Ethereum All Core Developers Consensus Call

*All on-chain data is dated as of 12:00 a.m. EST on Sunday, April 21st.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(Apr.14-20).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #BTC Halving #Layer2

EMIL LENDOF/THE WALL STREET JOURNAL

1 Macro Market Overview

Nasdaq Logs Worst Weekly Performance Since 2022. According to WSJ, Israel and Iran appear to be trying to calm tensions after trading military blows in recent days. Markets aren’t getting the message. An Israeli strike late Thursday night led to a brief spike in oil prices, rattling investors before the opening bell Friday morning in New York. That added momentum to a pullback in the S&P 500 and Nasdaq Composite that saddled both with their longest daily losing streak in more than a year. By the time the closing bell rang Friday afternoon, the tech-heavy Nasdaq had racked up a 5.5% weekly decline, its worst such performance since 2022. The S&P 500 dropped 3.1% for the week, and the Dow Jones Industrial Average eked out a tiny gain. The Nasdaq and S&P 500 have both declined in each of the past three weeks as a stronger-than-expected U.S. economy buoys inflation and scrambles Wall Street forecasts for interest-rate cuts by the Federal Reserve. Those changing expectations are hammering the speculative artificial-intelligence-oriented tech stocks that propelled a market rally in recent months. A run-up in yields in recent weeks has turned tech stocks, the big winners in previous months, into major losers. The so-called Magnificent 7 stocks lost a collective $950 billion in market capitalization this week, according to Dow Jones Market Data, their largest weekly loss on record. Those companies also weighed down major indexes Friday, when Nvidia slumped 10%. The Nasdaq fell 2.1%. The S&P 500 veered 0.9% lower. Boosted by financial firms and consumer staples, the Dow rose 0.6%, or 211 points.

Federal Reserve Chair Jerome Powell stated during a moderated discussion at the Wilson Center on Tuesday that recent data has evidently not given us more confidence that inflation will move toward the central bank's 2% target. There are indications that achieving this confidence may take longer than expected, considering the robust momentum in the labor market and the progress in inflation so far. Powell mentioned that it's appropriate to give restrictive policies more time to take effect and to let data and evolving outlook guide us.

The three major US stock indices performed poorly last week, with the tech-heavy Nasdaq Composite Index falling by 5.5%, the S&P 500 dropping by 3.1%, and the Dow Jones Industrial Average remaining flat. Similarly, stocks related to Web3 didn't fare well either, with COIN falling by over 14%, MSTR dropping by more than 20%, and MARA seeing a slight increase of 2%.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

Last week, the US Dollar Index (DXY) began to decline on Wednesday, followed by a rebound. By the close of trading on Friday, the US Dollar Index had risen to 106.114, a slight increase from the previous week's 106.103.

DXY (Source: TradingView)

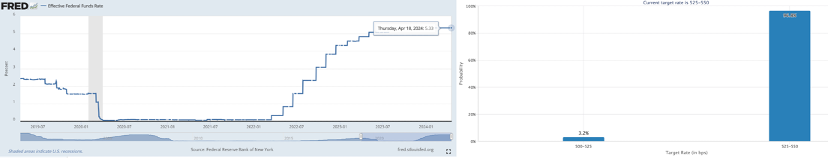

According to the latest data from the Chicago Mercantile Exchange (CME), only about 3% of investors anticipate the Federal Open Market Committee (FOMC) meeting in May of this year will witness the first interest rate cut. This proportion is nearly halved compared to the 6% reported in last week's data. More investors believe that the Federal Reserve will maintain interest rates unchanged.

Left: EFFR, Right: Target Rate Probabilities for May 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

The yield on the 10-year U.S. Treasury note (US10Y)—a benchmark for borrowing costs ranging from mortgages to corporate loans—rose to 4.623% this week, from 4.499% last week.

US10Y (Source: TradingView)

Last week marked the fourth Bitcoin halving. Bitcoin experienced its fourth halving as the block height reached 840,000, occurring around 4:00 am UTC on April 20. The 2024 Bitcoin halving reduces block rewards from 6.25 BTC to 3.125 BTC.

Interest in "Bitcoin halving" on Google has surged to its all-time high, with forecast data indicating that interest will be more than double that of the last halving in 2020, reaching 45 points and expected to reach 100 points by the end of this month. Despite recent cooling in Bitcoin's price trend, some market analysts believe that based on historical price patterns, Bitcoin may experience a significant increase in the months following the halving.

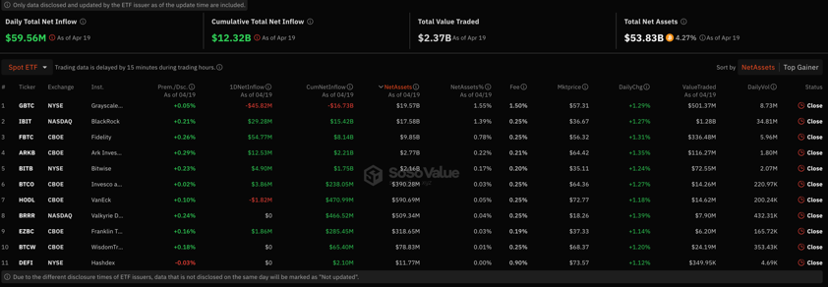

The total net inflows into Bitcoin spot ETFs currently stand at $12.3 billion, decreasing by $200 million over the past seven days. Last week, Bitcoin spot ETFs experienced net outflows once again. From Monday to Thursday of last week, there were net outflows of $37 million, $58 million, $165 million, and $4 million respectively. However, net inflows began on Friday of last week with $60 million. Overall, there were net outflows of over $2 billion last week. The current total net assets amount to $53.8 billion, accounting for 4.3% of the Bitcoin market value. As of the close of trading last Friday, Grayscale's GBTC has seen total net outflows amounting to $16.7 billion, while IBIT, managed by BlackRock, achieved total net inflows of $15.4 billion.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

Last week, the total market capitalization of the cryptocurrency market continued to decline, with the current total market capitalization standing at $2.39 trillion, experiencing a net outflow of approximately $200 billion over the past seven days. Bitcoin and Ethereum continued to consolidate last week. Amid recent higher-than-expected inflation data and adverse effects of geopolitical tensions, they reached near-term lows on the 19th, briefly slipping to $59,000 and $2,800 respectively. Subsequently, they began to rebound influenced by positive factors such as the Bitcoin halving. As of the early morning of April 23rd, the spot price of Bitcoin has risen to $65,000, with an increase of nearly 3% over the past 7 days. As the second-largest cryptocurrency, Ethereum's current price is $3,200, with an increase of nearly 2% over the past 7 days. Additionally, the market capitalizations of Bitcoin and Ethereum are approximately $13 trillion and $372 billion respectively, accounting for approximately 54% and 16% of the total market capitalization. The gap between Ethereum and Bitcoin continues to widen.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

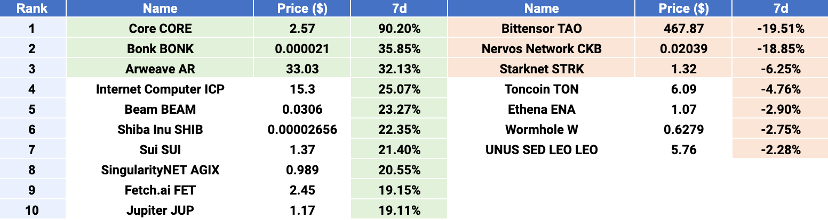

$CORE, $BONK, and $AR emerged as Top 3 gainers, while $TAO, $CKB, and $STRK were Top 3 losers. Last week, the overall market witnessed a trend of correction, with altcoins generally performing poorly. In the top 100 cryptocurrencies by market capitalization, $CORE surged by over 19% weekly, securing the top position. Influenced by the Bitcoin halving, $CORE, as a Layer 1 public chain in the BTC ecosystem, experienced a short-term increase in price accompanied by amplified trading volume. With the growing hash rate pledging ratio of Core, approximately 50% of miners are now contributing to the security and decentralization of the Core network. The second-ranked meme token, $BONK, has recently led the surge among meme tokens in the Solana ecosystem. $BONK is the first dog-themed meme token on Solana, with 50% of the total supply airdropped to the Solana community. Ranked third, $AR is the native utility token of the Arweave decentralized network, providing rewards for storing blockchain data and local backup disk space. In addition to rewards for providing storage space, nodes also receive a portion of transaction fees for assisting in processing network transactions. The project aims to enhance the protocol's scalability and computing power, experiencing strong upward momentum in recent times.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

Last week, the total supply of stablecoins ceased to grow, remaining at around $149 billion. Over the past seven days, the net position change in stablecoin supply has maintained a positive growth trend, with the net growth rate gradually increasing. This indicates a continuous influx of new funds into the cryptocurrency market recently. Additionally, observing the net position data of stablecoins on exchanges over the past week, there has been an overall trend shift from net outflows to net inflows, suggesting reduced selling pressure on crypto assets. Overall, the data indicates that the cryptocurrency market is undergoing a consolidation phase.

Stablecoins Market Cap (Data: Glassnode)

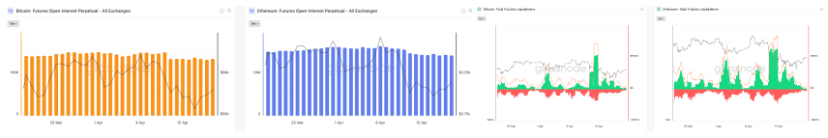

In the derivatives market, the open interest of Bitcoin and Ethereum perpetual contracts has significantly decreased over the past seven days. Since the significant pullback in cryptocurrency market assets began the week prior, the liquidation volume in the futures market has increased substantially, while the futures open interest perpetual has decreased significantly, reaching a one-month low. Further observation of liquidation data reveals that long positions account for the vast majority of the total liquidation volume, indicating that the current market is in a short-term correction period, with potential for a rebound in the future.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

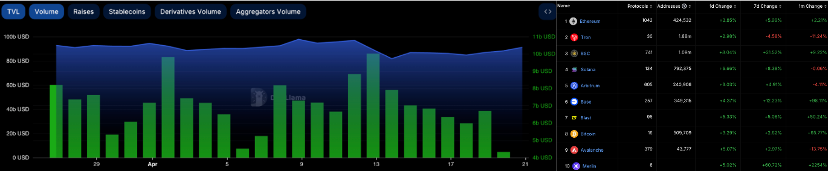

In the decentralized finance (DeFi) market, the Total Value Locked (TVL) rebounded last week and currently stands at $91.2 billion. Over the past seven days, the trading volume of decentralized exchanges (DEXs) continued to decrease to $4.5 billion, a 16% decrease compared to the previous week. The gap between decentralized exchanges (DEXs) and centralized exchanges (CEXs) in market share has widened, with DEXs currently accounting for 18% of the total CEX trading volume. The TVL of the top ten blockchain projects ranked by TVL mostly experienced increases over the past week. Among them, only Tron saw a 5% decrease in the past seven days. Meanwhile, Merlin Chain surged by over 60% in TVL over the week, securing a place in the top ten, and Binance Smart Chain (BSC) maintained its third position with a TVL increase of over 21%.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

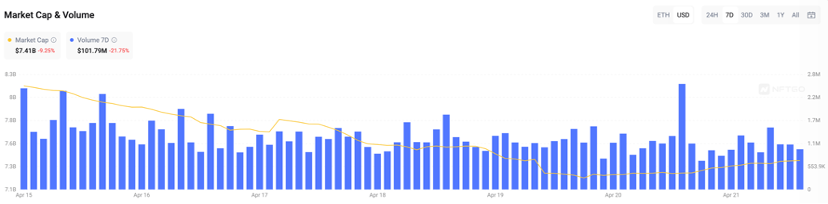

Last week, the market capitalization of Ethereum non-fungible tokens (NFTs) decreased by 9% to $7.4 billion. Meanwhile, the total trading volume decreased by 22% to just $100 million. Among the leading blue-chip NFT collections on Ethereum, the floor price of CryptoPunks decreased by 6%, while the average price increased by 2%. The second-ranked Bored Ape Yacht Club saw a 17% rebound in floor price but a 4% decrease in the average price. Pudgy Penguins witnessed an 8% decrease in the floor price and a 12% decrease in the average price, currently ranking third.

Market Cap & Volume, 7D (Data: NFTGo)

3 Major Project News

[Ethereum] Ethereum All Core Developers Consensus Call #132 Writeup. According to Christine Kim's summary of the 132nd Ethereum consensus layer core developer meeting (ACDC), the meeting primarily discussed the following: Preparation progress of Pectra Devnet 0 (initial CL specification and test vectors have been released, along with some discussions on issues such as EIP-7251-related topics, defining validator merges as CL operations or EL operations; compatibility issues after removing the committee index in EIP-7549; recommending an increase in Blob quantity). Discussion on research directions: A new model for Ethereum issuance policy changes, and issues related to attestation subnets (introducing the concept of network sharding, marking node IDs as numbers/network shards. Then, using this network shard/ID to allocate topics that nodes must subscribe to for a long time, related to data availability sampling and the PeerDAS scheme).

(Source: Galaxy)

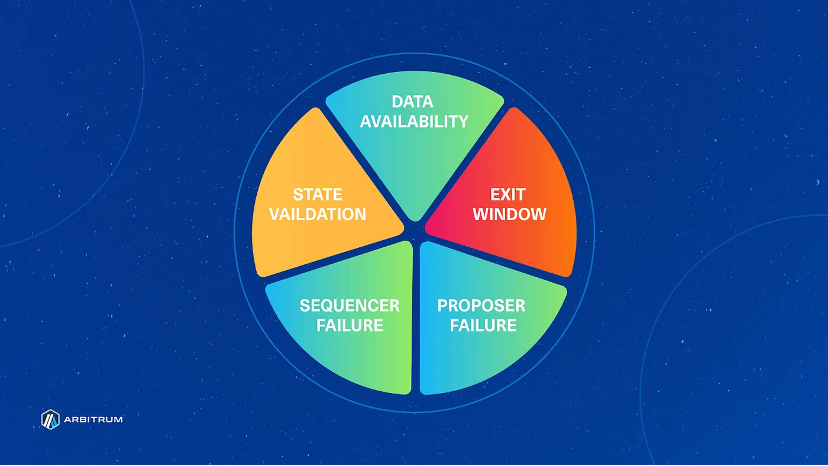

[Layer2] Arbitrum has launched the testnet for its next-generation fraud-proof protocol, BOLD. Arbitrum developer Offchain Labs has announced the official launch of its new generation off-chain dispute resolution protocol, Arbitrum BOLD, testnet. BOLD aims to provide functional interactive fraud proofs for optimistic rollup networks, marking a crucial step for Arbitrum towards fully permissionless validation and greater decentralization.

The BOLD protocol ensures the correctness of the Arbitrum state on the Ethereum mainnet by allowing anyone to verify or challenge transactions withdrawn from Arbitrum back to the Ethereum mainnet. It is now deployed on the public testnet, and validators can experience the operation of this cutting-edge protocol by submitting assertions to the Sepolia testnet. Offchain Labs is expected to soon propose the activation of BOLD on Arbitrum Sepolia and conduct voting through Tally.

(Source: medium/offchainlabs)

[Layer2] OKX launches Ethereum layer-2 network for lower fees & interoperability. Cryptocurrency exchange OKX has joined the likes of Coinbase in launching an in-house Ethereum-based layer-2 network to provide lower fees and interoperability for users interacting with decentralized applications.

OKX’s launched the public mainnet of X Layer, its zero-knowledge proof powered network, on April 15. The network was built using Polygon’s chain development kit (CDK) and enables shared state and liquidity across multiple blockchain networks using the Ethereum scaling protocol’s Aggregation Layer.

An announcement shared with Cointelegraph notes that X Layer provides faster, cheaper transaction capabilities when interacting with on-chain applications. The network uses ZK-proofs, the underlying technology used by various Ethereum layer-2 networks for improved security and scalability.

(Source: Twitter@XLayerOfficial)

[Layer2] Scroll plans to undergo the Bernoulli upgrade on April 29th, introducing support for EIP-4844. According to the official blog, the Layer2 network Scroll plans to undergo the Bernoulli upgrade on April 29th, aiming to reduce transaction costs by 10 times, depending on L1 Gas fees.

This upgrade reportedly introduces EIP-4844 data blob for L1 data availability and support for SHA2-256 precompilation.

(Source: Scroll)

[World Chain] Worldcoin announced that it will launch a new blockchain called World Chain later this summer, designed for humanity. The chain will be open to everyone, and verified real users will have priority access to block space and transaction gas allowances. Developers will be able to create practical applications that serve the daily lives of millions of real users worldwide.

The network will be deeply integrated with the Worldcoin protocol to accelerate growth and leverage World ID for human identity verification. Ethereum will serve as Layer 2 for security and scalability engineering through the Superchain ecosystem. World Chain will be permissionless, open-source, and ultimately governed independently by the community.

(Source: Worldcoin)

[Ton] Tether has expanded USDT to the TON network. According to official website data, Tether has expanded USDT to the TON network, with 1 billion USDT existing on the TON network, of which 70 million USDT has been authorized but not yet issued.

Additionally, according to an official announcement, TON will provide incentives of 11 million Toncoins to early adopters of on-chain USDT. Specifically, 5 million Toncoins will be used for Telegram wallet USDT mining, where users only need to purchase or deposit USDT to earn profits. Another 5 million Toncoins will be used to incentivize USDT liquidity on two major DEXs in the TON ecosystem, ston.fi and DeDust, where users can provide equivalent amounts of Toncoins and USDT to participate in liquidity mining and earn profits. Moreover, several centralized exchanges partnering with TON will provide 1.2 million Toncoins to offset fees for users withdrawing USDT or any TON assets to TON chain wallets.

(Source: blog.ton)

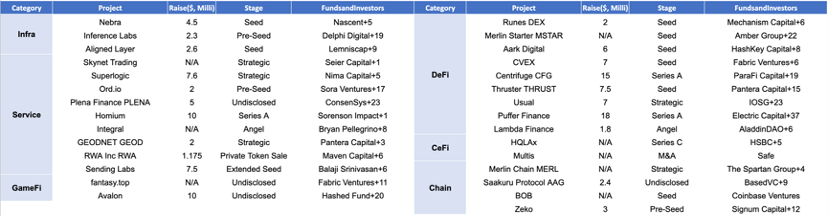

4 Key Fundraising Data

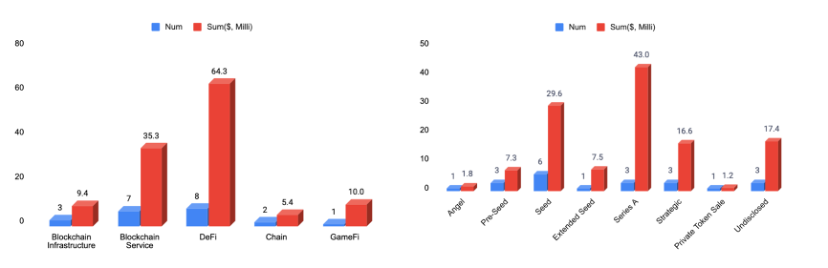

Last week witnessed a total of 29 financing events, raising a substantial amount of over $124.4 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The DeFi sector led with the highest number of financing events, totaling 8. The DeFi sector also recorded the highest total funding amount, raising a total of $64.3 million, accounting for 52% of the overall financing. The largest financing event was led by Puffer Finance, successfully raising $18 million. Puffer Finance is an Ethereum Liquid Staking Supercharged by EigenLayer. More detailed information is provided below.

* 8 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [DeFi] Liquid Restaking Protocol Puffer Raises $18M, Led by Brevan Howard, Electric Capital.

Liquid restaking protocol Puffer has raised $18 million in a Series A funding round, the company said last Tuesday. The round was led by Brevan Howard Digital and Electric Capital, with investments from Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Avon Ventures, Mechanism, Lightspeed Faction, Consensys, Animoca and GSR, the company said in a press release.

The fresh round of capital will be used to help launch Puffer’s mainnet. Prior to this, Puffer raised $5.5 million in a funding round co-led by Lemniscap and Lightspeed Faction.

- Official Link: https://www.puffer.fi/

RWA protocol Centrifuge announced the completion of a $15 million Series A financing round, with ParaFi Capital and Greenfield leading the investment, and participation from Circle Ventures, IOSG Ventures, Arrington Capital, Spartan Group, and Wintermute Ventures, among others. The new funds will primarily be used for product development, on-chain utility construction, ecosystem growth, and talent recruitment.

Founded in 2017, Centrifuge is a real-world asset tokenization platform aimed at bridging traditional finance with decentralized finance (DeFi) by creating a secure, compliant, and sophisticated platform. Centrifuge plans to establish an institutional-grade RWA lending market on the Base chain and integrate with Coinbase Verification.

- Official Link: https://centrifuge.io/

According to official sources, AI metaverse game AVALON has completed a $10 million financing round, led by BITKRAFT Ventures and HASHED, with participation from Coinbase Ventures, Foresight Ventures, Delphi Digital, Spirit DAO, Sanctor Capital, DEXT Force Ventures, Follow the Seed, LVT Capital, Andromeda Capital, FocusLabs, LiquidX, and Momentum6, among others.

The studio plans to release a large-scale multiplayer online game, Avalon, with a closed beta version set to launch later this year. Avalon's metaverse will combine technologies such as Unreal Engine 5 with an AI-assisted user-generated content system. Additionally, the upcoming NFT series from Avalon will introduce AI-driven avatar NFTs.

- Official Link: https://playavalon.com/

4. [Service] Homium Raises $10M and Tokenizes Home Equity Loans on Avalanche.

Homium, a real-estate equity mortgage lender and securitization platform, has gone live with its first home equity loans on Avalanche. The offering comes as real-world asset (RWA) tokenization continues to become more popular with some predicting the market will grow to as large as $10 trillion in this decade. Tokenization is a process whereby a digital representation of a real world asset – a home equity loan in this instance – is issued on a blockchain.

The Homium loans are currently live in Colorado, with plans to expand to other states. As part of securing the loan, homeowners commit a portion of their home’s price appreciation. For investors, i.e., those funding the loan, they receive a tokenized asset tracking the price appreciation of a pool of shared appreciation home loans issued on Homium.

- Official Link: https://www.homium.io/

المعاجم الشعبية

قراءات ذات صلة

لا توجد بيانات |