The 183rd Ethereum All Core Developers' Meeting: EIP-2935 and EIP-3074 to be included in the Pectra upgrade.

*All on-chain data is dated as of 12:00 a.m. EST on Sunday, April 14th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Apr.7-13).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #CPI #PPI

Shares of BlackRock fell 2.9% despite the company’s better-than-expected earnings. PHOTO: ANGUS MORDANT/BLOOMBERG NEWS

1 Macro Market Overview

U.S. indexes post broad declines after leading banks report results. According to WSJ, inflation worries and geopolitical uncertainty weighed on markets, capping off a losing week for everything from bank shares to energy and real-estate stocks. The Dow Jones Industrial Average shed about 476 points, or 1.2%, on Friday. For the week, the blue-chip index lost about 921 points, or 2.4%, its biggest weekly loss since March 2023. The S&P 500 fell 1.5%, while the Nasdaq Composite pulled back 1.6%, both also finishing with weekly losses. A hotter-than-expected consumer-price report released Wednesday forced investors to contend with the prospect of sticky inflation, upending hopes that the Federal Reserve will begin cutting interest rates soon. Cooler wholesale inflation figures offered some reassurance to the stock market on Thursday, but that relief didn’t last long.

Consumer confidence slipped in mid-April from the end of March, according to the University of Michigan’s latest reading released Friday. Inflation expectations for the year ticked up. Some of the country’s largest banks on Friday reported better-than-expected first-quarter earnings, but issued muted forecasts, saying they are starting to feel the pinch of higher-for-longer interest rates. JPMorgan shares declined 6.5%, the stock’s worst day since June 2020, while Citigroup fell 1.7% and Wells Fargo ticked down 0.4%.

Last week, all three major U.S. stock indices experienced declines. The tech-heavy Nasdaq Composite Index fell by 0.4%. The Dow Jones Industrial Average dropped by 2.4%, while the S&P 500 fell by 1.6%. Web3-related stocks performed mixed, with COIN and MSRT rising by 2% and 3%, respectively, while MARA declined by over 12%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

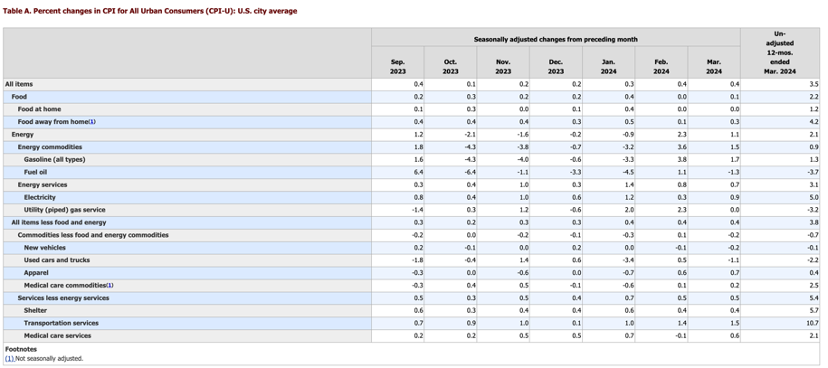

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in March on a seasonally adjusted basis, the same increase as in February, the U.S. Bureau of Labor Statistics reported last week. Over the last 12 months, the all items index increased 3.5 percent before seasonal adjustment.

(Source: U.S. BUREAU OF LABOR STATISTICS)

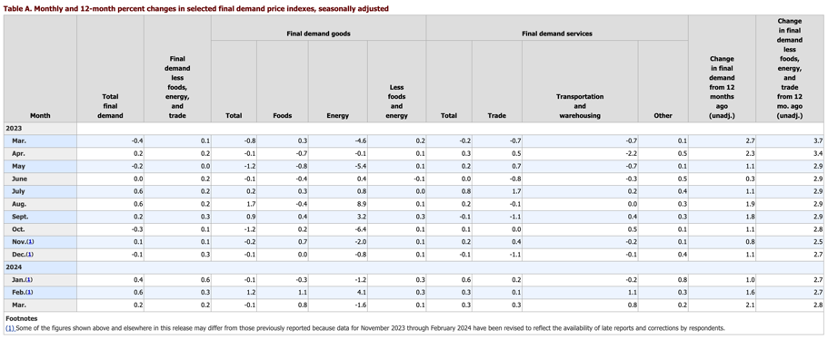

The Producer Price Index for final demand rose 0.2 percent in March, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices moved up 0.6 percent in February and 0.4 percent in January. (See table A.) On an unadjusted basis, the index for final demand increased 2.1 percent for the 12 months ended in March, the largest advance since rising 2.3 percent for the 12 months ended April 2023.

(Source: U.S. BUREAU OF LABOR STATISTICS)

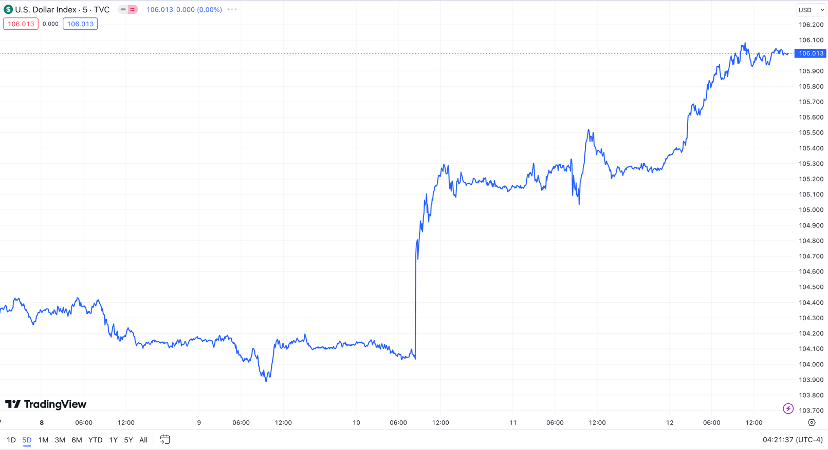

Last week, the U.S. Dollar Index (DXY) surged significantly after the release of new inflation data on Wednesday, exceeding expectations. By Friday's close, it had risen to 106.013, marking a 1.6% increase compared to the previous week's 104.286.

DXY (Source: TradingView)

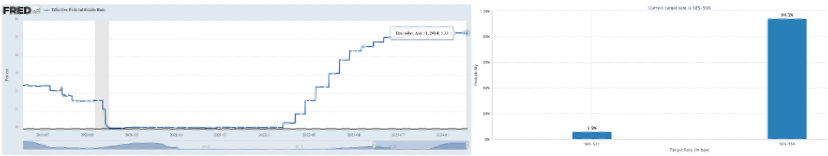

According to the latest data from the Chicago Mercantile Exchange (CME), approximately 6% of investors expect the Federal Open Market Committee (FOMC) meeting in May to witness the first interest rate cut of the year. This is slightly lower than the 7% reported in last week's data. A larger proportion of investors believe that the Federal Reserve will maintain interest rates unchanged.

Left: EFFR, Right: Target Rate Probabilities for May 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

The yield on the 10-year U.S. Treasury note—a benchmark for borrowing costs ranging from mortgages to corporate loans—rose to 4.499% this week, from 4.404% last week.

US10Y (Source: TradingView)

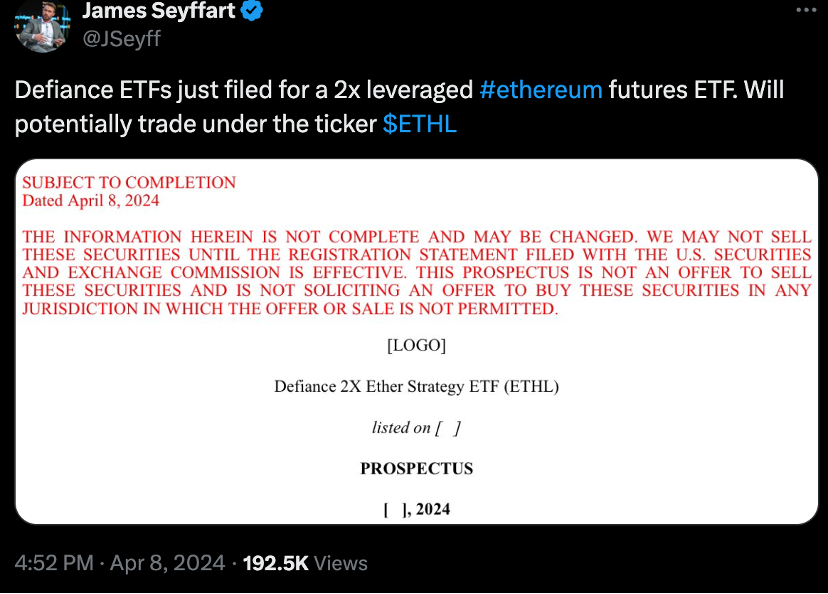

Defiance Investments plans to issue a 2x leveraged Ethereum futures exchange-traded fund (ETF). Bloomberg's ETF analyst, James Seyffart, tweeted that Defiance Investments has submitted an application to the U.S. Securities and Exchange Commission (SEC) to launch a 2x leveraged Ethereum futures exchange-traded fund (ETF), planned to be listed under the ticker $ETHL, with trading potentially starting as early as late June. Additionally, Defiance Investments has recently applied to launch a 2x leveraged ETF for shorting MicroStrategy ($MSTR) stock. According to the application documents, the daily return rate of this short ETF will be -2 times the MicroStrategy stock price return. Furthermore, ProShares has also submitted 2x and -2x Spot Ether ETFs, which utilize Ethereum futures contracts and add swap contracts to increase exposure to Ethereum twofold, without directly investing in Ethereum spot. Additionally, Grayscale has submitted an amended S-1/prospectus for their Grayscale Bitcoin Mini Trust, ticker $BTC, with no disclosed fee mentioned.

(Source: Twitter@JSeyff)

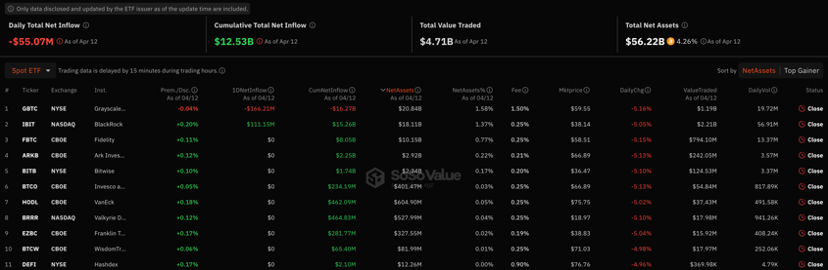

The total net inflow of Bitcoin spot ETFs currently stands at $12.5 billion, with an decrease of $80 million over the past seven days. Last week, Bitcoin spot ETFs experienced net outflows once again. On Monday of last week, Bitcoin spot ETFs saw net outflows exceeding $223 million, with net outflows of $20 million and $55 million on Tuesday and Friday, respectively. Overall, there were net outflows of over $80 million last week. The current total net assets stand at $56 billion, accounting for 4.3% of Bitcoin's market capitalization. As of Friday's close, Grayscale's GBTC saw total net outflows reaching $16.3 billion, while IBIT, managed by BlackRock, saw total net inflows of $15.3 billion.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

Last week, the cryptocurrency market experienced outflows, with the total market capitalization currently at $2.59 trillion, witnessing a net outflow of approximately $70 billion over the past seven days. Bitcoin and Ethereum underwent a new round of correction from last Monday, approaching lows after the release of unexpectedly strong inflation data on Friday, but then began to rebound over the weekend. As of the early hours of April 7th, the spot price of Bitcoin has risen to $69,360, a decrease of over 2% over the past 7 days. As the second-largest cryptocurrency, Ethereum's current price is $3,337, down over 6% over the past 7 days. Additionally, the market capitalizations of Bitcoin and Ethereum are approximately $1.4 trillion and $408 billion, respectively, accounting for approximately 54% and 16% of the total market capitalization. The gap between Ethereum and Bitcoin continues to widen.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

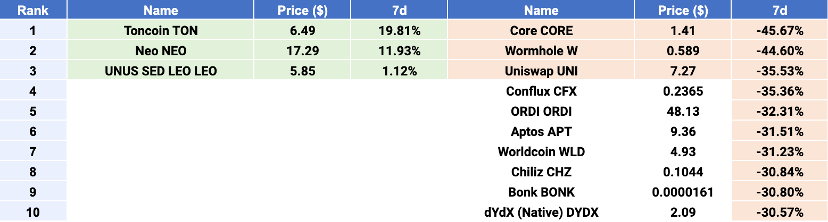

$TON, $NEO, and $LEO emerged as Top 3 gainers, while $CORE, $W, and $UNI were Top 3 losers. Last week, the overall market witnessed a trend of correction, with altcoins generally performing poorly. In the top 100 cryptocurrencies by market capitalization, $TON surged by over 19% weekly, securing the top position. $TON coin is the native cryptocurrency of the Telegram Open Network (TON), used for paying fees to execute smart contracts, use dApps, and participate in governance. The recent surge may be attributed to Telegram's recent incentive program, and $TON's association with Telegram-related products makes it more resilient to market adjustments. In second place, $NEO is the foundational cryptocurrency of the NEO network. The NEO network is a decentralized application development system, which saw a rise of over 11% in the past week. $LEO Token is a utility token created for use on Bitfinex and other trading platforms operated by its parent company, iFinex. As the third top gainer, it remained relatively stable over the past week.

On the other hand, most of the tokens in the top loser category experienced declines due to corrections following recent surges, such as some meme coins. The top loser, Corecoin ($CORE), is a cryptocurrency designed to be a decentralized, open-source digital currency. $CORE had seen continuous significant gains over the past two weeks, experiencing a correction of over 45% starting last week. $W is the native token of the Wormhole cross-chain protocol, which experienced a value plummet of over 50% within a week after its initial airdrop. $UNI token is the governance token of the Uniswap protocol, a decentralized trading protocol based on the Ethereum blockchain, providing a simple way to exchange tokens. Uniswap operates without a traditional order matching system, instead utilizing an Automated Market Maker (AMM) mechanism for price discovery and trading by swapping tokens in liquidity pools. The recent decline may be due to potential enforcement action by the U.S. Securities and Exchange Commission (SEC), accusing it of violating securities laws.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

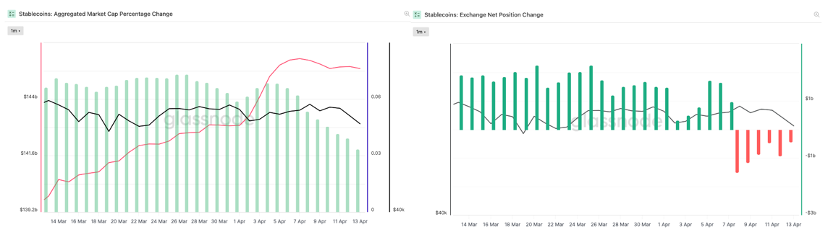

Last week, the total supply of stablecoins ceased to rise, remaining near $145 billion. Over the past seven days, the net position change in stablecoin supply has maintained a positive growth trend, but the net growth rate has declined. This indicates a reduction in investment enthusiasm in the cryptocurrency market recently. Additionally, observing the net position data of stablecoins on exchanges over the past week, it was noted that the net inflow significantly decreased and turned into a net outflow on Monday, indicating selling pressure on crypto assets. Overall, the data suggests that the cryptocurrency market is experiencing a correction phase.

Stablecoins Market Cap (Data: Glassnode)

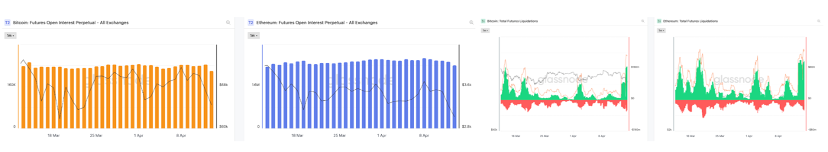

In the derivatives market, the open interest in perpetual contracts for Bitcoin and Ethereum remained largely unchanged over the past seven days. Both Bitcoin and Ethereum prices experienced relatively large fluctuations and corrections during the week, which coincided with the liquidation of a significant number of long positions, as indicated by the liquidation data. Particularly noticeable was the liquidation of a large number of long positions following the significant short-term decline over the weekend, leading to a noticeable decrease in future open interest perpetual. Overall, the data suggests that the cryptocurrency market is still undergoing a short-term correction.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

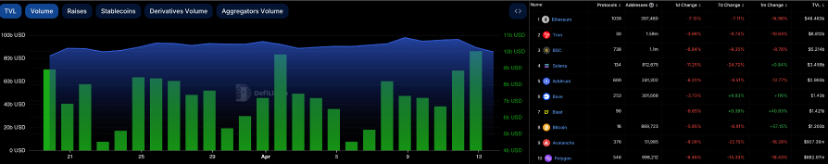

In the decentralized finance (DeFi) market, the Total Value Locked (TVL) started to decline last week, currently standing at $85.3 billion. Over the past seven days, the trading volume on decentralized exchanges (DEXs) has continued to increase, reaching $53.5 billion, a 9% increase from the previous week. The gap between decentralized exchanges (DEXs) and centralized exchanges (CEXs) in market share continues to shorten, with DEXs now accounting for 34% of the total CEX trading volume. The TVL of the top ten blockchain projects ranked by TVL has mostly experienced a downturn over the past week. Among them, only Base has seen the most significant growth, surging over 9% in the past seven days, while other chains experienced a large decline in TVL.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

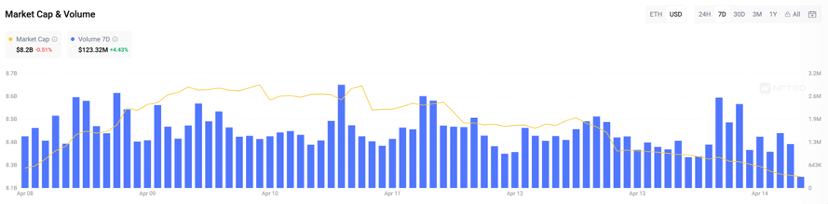

Last week, the market capitalization of Ethereum non-fungible tokens (NFTs) declined by 1% to $8.2 billion. Meanwhile, the total trading volume saw an increase of 4%, reaching $120 million. Among the leading blue-chip NFT collections on Ethereum, CryptoPunks saw a 1% decrease in floor price and a 13% decrease in average price. The second-ranked Bored Ape Yacht Club experienced an 8% decrease in floor price and a 1% decrease in average price. Pudgy Penguins witnessed a 10% decrease in floor prices and a 2% decrease in average prices, currently ranking third. The blue-chip index, measured in cryptocurrency, dropped from 3655 to 3515.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] The 183rd Ethereum All Core Developers' Meeting: EIP-2935 and EIP-3074 to be included in the Pectra upgrade. During the 183rd Ethereum All Core Developers' Meeting (ACDE), Ethereum core developer Tim Beiko summarized the outcomes on social media. It was confirmed that EIP-2935 and EIP-3074 will be included in the Pectra upgrade. EIP-7623 and EOF are under consideration for inclusion, with final decisions expected soon. Additionally, EIP-7667 and the Verkle migration are categorized under the Consideration for Inclusion (CFI) for the Osaka upgrade.

Furthermore, the tokenized fund management protocol Alvara Protocol announced that the Ethereum Foundation has officially recognized the ERC-7621 proposal and will merge it into the draft standard.

The ERC-7621 standard allows for the creation of tokenized funds supported by multiple assets on the blockchain. Anyone can deploy a Basket Token Set (BTS) containing multiple ERC-20 tokens, providing unprecedented flexibility for fund management.

(Source: Twitter@TimBeiko, Twitter@AlvaraProtocol)

[Layer2] Metis will activate the second phase of its Decentralized Sorter upgrade. On April 8th, Metis announced that approximately 7 days after block number 16,500,000, a hard fork will be activated to complete the second phase of the Decentralized Sorter upgrade. In the first phase, Metis successfully added multiple nodes to the sorter pool and introduced sorter rotation, significantly enhancing the network's resistance to censorship and its activity.

The second phase of this upgrade will introduce features such as multiple transactions within a single block, transaction pools, and sorter rewards. With this, Metis becomes the first Ethereum Layer 2 scaling solution to achieve decentralization of the sorter.

(Source: metis.io)

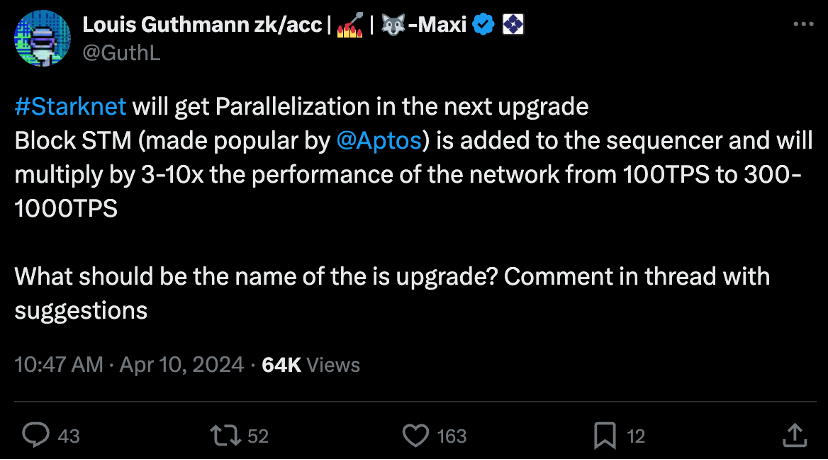

[Layer2] StarkWare's product lead: Starknet plans to introduce parallelism in the next upgrade, with TPS expected to increase 3-10 times. On April 10th, Louis Guthmann, the Product and Market Strategy Lead at StarkWare, announced that Starknet plans to introduce parallelization functionality in the next upgrade. By integrating the Block-STM (a parallel execution engine adopted by Aptos) into the sequencer, network performance is expected to increase from 100 TPS to 300-1000 TPS, indicating a potential 3-10x increase.

(Source: Twitter@GuthL)

[Layer2] a16z Crypto releases Jolt 'zkVM' to help scale chains with ZK proofs. A16z Crypto, the cryptocurrency-focused division of venture firm Andreessen Horowitz, has released Jolt, a zero-knowledge solution that it calls a “zkVM,” aiming to accelerate and streamline blockchain scaling operations. At the heart of Jolt is the integration of a type of zero-knowledge proof called SNARKs (Succinct Non-Interactive Arguments of Knowledge), which facilitate scalable ZK-rollups in the Layer 2 space.

Jolt is described as a novel method to build virtual machines proven via SNARKs. This could allow developers to create fast SNARK-based Layer 2 solutions, according to the firm. The team says that Jolt is "up to 2X faster" than the current zkVMs. “But beyond just the improvement in speed, because Jolt is based on a new design paradigm, it is easier for developers to extend, and is also much easier to audit, leading to greater security,” the firm said.

(Source: The Block)

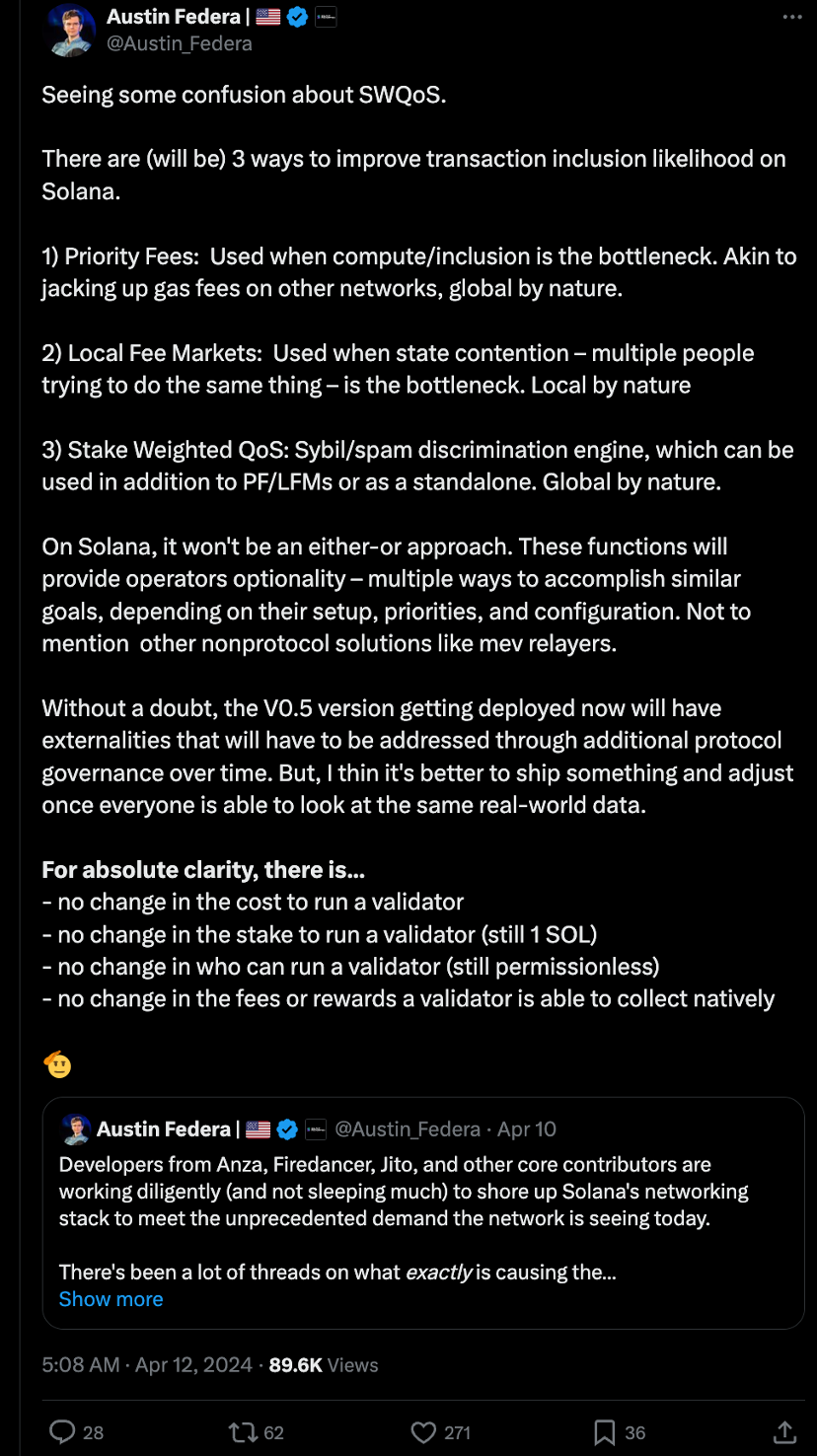

[Solana] Solana is set to introduce three major mechanisms to boost transaction priority and enhance network performance. Solana Foundation's Head of Strategy, Austin Federa, announced that Solana plans to alleviate network congestion by introducing three new mechanisms to prioritize transactions.

These mechanisms include: 1) Priority Fees: Similar to increasing Gas fees on other blockchain networks, Priority Fees are used to prioritize resource allocation and transaction packaging when bottlenecks occur, with global applicability. 2) Local Fee Markets: Used to address bottlenecks that arise when multiple users compete for the same state resources, Local Fee Markets operate on a local scale. 3) Stake Weighted Quality of Service (QoS): This mechanism serves as a means to identify and deter spam transactions and Sybil attacks. It can be used in conjunction with the first two mechanisms or independently, with global applicability.

(Source: Twitter@Austin_Federa)

[Interoperability] Chainlink launches Transporter bridging app for moving crypto cross-chain. According to The Block, Chainlink has launched the Transporter, a cross-chain token and message-passing application based on CCIP. The "Transporter" application, built in collaboration with the Chainlink Foundation and developer Chainlink Labs, aims to provide a user-friendly interface for submitting and monitoring cross-chain transactions on CCIP.

Initially, Transporter supports token transfers across multiple blockchain networks, including Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Optimism, and Polygon. It does not charge any additional fees apart from existing transaction costs and CCIP service provider fees.

(Source: The Block)

[Interoperability] Uniswap Labs and Across propose standard for cross-chain intents. On April 11th, Uniswap Labs and Across collaborated to introduce a new standard for cross-chain intent, establishing a unified framework for specifying the intent of cross-chain operations. This system enables interoperability among different intent systems through a unified filler network.

The aim of this standard is to enhance the efficiency and user experience of applications, fillers, and end-users, making the cross-chain ecosystem more interconnected and decentralized. The standard has been submitted for ERC review and open questions have been raised on the Ethereum Magicians forum to solicit feedback from the community.

(Source: blog.uniswap)

4 Key Fundraising Data

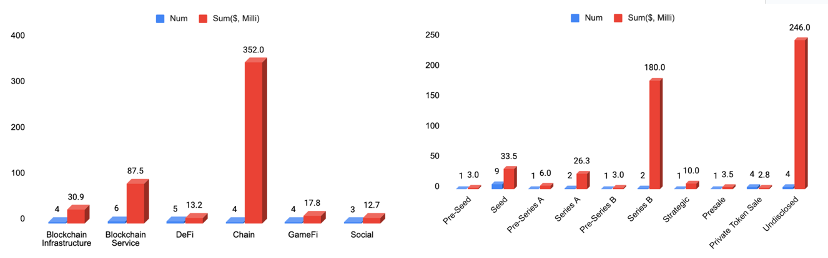

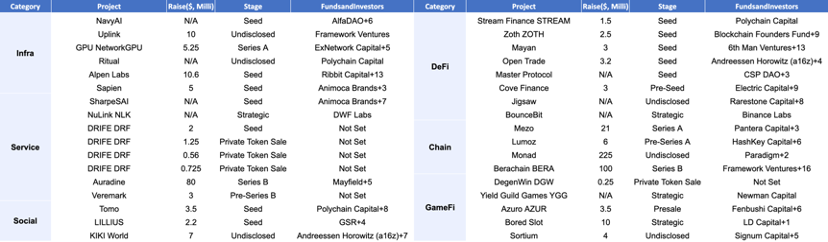

Last week witnessed a total of 34 financing events, raising a substantial amount of over $514 million*. Compared to the previous week, financing activities remained active both in terms of transaction volume and total funding amount. The service sector led with the highest number of financing events, totaling 6. The chain sector recorded the highest total funding amount, raising a total of $352 million, accounting for 68% of the overall financing. The largest financing event was led by Monad, successfully raising $225 million. Monad is a decentralized Layer1 EVM-compatible smart contract platform. More detailed information is provided below.

* 8 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

Layer 1 blockchain Monad Labs has completed a $225 million financing round, led by Paradigm, with participation from IOSG Ventures, SevenX Ventures, Electric Capital, and Greenoaks, among others. This marks the largest cryptocurrency sector financing so far in 2024. Monad's founder, Keone Hon, stated that Monad's innovation comes from rebuilding the Ethereum blockchain from scratch—maintaining the ability to execute smart contracts while achieving faster speeds, higher capacity, and lower costs for transactions. Unlike many new blockchains, Monad will fully support the Ethereum Virtual Machine (EVM).

According to BlockBeats, on March 12th, Fortune magazine reported, citing sources familiar with the matter, that Paradigm was negotiating to lead a round of financing for Monad Labs exceeding $200 million. The success of Monad Labs among investors also signifies the continued influence of Jump Crypto. Two former Jump employees founded Monad in 2022, with the third founder coming from a non-cryptocurrency background.

- Official Link: https://www.monad.xyz/

Bitcoin layer 2 network Mezo has completed a $21 million Series A funding round, led by Pantera Capital, with participation from Multicoin, Hack VC, Draper Associates, and others. Mezo, launched by the startup studio Thesis in 2014, aims to put idle Bitcoin assets to use through a loyalty program called "HODL Proof." The longer a contributor holds their Bitcoin, the higher their "HODL score multiplier."

Mezo aims to enhance the functionality of the Bitcoin infrastructure by facilitating cheaper and faster transactions without deviating from the network's core principles.

- Official Link: https://mezo.org/

Auradine, a leading provider of web infrastructure solutions, including blockchain, security, and AI, today announced the closing of its Series B funding round, which raised over $80 million. The round welcomed several new investors, including StepStone Group, Top Tier Capital Partners, MVP Ventures, and Maverick Capital, along with leading strategic and angel investors. Existing investors Celesta Capital, Mayfield Fund, and Marathon Digital also participated in this round. This Series B funding follows Auradine’s $81 million Series A, led by Celesta Capital and Mayfield in 2022.

Auradine started with a mission to disrupt the blockchain market with its revolutionary Teraflux™ family of Bitcoin ASIC Miners. Auradine has delivered leading-edge ASICs and solutions with the world's fastest miners, setting new performance and energy efficiency benchmarks. The Teraflux products also feature Auradine’s patent-pending EnergyTune™ and AutoTune™ innovations, which are critical to addressing the demand response and grid stability requirements of the energy infrastructure.

- Official Link: https://auradine.com/

New blockchain Berachain has announced the completion of a $100 million Series B funding round, approximately 45% higher than previously reported. The round was led by Abu Dhabi-based Brevan Howard Digital and Framework Ventures, with participation from Polychain Capital, Hack VC, and Tribe Capital, among others. Investors supported Berachain through Simple Agreement for Future Tokens (SAFT). Last month, Bloomberg reported that Berachain had raised over $69 million at a valuation of at least $1 billion. Berachain declined to provide the latest valuation.

Smokey The Bera, co-founder of Berachain, stated, "We view this funding round as significant validation of our approach to building a blockchain, which is based on real user and developer feedback, and creating value for those who truly contribute to the growth of the network." Berachain plans to use this funding to expand its operations to Hong Kong, Singapore, Southeast Asia, Latin America, and Africa.

- Official Link: https://www.berachain.com/

Popular Glossaries

Related Readings

No data |