LBank offers a comprehensive copy trading system for futures trading with flexible parameters to suit various trading strategies. This guide outlines the five key configuration modules—Single Investment Method, Maximum Follow Amount, Risk Control, Individual Futures Advanced Settings, and Additional Settings—to help users optimize their copy trading experience.

Single Investment Method (Required)

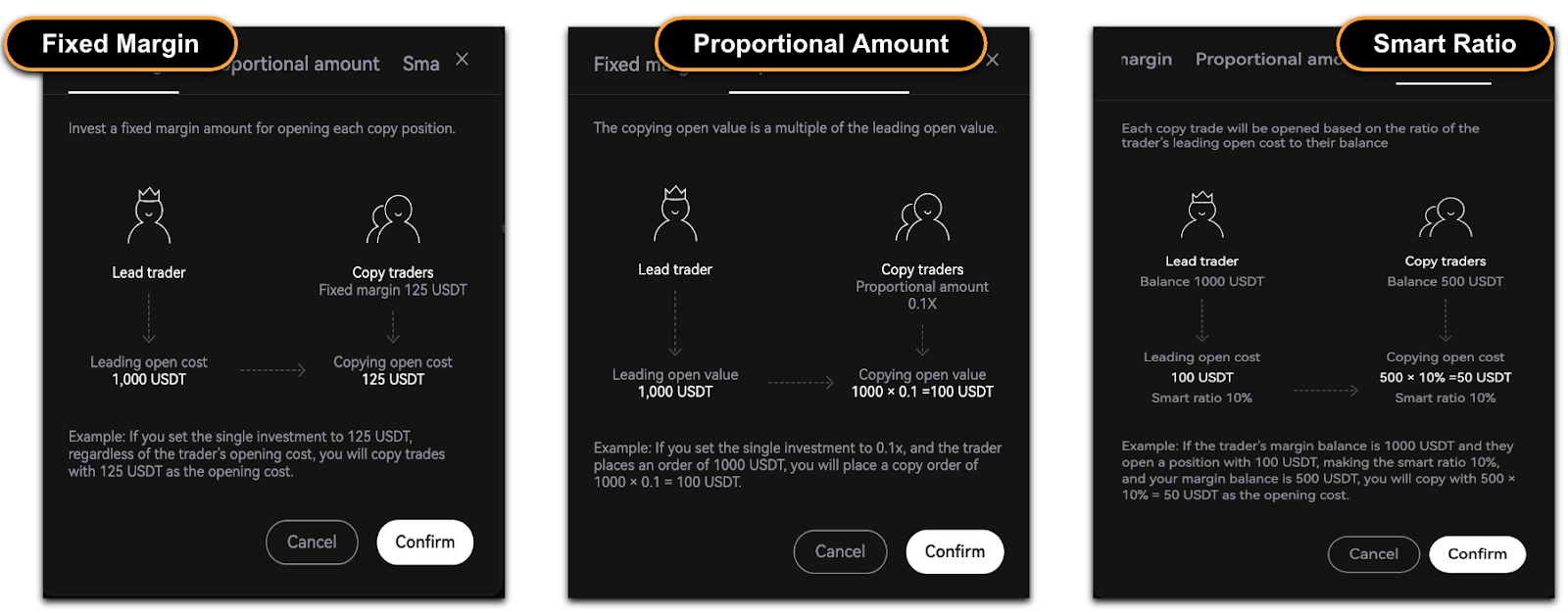

📌LBank provides three methods for determining the investment amount per futures trade: Fixed Amount, Fixed Multiple, and Smart Ratio. The default is Fixed Amount. Below is an overview of each method:

-

Fixed Amount: Set a specific amount for each trade (e.g., $100 per trade).

-

Proportional Amount: Follow the lead trader’s position size multiplied by a fixed factor (e.g., 2x the trader’s position).

-

Smart Ratio: Dynamically allocate funds based on a percentage of your available balance, adapting to market conditions.

💡Note: Ensure your chosen method aligns with the lead trader’s strategy for optimal results.

Maximum Follow Amount (Required)

📌This setting limits the total capital allocated to copy trading, either across all futures trading pairs or for specific futures contracts.

-

Total Amount: Caps the cumulative margin used for all trading pairs. Once the limit is reached, no new positions are opened until existing ones are closed and the margin falls below the limit.

-

Per Futures Contract: Sets a margin cap for each trading pair individually. If the limit is reached for one pair, copy trading stops for that pair but continues for others.

💡Tip: Adjust these limits based on your risk tolerance and the lead trader’s trading frequency.

Risk Control (Optional)

📌LBank’s risk control module allows users to manage their copy trading positions beyond simply mirroring the lead trader.

-

Single Trade Stop-Loss:

-

Automatically closes a position if losses exceed a set percentage (e.g., 10%).

-

Applied to every trade copied from the lead trader.

-

If the lead trader closes a position before the stop-loss triggers, your position closes simultaneously.

-

Single Trade Take-Profit:

-

Automatically closes a position if profits exceed a set percentage (e.g., 10%).

-

Applied to every copied trade.

-

If the lead trader closes a position before the take-profit triggers, your position closes simultaneously.

💡Tip: Set conservative stop-loss and take-profit levels to protect your capital while allowing flexibility for the lead trader’s strategy.

Individual Futures Advanced Settings & Leverage Adjustment (Optional)

📌These settings allow customization for specific futures trading pairs, overriding global settings, and adjusting leverage modes.

-

Select Futures Trading Pairs: Choose which futures trading pairs to copy.

-

Per-Futures Contract Settings:

-

Customize Single Investment Method, Maximum Follow Amount, and Risk Control for individual pairs.

-

These settings take priority over global configurations.

-

Leverage Modes:

-

Follow Lead Trader’s Leverage: Copy the lead trader’s leverage (e.g., 10x or 20x). If your balance is insufficient, the trade fails.

-

Fixed Leverage: Use a predefined leverage (e.g., 5x for BTC/USDT), regardless of the lead trader’s leverage.

-

Account Leverage: Use your account’s default leverage (e.g., 10x), independent of the lead trader’s settings. Verify your default leverage, as the system may set a high default.

💡Tip: Align leverage with the lead trader’s settings unless you have a specific risk preference. Avoid excessively high leverage (>20x).

Additional Settings (Optional)

-

Lead Trader Liquidation Settings:

-

Follow Liquidation (Default): If the lead trader’s position is liquidated, your position closes at market price.

-

Do Not Follow Liquidation: Your position remains open if the lead trader is liquidated. You’ll receive a system notification to manually manage the position (e.g., adjust margin or close it). Use this option cautiously.

💡Tip: For beginners, stick with the default “Follow Liquidation” to avoid managing open positions manually.

Copy Trading Tips for Success

📌To maximize returns, align your settings with the lead trader’s strategy. Key considerations include:

-

Single Investment and Maximum Follow Amount:

-

For Fixed Amount:Check the lead trader’s profile or communicate directly to confirm their layering strategy.

-

For Proportional Amount:Set to closely mirror their strategy and capture market opportunities.

-

Futures Trading Pairs: Match the lead trader’s selected pairs for consistency.

-

Leverage: Avoid high leverage (>20x) unless it matches the lead trader’s approach.

-

Risk Control and Advanced Settings: Beginners can rely on default settings unless specific adjustments are needed.

Risk Disclosure

Copy trading involves significant risks and may result in partial or complete loss of funds, making it unsuitable for all investors. Market fluctuations, strategy failures, or technical issues may adversely affect trading results. Past performance is not indicative of future outcomes. Please carefully evaluate your risk tolerance and consider seeking advice from a professional financial advisor. LBank bears no liability for losses incurred from copy trading.

Still Need Help?

If you have further questions or cannot resolve the issue, please visit the LBank official website (https://www.lbank.com) or contact our support team at [email protected]. We are committed to providing you with a secure and seamless trading experience!