What Is a Limit Order?

Introduction to Limit Orders

Controlling Trade Prices: Definition and Characteristics of Limit Orders

In cryptocurrency trading, choosing the right order type is crucial for achieving trading objectives. Limit orders, a common order type, allow traders to set a specific buy or sell price. This means if you wish to buy Bitcoin or Ethereum, you can specify a price through a limit order that will only execute when the market price reaches or falls below that price; similarly, a sell limit order requires the market price to reach or exceed your set price to execute.

Convenience of Automated Trading

A significant advantage of limit orders is their automation feature, freeing up investors' time and energy. You don't need to constantly watch market fluctuations or worry about missing the ideal buying or selling opportunity when you're not online. This automated execution mechanism ensures that as long as the market price hits your set limit, the order will be executed, even if you're asleep or busy with other tasks.

Considering Execution Uncertainty

However, limit orders are not without flaws. A major limitation is the uncertainty of execution. If the market price never reaches your set limit, your order remains unexecuted, potentially hanging on the trading platform for a long time until you cancel the order or the market price meets the order conditions. This can be a challenge for investors who wish to complete transactions quickly.

Platform Differences and Duration

It's worth noting that different cryptocurrency trading platforms handle limit orders and their duration differently. On some platforms, limit orders can remain active for months until triggered by the market price or cancelled by the trader. This flexibility is convenient for long-term strategy planning but also requires traders to be fully aware of the platform rules they are using.

How Limit Orders Work

Position in the Order Book

When traders submit a limit order, it's immediately recorded in the order book but only executed under specific conditions. For example, if you plan to sell 10 LBKs at $600, but the current price is $500, your limit order will only be executed when the price of LBK reaches $600 or higher. This mechanism ensures traders can trade at their expected price.

Market Liquidity and Execution Order

The execution of limit orders also depends on market liquidity and other orders ahead in line. If there are existing sell orders at the same or better prices, new limit orders will be placed behind them for execution. This means even if the LBK price reaches $600, if there's insufficient market liquidity or a large number of orders at similar prices ahead, the execution of your limit order might be delayed.

Considering the Expiration of Orders

The expiration of limit orders is another important factor. Market price fluctuations could lead to a final sale price different from the initial intention. For instance, if the LBK price jumps from $500 to $700 within a week, and your sell price was set at $600, your order will be executed at $600, missing out on the opportunity for higher profits. Therefore, regularly reviewing and adjusting your limit orders according to market changes is crucial to ensure your trading strategy aligns with market conditions.

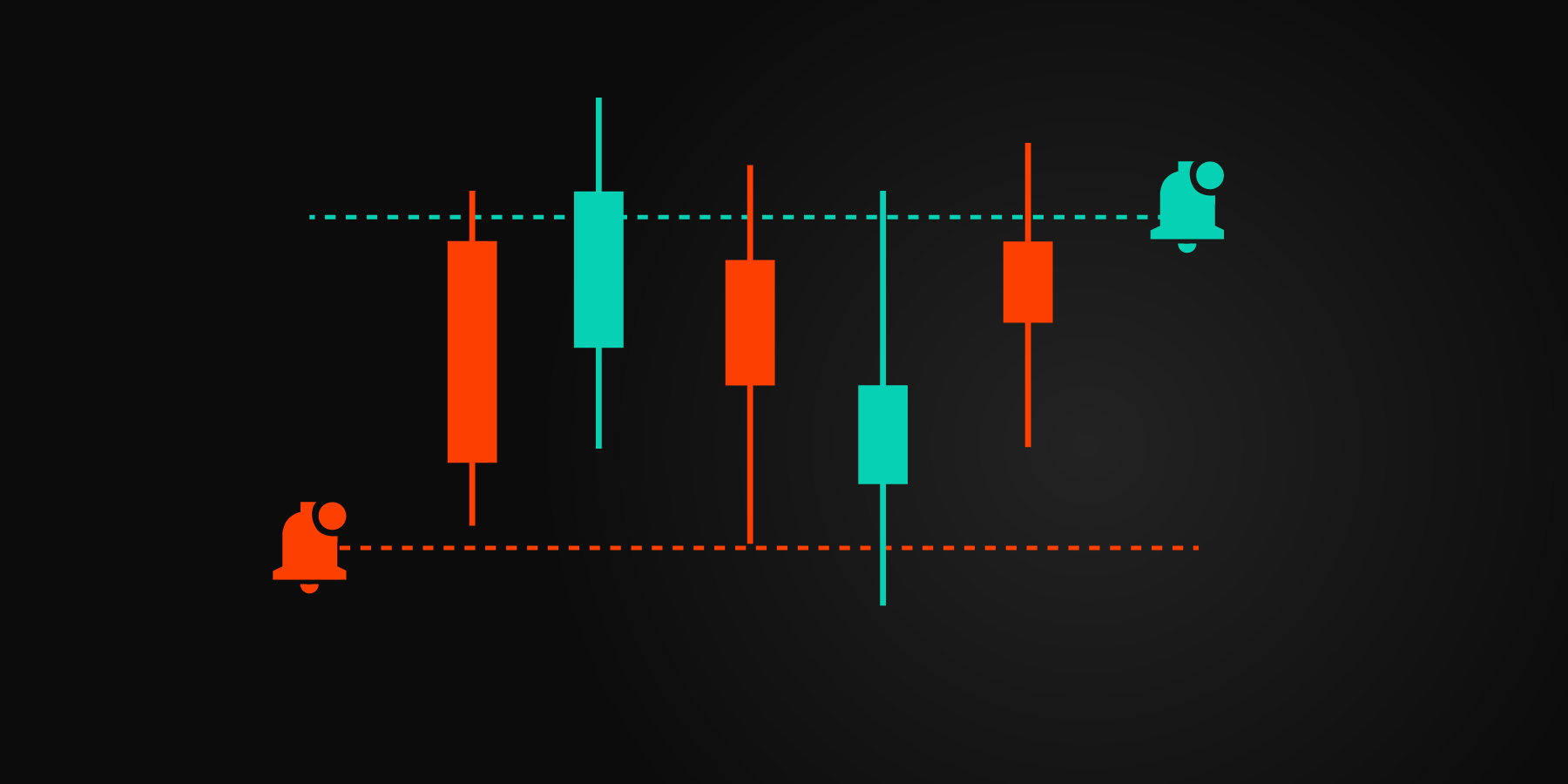

Stop Orders and Limit Orders: A Dual Strategy for Risk Management

Stop Orders: Goalkeepers of Risk Control

In the volatile cryptocurrency market, stop orders are a crucial risk management tool. They allow investors to set a predetermined stop price, which, once the market price hits this price, automatically turns the stop order into a market order for execution, aiming to limit potential losses. This type of order is particularly suited for those looking to minimize losses in unfavorable market trends or to lock in unrealized profits to prevent them from turning into losses.

Differences Between Limit Orders and Stop Orders

While limit orders and stop orders share operational similarities, their execution logic is significantly different. Limit orders focus on price control, executing only when the market price meets or betters the set price, ensuring cost-effective transactions; stop orders, however, convert into market orders to execute at the current market price, with the primary goal of exiting quickly to prevent larger losses. This fundamental difference makes them play unique roles in trading strategies.

Stop-Limit Orders: The Best of Both Worlds

A stop-limit order combines the features of stop orders and limit orders, offering a mechanism to set both a stop price and an execution price. When the market price hits the set stop price, the system automatically places a limit order. This order type considers the need for an emergency market exit while attempting to control the execution price to reduce slippage, making it a more advanced risk management tool.

Considerations in Practice

Taking LBK trading as an example, suppose the current price is $600, and an investor worries about a price drop, thus setting a stop price at $590 and wishing to sell at no less than $585. In this case, a stop-limit order is an ideal choice; once LBK falls to $590, the system automatically places a limit sell order at $585. This sets a safety net for exiting the market while trying to maintain control over the sell price as much as possible. However, be wary that if the market price rapidly falls below $585, even if the stop price is triggered, the limit order may not execute if there are no matching buy orders, still posing certain risks.

Choosing Between Stop Orders and Stop-Limit Orders

Choosing between using a stop order or a stop-limit order mainly depends on personal risk preference and market conditions. Stop orders provide a guarantee for quick exit, suitable for rapidly stopping losses in volatile market conditions; whereas stop-limit orders, while attempting to control the transaction price, add uncertainty to execution, fitting scenarios where there is a desire to control the trade price to some extent.

Applicable Scenarios for Limit Orders

Seeking Specific Price Points for Buying or Selling

Limit orders are ideal when you have a clear price target. When you want to purchase assets at a price lower than the current market price or sell assets at a price higher than the current market price, limit orders can help you lock in the desired price. This strategy is suitable for investors willing to wait for the market to reach their preset price levels.

Preference for Non-Urgent Transactions

If you're not in a hurry to complete a transaction immediately, limit orders offer a method to patiently wait until the market price meets your buying or selling conditions. This strategy avoids unfavorable transaction prices that might result from hasty decisions.

Risk and Reward Management

Limit orders also play a crucial role when you want to lock in profits already gained or minimize potential losses to the greatest extent. By setting a specific price point to exit the market, you can manage investment risks more effectively.

Implementing a Dollar-Cost Averaging Strategy

Limit orders can also be used to implement a dollar-cost averaging (DCA) strategy, where a larger investment is broken into smaller purchases at various prices to lower the overall cost of entry. By breaking down a large order into multiple small limit orders, you can diversify buy-ins at different price points, thus spreading out the risk of price fluctuations.

Market Conditions and Execution Uncertainty

It's important to note that even if the market price reaches your set limit price, execution of the order is not guaranteed; it depends on the market's liquidity and other orders in the order book. In some instances, your limit order may only be partially executed, an important factor to consider when using limit orders.

Placing a Limit Order on LBank: A Step-by-Step Guide

Step One: Log In and Select a Trading Pair

Log in and navigate to [Trade] - [Spot Trading] to enter the trading interface. Once there, you need to find and select the digital currency pair you wish to trade, such as [LBK/USDT].

Step Two: Set Limit Order Details

With your trading pair selected, the default [Limit] tab allows you to specify the maximum or minimum price you're willing to accept for buying or selling. You can also decide the specific amount you wish to purchase. To simplify this process, LBank offers percentage buttons, enabling you to quickly set the order amount based on your account balance, with options including 25%, 50%, 75%, or 100%.

Step Three: Confirm and Execute

After setting the price and quantity, click [Buy LBK] or the corresponding sell button to submit your limit order. A confirmation window will appear to double-check all details are correct before confirming the submission. At this point, your order has been successfully placed but will only execute once the market price meets your set limit.

Step Four: Order Management

To track the status of your order, you can scroll down to the [Open Orders] section in the trading interface. If the market price does not reach your limit price, the order will remain unexecuted. This stage offers convenience for adjusting or canceling orders, ensuring you can flexibly respond to market changes.

Conclusion

Limit orders, as a core tool in trading strategies, provide investors with a way to precisely control trading prices, whether in the volatile cryptocurrency market or other financial markets. By thoroughly analyzing the definition of limit orders, how they operate, comparisons with stop orders, and their application in specific scenarios, this article aims to deepen readers' understanding of the importance and practicality of limit orders.

As trading platforms like LBank continue to offer more user-friendly features, placing limit orders has become more straightforward. However, successful trading relies not just on using tools but also on a deep analysis and understanding of the market. In the future, as the market evolves and technology advances, limit orders and other trading commands will continue to develop, offering investors more control and flexibility to adapt to the ever-changing market environment.

Istilah Populer

Bacaan Terkait

Tidak ada data |