Bitcoin is having a rough start to 2026. After hitting an all-time high of $126,000 in October 2025, the price has dropped to the $60,000–$70,000 range, a fall of roughly 52%. That sounds alarming, but if you zoom out, the picture looks a lot less surprising.

This Has Happened with Bitcoin Before

According to research firm Kaiko, this correction fits squarely within Bitcoin's historical 4-year halving cycle. Every previous cycle has produced a 50–80% drawdown after the peak.

The 2024 halving happened in April of that year, and Bitcoin topped out about 12–18 months later, exactly in line with past cycles.

Image via Kaiko

That said, not everyone agrees. Some analysts argue the 4-year cycle no longer applies, pointing to institutional money, ETF adoption, and global liquidity as bigger price drivers now.

The debate is worth paying attention to, but the data from this cycle hasn't contradicted history yet.

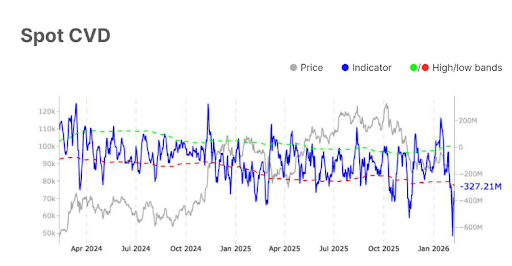

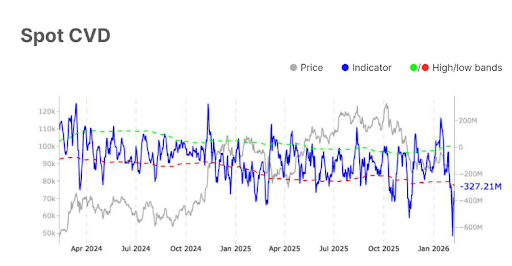

What the Numbers Are Saying Right Now

On-chain data from Glassnode paints a detailed picture of where the market stands. Around 45% of Bitcoin's circulating supply is currently at a loss, meaning those holders bought at higher prices.

Futures open interest has dropped sharply, and funding rates have cooled close to zero, both signs that leveraged traders are stepping back.

Spot CVD—a measure of buying versus selling pressure—remains negative, meaning sellers are still in control on exchanges.

Image via Glassnode

ETF flows tell a similar story. US spot Bitcoin ETFs saw over $1 billion in weekly outflows during the worst of the sell-off. That number has since pulled back to around $419 million, which suggests the pace of institutional exits is slowing.

ETF trading volume, on the other hand, surged 67%—a sign that engagement is high even if sentiment is cautious.

Taken together, these signals point to a market that's under pressure but potentially nearing the exhaustion phase of a correction, not the beginning of one.

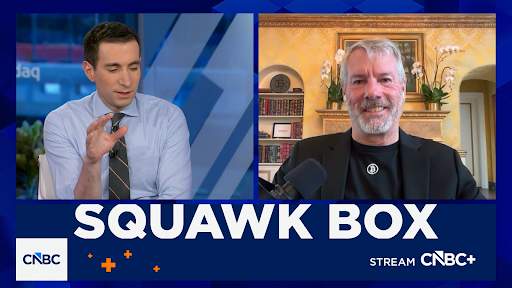

What Strategy Is Doing With All This

While many investors are on the sidelines, Michael Saylor's company, Strategy, is moving in the opposite direction.

The firm recently added 1,142 BTC for approximately $90 million, pushing its total Bitcoin holdings to 714,644 BTC, over 3.4% of the total supply that will ever exist.

Speaking on CNBC, Saylor stated he expects Bitcoin to deliver two to three times the returns of the S&P 500 over the next four to eight years, and that Strategy has no plans to sell regardless of short-term price moves.

Image via CNBC

What This Means for You

Historically, periods like this have marked accumulation windows before the next upward move. But bear markets rarely bottom cleanly.

Kaiko notes that past cycles have taken six to twelve months to fully bottom, with multiple failed recoveries along the way. That means patience matters more than timing right now.

If you're already holding Bitcoin, this data suggests panic selling at current levels is historically the wrong call. If you're watching from the sidelines, dollar-cost averaging over time has been one of the more reliable strategies during extended corrections.

Where Things Stand

Bitcoin is currently bouncing between $60,000 and $70,000, with early signs of stabilization forming. Whether this is the bottom or just a pause remains unclear. What is clear is that the broader structure of this cycle hasn't broken down.

The next few months will be the real test; either history repeats and accumulation builds toward the next leg up, or new macro forces write a different ending.