First U.S. Dogecoin ETF (DOJE) Launches With Strong Trading Debut

Dogecoin has just entered a new chapter in mainstream finance. On September 18, 2025, the first U.S. exchange-traded fund (ETF) tied to Dogecoin, known as DOJE, officially launched.

The REX-Osprey Dogecoin ETF (DOJE) became the first U.S.-listed ETF to provide regulated exposure to Dogecoin. The fund recorded $17 million in trading volume on its first day. This number crushed initial forecasts of just $2.5 million. Total day-one volume was later estimated at $30 million across DOGE and XRP ETFs combined, underscoring strong initial demand.

Shortly after, 21Shares’ Dogecoin ETF (TDOG) appeared on the DTCC listing system, a necessary step before trading but not yet full SEC approval. Together, these products give investors new ways to gain exposure to Dogecoin’s price without directly holding the cryptocurrency, using structures similar to the spot Bitcoin ETFs launched in 2024.

While the long-term impact remains uncertain, these launches mark a turning point. Dogecoin, once dismissed as a meme, now has regulated investment vehicles that lower entry barriers for institutions. At the same time, they show regulators are willing to extend ETF approval beyond Bitcoin and Ethereum, opening the door for broader crypto diversification in traditional markets.

Review DOGE Price on LBank

DOGE() Price

The current price of DOGE() is $0, with a % change in the past 24 hours and a % change over the Past Six Months period. For more details, please check the DOGE price now.

Key Players Behind the Dogecoin ETF

Several organizations worked to make Dogecoin ETFs a reality. REX Shares and Osprey Funds partnered to launch the DOJE ETF, combining Osprey’s crypto expertise under CEO Greg King with REX’s experience in ETF structuring. Their teams had earlier tested market appetite with a Solana ETF in July 2025.

21Shares, a Swiss firm known for managing multiple crypto ETPs in Europe, also entered the arena. Its proposed TDOG ETF has been listed on the DTCC clearing system, an important step toward a U.S. launch. This shows how 21Shares is expanding from Europe into U.S. markets for altcoin products.

Meanwhile, Bitwise and Grayscale are pursuing their own DOGE filings. Grayscale in particular seeks to convert its long-running Dogecoin Trust into an ETF, following the same pathway it took with its Bitcoin Trust in 2024. Supporting infrastructure matters too: the Cboe BZX Exchange lists DOJE for trading, while DTCC ensures clearing and settlement, making these funds accessible through standard brokerage accounts.

How Dogecoin ETFs Actually Work

The DOJE ETF is designed around derivatives rather than direct Dogecoin holdings. It uses futures and swaps, with trades executed through a Cayman Islands subsidiary.

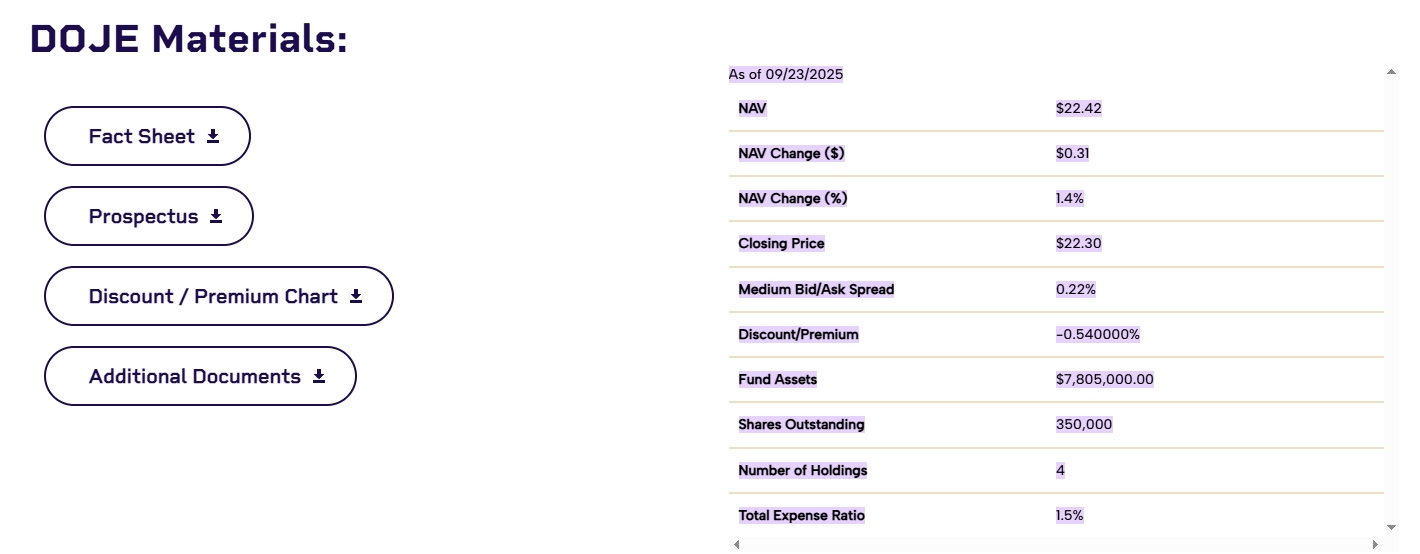

This setup contrasts with spot Bitcoin and Ethereum ETFs, which hold the underlying asset. The REX-Osprey team chose a regulatory structure that allowed DOJE to reach the market more quickly, though it comes with a higher expense ratio of 1.5%. The trade-off for speed is higher cost and potential tracking differences.

Meanwhile, 21Shares’ TDOG ETF is listed on the DTCC system but has not yet received trading approval. The company has not disclosed the full structure, but the fund will also provide indirect DOGE exposure. Both DOJE and TDOG aim to give investors access to Dogecoin price movements without the operational complexity of managing wallets, keys, or crypto exchanges.

Timeline of Dogecoin ETF Development

The path to Dogecoin ETFs unfolded over several months in 2025:

Bitwise DOGE Filing

NYSE Arca filing to list the Bitwise Dogecoin ETF published in the Federal Register.

21Shares S-1 Filed

21Shares submits Form S-1 for the 21Shares Dogecoin ETF (TDOG).

DOJE Trading Begins

REX-Osprey Dogecoin ETF (DOJE) starts trading on Cboe BZX.

SEC OKs Generic Rules

SEC approves generic listing standards for crypto spot ETPs.

TDOG DTCC Listing

21Shares Dogecoin ETF (TDOG) appears on DTCC system (pre-trading step).

SEC Delays Altcoin ETFs

SEC extends review deadlines for other altcoin ETF applications (e.g., Bitwise DOGE).

Regulatory Breakthroughs That Made It Possible

Two major regulatory changes enabled the Dogecoin ETF launches. First, the SEC approved generic listing standards for digital asset exchange-traded products on September 18, 2025. This means exchanges can now list crypto funds that meet certain standards without filing separate rule changes each time.

Second, the success of Bitcoin and Ethereum ETFs paved the way. Bitcoin ETFs alone pulled in $39.94 billion since January 2024. This massive inflow proved institutional demand for regulated crypto products exists.

The 1940 Act structure represents another breakthrough. By using derivatives instead of holding actual crypto, fund managers avoid the SEC's strict custody requirements. This workaround might become the template for future altcoin ETFs.

Corporate treasuries also helped legitimize Dogecoin before the ETF launch. Companies like CleanCore Solutions and Thumzup Media announced significant Dogecoin holdings. These moves showed that businesses view DOGE as more than just a meme.

Image by: REX Shares

Market Impact and Price Movement Analysis

The Dogecoin ETF launches created interesting price dynamics. DOGE rallied 17-21% in the week before the DOJE launch. The cryptocurrency gained another 12% on launch day itself. But after the initial excitement, the price dipped slightly by 0.81%.

Trading volume tells a different story. Dogecoin's 24-hour spot trading volume hit $3.67 billion on launch day. The DOJE ETF itself traded $17 million worth of shares. These numbers show strong interest from both retail and institutional investors.

Technical indicators suggest more upside ahead. A "golden crossover" formed between the 50 and 200-day exponential moving averages. This pattern often signals the start of a sustained uptrend.

Analysts project different price targets based on ETF inflows:

- If DOJE captures 30% of Bitcoin ETF inflows: DOGE could reach $0.34

- If DOJE captures 50% of Bitcoin ETF inflows: DOGE could reach $0.50

- If key resistance levels break: Price targets range from $0.40 to $0.60

Whale activity adds another bullish signal. Large holders accumulated over 1 billion DOGE in the month before the ETF launch. One whale alone bought 52.9 million DOGE worth $11.71 million during a price dip. This behavior mirrors accumulation patterns from the 2021 bull run.

Comparison: Dogecoin ETFs vs. Bitcoin & Ethereum Spot ETFs

| Aspect | Dogecoin ETFs (e.g., DOJE, TDOG) | Bitcoin & Ethereum Spot ETFs |

| Expense Ratio | ~1.5% annually (higher due to derivatives structure) | 0.2% - 0.4% annually (lower, simpler structure) |

| Regulatory Framework | Investment Company Act of 1940 | Securities Act of 1933 |

| Fund Structure | Derivatives-based (futures, swaps, Cayman subsidiary) | Spot-based, holding actual BTC/ETH in custody |

| Performance Tracking | Risk of tracking errors, especially in volatility | Tracks price closely with minimal tracking error |

| Market Depth | Smaller liquidity, less institutional adoption | Deeper liquidity, mature derivatives markets |

| Volatility Impact | Higher spreads and potential ETF price swings | More stable pricing due to deeper market base |

Winners and Challenges in the New Landscape

The Dogecoin ETF launches create clear winners in the market. REX Shares, Osprey Funds, and 21Shares established themselves as pioneers. They'll benefit from management fees and increased brand recognition. Early movers in crypto ETFs often maintain market share even as competition increases.

Dogecoin itself gains unprecedented legitimacy. Access to traditional investment accounts means pension funds, IRAs, and institutional portfolios can now include DOGE exposure. This broader investor base should increase liquidity and potentially reduce volatility over time.

Major crypto exchanges like LBank benefits from the "halo effect." As mainstream interest in Dogecoin grows, these platforms see increased trading volume across all their listed assets.

But challenges exist too. Smaller, unregulated brokers face tough competition from convenient ETF products. Why deal with sketchy exchanges when you can buy DOGE exposure through your regular broker?

Speculative traders might find their strategies less effective. Increased institutional participation often dampens extreme price swings. The wild 50% daily moves that characterized early Dogecoin trading could become less common.

Other altcoins face a new divide. Projects that secure ETF approval gain massive advantages over those that don't. This could create a two-tier system where ETF-eligible cryptos attract most institutional capital.

Risks Investors Should Consider

Dogecoin ETFs carry unique risks beyond typical cryptocurrency volatility. The derivatives-based structure of DOJE means performance might not perfectly match Dogecoin's spot price. During extreme market moves, this tracking error could become significant.

The 1.5% expense ratio eats into returns over time. An investor holding DOJE for five years pays 7.5% in fees. That's a substantial drag on performance compared to holding actual Dogecoin or cheaper Bitcoin ETFs.

Dogecoin's fundamental value remains questionable. Unlike Ethereum with its smart contracts or Bitcoin with its fixed supply, Dogecoin lacks clear utility beyond payments and tipping. The cryptocurrency's value depends heavily on social media sentiment and celebrity endorsements, such as Elon Musk and Dogecoin.

Regulatory risk persists despite the ETF approvals. The SEC could change its stance on derivatives-based crypto funds. Congress might pass laws affecting cryptocurrency taxation or trading. These changes could impact ETF operations or investor returns.

Competition from newer memecoins poses another threat. Shiba Inu, Pepe, and other tokens constantly vie for the memecoin crown. If investor attention shifts, Dogecoin ETFs could see outflows even as the broader crypto market grows.

The Future of Altcoin ETFs

The Dogecoin ETF launches open the door for more altcoin products. The 1940 Act structure provides a template other fund managers will likely copy. Expect applications for Solana, Cardano, and Polygon ETFs in the coming months.

Generic listing standards make the process easier. Exchanges no longer need separate SEC approval for each new crypto fund. This streamlined approach could lead to dozens of altcoin ETFs by 2026.

Fee compression will likely follow. As more altcoin ETFs launch, competition should drive expense ratios lower. The 1.5% charged by DOJE might drop to 1% or less within a year.

International expansion looks probable too. If U.S. Dogecoin ETFs succeed, expect similar products in Europe, Asia, and Latin America. Global accessibility would further legitimize Dogecoin as an asset class.

The bigger question is whether memecoins deserve this legitimacy. Dogecoin ETFs force traditional investors to take internet culture seriously as an investment theme. This cultural shift might be the most lasting impact of these launches.