The crypto world's two biggest stablecoins are locked in an intense competition for the market. Tether's USDT holds $171 billion in market cap while Circle's USDC manages $60 billion. These numbers tell only part of the story. The real fight started when the U.S. passed the GENIUS Act in July 2025. This law forces every stablecoin to meet strict federal standards if they want to operate in America.

Both companies took different paths to success. USDT became the global leader by serving everyone everywhere with minimal restrictions. USDC grew by following U.S. regulations and partnering with American banks. Now these opposite strategies must adapt to the same rules. The winner gets access to a market projected to reach $650-750 billion by 2027.

Review USDC Price on LBank

USDC() Cena

Aktualna cena

The History of USDT and USDC: From Pioneer to Challenger

Origins of Tether and USDT

Tether created the stablecoin industry in July 2014. It first launched under the name “Realcoin.” The founders wanted to solve a clear problem in crypto trading. Moving money between cryptocurrencies and dollars through banks often took days. Realcoin promised instant dollar transfers on the blockchain.

In October 2014, the project changed its name to Tether. That same month, it issued the first USDT tokens on the Omni protocol. This first-mover advantage set the stage for Tether’s dominance and still defines the market today.

Early Growth and Controversies

By 2017, USDT had become essential for crypto exchanges. But with growth came problems. In November of that year, hackers stole about $31 million in USDT. Tether responded by hard-forking the Omni protocol to freeze the stolen funds. The move showed they could control the blockchain but also raised questions about centralization.

Regulatory troubles soon followed. The New York Attorney General discovered that Tether had used $850 million of reserves to cover losses at its sister company, Bitfinex. This led to an $18.5 million settlement in February 2021. Later that year, in October, the CFTC fined Tether $41 million, saying it had made false statements about its reserves.

Circle and the Rise of USDC

Circle launched USDC in September 2018 with a different vision. They wanted it to be the regulated alternative to Tether. The timing was right. Tether faced growing scrutiny while institutions were searching for trustworthy stablecoins.

Circle partnered with Coinbase to create the Centre Consortium. This alliance gave USDC instant credibility and access to their massive user base. USDC also took a different approach to transparency. It published monthly attestations to verify reserves and secured regulatory licenses from the start.

This strategy paid off. By July 2022, USDC circulation had reached $55 billion. Yet despite its rapid growth and reputation for transparency, it still trailed behind Tether’s larger market cap.

The People Behind USDT and USDC

The story of Tether’s leadership is unusual. The project began in 2014 with three founders. Brock Pierce was well known in tech circles, with experience in digital currencies and even a past as a child actor. Craig Sellars contributed as a blockchain engineer, while Reeve Collins handled business operations with his background in digital advertising. As Tether grew, the original team stepped back and passed control to new leadership.

Today, Tether is led by Paolo Ardoino. He worked as Chief Technology Officer for years before becoming CEO in October 2023. He replaced Jean-Louis van der Velde, who had guided the company through its toughest controversies and regulatory settlements. Ardoino now represents a new chapter. He appears at conferences defending Tether’s reserves and explaining blockchain issues with his technical expertise. Still, he must address problems that began before his time as CEO.

Circle followed a different path. Jeremy Allaire co-founded the company and still serves as CEO. He had built successful venture-backed businesses before Circle, giving him the experience to scale a global fintech firm. From the start, he positioned Circle as a bridge between crypto and traditional finance.

The Centre Consortium, which included Coinbase, gave USDC credibility and distribution power. In August 2023, Circle dissolved the consortium, giving Allaire full control over USDC. This simpler structure helped prepare for an IPO. By June 2025, Circle went public and listed on the New York Stock Exchange.

Image by: ChatGPT

What Makes USDT Different from USDC

The fundamental differences between these stablecoins go beyond just size. Each one built its business around different principles and user needs.

USDT operates like a global currency without borders. Tether designed it for maximum accessibility. Anyone can use USDT on almost any blockchain. The company doesn't ask many questions about who you are or why you need it. This approach made USDT essential for international traders and people in countries with unstable currencies. The token processes over $70 billion in daily volume across hundreds of exchanges worldwide.

USDC works more like a digital version of a U.S. bank account. Circle built it for users who value compliance and transparency. Every USDC transaction can be traced and audited. The company follows strict know-your-customer rules. They publish detailed monthly reports about their reserves. This makes USDC perfect for American businesses and DeFi protocols that need regulatory clarity.

The technical infrastructure reflects these philosophies. USDT runs on 15+ different blockchains to maximize reach. USDC focuses on 6-7 chains but with deeper integration and better security. USDT updates quarterly reports while USDC provides monthly attestations plus weekly reserve data. These choices show how each company prioritizes different values.

Tether's Financial Dominance and Profit Machine

Tether's financial strength gives them massive advantages in any competition. The company reported $13 billion in net profits for 2024. They added another $4.9 billion in Q2 2025 alone. These profits come mainly from interest earned on their reserves. With $171 billion under management and interest rates above 5%, the math becomes simple.

The company's reserve composition reveals sophisticated treasury management:

- $127 billion in U.S. Treasury bills (as of Q2 2025)

- $7 billion excess buffer above circulating supply

- Holdings in gold for diversification

- Bitcoin reserves for crypto exposure

- Cash and cash equivalents for liquidity

This massive Treasury position makes Tether one of the largest holders of U.S. government debt globally. They own more Treasuries than many countries. This gives them significant influence in bond markets. The interest from these holdings generates billions in pure profit with minimal operational costs.

Tether keeps most profits instead of sharing with partners. They don't pay distribution fees like Circle does with Coinbase. They operate from jurisdictions with favorable tax treatment. Their private company structure means no dividends to shareholders. All these factors create incredible capital accumulation that funds expansion and innovation.

Image Source: Circle

Circle's Public Company Strategy and Wall Street Integration

Circle took a completely different path by going public in June 2025. The IPO raised $1.05 billion at $31 per share. But the stock price exploded to $107 within days. This 245% gain showed Wall Street's hunger for regulated crypto exposure. The public listing gives Circle advantages that Tether can't match.

Being public means radical transparency. Circle must file quarterly earnings reports with the SEC. They disclose executive compensation and business risks. Any material changes require immediate disclosure. This transparency builds trust with institutions and regulators. Banks feel comfortable working with a company they can analyze like any other public firm.

Circle's key partnerships demonstrate their traditional finance integration. BlackRock, the world's largest asset manager, manages the Circle Reserve Fund. This fund holds only short-term U.S. Treasuries and overnight repos. Coinbase provides retail distribution to millions of users. Major banks like J.P. Morgan handle banking services. Deloitte conducts monthly attestations of reserves.

The business model differs significantly from Tether's approach. Circle generated $1.7 billion revenue in 2024 but paid $1.01 billion to distribution partners. This means much lower profit margins than Tether. But Circle argues this creates sustainable growth through aligned incentives. Partners have skin in the game and actively promote USDC adoption.

Image Source: Circle

How the GENIUS Act Changes Everything

The GENIUS Act represents the most important regulatory development in stablecoin history. President Trump signed it into law on July 18, 2025. The act creates comprehensive federal standards that override the previous patchwork of state regulations.

Key requirements under the GENIUS Act include:

- Monthly public disclosure of reserve composition

- Attestations from qualified third-party auditors

- Reserves must be high-quality liquid assets only

- Prohibition on paying yield to token holders

- Real-time proof of banking and blockchain integration

- Clear oversight by federal regulators

These rules favor USDC's existing model. Circle already provides monthly attestations and holds only high-quality assets. Their infrastructure meets most technical requirements. They just need minor adjustments for full compliance. This gives them a huge first-mover advantage in the regulated era.

USDT faces bigger challenges with compliance. Their quarterly reporting must become monthly. Their global user base includes many who can't pass U.S. compliance checks. The diverse blockchain deployments need upgraded monitoring. Tether can't simply make USDT compliant without breaking what made it successful globally. This explains why they created USAT as a separate U.S.-compliant token while keeping USDT for international markets.

This puts the company in direct competition with Circle's USDC on home soil.

Market Share Predictions and Growth Scenarios

Industry analysts project three likely scenarios for U.S. market development by 2027.

Base Case: USDC Maintains Leadership

The U.S. market grows to $650 billion total. USDC captures 60-65% market share due to regulatory advantages. Tether's new USAT token takes 20-25% by leveraging the parent company's resources. Other compliant stablecoins share the remaining 15%. This scenario assumes steady adoption without major surprises.

Bull Case: Aggressive Competition

The market expands to $750 billion as adoption accelerates. Tether fights hard for share by offering zero fees and better terms. USDT's global liquidity creates network effects benefiting U.S. users. Market share splits more evenly with USDC at 45-50% and USAT at 35-40%. Competition drives innovation and user benefits.

Bear Case: Regulatory Disruption

Growth stalls at $550 billion due to regulatory uncertainty. New rules favor bank-issued stablecoins over crypto-native ones. The Federal Reserve launches a competing central bank digital currency. Both USDC and USDT lose share to new entrants. This scenario shows how regulation remains the biggest variable.

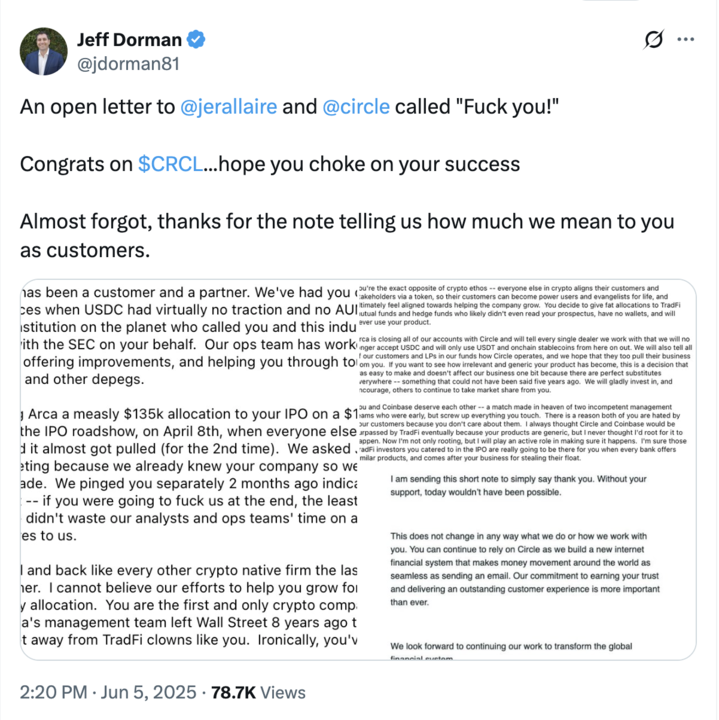

The IPO Controversy That Divided the Crypto Community

Circle's IPO allocation process created unexpected backlash from crypto insiders. Jeff Dorman from Arca published a scathing critique on June 5, 2025. He accused Circle of betraying early supporters by giving them "horrible or zero allocations" of IPO shares. Meanwhile, traditional mutual funds and hedge funds received generous allocations.

Source: Jeff Dorman on X

Dorman argued this violated crypto's ethos of rewarding early believers. He blamed Circle's management directly, not the investment banks. Companies have final say over share allocations. Circle chose to favor Wall Street over the crypto funds that supported USDC from the beginning. This decision sent a clear message about Circle's priorities.

The controversy highlights a deeper tension facing crypto companies going mainstream. They need traditional finance for growth and legitimacy. But they built their success on crypto-native communities. Abandoning those communities for Wall Street acceptance risks losing core users. Tether benefits from this backlash simply by staying private and crypto-focused.

Reserve Management and Treasury Market Impact

Both stablecoins significantly affect U.S. Treasury markets through their massive holdings. Combined, they own over $180 billion in U.S. government debt. This exceeds the foreign reserves of most countries. Their buying supports Treasury prices and compresses yields, especially in short-term bills.

The Federal Reserve Bank of Kansas City raised important concerns about systemic effects. If stablecoins absorb large amounts of bank deposits, lending capacity could shrink. Banks use deposits to make loans. When those deposits buy Treasuries instead, credit becomes scarcer and more expensive. This could slow economic growth if the shift happens too quickly.

The concentration risk also worries regulators. Two companies controlling hundreds of billions in Treasury demand creates vulnerability. A sudden failure could force massive Treasury selling. This might destabilize bond markets during a crisis. Regulators must balance stablecoin benefits against these systemic risks. The GENIUS Act includes provisions for orderly wind-downs to address this concern.

Technology Infrastructure and Blockchain Deployment

The technical approaches of USDT and USDC reveal different priorities and strategies. Here's a comparison list of USDT vs. USDC with their chain deployments and amounts:

This broad deployment maximizes accessibility but creates complexity. Each chain needs separate reserve reconciliation. Security becomes harder with more attack surfaces. But users can find USDT wherever they trade.

Circle prioritizes quality over quantity in blockchain deployment. They work directly with blockchain teams on native integration. Each deployment meets strict security requirements. This approach trades some accessibility for better user experience and safety. For investors looking to gain exposure, you can easily buy USDT or buy USDC on LBank.

Timeline of Critical Events in 2025

The competition accelerated dramatically through 2025:

Tether Profit Q4 2024

Tether releases Q4 2024 attestation showing record $13B annual profit

Circle Audit

Publishes February attestation with Deloitte verification

Circle IPO

Priced at $31 per share, raises $1.05B

CRCL Trading

Stock closes first day at $84

IPO Critique

Jeff Dorman critiques Circle’s IPO allocation

Stablecoin Law

GENIUS Act signed into law, creating U.S. framework

Tether Profit Q2

Reports $4.9B profit in Q2 2025 attestation

Tether Compliance

Announces USAT token for U.S. regulation

User Experience and Practical Differences

Real users experience these stablecoins differently in daily use. The differences affect everything from fees to speed to availability.

USDT works everywhere but with varying experiences. On Tron, transactions cost pennies and confirm in seconds. On Ethereum, fees can reach $20+ during congestion. Some exchanges offer free USDT transfers between accounts. Others charge percentage fees. The inconsistency frustrates users but the universal availability compensates. You can always find someone accepting USDT.

USDC provides more consistent but sometimes limited experience. Fees and speeds stay predictable across supported chains. Circle maintains quality standards for all integrations. But USDC isn't available everywhere USDT is. Some international exchanges don't list it. Certain DeFi protocols only accept USDT. American users rarely notice these gaps but global users do.

What Happens Next in the Stablecoin Wars

The competition between USDT and USDC will intensify as the market matures. Several factors will determine outcomes over the next few years.

Regulatory development remains the biggest variable. The GENIUS Act is just the beginning. International coordination could create global standards. Central bank digital currencies might compete directly. New laws could favor different models. Both companies must stay agile as rules evolve. The one that adapts fastest to regulatory changes gains huge advantages.

Technology evolution will reshape competitive dynamics. Layer 2 solutions make transactions cheaper and faster. Cross-chain bridges improve interoperability. Programmable money applications create new use cases. Artificial intelligence might enable new financial products. The stablecoin that best leverages new technology wins user adoption.

Market maturation changes what users value most. Early adopters cared about availability and low fees. Mainstream users prioritize safety and ease of use. Institutions need compliance and transparency. Each phase of adoption favors different strengths. USDT dominated the early phase. USDC positioned better for mainstream adoption. But the game isn't over.

The most likely outcome is continued coexistence with specialization. USDT keeps dominating international and trading markets where its liquidity matters most. USDC leads in U.S. institutional and DeFi applications requiring compliance. New entrants serve specific niches neither giant addresses well. The market grows large enough for multiple winners. Competition benefits users through better products and lower costs. Both Tether and Circle must innovate constantly to maintain position. The real winners are people and businesses getting improved stablecoin options.