The Stablecoin Payment Revolution

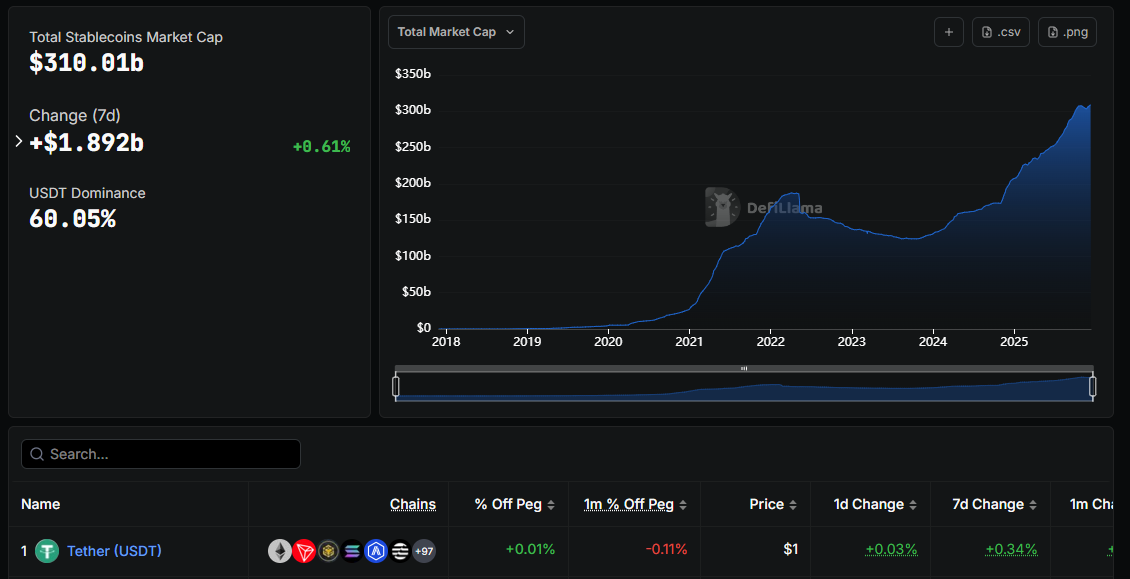

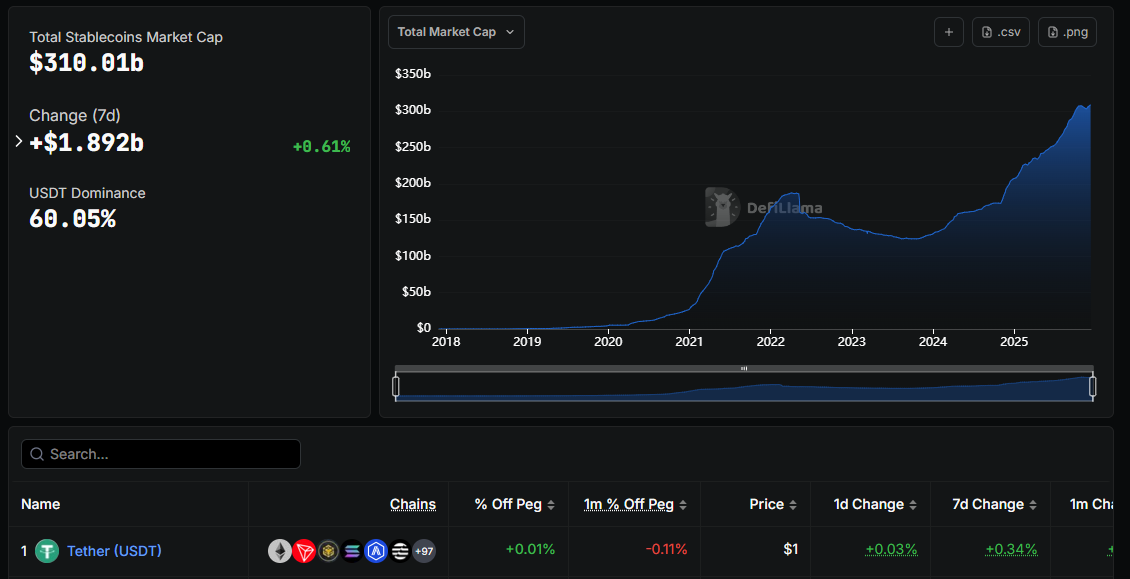

We hear about "this chain" and "that chain" daily, but the market is largely missing the point. The stablecoin market has exploded to over $300 billion in 2025, growing by more than $100 billion in this year alone. By 2030, this market is projected to reach a staggering $2.8 trillion. The world is waking up to digital dollars. YouTube has recently added Stripe stablecoin payments, and soon, everything from supermarkets to airlines will likely transact in stablecoins. But there is a massive infrastructure problem holding this future back.

Most stablecoins today run on general-purpose blockchains like Ethereum or Solana. These networks are fantastic for DeFi, NFTs, and gaming, but they weren't designed specifically to move digital cash. High gas fees, network congestion, and slow speeds during peak times create friction for real-world payments.

Enter Stable, a Layer-1 blockchain built exclusively for USDT, designed to be the dedicated highway for the digital economy.

Introducing StableChain

Against this backdrop, StableChain emerges as the first Cosmos-based “stablechain” dedicated to stablecoins. Powered by Tether’s USDT as its native gas token, StableChain makes USDT more than just an asset on the blockchain it is the currency of the network. This design choice eliminates the need for holders to juggle volatile coins like ETH or BTC to pay fees; every transaction fee can be paid directly in USDT, stabilizing costs for users and businesses.

Built on a customized Cosmos SDK with the CometBFT consensus engine, StableChain boasts sub-second block times and finality. It can process thousands of transactions per second with ultra-low fees (a fraction of a cent), even under heavy load. In practice, that means a merchant accepting USDT on StableChain will see funds arrive in under a second, with essentially zero delay and minimal cost.

Key features of StableChain include:

- Guaranteed payment lanes. Similar to Tempo’s dedicated lanes, StableChain will reserve blockspace specifically for stablecoin payments. This ensures transfers never get stuck behind other network traffic, giving enterprises predictable throughput even in a crisis or market frenzy.

- Enterprise-grade security & compliance. StableChain uses a delegated Proof-of-Stake (StableBFT) consensus, providing robust security for high-value transfers. Confidential transaction support is planned, hiding amounts from the public while still allowing auditors and regulators to verify via special keys. The network is explicitly designed with banking needs in mind: for example, its planned wallet even supports KYC/AML tools under the hood.

- Full EVM compatibility. By supporting Ethereum’s Virtual Machine, StableChain lets developers use familiar tools (Solidity, Hardhat, MetaMask, etc.) to build new apps. Existing DeFi contracts (lending, payments, DEXes) can be ported with little change. This makes it easy for the DeFi community to embrace the chain.

- User-friendly experience. StableChain plans consumer features like social logins, human-readable wallet names, and even linked debit/credit cards that spend USDT. The goal is a digital dollars-on-chain experience that feels as natural as spending any other electronic money. (For example, one could “top up” a StableChain wallet via a bank transfer or card in the StablePay wallet, and then pay for groceries with USDT as easily as tapping a phone.)

StableChain is backed by a $28 million seed round led by Bitfinex and Hack VC, with notable crypto figures advising (like Tether’s CTO Paolo Ardoino). The Stable Foundation an independent non-profit,now oversees the network and will issue a governance token (STABLE) in due course. In December 2025 the chain officially launched its mainnet, marking the culmination of its development cycle. During testing, over $2 billion in deposits flowed into StableChain from tens of thousands of wallets, demonstrating clear demand for a dedicated stablecoin network

StableChain vs. the Competition :

StableChain distinguishes itself in several ways among its peers:

- Cosmos interoperability. Because StableChain is built on Cosmos, it naturally connects to the broad Cosmos ecosystem via IBC. This means any stablecoin issued on another Cosmos chain (for example, Circle’s EURC or Monerium’s EURe on a future Cosmos hub) could flow into StableChain easily. According to Cosmos Labs, USD stablecoins already account for over half of all IBC traffic in 2025, StableChain is poised to tap that liquidity.

- USDT focus. While some chains (Arc) center on USDC and others (Plasma) support multiple, StableChain explicitly optimizes for USDT, the largest stablecoin by market cap. This allows the chain to handle extremely high volume and to integrate tightly with Tether’s existing DeFi presence.

- Enterprise features. StableChain was conceived with banks and payment processors in mind. In addition to the guaranteed blockspace and privacy modes mentioned above, it plans tools like “Off-Chain Transfer Certificates” (for instant settlement guarantees) and split-fee payment channels. In short, it aims to give businesses the predictability and auditability they need something general blockchains usually lack.

- Global payment focus. By tying directly into Cosmos’s global network of chains, StableChain is not limited to US markets. The Stable whitepaper speaks of making “even those with limited banking access” able to transact in USDT. In practice, that could open up on-chain euro payments too: banks issuing a regulated euro token could list it on StableChain, and European consumers or businesses could send euros as easily as dollars.

In contrast, other projects have trade-offs. Tempo boasts enormous institutional backing and elegant payment features, but as of late 2025 it is only on testnet. Arc is highly polished (USDC gas, deterministic finality) but oriented around Circle’s ecosystem. Plasma offers zero-fee transfers and even a built-in neobank, but its native token (XPL) must secure the network. Gnosis Chain is already live and supports EURe, but it is a more general-purpose EVM chain (with xDAI fees) rather than a payment-only network.

By comparison, StableChain’s combination of USDT-native gas, enterprise features, and Cosmos connectivity is unique. It aims to be a global payments hub one that can handle billions in institutional transfers, serve everyday wallets, and link seamlessly to other stablecoin rails. As the Stable CEO put it, this is about “rewriting the way digital payments are processed and received around the world”.

Why Stable Wins on Infrastructure

- USDT is Gas: Forget about holding volatile tokens like ETH or SOL just to pay for fees. On Stable, you pay transaction fees directly in USDT, eliminating complexity.

- Ultra-Low Fees & Instant Settlement: Transactions are finalized in under a second and cost a fraction of a cent. This makes micropayments (like paying for coffee) economically viable.

- Guaranteed Blockspace (Enterprise): Businesses cannot afford network jams. Stable offers enterprises guaranteed blockspace, ensuring consistent transaction latency even when the network is congested

Implications for DeFi and the Real World

The rise of StableChain (and other stablecoin chains) is about more than crypto speculation, it fundamentally changes how money moves:

- For DeFi and crypto, dedicated stable rails mean greater liquidity and stability. DeFi apps on StableChain can assume their users always have access to dollars (USDT) with finality in seconds. Cross-chain bridges (via Cosmos IBC or LayerZero) can route liquidity seamlessly between StableChain and Ethereum or other networks. In effect, StableChain becomes a wholesale market for stablecoins where DeFi yields and trading can occur in real time. Institutions that were hesitant about crypto can now transact in tokenized USD/EUR on-chain with the same certainty they have in banks a bridge between TradFi and DeFi.

- For consumers and businesses, StableChain could make everyday payments more efficient. Imagine using a StableChain-linked debit card to spend euros or dollars that you hold on-chain, earning yield until purchase time. Or a merchant receiving settlement in seconds on-chain instead of waiting days from a bank. Cross-border remittances become as fast and cheap as local transfers. Companies operating globally can settle invoices instantly, and switch between currencies via on-chain stablecoin markets.

- For European payments, StableChain and its peers intersect with the euro stablecoin movement. A European bank’s euro stablecoin (e.g. the upcoming Qivalis token) could be bridged into StableChain, allowing euros to trade instantly with dollars on-chain. This aligns with Europe’s strategic goal of a “European payment standard”. Even as central banks explore digital currencies, private stablecoin networks like StableChain provide a complementary innovation: they deliver programmability and transparency that a government currency alone might lack.

- For everyday users, the benefits are tangible. With StableChain’s low fees and fast finality, sending pocket money to family abroad could cost under a cent with funds arriving instantly. A small business could pay international suppliers in stablecoins overnight instead of wiring dollars for hefty fees. Essentially, the world of finance moves closer to a 24/7 Uber economy, where value snaps around the globe on demand.

In short, StableChain and its peers are building the next-generation rails of money. By anchoring on stablecoins, they strip away much of the friction that has kept blockchain tech out of mainstream payments. As one industry insider observed, we may be moving “from stablecoin sandwich to seamless on-chain FX” and StableChain aims to sit right in the middle of that journey.

Key Takeaways: StableChain is a Cosmos-based L1 built for USDT (and potentially other stablecoins) that offers ultra-low fees, sub-second finality, and enterprise features like guaranteed blockspace. It joins a growing family of “stablechains” (e.g. Stripe’s Tempo, Circle’s Arc, and Plasma) that are unlocking on-chain stablecoin usage. Together, these platforms could make sending euros or dollars on the blockchain as easy as swipe-and-go, reshaping DeFi and global finance in the process

Conclusion

In the unfolding era of digital currency, StableChain stands as a deeply-considered experiment in payments infrastructure. It is not merely a speculative blockchain; it is a platform engineered for real economic use. By harmonizing the robustness of Cosmos with the ubiquity of USDT, StableChain offers institutions and consumers a vision of money that’s fast, frictionless, and programmable.

Throughout 2025 we’ve seen a proliferation of stablecoin projects ,from Gnosis Chain’s euro token partnerships to Stripe’s Tempo and Circle’s Arc. Each reflects the same insight: fiat money on-chain can be revolutionary, but only if it has the right train tracks to run on. StableChain’s unique value proposition is its holistic, enterprise-ready approach. It promises not just low fees or quick swaps, but an entire ecosystem: wallets, governance, compliance, and cross-chain bridges.

As the stablecoin market grows toward a projected $2.8 trillion by 2030, the importance of these rails cannot be overstated. For readers today, the takeaway is clear: StableChain may well be a cornerstone of the on-chain euro and dollar economies, and watching it (and its competitors) gives insight into how digital payments will evolve.