In 2025, cloud mining and crypto staking are two primary methods for generating passive crypto income. Cloud mining provides a simple entry point, making it accessible for users without technical expertise.

However, staking is increasingly favored as a more robust, stable, and sustainable long-term strategy. This is because staking has lower operational risks compared to the high risks associated with cloud mining. Staking also benefits from greater regulatory clarity, while cloud mining faces significant uncertainty.

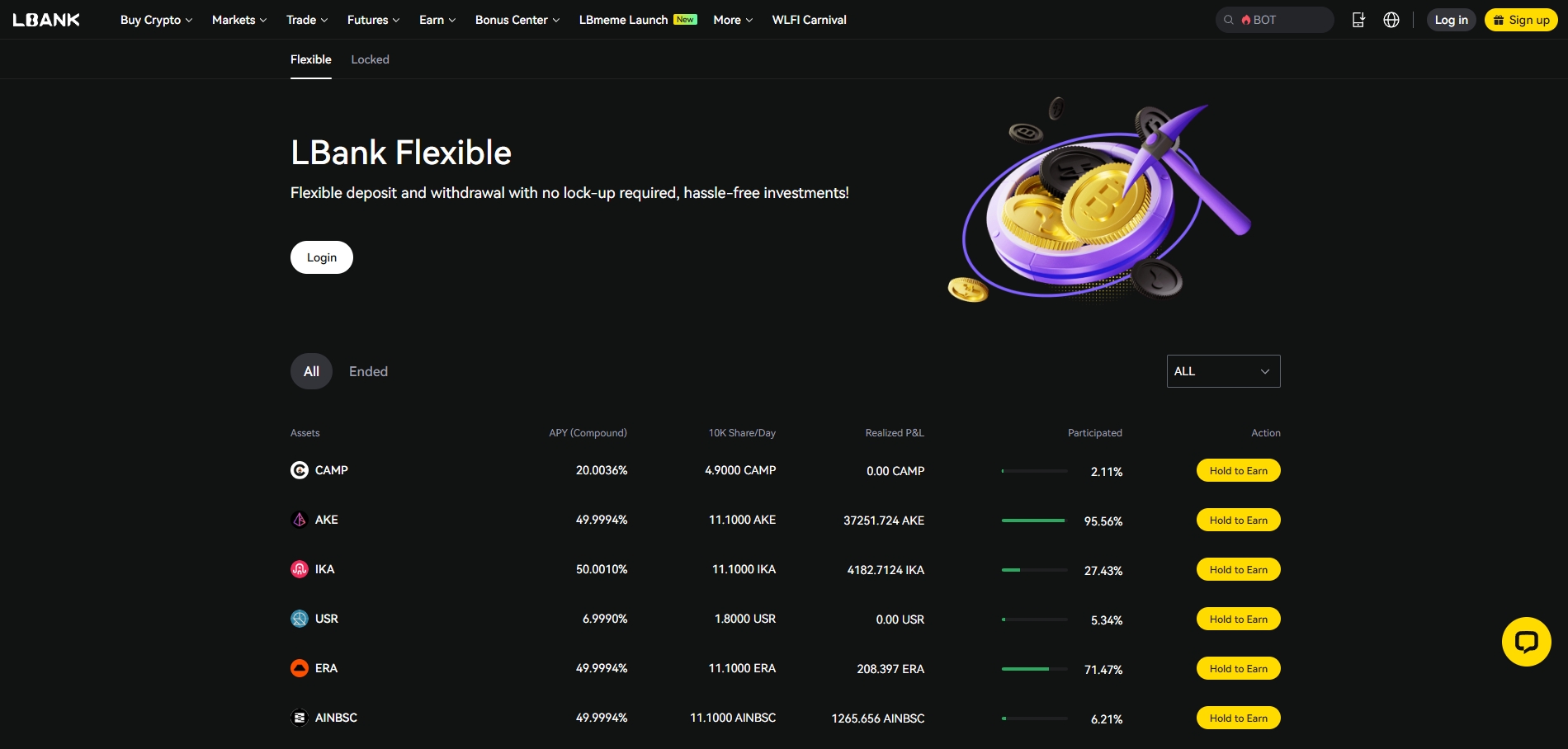

Source: LBank Earn Flexible

Cloud Mining vs. Crypto Staking: Profitability Comparison

When evaluating potential returns, it's clear that staking generally offers more stable and predictable yields, whereas cloud mining can provide higher returns but comes with more speculation and risk.

| Cloud Mining Returns in 2025 | Crypto Staking Yields in 2025 |

| Standard Contracts: Typical cloud mining contracts for Bitcoin offer an average annual percentage rate (APR) of 5%-10%. Platforms like ZA Miner also report returns within this bracket. | Staking provides more predictable, though still variable, returns that differ based on the specific network. |

|

High-Risk Schemes:

The cloud mining sector is also known for speculative schemes, especially those involving XRP, which promise unrealistic returns between 100% and 800% APR.

These are widely viewed as unsustainable and are often associated with Ponzi schemes or outright scams. |

As of mid-2025, average annual percentage yields (APY) are:

|

What is Cloud Mining?

Cloud mining is a method that allows you to participate in cryptocurrency mining without owning the physical hardware.

It is particularly popular for mining cryptocurrencies like Bitcoin. The process involves renting computing power, known as "hash power," from a company that operates large-scale mining farms or data centers.

In this method, you purchase a contract from a cloud mining provider, which is essentially a lease for their mining equipment.

In exchange, you receive a portion of the mining rewards, such as daily payouts in BTC or ETH, based on the amount of hash power you've rented. These payouts are calculated after the provider deducts fees for services and maintenance.

This approach makes crypto mining accessible to a much wider audience, especially those with limited technical knowledge or who live in areas where hardware and energy costs are infeasible.

What is Crypto Staking?

Crypto staking is a fundamental activity in Proof-of-Stake (PoS) networks. It involves token holders locking up their cryptocurrency assets to help secure and validate transactions on the network.

Participants have two main options for staking:

- Run their own validator node, which requires technical expertise.

- Delegate their tokens to an established validator, which is the more common method.

By contributing to the network's security, stakers earn rewards, typically in the form of more crypto tokens. Validators usually charge a small commission fee from these rewards for their service.

A significant recent development in this area is liquid staking, offered by platforms such as Lido and Marinade.

These services issue derivative tokens (like stETH or mSOL) that represent the user's staked assets.

This innovation allows stakers to earn yields while their assets remain liquid, meaning they can be used in other DeFi applications simultaneously.

Key Risks of Cloud Mining and Staking

Both strategies come with risks, but the nature and severity of these risks differ significantly. The following table provides a direct comparison.

| Risk Factor | Cloud Mining | Crypto Staking |

| Platform Risk |

Very High. The sector is "rife with scams and fraudulent operations". Key risks include platform insolvency, lack of transparency, and the simple fact that reliable, audited providers are "rare". |

Moderate. The staking industry has "matured". The main risks involve validator downtime or misbehavior, which can lead to "slashing" penalties where a portion of the staked tokens is lost. |

| Market Volatility |

High. Payouts are in crypto, so a sudden market downturn can "wipe out fiat gains overnight". This is especially true for speculative high-yield schemes. |

High. Staking returns are also paid in crypto, making their fiat value subject to token price fluctuations. |

| Liquidity |

Low. The initial investment is usually locked until the mining contract expires. |

Moderate to High. Traditional staking may have "unbonding" periods of days or weeks. However, liquid staking tokens provide immediate liquidity, effectively removing this risk. |

| Operational Risk |

High. Returns are dependent on factors outside the user's control, such as hardware becoming obsolete and fluctuations in energy prices. |

Low to Moderate. For delegators, the primary operational risk is the performance and reliability of their chosen validator. |

| Centralization |

High. The industry is dominated by large mining farms, which promotes centralization and goes against the decentralized ethos of cryptocurrency. |

Moderate. While large validators exist, the PoS model generally allows for a more distributed network of participants. |

Environmental Impact and Sustainability

For many modern investors, the environmental, social, and governance (ESG) impact of an investment is a critical factor, and this is where cloud mining and staking diverge sharply.

Cloud Mining

It is an energy-intensive process, directly tied to Proof-of-Work mining like Bitcoin's, which consumes an estimated 150 TWh of electricity annually, often from fossil fuels.

While some mining farms are taking steps to improve sustainability by using renewable energy or locating in colder climates like Iceland to reduce cooling costs, the industry's overall environmental impact remains a "major concern".

Staking

In contrast, staking operates on the "inherently energy-efficient" Proof-of-Stake consensus mechanism.

A key milestone was Ethereum's transition to PoS in 2022, which reduced its energy consumption by an estimated 99.95%. This significant difference makes staking the "clear choice for ESG-minded crypto investing".

Regulation and Investor Suitability in 2025

The regulatory landscape for these two strategies is also quite different.

Cloud mining faces considerable regulatory uncertainty and challenges. Some nations, such as Kuwait, have banned mining activities due to the strain they place on national power grids.

In the U.S., relaxed environmental policies have led to an expansion of mining operations, but this has also drawn criticism from environmental groups.

Staking, on the other hand, benefits from a more favorable regulatory outlook and "faces fewer regulatory hurdles".

The industry has matured to the point where staking-as-a-service providers now offer regulated infrastructure, complete with audits, insurance, and custody solutions.

These developments have made staking a "credible option" for institutional and compliance-focused investors.

Choosing the Right Strategy for You

Ultimately, the decision between cloud mining and staking in 2025 depends on your investor profile, risk tolerance, and long-term goals.

For Beginners and Low-Tech Users

Cloud mining offers a simple "plug-and-play" model with potential returns of 5%-10% APR. However, staking through exchanges or liquid staking platforms provides an equally simple and often safer alternative.

For High-Risk, High-Yield Seekers

While speculative XRP cloud mining schemes may advertise returns of 100%-800% APR, they are extremely risky and lack transparency.

A safer high-yield strategy could be staking on emerging networks like Cosmos or NEAR, which can yield 15%-20% for those willing to manage a slightly more complex process.

For Institutional and Compliance-Focused Investors

Staking has clearly "pulled ahead". Its regulated infrastructure, availability of audits, and insured custody solutions are critical features that the cloud mining industry generally cannot provide.

For Long-Term and ESG-Conscious Investors

Staking is the "superior strategy". Its combination of regulatory resilience, lower volatility, and significant environmental benefits aligns perfectly with modern trends in sustainable investing and DeFi.

Due to its various risks, cloud mining is better suited for speculative traders.