Ethereum Layer-2 scaling has entered an interesting phase. The first generation of ETH Layer-2 solutions focused on making Ethereum cheaper and more accessible without compromising security, and it largely succeeded. Rollups like Arbitrum, Optimism, Base, and zkSync now process millions of transactions daily and secure billions of dollars in value.

However, performance expectations have shifted. As on-chain applications expand beyond traditional DeFi into real-time trading, gaming, social systems, and latency-sensitive infrastructure, the question arises: Is “fast enough” actually fast enough?

MegaETH represents a new class of Layer-2 networks that answers this question differently. Instead of prioritizing decentralization or composability from day one, MegaETH emphasizes real-time execution, ultra-low latency, and high throughput, while still anchoring security to Ethereum.

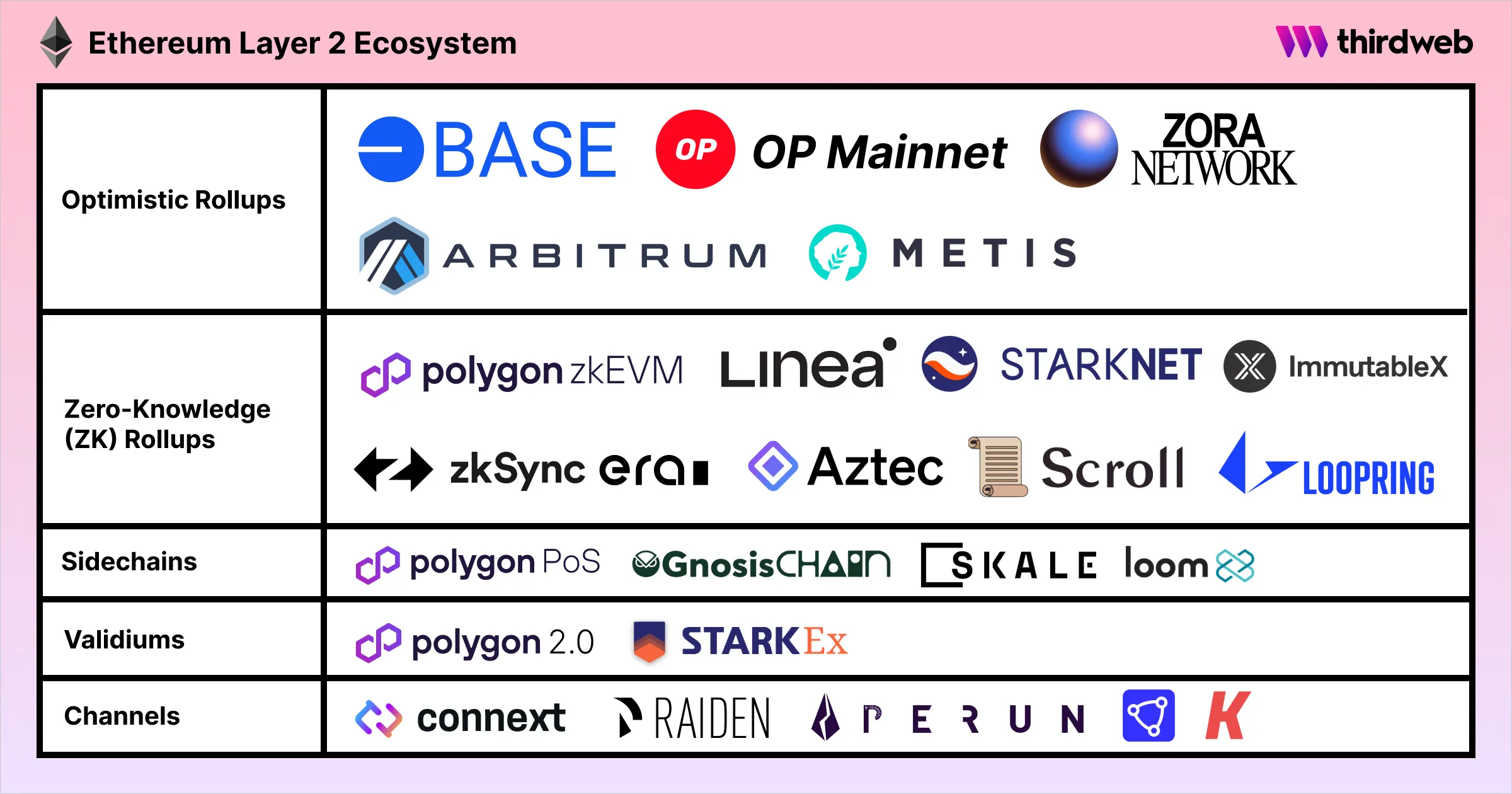

Source: ThirdWeb

Different Ethereum Layer-2 Networks

Layer-2 networks process transactions off-chain to reduce Ethereum mainnet congestion while retaining Ethereum’s security guarantees. Different approaches have emerged:

1. Optimistic Rollups

Mechanism:

Optimistic rollups assume transactions are valid by default and rely on fraud proofs during a challenge period to detect invalid state transitions.

Core Characteristics:

- EVM compatibility

- Mature developer tooling

- Lower computational overhead than ZK systems

- Withdrawal delay due to challenge window

- Strong alignment with Ethereum security model

Major Optimistic Rollups

| Network | Focus / Notes |

| Arbitrum | One of the largest L2 ecosystems; strong DeFi presence |

| OP Mainnet (Optimism) | Modular stack vision via the OP Stack; supports Superchain model |

| Base | Built on OP Stack; focuses on consumer and retail onboarding |

| Metis | Optimistic framework with emphasis on DAC-based scaling |

| Zora Network | Creator-focused L2 optimized for NFTs and media |

Professional insight:

Optimistic rollups currently dominate TVL among rollup designs due to early deployment and tooling maturity. The main trade-off remains withdrawal latency and reliance on honest challengers.

2. Zero-Knowledge (ZK) Rollups

Mechanism:

ZK rollups generate cryptographic validity proofs for batches of transactions. These proofs are verified on Ethereum, ensuring correctness without requiring a dispute window.

Core Characteristics:

- Faster finality than optimistic rollups

- No challenge period

- Higher prover computational cost

- Strong mathematical security guarantees

- Increasing EVM compatibility over time

Major ZK Rollups

| Network | Focus / Notes |

| Polygon zkEVM | EVM-equivalent zk rollup within Polygon ecosystem |

| zkSync Era | EVM-compatible zk rollup with account abstraction focus |

| Linea | ConsenSys-backed zkEVM network |

| Starknet | Uses STARK proofs; custom Cairo VM |

| Scroll | zkEVM rollup targeting Ethereum equivalence |

| Immutable X | Gaming-focused zk rollup built on StarkEx |

| Loopring | zk rollup optimized for payments and DEX functionality |

| Aztec | Privacy-focused zk rollup integrating encrypted transactions |

Professional insight:

ZK rollups represent the long-term scalability direction for Ethereum due to validity proofs and instant finality. However, prover decentralization and computational costs remain structural considerations.

3. Sidechains

Mechanism:

Sidechains operate independently from Ethereum and bridge assets to and from mainnet. They do not inherit Ethereum security directly.

Core Characteristics:

- Independent validator sets

- Faster and cheaper execution

- Lower security guarantees than rollups

- Suitable for high-throughput applications

Major Sidechains

| Network | Focus / Notes |

| Polygon PoS | High-throughput sidechain widely used for DeFi and gaming |

| Gnosis Chain | Stable infrastructure chain with DAO alignment |

| SKALE | Elastic sidechain infrastructure for dApps |

| Loom Network | Application-specific sidechain architecture |

Professional insight:

Sidechains trade off Ethereum-native security for scalability and flexibility. Security assumptions depend on the sidechain validator model rather than Ethereum fraud or validity proofs.

4. Validiums

Mechanism:

Validiums use validity proofs like ZK rollups but keep data availability off-chain rather than on Ethereum.

Core Characteristics:

- Lower gas costs

- Validity proof security for computation

- Off-chain data availability assumption

- Higher scalability potential

Major Validiums

| Network | Focus / Notes |

| StarkEx | Infrastructure layer powering applications like dYdX and Immutable |

| Polygon 2.0 (Validium Mode) | Modular architecture supporting multiple scaling configurations |

Professional insight:

Validiums provide scalability benefits but introduce data availability trust assumptions. They are appropriate for high-throughput applications where Ethereum-level data availability is not mandatory.

5. State Channels and Payment Channels

Mechanism:

Channels allow participants to transact off-chain while only settling the final state on Ethereum.

Core Characteristics:

- Instant settlement between participants

- Extremely low fees

- Limited to predefined participants

- Best suited for repeated interactions

Major Channel Networks

| Network | Focus / Notes |

| Connext | Cross-chain communication and state channel infrastructure |

| Raiden | Ethereum payment channel network |

| Celer Network |

Off-chain scaling and state channel infrastructure |

Professional insight:

Channels are highly capital efficient for bilateral or small-group interactions but do not provide generalized scaling for global smart contract execution.

6. New-Generation Execution Layers

Beyond traditional rollups and sidechains, new architectures are emerging.

MegaETH

MegaETH represents a next-generation execution approach focused on:

- Near real-time transaction processing

- Modular execution separation

- High-performance sequencer architecture

- Reduced batching latency compared to classical rollups

This reflects a broader industry shift toward:

- Modular blockchain design

- Specialized execution layers

- Data availability separation

- Performance-focused sequencing

Strategic Comparison

| Category | Security Inheritance | Finality Speed | Data Availability | Computation Cost |

|---|---|---|---|---|

| Optimistic Rollups | High | Delayed | On Ethereum | Moderate |

| ZK Rollups | High | Fast | On Ethereum | High |

| Validiums | Medium to High | Fast | Off-chain | High |

| Sidechains | Independent | Fast | Independent | Low |

| Channels | High (final settlement) | Instant between parties | Off-chain | Very Low |

Ethereum L2s collectively hold over $51.5 billion in TVL, driven by both DeFi activity and user demand for faster confirmation and lower fees. Ethereum’s 2024 upgrades have further stabilized fees and improved L2 capacity.

MegaETH Performance vs Ethereum L2s: Throughput and Latency

Performance metrics such as throughput and latency are foundational when assessing the suitability of a Layer-2 network for different classes of applications. Throughput, measured in transactions per second (TPS), determines how much sustained transactional activity a network can support without congestion. Latency, commonly expressed as time to execution or time to finality, reflects how quickly transactions are processed and confirmed from a user or application perspective. While many Ethereum Layer-2 solutions have significantly reduced costs, latency has increasingly become the primary constraint for advanced, real-time use cases.

Most existing Ethereum Layer-2 networks operate within performance envelopes that are sufficient for traditional DeFi, NFT minting, and batch-based financial workflows. However, applications that depend on continuous state updates, rapid price discovery, or immediate execution feedback expose the limitations of second-level or even sub-second confirmation times. In these contexts, performance is not an optimization but a prerequisite.

MegaETH’s Performance Targets

MegaETH is architected with performance as a first-order design goal rather than a secondary optimization. According to publicly available technical summaries, MegaETH aims to achieve.

- 100,000+ transactions per second, enabling high-volume transaction processing without reliance on batching delays

- Block times of approximately 10 milliseconds, allowing near-instant execution feedback for users and applications

This performance profile is enabled by a modular architecture that separates sequencing, execution, and verification.

Unlike traditional rollups that collect transactions into batches before processing and settlement, MegaETH is designed to process transactions continuously.

This reduces the waiting period between transaction submission and execution, which is a primary source of latency in existing Layer-2 systems.

From an application standpoint, such performance characteristics could materially expand the design space for on-chain systems. Potential use cases include:

- High-frequency DeFi protocols, where execution timing and price precision directly impact risk and profitability

- Real-time blockchain gaming, requiring continuous state updates and immediate player feedback

- Microtransaction streams, such as usage-based billing or streaming payments, where per-transaction latency affects user experience

- Instant settlement flows, where delayed confirmation introduces operational or counterparty risk

The table below summarizes how MegaETH’s performance targets differ from typical Ethereum Layer-2 execution profiles:

It is important to emphasize that MegaETH’s performance figures represent architectural targets rather than benchmarks validated under sustained mainnet conditions. Delivering consistent performance at this scale requires successful execution under real-world load, adversarial conditions, and ecosystem growth.

Readers interested in the technical architecture and tokenomics behind these performance claims can reference the MegaETH Introduction article for a detailed breakdown.

Performance of Established L2s

Arbitrum: Block times of ~250 ms; throughput 2,000–4,000 TPS

Optimism / Base: Block finality ~2 seconds; throughput 2,000–3,000 TPS

ZK Rollups (zkSync Era, StarkNet): TPS in thousands to low tens of thousands; latency <1 second

Other solutions (Polygon zkEVM): Trade-offs between TPS, latency, and cost

Broad L2 surveys show typical rollup throughput between 2,000 and 20,000+ TPS, with Optimistic Rollups tending toward the lower end and leading ZK solutions approaching the upper range under optimal conditions. The gap between MegaETH’s design goals and current rollup performance underscores the frontier of scaling research while highlighting the need for MegaETH to meet its execution targets in live environments.

Ethereum Layer-2’s Performance Comparison Table

Note: MegaETH targets are design goals, not fully validated under sustained production load.

Security and Decentralization Considerations in Ethereum Layer-2 Design

Achieving high throughput and ultra-low latency introduces specific design constraints that directly affect security models, decentralization, and trust assumptions. Ethereum Layer-2 networks optimize different parts of the scaling triangle, and these architectural choices determine how users, developers, and protocols should evaluate risk.

Optimistic Rollups

Optimistic rollups such as Arbitrum and Optimism prioritize Ethereum compatibility and decentralization while maintaining strong security guarantees. Transactions are assumed valid by default and can be challenged during a defined dispute window.

Key characteristics include:

- Strong alignment with Ethereum’s security model, as fraud proofs allow invalid state transitions to be contested

- Delayed final settlement, typically several days, due to challenge periods

- Higher latency for withdrawals and cross-chain operations, even though execution may appear fast at the application level

For capital-intensive DeFi protocols and systems requiring censorship resistance, these properties are often acceptable. However, delayed finality can be a limitation for applications that require immediate economic certainty.

Zero-Knowledge Rollups

ZK rollups such as zkSync Era and StarkNet use cryptographic proofs to verify state transitions, offering faster finality and stronger correctness guarantees.

Their design characteristics include:

- Near-immediate finality once proofs are verified, reducing settlement uncertainty

- Higher computational overhead, as generating zero-knowledge proofs is resource-intensive

- More complex infrastructure and tooling, which can slow developer onboarding and ecosystem growth

ZK rollups are well-suited for applications that require fast finality and strong correctness guarantees but can tolerate higher operational complexity and evolving tooling.

MegaETH’s Execution Model

MegaETH takes a different approach by optimizing for real-time execution and minimal latency. To achieve millisecond-level block times and continuous processing, MegaETH relies on centralized or tightly coordinated sequencing.

This design introduces important considerations:

- Reduced latency and deterministic execution ordering, which is critical for real-time systems

- Increased operational and censorship risk, as sequencing control is more centralized than in mature rollup systems

- Stronger reliance on operator honesty and uptime, especially in early-stage deployments

For professional users, this shifts the trust model. MegaETH’s architecture may be appropriate for environments where responsiveness and execution speed outweigh strict decentralization requirements, such as high-frequency trading systems or controlled application ecosystems.

Evaluating Trust Assumptions

Ultimately, the question is not which model is “better,” but which assumptions are acceptable for a given use case. Centralization affects:

- Protocol governance and upgrade risk

- Censorship resistance under stress conditions

- Developer and user confidence in long-term neutrality

Professional users should explicitly assess how each Layer-2’s design aligns with their application’s tolerance for latency, settlement delay, and trust concentration. In this context, decentralization is not binary but a spectrum shaped by architectural intent and operational maturity.

Ecosystem Adoption and Total Value Locked (TVL)

Total Value Locked and adoption metrics provide a concrete view of how Ethereum Layer-2 networks perform in real-world conditions, beyond theoretical throughput and architectural design. TVL reflects the amount of capital that users and protocols are willing to commit to a network, making it a proxy for trust, liquidity depth, developer confidence, and overall ecosystem maturity.

High adoption typically signals strong infrastructure, reliable tooling, and active application ecosystems, while lower TVL often indicates early-stage development or unproven economic security.

Evaluating TVL alongside user activity helps distinguish between networks that are technically promising and those that have already achieved sustained usage at scale.

TVL and adoption illustrate real-world relevance:

- L2s collectively exceed $51.5 billion TVL, with Arbitrum ~$18B and Base ~$11B

- zkSync Era and StarkNet contribute but have smaller TVL

- MegaETH is in early adoption, with minimal deployed applications, highlighting the need for ecosystem development to support its performance goals

Developer Tooling, Integration, and Ecosystem Growth

Raw performance alone is not sufficient to drive sustainable Layer-2 adoption. Developer tooling, infrastructure integrations, and ecosystem support play a decisive role in whether protocols can realistically deploy, maintain, and scale applications on a network.

Mature tooling reduces development friction, shortens deployment cycles, and lowers operational risk for teams handling real user funds. Wallet compatibility, reliable bridges, observability tooling, indexing services, and debugging frameworks all directly affect developer productivity and user experience.

Networks that fail to provide familiar or well-documented development environments often struggle to attract serious builders, regardless of their theoretical performance advantages.

For MegaETH, the success of its performance-first architecture will depend heavily on how quickly it can deliver production-grade tooling and integrations that allow developers to fully leverage its low-latency execution model without sacrificing reliability or security.

Comparing Centralization and Latency in Ethereum Layer-2 Design

One of the most important architectural questions in Ethereum Layer-2 design is how much decentralization can be sacrificed to achieve lower latency and higher throughput. Latency directly affects user experience, especially for applications that rely on real-time feedback, while decentralization affects censorship resistance, fault tolerance, and long-term trust assumptions.

MegaETH and established Layer-2 networks approach this balance differently.

MegaETH prioritizes execution speed and responsiveness by relying on a more centralized sequencing model. This allows transactions to be ordered and executed almost instantly, significantly reducing confirmation delays. Such an approach can be effective in environments where performance is critical and where participants accept stronger trust assumptions in exchange for speed.

Established Layer-2s such as Arbitrum, Optimism, and zk-based rollups aim for a more balanced design, maintaining stronger decentralization properties while delivering sufficient performance for most DeFi and composable applications. Their latency is higher, but their security and governance models are closer to Ethereum’s trust-minimized philosophy.

Centralization vs Latency Comparison

Understanding this distinction is essential. Latency-sensitive applications may tolerate higher centralization, while capital-intensive protocols typically prioritize censorship resistance and long-term security guarantees.

Risks and Considerations for Professional Users

From a professional perspective, evaluating MegaETH requires a clear-eyed assessment of both its upside and its risks. Performance alone is not sufficient if execution, governance, or incentives fail to align over time.

Key Risk Dimensions

Established Layer-2s benefit from years of production usage, battle-tested infrastructure, and large developer communities. MegaETH, by contrast, is still proving its execution capabilities. This makes it higher risk but potentially higher reward for specific use cases.

Professional users should treat MegaETH as infrastructure under active validation, not a finished alternative to mature rollups.

Conclusion: Positioning MegaETH in Ethereum Scaling

MegaETH represents one of the most aggressive attempts to push Ethereum Layer-2 performance toward real-time execution. Its architectural focus on ultra-low latency and extreme throughput differentiates it clearly from Optimistic and ZK Rollups that dominate today’s ecosystem.

Rather than replacing existing Layer-2 solutions, MegaETH should be viewed as a specialized execution layer designed for applications that cannot tolerate multi-second confirmation times. If its performance targets are achieved and its decentralization roadmap progresses, it could unlock categories of on-chain activity that remain impractical on current rollups.

Professional users evaluating MegaETH should focus on four core criteria:

- Performance requirements of their application

- Trust assumptions related to sequencing and governance

- Ecosystem maturity and developer tooling readiness

- Real-world adoption indicators, including deployed applications and TVL growth

MegaETH signals a broader shift in Ethereum scaling from cost reduction toward performance optimization. Whether this approach becomes a dominant model or remains a niche solution will depend on execution quality, ecosystem growth, and the network’s ability to balance speed with credible decentralization over time.