剛剛

親愛的 LBank 用戶

我們的線上客服系統目前遇到連線故障。我們正積極修復這一問題,但暫時無法提供確切的恢復時間。對於由此給您帶來的不便,我們深表歉意。

如需幫助,您可以透過電子郵件聯繫我們,我們將盡快回覆。

感謝您的理解與耐心。

LBank 客服團隊

Reading cryptocurrency charts is one of the most valuable skills you can develop as a trader. While the array of lines, candles, and indicators may seem overwhelming at first, understanding how to interpret these visual representations of price action can significantly enhance your trading decisions.

This comprehensive guide will transform you from a chart novice into a confident analyst capable of identifying trends, patterns, and potential trading opportunities.

Cryptocurrency charts are visual representations of price movements over time. They display how the price of a cryptocurrency has changed across different time periods, from one-minute intervals to monthly timeframes. These charts are the primary tool traders use to analyse market behaviour and make informed trading decisions.

The most common type of chart used in cryptocurrency trading is the candlestick chart, which originated in 18th-century Japan for rice trading. Each candlestick represents price action during a specific time period and provides four critical pieces of information: the opening price, closing price, highest price, and lowest price during that period.

Understanding these charts allows you to see patterns that repeat throughout market history, identify support and resistance levels where price tends to bounce or reverse, recognise trends and their strength, spot potential entry and exit points for trades, and gauge market sentiment and momentum.

Image source: TradingView

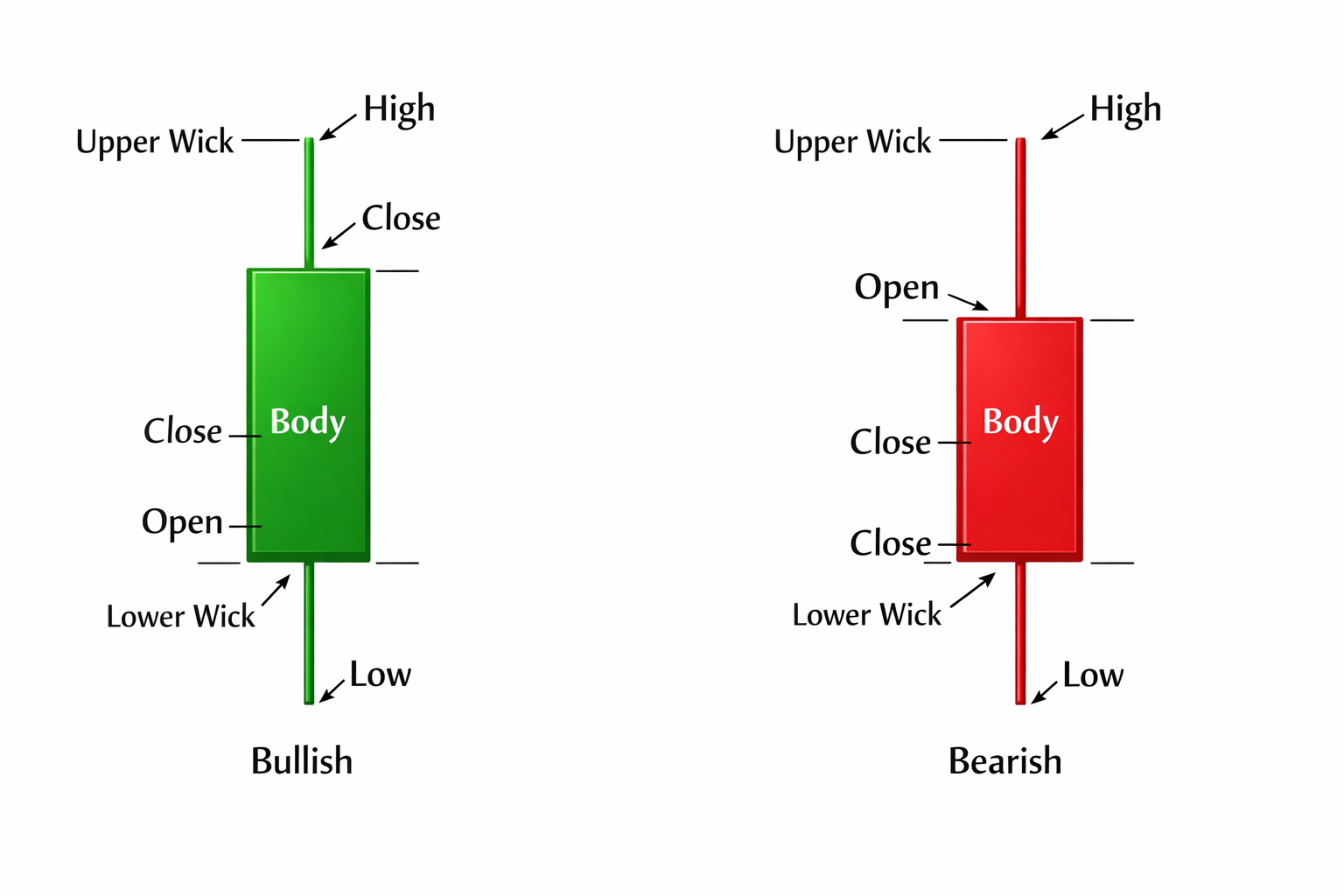

Before diving into patterns and analysis, you need to understand what each candlestick represents. A candlestick consists of a body and wicks, also called shadows.

The body is the thick rectangular part of the candlestick. It represents the range between the opening and closing prices. A green or white body indicates the price closed higher than it opened, signalling bullish price action. A red or black body indicates the price closed lower than it opened, signalling bearish price action.

The wicks are the thin lines extending above and below the body. The upper wick shows the highest price reached during the time period, while the lower wick shows the lowest price reached during the time period. Long wicks indicate that the price moved significantly in that direction but was rejected, often signalling important support or resistance levels.

The length and proportions of these components tell you a story about what happened during that trading period. A small body with long wicks suggests indecision and volatility. A long body with small wicks suggests strong directional conviction. No upper wick suggests strong buying pressure that pushed the price to the high. No lower wick suggests strong selling pressure that pushed the price to the low.

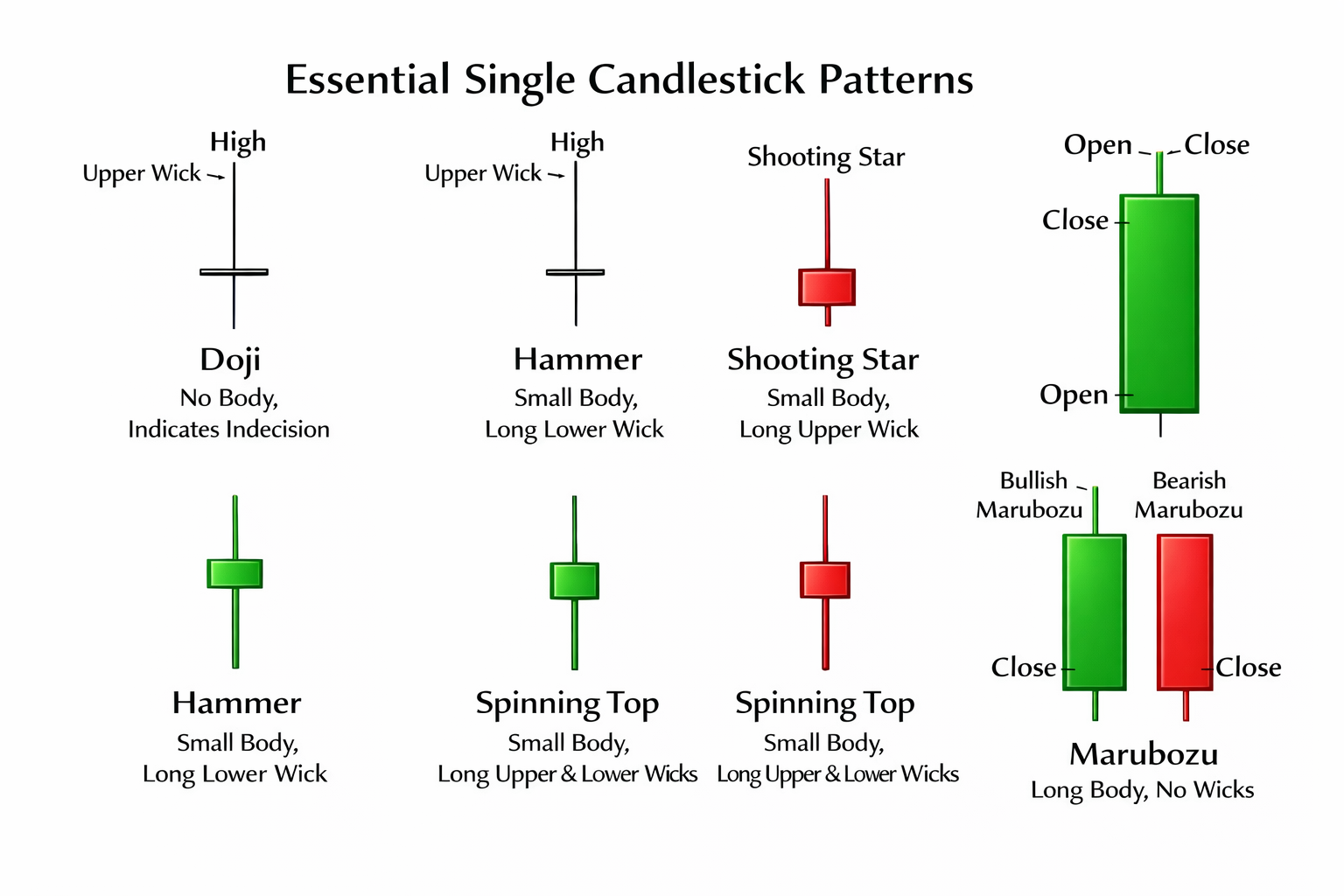

Individual candlesticks can provide valuable information about market sentiment and potential reversals. Understanding these patterns is fundamental to reading charts effectively.

The Doji is a candlestick with virtually no body, meaning the opening and closing prices are nearly identical. The upper and lower wicks can be of varying lengths. A Doji indicates indecision in the market—buyers and sellers are in equilibrium. When a Doji appears after a strong trend, it often signals a potential reversal as the trend is losing momentum.

The Hammer appears at the bottom of downtrends and signals a potential bullish reversal. It has a small body at the top of the candlestick with a long lower wick that's at least twice the length of the body. The long lower wick shows that sellers pushed the price significantly lower, but buyers regained control and pushed it back up, closing near the high. This rejection of lower prices suggests buying pressure is building.

The Shooting Star is the opposite of a hammer and appears at the top of uptrends. It has a small body at the bottom with a long upper wick. This pattern shows that buyers pushed the price higher, but sellers took control and drove it back down, closing near the low. It signals that the upward momentum may be exhausting, and a reversal could be imminent.

The Spinning Top has a small body with upper and lower wicks of similar length. This candlestick indicates indecision and uncertainty in the market. Neither buyers nor sellers could gain control. When spinning tops appear after a strong trend, they often precede a reversal or consolidation period.

The Marubozu is a candlestick with a long body and virtually no wicks. A bullish Marubozu opens at the low and closes at the high, showing strong buying pressure throughout the entire period. A bearish Marubozu opens at the high and closes at the low, showing relentless selling pressure. These candlesticks indicate strong conviction and often signal continuation of the current trend.

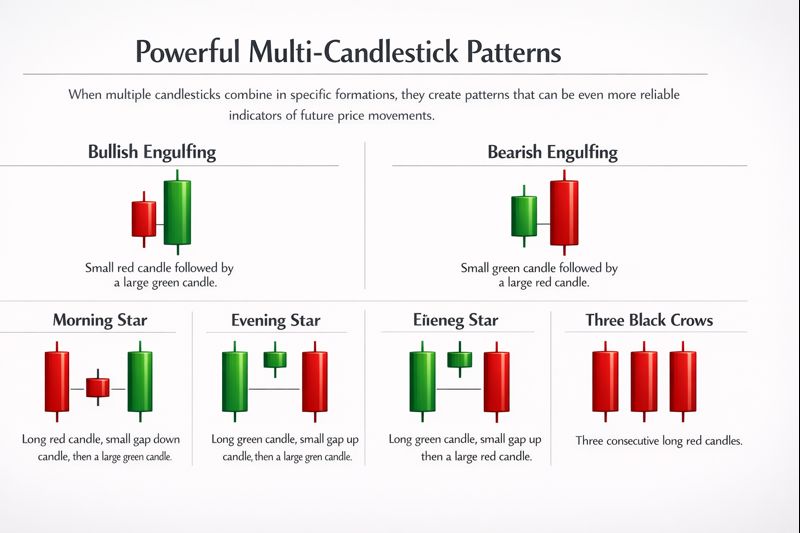

When multiple candlesticks combine in specific formations, they create patterns that can be even more reliable indicators of future price movements.

The Engulfing Pattern consists of two candlesticks. A bullish engulfing pattern occurs when a small red candle is followed by a larger green candle that completely engulfs the previous candle's body. This shows that buyers have overwhelmed sellers and signals a potential upward reversal. A bearish engulfing pattern is the opposite—a small green candle followed by a larger red candle that engulfs it, signalling potential downward movement.

The Morning Star is a three-candlestick pattern that signals a bullish reversal at the bottom of a downtrend. It consists of a long red candle, followed by a small-bodied candle that gaps down, followed by a long green candle that closes well into the first candle's body. This pattern shows the transition from selling pressure to buying pressure.

The Evening Star is the bearish counterpart to the morning star and appears at the top of uptrends. It consists of a long green candle, a small-bodied candle that gaps up, and then a long red candle that closes well into the first candle's body. This signals that buying momentum is exhausting and sellers are taking control.

The Three White Soldiers pattern consists of three consecutive long green candles with small wicks, each opening within the previous candle's body and closing near its high. This pattern shows strong and sustained buying pressure and typically signals the continuation or beginning of an uptrend.

The Three Black Crows is the bearish equivalent—three consecutive long red candles, each opening within the previous candle's body and closing near its low. This indicates strong selling pressure and often signals the continuation or beginning of a downtrend.

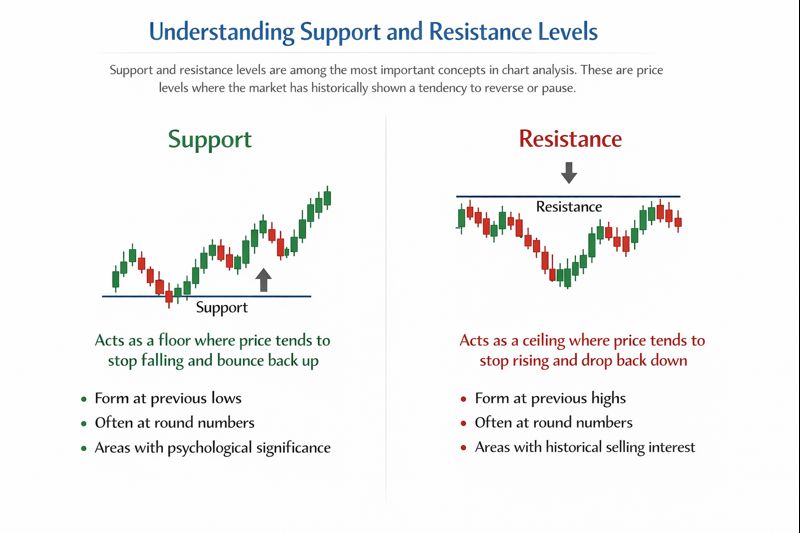

Support and resistance levels are among the most important concepts in chart analysis. These are price levels where the market has historically shown a tendency to reverse or pause.

Support is a price level where buying pressure is strong enough to prevent the price from falling further. Think of it as a floor that catches the price as it falls. When the price approaches a support level, buyers tend to step in, creating demand that pushes the price back up. Support levels form at previous lows, round numbers that have psychological significance, and areas where buyers have historically shown interest.

Resistance is the opposite—a price level where selling pressure prevents the price from rising further. It acts as a ceiling that stops upward price movement. When price approaches resistance, sellers tend to step in, creating supply that pushes the price back down. Resistance levels form at previous highs, round numbers, and areas where sellers have historically appeared.

The more times a support or resistance level is tested and holds, the more significant it becomes. However, when these levels are definitively broken, they often switch roles—a broken resistance level becomes the new support, and a broken support level becomes the new resistance. These role reversals provide excellent trading opportunities.

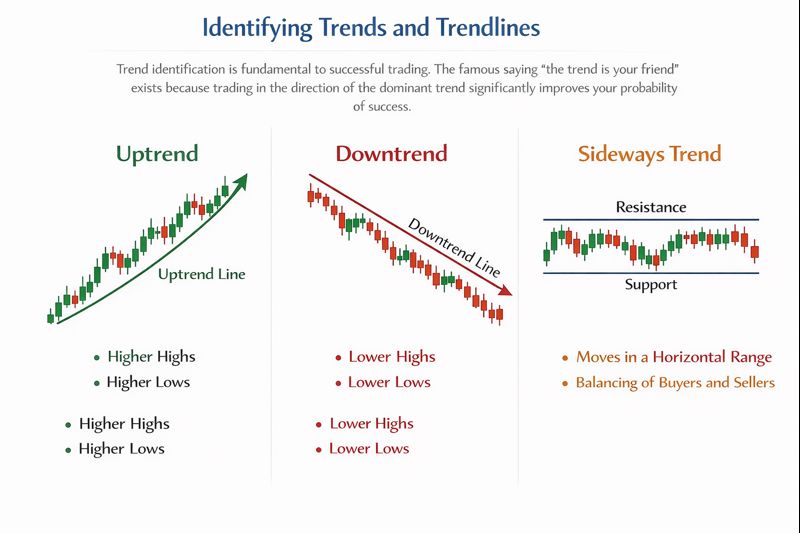

Trend identification is fundamental to successful trading. The famous saying "the trend is your friend" exists because trading in the direction of the dominant trend significantly improves your probability of success.

An uptrend is characterised by a series of higher highs and higher lows. Each peak is higher than the previous peak, and each trough is higher than the previous trough. This pattern shows that buyers are in control and willing to pay increasingly higher prices.

A downtrend consists of lower highs and lower lows. Each peak is lower than the previous peak, and each trough is lower than the previous trough. This shows that sellers are in control and buyers are only willing to pay decreasing prices.

A sideways trend or consolidation occurs when price moves within a horizontal range without making significantly higher highs or lower lows. This represents a balance between buyers and sellers and often precedes a strong directional move once the balance is broken.

Trendlines are diagonal lines drawn on charts to visualise trends. In an uptrend, you draw a trendline connecting the rising lows. In a downtrend, you draw a trendline connecting the declining highs. Valid trendlines should connect at least three points—two points make a line, but three points confirm a trend. When price approaches a trendline, it often acts as support in an uptrend or resistance in a downtrend. A break of the trendline can signal a potential trend reversal.

One of the most critical decisions in chart analysis is choosing the right timeframe to analyse. Different timeframes reveal different aspects of market behaviour, and professional traders often analyse multiple timeframes simultaneously.

Short-term timeframes, including one-minute, five-minute, and fifteen-minute charts, are used by day traders and scalpers who make multiple trades within a single day. These timeframes show short-term price fluctuations and are sensitive to news and market volatility. The signals on these charts are less reliable individually, but useful for precise entry and exit timing.

Medium-term timeframes like one-hour, four-hour, and daily charts are popular among swing traders who hold positions for days to weeks. These timeframes filter out much of the market noise while still showing meaningful price movements. Daily charts are particularly important as they reflect the sentiment of all market participants over a full trading day.

Long-term timeframes, including weekly and monthly charts, are used by position traders and investors who hold for months or years. These charts show the big picture and major market cycles. Patterns and levels on these timeframes are generally more significant and reliable than those on shorter timeframes.

The concept of multiple timeframe analysis is crucial for professional trading. This involves analysing the same cryptocurrency across different timeframes to get a complete picture. A common approach is to use a longer timeframe to identify the overall trend and major support and resistance levels, a medium timeframe to identify potential entry setups, and a shorter timeframe to fine-tune entry and exit points.

Volume represents the total amount of cryptocurrency traded during a specific time period. It's displayed as vertical bars at the bottom of most charts and provides crucial confirmation for price movements and patterns.

High volume during a price movement suggests strong conviction behind that move. When price breaks through resistance on high volume, it confirms that many traders believe in the breakout, making it more likely to continue. When price breaks through support on high volume, it confirms strong selling pressure and increases the probability of further decline.

Low volume during a price movement suggests weak conviction and increases the probability that the move will reverse. Breakouts on low volume are often false breakouts that quickly reverse. Price movements on declining volume suggest the trend is losing momentum.

Volume should increase in the direction of the trend. In an uptrend, up days should have higher volume than down days. In a downtrend, down days should have higher volume than up days. When volume starts increasing against the trend direction, it can signal an impending reversal.

Volume spikes often occur at important turning points in the market. Extremely high volume can indicate capitulation in a downtrend or euphoria at a market top. These exhaustion points often mark excellent trading opportunities.

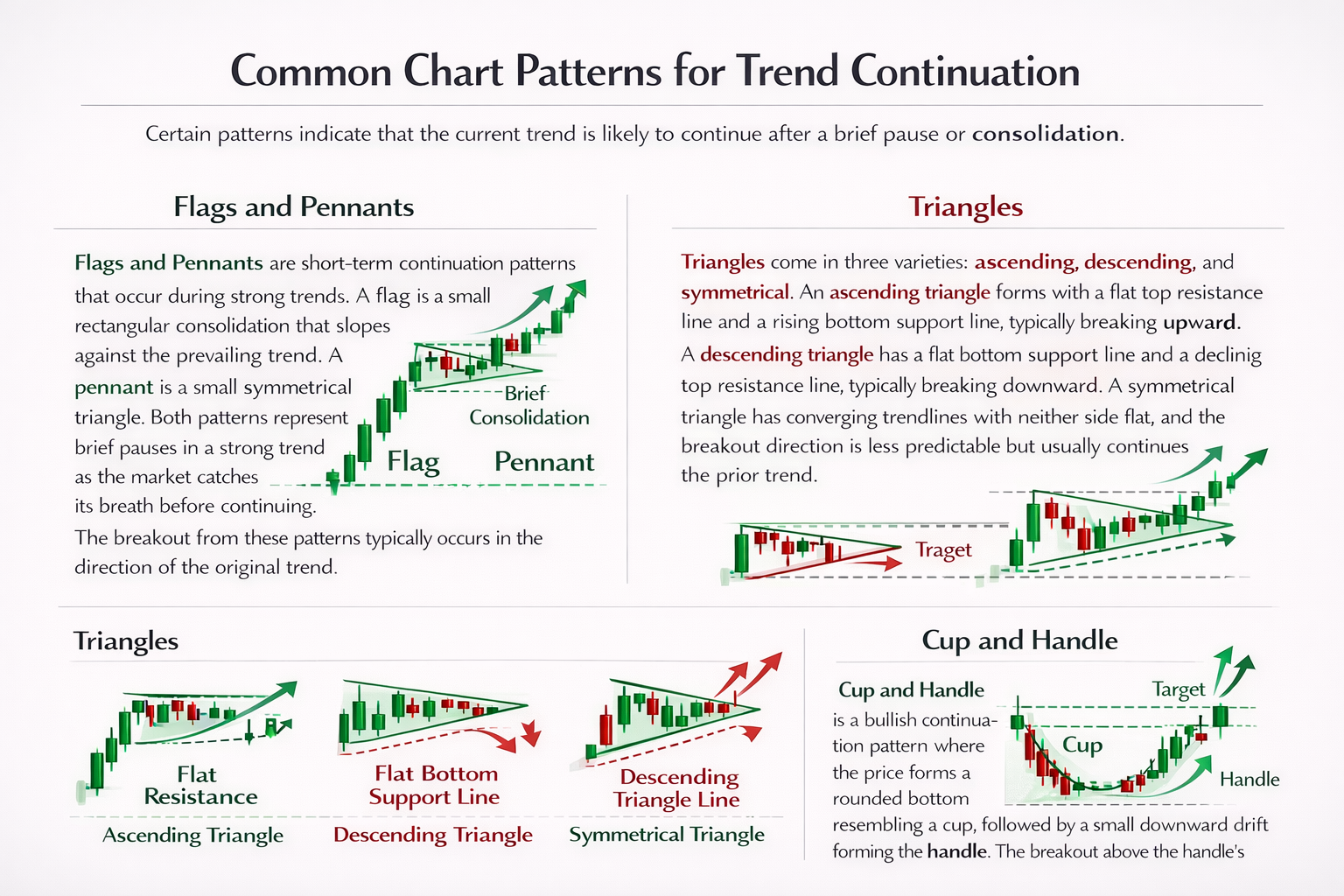

Certain patterns indicate that the current trend is likely to continue after a brief pause or consolidation.

Flags and Pennants are short-term continuation patterns that occur during strong trends. A flag is a small rectangular consolidation that slopes against the prevailing trend. A pennant is a small symmetrical triangle. Both patterns represent brief pauses in a strong trend as the market catches its breath before continuing. The breakout from these patterns typically occurs in the direction of the original trend.

Triangles come in three varieties: ascending, descending, and symmetrical. An ascending triangle forms with a flat top resistance line and a rising bottom support line, typically breaking upward. A descending triangle has a flat bottom support line and a declining top resistance line, typically breaking downward. A symmetrical triangle has converging trendlines with neither side flat, and the breakout direction is less predictable but usually continues the prior trend.

Cup and Handle is a bullish continuation pattern where the price forms a rounded bottom resembling a cup, followed by a small downward drift forming the handle. The breakout above the handle's resistance often leads to a strong upward move equal to the depth of the cup.

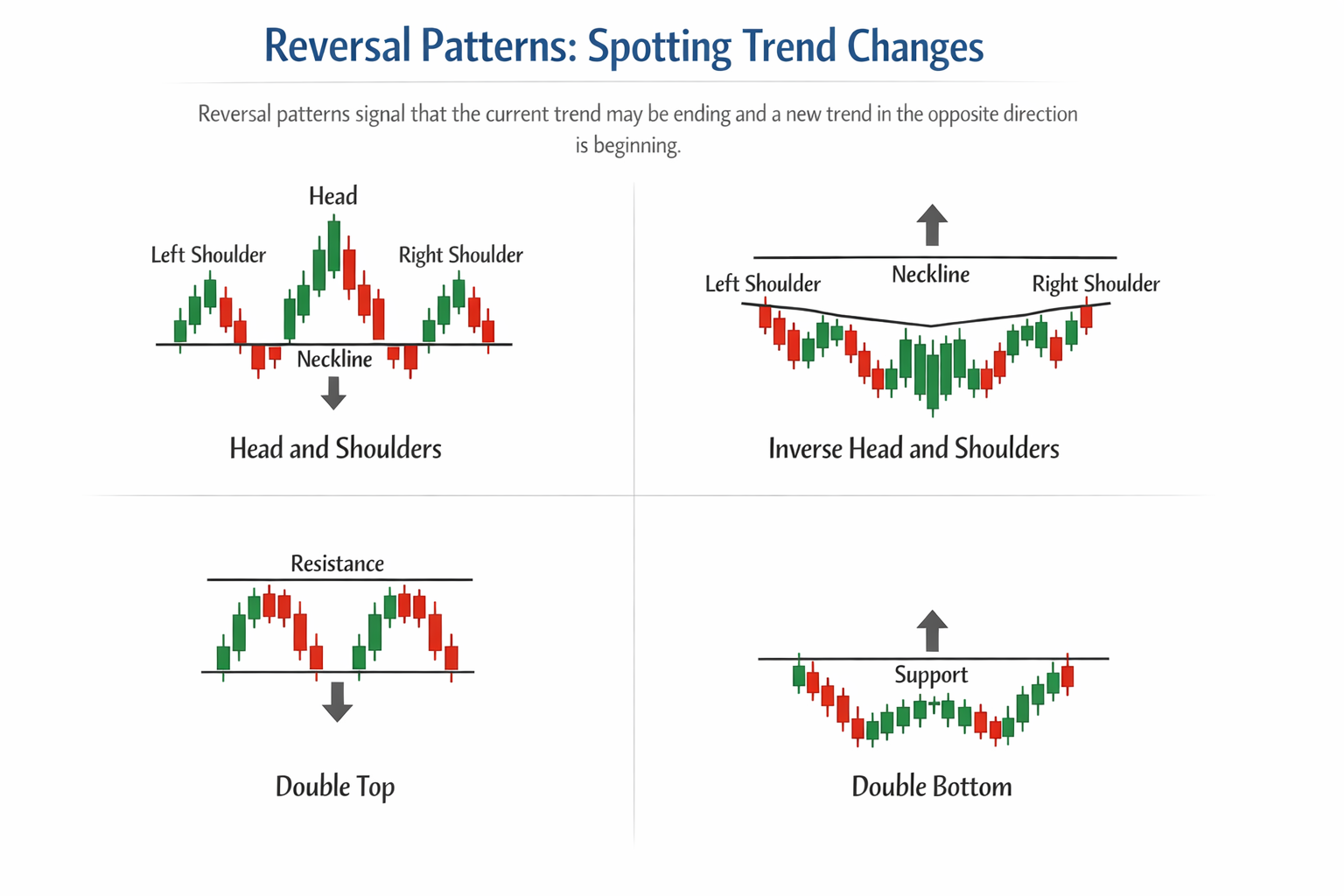

Reversal patterns signal that the current trend may be ending and a new trend in the opposite direction is beginning.

Head and Shoulders is one of the most reliable reversal patterns. It consists of three peaks: a higher peak in the middle flanked by two lower peaks. The pattern forms at the top of an uptrend and signals a potential reversal to a downtrend. The neckline connecting the two troughs between the peaks serves as the trigger point—when price breaks below the neckline, the reversal is confirmed.

Inverse Head and Shoulders is the bullish version that forms at the bottom of downtrends, signalling a potential reversal to an uptrend.

Double Top and Double Bottom patterns occur when price tests the same level twice and fails to break through. A double top forms at resistance levels where price reaches a high, pulls back, rallies to test that high again, then fails and reverses downward. A double bottom is the opposite pattern at support levels, signalling an upward reversal.

Reading charts like a professional means combining all these elements into a coherent analysis framework. Here's a systematic approach to analysing any cryptocurrency chart.

Start with the big picture by examining monthly and weekly charts to understand the long-term trend and identify major support and resistance levels. This context is crucial for understanding where the market is in its broader cycle.

Then zoom into your trading timeframe and identify the current trend direction, draw relevant trendlines, mark significant support and resistance levels, and look for chart patterns that are forming or completing.

Analyse candlestick patterns by looking for reversal or continuation patterns at key levels and confirming these patterns with volume analysis.

Check volume confirmation to ensure that price movements align with volume behaviour, and that volume supports the direction you're considering trading.

Look for confluence, which means multiple factors pointing to the same conclusion. The best trading opportunities occur when several indicators align, such as a candlestick reversal pattern at a major support level with high volume confirmation and a trendline bounce.

Always consider the broader market context. Even the best chart patterns can fail if they conflict with the overall market environment or major news events.

Even experienced traders make mistakes in chart analysis. Being aware of these pitfalls will help you avoid them.

Becoming proficient at reading crypto charts requires consistent practice and ongoing education. Study historical charts and identify patterns in hindsight. Understanding how patterns played out in the past will help you recognise them in real-time.

Keep a trading journal documenting the charts and patterns you traded, including screenshots and notes about what you saw and why you made your decision. Review these regularly to learn from both successes and failures.

Use paper trading or demo accounts to practice identifying and trading patterns without risking real money. This allows you to test your chart-reading skills and develop confidence.

Stay updated on new techniques and indicators as the field of technical analysis continues to evolve. Follow experienced traders, read books, and participate in trading communities.

Learning to read crypto charts like a professional is a journey that combines technical knowledge with practical experience. Understanding candlestick patterns, support and resistance, trends, volume, and chart patterns provides you with a powerful toolkit for analysing cryptocurrency markets on LBank's platform.

Remember that chart analysis is both an art and a science. While the patterns and principles are objective, their interpretation requires judgment, experience, and context. No single pattern or indicator is foolproof, and the best traders combine multiple forms of analysis to make informed decisions.

Start with the basics, master individual candlestick patterns and simple support and resistance concepts before progressing to complex patterns and multi-timeframe analysis. With patience, practice, and disciplined application of these principles, you'll develop the ability to read charts with confidence and make more informed trading decisions in the dynamic world of cryptocurrency trading.

剛剛

親愛的 LBank 用戶

我們的線上客服系統目前遇到連線故障。我們正積極修復這一問題,但暫時無法提供確切的恢復時間。對於由此給您帶來的不便,我們深表歉意。

如需幫助,您可以透過電子郵件聯繫我們,我們將盡快回覆。

感謝您的理解與耐心。

LBank 客服團隊