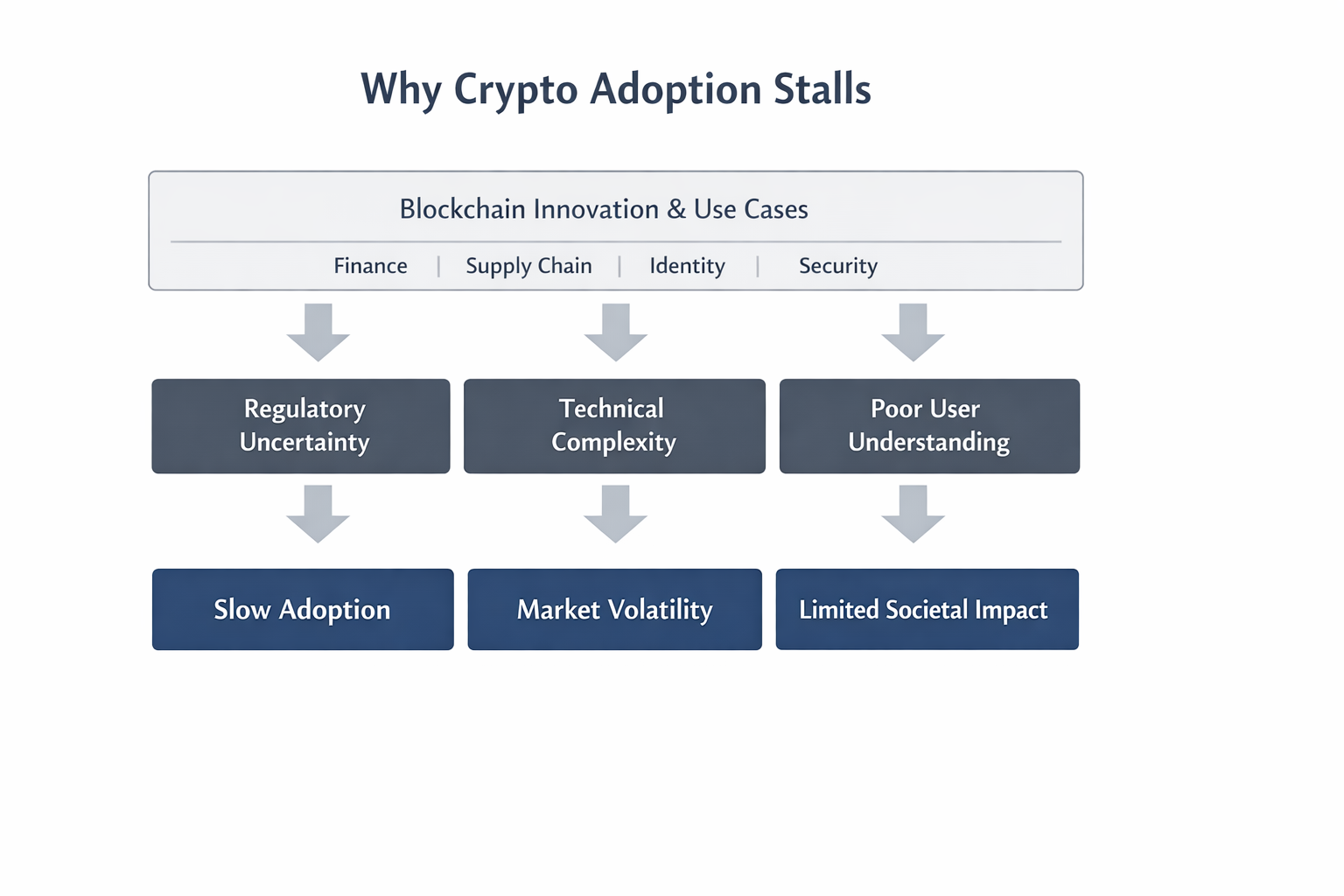

Blockchain and crypto do not suffer from a lack of real-world use cases. In different industries, blockchain is already being used and integrated in finance, logistics, identity, and data systems. The real problem delaying the space is not technology, it is clarity.

Many years, crypto has a faster transactions, financial inclusion, and the removal of unnecessary intermediaries. But with these advantages, many institutions and traditional sectors refused to adopt it. This is not intentional. It is due to regulatory uncertainty, poor understanding of blockchain systems, and the complexity of using the technology itself.

Why Regulatory Clarity Is the Real Bottleneck

Regulatory confusion remains the most serious pressing issue. In many ways, governments still struggle to clarify what some digital coin is, whether it should be treated as a security, a commodity, or something entirely new. As a result, individuals continue to buy and use digital assets without knowing its classification or regulation. This uncertainty discourages potential investors and businesses from fully using the space.

Efforts such as the proposed U.S. CLARITY Act highlight why regulation matters. The goal of such frameworks is not to stop innovation but to reduce uncertainty by clearly defining digital assets, assigning regulatory responsibilities, and outlining compliance pathways. Whether or not any single bill succeeds, the broader point remains; adoption cannot happen without regulatory clarity.

How Complexity and Poor Usability Slow Adoption

Beyond regulation, crypto also struggles with usability. Blockchain systems are still difficult for it non-users to understand and operate. This complexity creates a gap between innovation and real-world adoption. If people cannot easily use the technology or understand its value, adoption will remain slow regardless of its potential.

Slow adoption limits market maturity, increases volatility, and weakens trust. Compared to traditional financial markets, the crypto market remains small, affecting its influence on the global economy. This also slows innovation above finance. Blockchain’s potential in areas such as supply chains, identity systems, and voting infrastructure remains largely untouched, not because the technology cannot support it, but because adoption has not reached the necessary volume.

Cryptocurrency has scalability problem posing another form of threat to its wide adoption. The more users on a particular network transact the more the network is congested. It slows down the transaction speed increasing the fees to pay. Scalability has been a challenge in the crypto space for years, there is a need for this to be addressed in order for more adoption.

Security, Taxation, and the Trust Gap Holding Crypto Back

The societal benefits of crypto adoption are often discussed but hardly realized. When seriously integrated, blockchain systems can expand financial access, reduce dependency on centralized intermediaries, and provide new economic opportunities. However, without widespread adoption, these benefits remain unknown.

Security is another area where blockchain offers advantages, although not completely. Decentralized systems can reduce certain risks associated with centralized data storage and improve data integrity. These benefits only matter if the systems are really understood and implemented. Taxation further complicates adoption, as different crypto tax rules across countries continue to create confusion for individuals and businesses.

The crypto space embrace pseudonym, Satoshi Nakamoto for example, but it's pseudonymous nature comes with hacking, scams, and theft, as well as money laundering. Regulatory bodies should make a measurement against this to enforce crypto cybersecurity.

Ultimately, widening crypto adoption requires more than innovation. It requires regulatory clarity, simpler user experiences, better education, and honest collaboration between governments, institutions, and crypto native participants. Until these issues are addressed, adoption will continue to slow, not because crypto lacks value, but because the its future remains uncertain.