When a whale sends large amounts of ETH to a centralized exchange, that sends crypto twitter into a frenzy. As soon as users see things like "$23 million sent to Coinbase" or "5,000 ETH deposited to an exchange," they're immediately in speculation-mode, and the speculative machinery is cranked up to 11 within minutes. And the sentiment among traders almost always seems to be, "oh no, there goes another dump; better sell immediately." But the truth is that inflows to exchanges are actually some of the most misinterpreted on-chain metrics in the crypto space; so if you're making your trading decisions just based on an inflow alert without any further context, then you're probably reacting to noise instead of data -- and it may cost you a lot of money. In this article I will be explaining what exchange inflows of ETH actually reflect, and when whale inflows are actually indicative of future selling pressure versus not.

What Is ETH Exchange Inflow?

Exchange inflow, or the amount of ETH transferred into centralized exchange wallets during a specific period, is tracked by exchange inflows on platforms like Glassnode and CryptoQuant as a major on-chain metric. Investors typically make a transaction when they're going to sell, trade, or use crypto as a collateral; therefore, an increase in exchange inflow indicates that more ETH will be available to sell in the market. This often shows downward price pressure on ETH.

However, that statement is somewhat misleadingly vague, since exchange inflow data doesn't provide insight into the reason why people are trading or how many people will be selling. Movement of funds may have an alternative purpose, with the exception of a whale potentially sending 10,000 ETH to exchange (for example) to dump it, re-balance wallets, place collateral for a futures contract, or just to transfer funds and take advantage of the lending or staking capabilities the exchange offers. Therefore, the metric alone needs to be viewed in context.

Why Whale Deposits Get All the Attention

Whale transactions are so large that they can change a market and therefore are the main focus of this story. EmberCN, an on-chain analyst, found a whale in August 2025 who deposited 5,001 ETH, about $23.49 million, in two transactions in a matter of minutes. The short-term sentiment of traders changes quickly when that volume hits the order book of an exchange.

Historical data shows that the average price decrease for large single-entity inflows to centralized exchanges is between 3% and 5% within 24 hours.

The alert-based community tends to overlook that whale behavior in 2025 is highly split. For example, some large holders of Ethereum have moved their Ethereum to exchanges, such as Arthur Hayes expressing his decision to move away from Ethereum and towards DeFi tokens. In contrast, some large holders have done the opposite. According to Glassnode's data from June 2025, whale wallets with 1,000–10,000 ETH have been accumulating at a rate of more than 800,000 ETH daily for the last week, with June 12 reaching an all-time high of 871,000 ETH. There is no single deposit that constitutes this trend.

Exchange Inflow vs. Outflow: Read Both Sides

You cannot evaluate the flow of ETH into exchanges without evaluating ETH out of exchanges also. The typical outflow of ETH from centralized exchanges into cold storage or personal wallets is generally seen as a positive sign. When holders remove their ethereum from exchanges, they are lowering the supply available to sell. As noted by Cryptopotato, the majority of ETH outflows occurred in mid-2025, where during a 30-day period, more than 1 million ETH left centralized exchanges, which lowered the total amount of ETH held by exchanges to 19 million, the lowest in nearly a decade.

Typically, when inflows of ETH into exchanges have increased, there is little to no preparation for a mass sell-off when the net flow of ETH (inflow - outflow) has remained positive or flat. It is therefore not appropriate to use the raw inflow data alone as an indication of net inflows into exchanges; rather, it is best to use CryptoQuant's Exchange Netflow statistic. A positive netflow is the best indicator of any potential sell-off as it shows that more ETH is being deposited in exchanges than exercising; however, from time to time, statistical noise will occur due to a single whale deposit occurring in a longer outflow trend.

When a Whale Deposit Actually Is Bearish

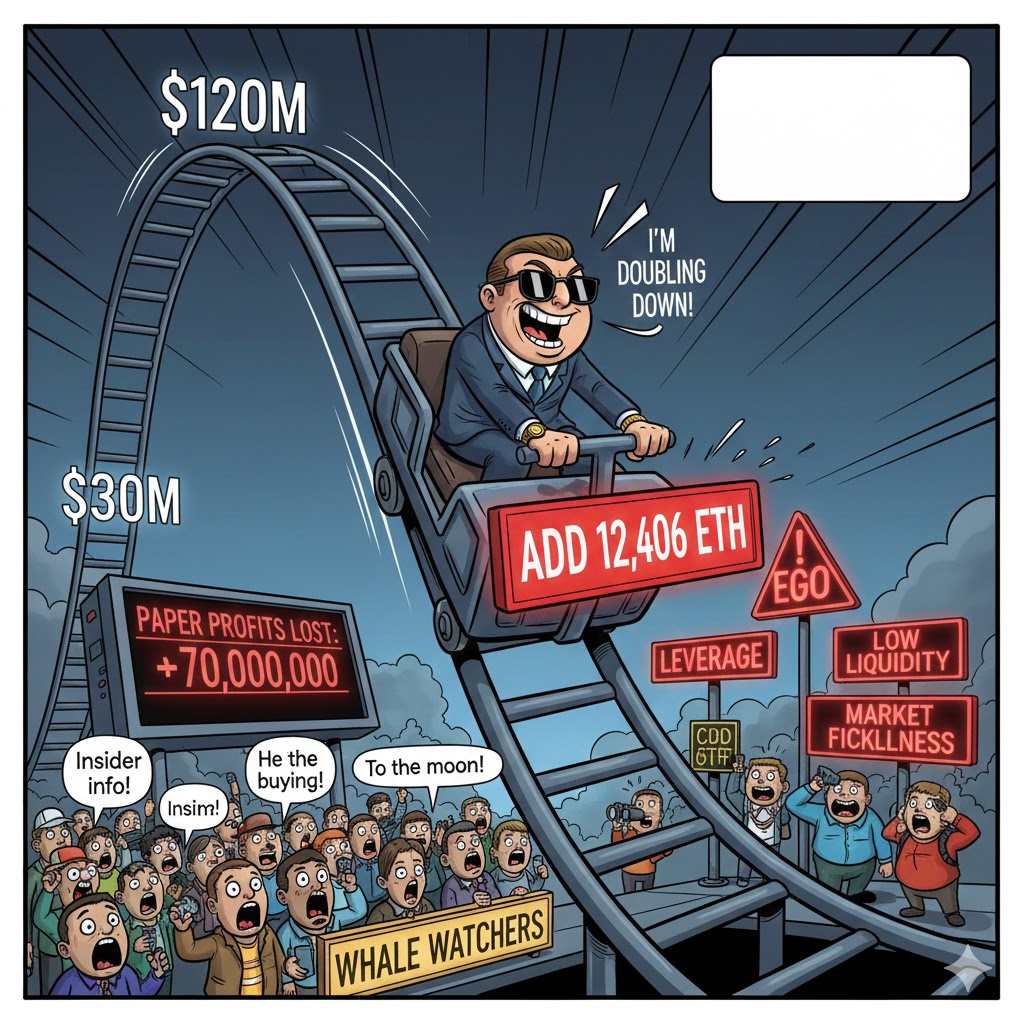

There are occasions when large whale deposits to exchanges may signal future selling pressure; thus, both a blind eye to the whales and a panic reaction are dangerous. A good starting point is clustering, which increases the probability of coordinated selling when multiple large wallets deposit into exchanges across a similar time frame of two to three days (roughly, within the same 24-48 hours). A second way to establish the context and correlation between whale deposits is by looking at the Estimated Leverage Ratio. If there is a simultaneous increase in inflows to exchanges and increased leverage being used by traders opening short positions, it creates a double-negative situation.

Thirdly, review sentiment indicators more broadly. BeInCrypto reported that four warning signs for ETH were present at the same time in late December 2025: growing exchange reserves, high leverage ratios, continued ETF outflows and declining Coinbase Premium Index. In contrast, a single wallet relocating Ethereum to an exchange on any given Tuesday represents a very different circumstance than those identified through cluster analysis above. The key to proper interpretation of exchange inflows is provided by context, correlation and confluence.

What Institutional ETF Flows Add to the Picture

Imagine you're looking at the value creation of the new ETF Product, and you've mapped out four major layers of data between now and when that product first came out. One of those layers is the ETF data for Ethereum (ETH). As of this writing, there are approximately $21 billion of reported assets held within Ethereum based spot ETFs, which is roughly 5% of Ethereum's total market value. These ETF inflows are providing demand-side support against the ongoing sell pressure of large single day ETH (1217, December 8, 2020) ETF inflows of over $177.64 million, which were greater than the amount of Bitcoin ETF inflows during the same period. As such, the institutional capital influx into regulated Ethereum products serves as a long term accumulation strategy instead of indicating short term trading activity.

At this stage, the bigger, more complex atmosphere created from monitoring whale alerts vs. monitoring the influx of institutional capital creates a lot of confusion. While the majority of the institutional capital should continue to be long, there is a great chance that the only source of Ethereum sell pressure may be from a limited number of large traders in the event that on-chain exchange inflows are at record levels and ETF inflows are stagnating. Therefore, if you only use one metric to drive all your decisions for Ethereum, you're likely to mislead yourself.

My Framework for Reading ETH Exchange Inflows

Before responding, I personally assess an ETH exchange inflow event as follows. To start, look at the net flow. Is there a greater amount of ETH coming into exchanges than going out, or is this inflow an exception in a larger trend of outflow? Secondly, see who is making the deposit. Just one whale? It could be anything. Several big wallets in a little period of time? That's more worrying. Third, compare with funding rates and leverage. There is real bearish pressure brewing if leverage is increasing in tandem with inflows. Fourth, look at the direction of the ETF flow; institutional sentiment can take precedence over on-chain noise. Fifth, take a closer look at exchange reserves. One deposit won't impact the structural scarcity if the overall amount of ETH on exchanges is at multi-year lows.

Whale deposits provide exciting news stories. However, the most important signal in cryptocurrency is rarely the one that appears first in your notifications. Examine the data thoroughly before making a sale.