co-founded Plasma. Faecks previously co-founded Alloy, a crypto infrastructure company. Angermayer is an entrepreneur and investor known for running Apeiron Investment Group. The team brought in serious financial backing from the start.

The project raised over $75 million in total. Framework Ventures and Bitfinex co-led the Series A round. Other participants included DRW/Cumberland, and Nomura. Peter Thiel's Founders Fund joined in May 2025. Paolo Ardoino from Tether also backed the project.

The public token sale attracted massive attention. Users deposited over $1 billion in stablecoins to earn the right to purchase XPL tokens. The sale happened at a $500 million valuation. This level of institutional and retail interest set the stage for a strong mainnet launch.

Funding Timeline for Plasma (XPL)

Seed Backing

Bitfinex leads an undisclosed round, raising $3.5 million for early development.

October 2024

Framework Ventures and Bitfinex co-lead a $24 million seed/Series A round.

Strategic Backing from Founders Fund

Founders Fund provides a strategic, undisclosed investment to expand institutional credibility.

Public Token Sale on Echo

Plasma raises $50-51 million through its public token sale on Echo.

XPL Token Design and Distribution

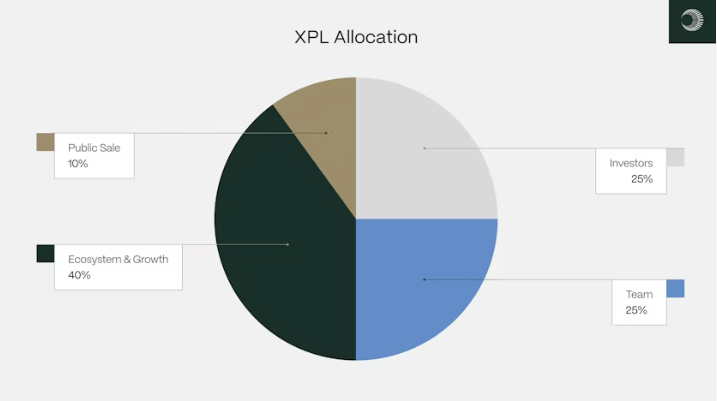

XPL is the native token of the Plasma blockchain. The token has a total initial supply of 10 billion XPL. The distribution splits between four main groups:

- Ecosystem and Growth (40%): 4 billion XPL allocated for strategic growth, liquidity programs, and institutional adoption

- Team (25%): 2.5 billion XPL for current and future contributors

- Investors (25%): 2.5 billion XPL sold to venture firms and strategic backers

- Public Sale (10%): 1 billion XPL distributed to deposit campaign participants

Image by: Plasma Docs

The unlock schedule is designed to prevent immediate sell pressure. Only 8% of the ecosystem allocation (800 million XPL) unlocked at launch. These tokens went toward DeFi incentives and exchange integrations. The remaining 32% unlocks monthly over three years.

Team and investor tokens follow a stricter schedule. One-third of these allocations have a one-year cliff. The rest unlocks monthly over the following two years. Public sale participants outside the US received their tokens fully unlocked at launch. US purchasers face a 12-month lockup that ends on July 28, 2026.

Plasma uses a Proof-of-Stake consensus mechanism. Validators stake XPL to secure the network and earn rewards. The network starts with 5% annual inflation for validator rewards. This rate decreases by 0.5% each year until it reaches a 3% baseline. Plasma also implements the EIP-1559 burn mechanism. Base transaction fees are permanently removed from circulation. This helps offset the inflation from validator rewards.

The Mainnet Launch and Market Response

September 1, 2025 marked Plasma's mainnet beta launch. The network went live with over $2 billion in initial liquidity. Over 50 DeFi protocols launched on Plasma from day one. Aave, Ethena, and Curve were among the first partners. The launch included an airdrop where even small contributors received over 9,300 XPL tokens.

XPL debuted on major exchanges including LBank. The token opened with a market capitalization exceeding $2.4 billion. The price held above $1.20 immediately after launch. It peaked at $1.67 over the launch weekend before settling around $1.33.

Trading volume was massive. Hyperliquid saw $763 million in volume. Data from Hyperliquid showed that over 56% of whale traders took long positions on XPL. Open interest remained high at $1.6 billion even after the initial excitement cooled.

Within the first 24 hours, over $1.1 billion in stablecoins bridged from Ethereum and Arbitrum via LayerZero. The network's Total Value Locked grew rapidly. By the end of the first week, Plasma's TVL surpassed $5.6 billion. This put it ahead of established chains like Arbitrum and Base. Some reports claim Plasma saw over $7 billion in total inflows during the launch weekend.

How Plasma Compares to TRON

TRON has been the dominant network for stablecoin transfers for years. The network's low fees and high throughput made it the preferred choice for moving Tether. At the time of Plasma's launch, TRON held $6.10 billion in TVL. The network processes millions of stablecoin transactions daily.

Plasma reached $5.6 billion in TVL within one week. This rapid growth puts it nearly level with TRON. The competition centers on Total Value Locked and transaction volume. Both networks target the same core use case: cheap and fast stablecoin transfers.

Plasma's main advantage is its zero-fee structure for USD₮ transfers. TRON charges small fees that add up at scale. For users making frequent transfers or moving large volumes, these fees matter. Plasma's purpose-built architecture also offers better integration with DeFi protocols and traditional finance infrastructure.

TRON has advantages too. The network has years of proven uptime and reliability. It has deep liquidity across multiple exchanges. Many wallets and services already support TRON. Users trust what they know. Plasma needs to prove it can maintain performance and security over time.

The battle between these networks will play out over months and years. TRON won't give up its position easily. Plasma's rapid TVL growth shows it has real momentum. The network that wins will likely become the primary settlement layer for trillions of dollars in stablecoin value.

Review TRX Price on LBank

TRX() Price

The current price of

Real-World Use Cases Plasma Enables

Plasma's zero-fee structure opens up use cases that are too expensive on other networks. Remittances are one major application. People send money across borders to family members in other countries. Traditional services charge high fees. Banks add multiple layers of costs. Plasma lets users send Tether with no additional fees for international transfers.

Micropayments become viable on Plasma. Gig economy workers can receive small payments without losing a chunk to fees. Content creators can accept payments for individual articles or videos. Internet-native businesses can process tiny transactions profitably. These use cases don't work when each transaction costs even a few cents.

Global payouts are another strong use case. Companies with international contractors or employees can pay everyone instantly. This matters especially in emerging markets where banking access is limited. Workers receive stable dollar-denominated payments directly. They can spend or save without going through local banks that charge high fees or offer poor exchange rates.

Merchant acceptance gets easier with Plasma's infrastructure. Online stores can accept stablecoin payments with instant settlement. Offline merchants can use integrated card solutions. The network's built-in compliance tooling helps businesses meet regulatory requirements. Lower fees mean merchants can offer better prices or keep more profit.

Over 40% of Tether holders use it as a savings tool. Plasma enables permissionless banking for people in regions with high inflation or capital controls. Users only need a mobile phone to access dollar-denominated savings. They can participate in global markets and financial services without traditional bank accounts.

Plasma One: Testing the Infrastructure in the Real World

On September 22, 2025, Plasma announced Plasma One. This stablecoin-native neobank targets users in emerging markets. The mobile app combines saving, spending, and sending functions in one place. Users get permissionless access to dollar-denominated accounts.

Plasma One offers double-digit yields exceeding 10% on savings. Users can earn up to 4% cash back on purchases. The app provides both physical and virtual cards that work in 150 countries. Transfers between Plasma One users are free and instant. These features directly compete with traditional banking services.

Image by: Plasma

The company calls Plasma One a "proving ground" for its payment stack. The team wants to battle-test the infrastructure before opening it to external developers. This approach lets them find and fix problems in a controlled environment. Once proven, other companies can build similar apps on Plasma's infrastructure.

The neobank approach shows Plasma's ambition beyond just being a blockchain. The team wants to create complete financial products that compete with traditional banks. Success with Plasma One could attract more developers to build consumer-facing apps. It also demonstrates the practical use of Plasma's zero-fee transfers to mainstream users.

What Plasma's Success Means for the Stablecoin Market

Plasma's rapid rise challenges the assumption that TRON's dominance is permanent. The stablecoin market has room for multiple winners. Different networks can serve different use cases and user bases. TRON excels at simple transfers and has massive adoption in Asia. Plasma targets more complex financial applications with its DeFi integrations and banking infrastructure.

The competition between these networks will likely lower costs for users. TRON may need to reduce fees to compete with Plasma's zero-fee model. Both networks will invest in better user experiences and more partnerships. This benefits everyone who uses stablecoins for payments or savings.

Traditional finance institutions are watching these developments closely. Banks and payment processors see blockchain-based stablecoins as both threat and opportunity. Plasma's backing from mainstream investors like Peter Thiel signals that institutional money is taking stablecoin infrastructure seriously. More capital and talent will flow into this space.

Regulators are also paying attention. As stablecoin networks handle billions in transactions, governments want oversight. Plasma's built-in compliance tooling addresses these concerns. Networks that make it easy for businesses to meet regulations will win long-term. The industry needs to work with regulators instead of fighting them.

The emergence of purpose-built stablecoin networks like Plasma represents the maturation of crypto infrastructure. Early blockchains tried to do everything. Specialized networks that optimize for specific use cases perform better. This trend will likely continue with networks built for specific industries or transaction types.

The Road Ahead for Plasma

Plasma has made an impressive start with its mainnet launch and rapid TVL growth. The network reached nearly $6 billion in locked value within one week. It attracted major DeFi protocols and launched a consumer-facing neobank. These achievements show the project has real substance behind the hype.

The real test comes in the months ahead. Can Plasma maintain its TVL growth as unlock schedules increase selling pressure? Will the network prove reliable and secure under sustained heavy usage? Can Plasma One attract mainstream users who don't normally use crypto? These questions will determine the project's long-term success.

TRON won't surrender its market position without a fight. The network has years of operational history and deep integration across the crypto ecosystem. Plasma needs to keep delivering on its promises and expanding its user base. The stablecoin market is large enough for both networks to succeed. The competition will ultimately benefit users through better services and lower costs.

For advanced crypto users and investors, Plasma represents a significant development in stablecoin infrastructure. The project combines strong fundamentals, serious backing, and a clear value proposition. Whether XPL becomes a top-tier investment remains to be seen. What's certain is that Plasma has changed the conversation about where and how stablecoins should move in the future.