Optimism announced the launch of the Superchain Application Deployment Rebate Program

*All on-chain data is dated as of 12:00 a.m. EST on Sunday, May 19th.

Welcome back to LBank Labs Weekly Digest! Here we list all you need to know about crypto market in the past week(May.12-18).

Author: LBank Labs Research team - Hanze, Johnny

Keywords: #CPI #PPI #ETF

ALEXANDRA CITRIN-SAFADI/WSJ; F. MARTIN RAMIN/WSJ

1 Macro Market Overview

U.S. Stock Indexes Book Records After Inflation Eases. According to WSJ, the Dow rose as high as 40051 on last Thursday morning before pulling back to close at 39869. It has soared nearly 40% from its low in September 2022—and more than doubled since the spring of 2020, when attempts to slow the spread of Covid-19 closed swaths of the economy. The 30-stock index has advanced 5.8% this year, setting 18 record closes along the way. The broader-based S&P 500 and the tech-heavy Nasdaq Composite are both up 11%. The latest leg of the rally has been powered by signs of continuing U.S. economic strength, offsetting the retreat of investor expectations that inflation will cool enough to allow central-bank officials to sharply reduce interest rates this year. Recent data showed hiring slowed in April, but the labor market remains robust and inflation has declined from its peaks without returning to the Fed’s target. Data Wednesday showed that core consumer prices, which exclude the volatile categories of food and energy, last month posted their smallest increase since April 2021. The Dow climbed after the inflation report and then crossed 40000 Thursday before paring its gains.

The three major U.S. stock indices all saw gains last week. The Nasdaq Composite Index, which is dominated by technology stocks, rose by 2.1%, while the Dow Jones Industrial Average and the S&P 500 increased by 1.3% and 1.6%, respectively. Web3-related stocks also experienced a rebound. COIN rose by 4.1%, and MARA and MSTR saw increases of over 12.7% and 27.2%, respectively.

Left: Three Indexes, Right: Nasdaq, COIN & MARA & MSTR (Source: Yahoo Finance)

Macro indexes

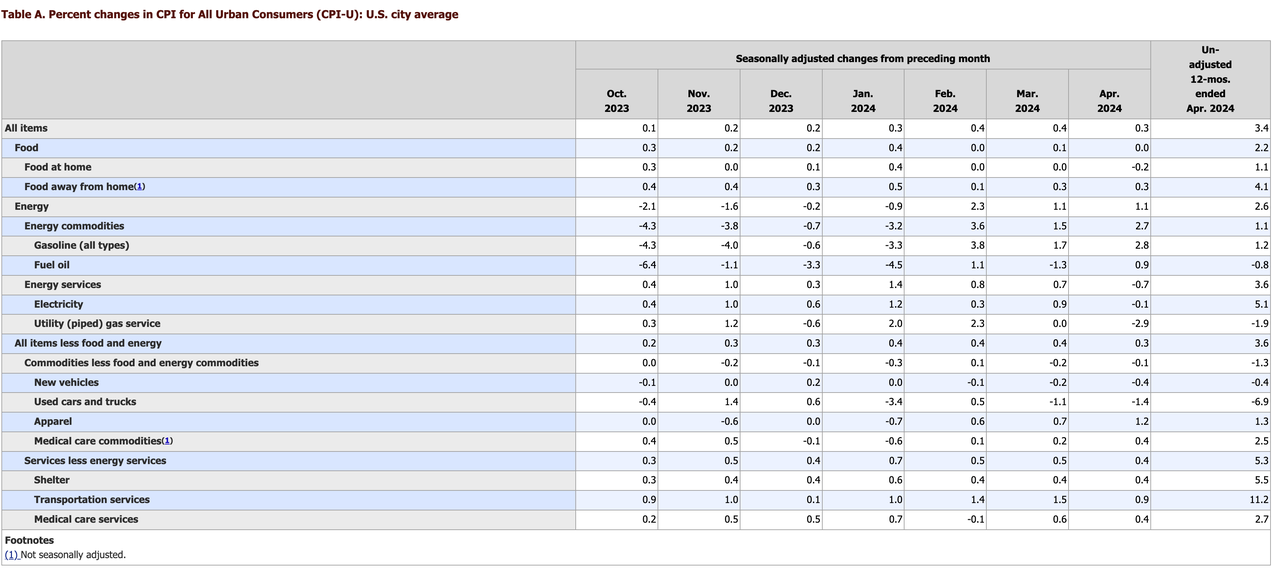

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis, after rising 0.4 percent in March, the U.S. Bureau of Labor Statistics reported last week. Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment.

(Source: U.S. Bureau of Labor Statistics)

The Producer Price Index for final demand rose 0.5 percent in April, seasonally adjusted, the U.S. Bureau of Labor Statistics reported last week. Final demand prices declined 0.1 percent in March and advanced 0.6 percent in February. (See table A.) On an unadjusted basis, the index for final demand moved up 2.2 percent for the 12 months ended in April, the largest increase since rising 2.3 percent for the 12 months ended April 2023.

(Source: U.S. Bureau of Labor Statistics)

Last week, the US Dollar Index (DXY) moved in the opposite direction of the stock market's upward trend, as recent inflation data showed signs of warming up. On Wednesday, DXY briefly fell below 104.100, closing at 104.497 on Friday.

DXY (Source: TradingView)

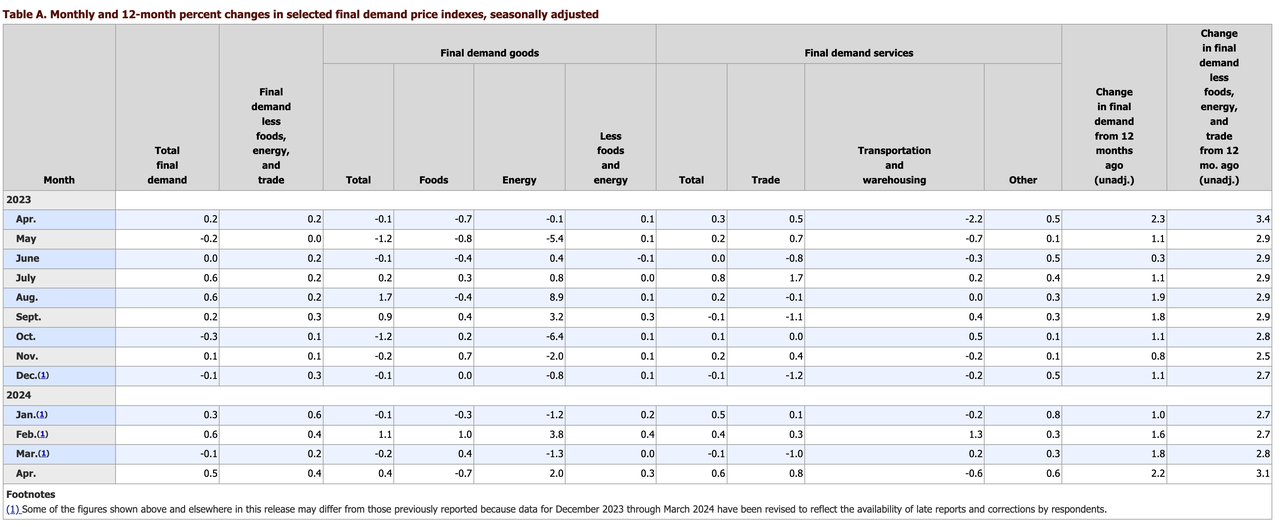

According to the latest data from the Chicago Mercantile Exchange (CME), as the stock market rebounded last week following a recent downturn, approximately 9% of investors believe there will be the first rate cut of the year at the upcoming June Federal Open Market Committee (FOMC) meeting. However, nearly 91% of investors think that the interest rates will remain unchanged.

Left: EFFR, Right: Target Rate Probabilities for June 2024 Fed Meeting

(Source: Federal Reserve Bank of New York, CME FedWatch Tool)

The benchmark 10-year Treasury yields (US10Y) followed a similar trend to the DXY last week. They hit a low of 4.310% on Wednesday, then slightly rebounded to 4.422% by Friday's close. This represents a decline from 4.500% a week earlier.

US10Y (Source: TradingView)

Futures exchange CME plans to launch bitcoin trading. The Chicago Mercantile Exchange (CME Group) is planning to launch Bitcoin spot trading, aiming to capitalize on the surge in demand for the cryptocurrency industry among Wall Street fund managers this year. According to three individuals familiar with the negotiations, CME has been in discussions with traders who want to buy and sell cryptocurrencies in regulated markets. The plan has not been finalized yet, but if implemented, it would signify further involvement of major Wall Street institutions in the digital asset industry.

CME has been one of the biggest beneficiaries of the wave of renewed institutional interest as traders try to profit from the coin’s volatility © Reuters

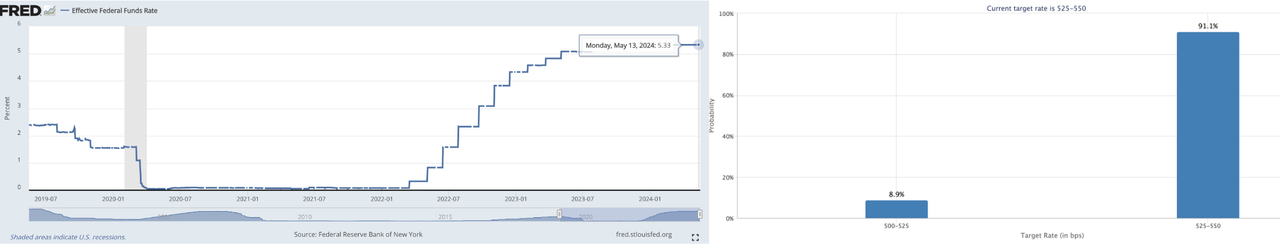

As of last week, the cumulative total net inflow for US BTC spot ETFs was $12.6 billion, with total net assets amounting to $56.3 billion, accounting for 4.3% of BTC's market value. Over the past week, BTC spot ETFs experienced significant net inflows for five consecutive trading days, reaching a peak single-day net inflow of $303.0 million on Wednesday. The cumulative total net inflow increased by nearly $0.9 billion within the week. Looking at the single-day data from last Friday, all ETFs showed net inflows, with Grayscale's GBTC receiving $32 million, BlackRock's IBIT seeing $38 million, and notably, Fidelity's FBTC attracting a single-day inflow of $99 million.

Bitcoin Spot ETF Overview (Source: SoSo Value)

2 Crypto Market Pulse

Market Data

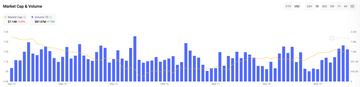

Last week, the total market capitalization of the cryptocurrency market rebounded, with over $160 billion flowing in within seven days, bringing the current total market value to $2.41 trillion. Following the slightly lower-than-expected CPI data for April released by the U.S. last week, traders solidified their bets on the Federal Reserve cutting interest rates in September and December, leading to more funds flowing into the crypto market. As of the early morning of May 19, the spot price of Bitcoin was $66,960, reflecting an increase of nearly 10% over the past seven days. Ethereum, the second-largest cryptocurrency, was priced at $3,101, having risen nearly 5% in the same period. Additionally, the market capitalizations of Bitcoin and Ethereum were approximately $1.3 trillion and $372 billion, respectively, accounting for about 54% and 15% of the total market capitalization. The market share gap between Bitcoin and Ethereum continues to widen.

Left: Market Cap, Right: BTCÐ Price (Data: CoinMarketCap)

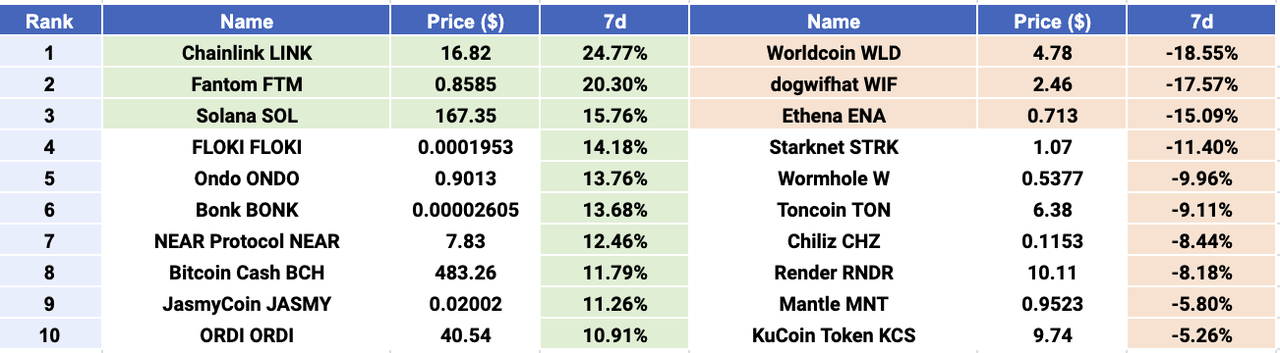

$LINK, $FTM, and $SOL emerged as Top 3 gainers, while $WLD, $WIF, and $ENA were Top 3 losers. Last week, in the top 100 cryptocurrencies by market capitalization, the top gainer Chainlink ($LINK) is a decentralized oracle network aimed at connecting smart contracts with real-world data. Speculation suggests that the recent price increase of Chainlink was driven by the completion of its latest platform updates and the pilot implementation of its smart asset allocation plan, which aims to accelerate fund tokenization. This plan involves testing with major U.S. banks such as JPMorgan, Dunpont, and Bank of New York Mellon.

Fantom ($FTM) is a Directed Acyclic Graph (DAG) smart contract platform that provides decentralized finance (DeFi) services to developers through its proprietary consensus algorithm. Fantom ($FTM) outperformed all other Layer 1 tokens last week, rising by over 20% amid a recent surge in network activity. Investors are flocking to Fantom mainly due to expectations for the network's new Sonic upgrade. Sonic is set to increase the network's throughput from the current 1.5 to 2.5 transactions per second to 2000 transactions per second.

Solana ($SOL) is a highly functional open-source project leveraging blockchain technology's permissionless nature to offer decentralized finance (DeFi) solutions. Trading platform Robinhood announced the launch of its first cryptocurrency staking product tailored for European customers. According to the announcement, Robinhood customers can now stake Solana through the app and earn a 5% yield. Competitors offering $SOL staking, such as Kraken and Binance, claim yields of up to 5% and 8%, respectively. This announcement enhances investors' confidence in Solana, as listings on major platforms like Robinhood can be seen as validation of cryptocurrency's potential and stability. Additionally, the prospect of earning a 5% yield through staking may encourage more people to buy and hold $SOL, reducing available supply in the market and leading to price increases.

Top 10 Gainers & Losers (Data: CoinMarketCap, LBank Labs)

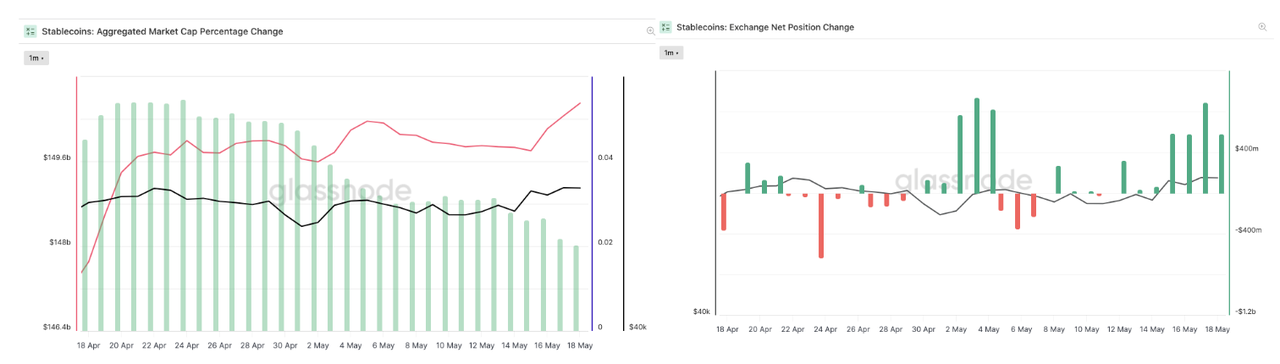

Last week, the growth rate of stablecoin total supply slowed down, maintaining at approximately $151 billion. Over the past seven days, the net change in stablecoin supply holdings continued to show a positive growth trend, although the net growth rate declined. Despite the rebound in the crypto market last week, the data trends for stablecoins tend to lag behind. Furthermore, observing the net holdings of stablecoins on exchanges over the past week, the overall trend shifted to a net inflow trend, indicating that the cryptocurrency market has ended its brief correction phase and is beginning to rebound and rise again.

Stablecoins Market Cap (Data: Glassnode)

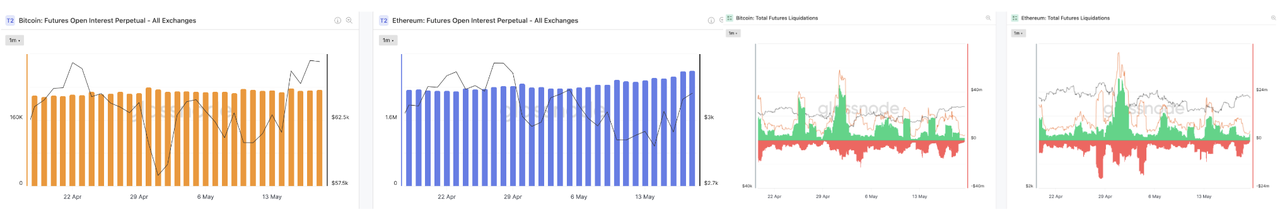

In the derivatives market, over the past seven days, the open interest of perpetual contracts for both Bitcoin and Ethereum has increased. With Bitcoin experiencing a significant rebound of nearly 10% last week, there was a slight increase in the open interest of perpetual contracts. On the other hand, despite Ethereum's weaker price increase, a notable increase in the open interest of its perpetual contracts can be observed. Looking at last week's liquidation data, in line with the trend of cryptocurrency prices, the positions liquidated were evenly split between long and short positions. The data indicates that investors remain optimistic about the current market trend, with the market currently in a rebound phase.

Left: BTC & ETH Open Interest, Right: BTC & ETH Total Futures Liquidations (Data: Glassnode)

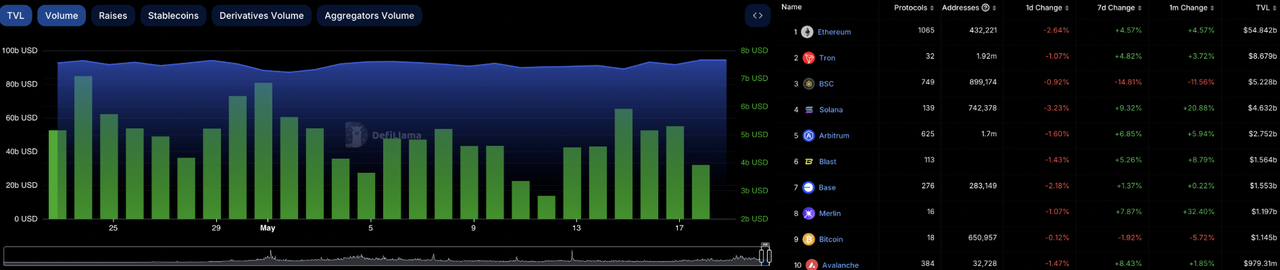

In the decentralized finance (DeFi) market, the Total Value Locked (TVL) rebounded last week and currently stands at $94.2 billion. Over the past seven days, the trading volume on decentralized exchanges (DEXs) has slightly increased to $32.2 billion, marking a 4% increase compared to the previous week. The market share gap between DEXs and centralized exchanges (CEXs) has widened, with DEXs now accounting for 17% of the total CEX trading volume. Among the top ten blockchain projects ranked by TVL, most projects have seen an increase in TVL over the past week. Notably, Solana and Avalanche have shown impressive gains of over 9% and 8%, respectively, while Binance Smart Chain (BSC) and Bitcoin experienced declines of 15% and 2% last week.

Left: TVL & Volume, Right: Top 10 chains (Data: DefiLlama)

Last week, the market value of Ethereum non-fungible tokens (NFTs) continued to decline by 2%, reaching $7.1 billion. Meanwhile, the total trading volume saw a slight increase of 8%, with the volume over the past seven days totaling only $87.57 million. In Ethereum's leading blue-chip NFT collections, the floor price of CryptoPunks decreased by 6%, with the average price plummeting by 58%. The second-ranked Bored Ape Yacht Club saw its floor price and average price decline by 10% and 8%, respectively. Pudgy Penguins' floor price decreased by 3%, with the average price down by 2%, currently ranking third.

Market Cap & Volume, 7D (Data: NFTGo)

LBank Labs Recap

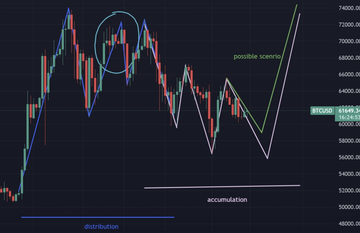

BTC: Following our previous analysis of Wyckoff distribution and accumulation, Bitcoin is likely to bottom out at $60,000. Expect higher lows and higher highs in the coming weeks. ETF inflows have been healthy for several days, though major stablecoin inflows are still absent. As macroeconomic conditions improve, capital will gradually flow into crypto.

ETH: The first batch of Ethereum ETFs is pending approval on the 23rd of this month. The odds of approval are currently low, which the market has already priced in. Any positive announcement could drive the price significantly higher.

ENA: Large holders sold off last week, breaking the support line and pushing the price into a discovery mode. ENA's price is closely tied to general market sentiment, especially Ethereum. Therefore, any upside movement in ETH will likely drive ENA back to its all-time high, and vice versa.

WIF: The perpetual funding rate has entered negative territory, likely due to deliberate shorting by major players. We believe whales are accumulating more tokens. The current level presents a good buying opportunity.

3 Major Project News

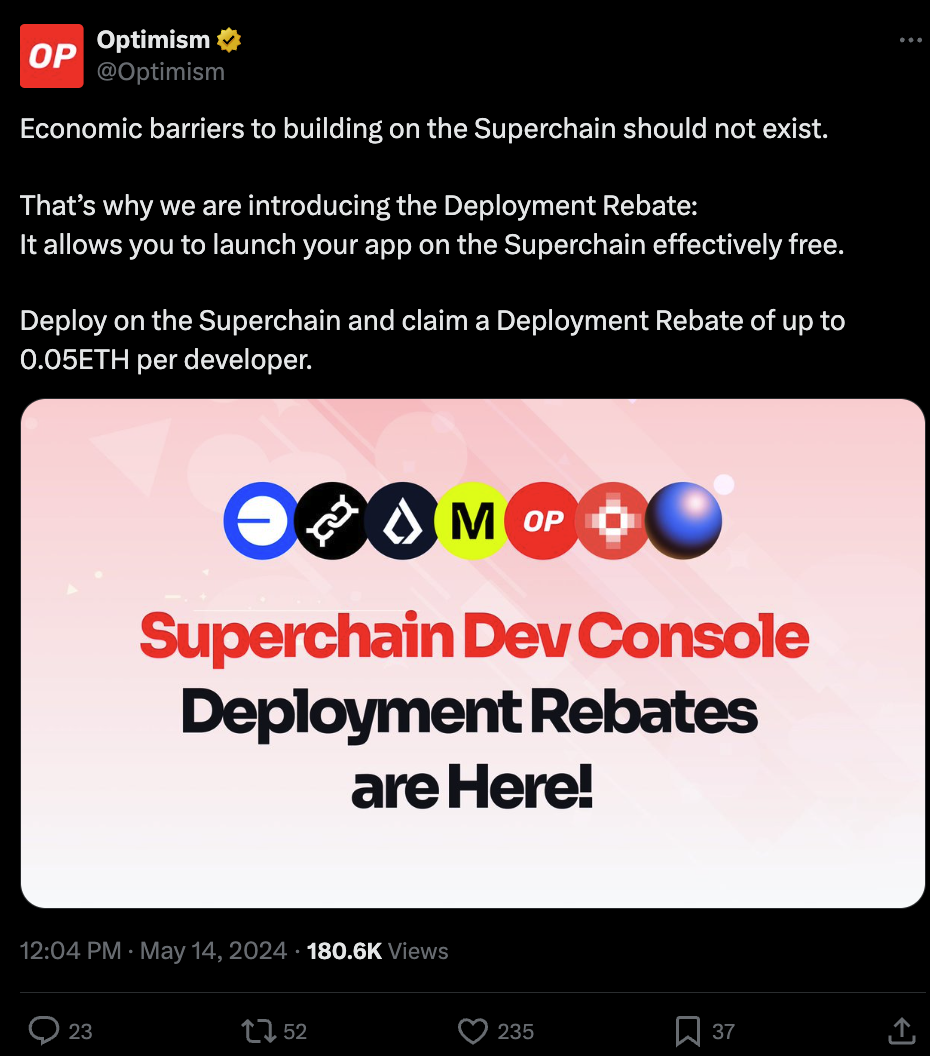

[Layer2] Optimism announced the launch of the Superchain Application Deployment Rebate Program. On May 14th, Optimism announced the launch of the Superchain Application Deployment Rebate Program, allowing developers to deploy applications on the Superchain for free. For each deployment on the Superchain, developers will receive a rebate of 0.05 ETH.

Additionally, on May 15th, Optimism announced the opening of OP Governance Season 6, themed around optimizing support for the Superchain, from June 27th to December 11th. Subsidy applications will open on July 18th and will occur every three weeks. The goal is to achieve decentralization, bring different public chains into the Superchain, and foster developers of applications on the Superchain.

(Source: Optimism)

[Layer2] Manta Network achieved native staking of MANTA through the full-chain LSD protocol Bifrost and the full-chain protocol LayerZero. On May 15th, according to official sources, Manta Network achieved native staking of MANTA through the full-chain LSD protocol Bifrost and the full-chain protocol LayerZero (L0). This allows users to stake MANTA directly after withdrawing it from exchanges to Manta Pacific without the need to cross-chain to the Manta Atlantic network.

Users can stake MANTA tokens by using a 0x address on the Omni interface (https://omni.ls/) through Web3 wallets like Metamask. By staking MANTA tokens, users can earn staking rewards and receive liquidity tokens called vMANTA, with the current APY being 31.32%.

(Source: Omni)

[Sei] Sei announced its V2 upgrade plan in three phases. On May 15th, Sei announced its V2 upgrade plan in three phases, aiming to launch the first highly scalable parallelized EVM. According to the official Sei blog, the upgrade will be divided into three stages: governance, Alpha release, and V2 readiness. During the governance phase, Sei Labs engineers will initiate the governance approval process through on-chain proposals. If approved, validators will begin upgrading node software, and the existing Sei Pacific-1 mainnet will also be upgraded to "V2." The Alpha release phase will focus on the stability of the chain and the deployment of third-party infrastructure, including RPC nodes, cross-chain bridges, indexers, and multisig tools. Sei Labs will continue to monitor and report on the stability of the chain. It's worth noting that the functionality of existing applications and tokens will not be affected by the upgrade.

Once the core infrastructure is ready, Sei's official Twitter account will announce the entry into the V2 readiness phase. To ensure stability, the block gas limit will be initially set and will gradually increase based on actual demand. Sei states that the V2 upgrade is an important milestone in its goal to create a blockchain capable of supporting consumer-grade applications with tens of millions of users.

(Source: Sei)

[Phantom] The Fantom Foundation announced details of its new plan for the Sonic Network. On May 17th, the Fantom Foundation announced details of its new plan for the Sonic Network, a blockchain network. Sonic will serve as a brand-new Layer 1 blockchain and will be bridged natively to Ethereum through cross-chain bridges. Based on the results of governance voting, existing FTM token holders will be able to migrate to Sonic's native token, S, at a 1:1 ratio during the genesis of Sonic.

Utilizing advanced bridging architecture, Sonic will offer significantly better performance for users and dApp developers compared to the existing Opera network. Additionally, the Fantom operating company has pledged to continue providing validator support for Opera. The Fantom Foundation will also allocate hundreds of millions of dollars worth of FTM from its treasury to support the development of the Sonic ecosystem, including marketing, business development, migration grants, and more. The foundation will initiate a series of governance votes to ensure community support for the transformation plan and to collectively shape the future of the Sonic network.

(Source: Phantom)

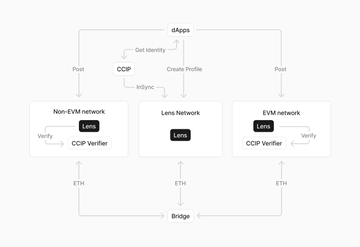

[Lens Network] Lens announced the construction of the Lens Network based on the ZK Stack. Lens announced the launch of the Lens Network expansion infrastructure based on the ZK Stack, which will support decentralized social spaces designed for large-scale adoption. The Lens Network will initially be launched as an Ethereum-protected EVM-compatible Validium chain and transition into the Volition network built using zkSync from the ZK Stack in three stages. In the first stage, Lens Network will use Validium to ensure the verifiability of user social activities, with Validium serving as the DA for private interactions. In the second stage, Lens Network will establish independent and synchronized public and private Validium chains. In the third stage, transaction security and user control will be enhanced by combining ZK rollup and Validium technologies. Lens Protocol previously raised $15 million in funding led by IDEO CoLab Ventures in June 2023, accumulating a total of $49 million in multiple rounds of funding.

(Source: Lens)

[LayerZero] LayerZero has announced the conclusion of the sybil self-reporting phase. During this period, after analysis by LayerZero, Chaol Labs, and Nansen, a total of 803,093 addresses were identified as potential sybil accounts (including self-reports), and the list of addresses has been published. It's worth noting that initially, over 2 million addresses were flagged as potential sybil accounts, but stricter criteria were applied to minimize false positives.

In the next two weeks, a community bounty hunt will begin, with reports requiring a minimum of 20 addresses and clear methods. Rewards of 10% of the expected sybil token allocation will be available, awarded to the first qualifying reporter.

(Source: Twitter@LayerZero_Labs)

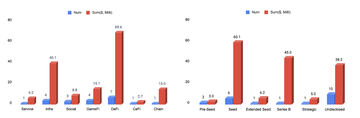

4 Key Fundraising Data

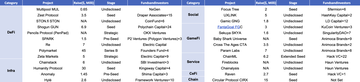

Last week witnessed a total of 26 financing events, raising a substantial amount of over $157.4 million*. Compared to the recent weeks, financing activities remained active both in terms of transaction volume and total funding amount. The DeFi sector led with the highest number of financing events, totaling 7. The DeFi sector also recorded the highest total funding amount, raising a total of $70 million, accounting for 45% of the overall financing. The largest financing event was led by Polymarket, successfully raising $45 million. Polymarket is a decentralized information markets platform where users can trade on highly-debated topics such as coronavirus, politics, and current events. Users can build portfolios based on their forecasts and earn returns if they're correct. Market prices reflect traders' views on future event odds, providing actionable insights for decision-making. More detailed information is provided below.

* 5 events of unknown amount are included, which have been excluded from the remaining data.

Top Left: Stats in Areas; Top Right: Stats in Rounds; Bottom: All Events

(Data: Cryptorank, Foresights, LBank Labs)

Below, we listed the most noteworthy fundraising deals for you:

1. [GameFi] Animoca Brands leads $7M funding round for Param Labs.

Gaming infrastructure developer Param Labs raised $7 million worth of funds in a “significantly oversubscribed” investment round. The modular gaming ecosystem’s $7 million round was led by crypto venture capital (VC) firm Animoca Brands, with participation from investment firms including Delphi Ventures, Cypher Capital, P2 Ventures (formerly Polygon Ventures), Mechanism Capital, Merit Circle, TRGC Capital, Double Peak Group, and MH Ventures. The funding will be used to address one of the most pressing shortcomings of Web3 gaming — the lack of underlying infrastructure. Modular gaming ecosystems like Param will be crucial for laying the groundwork for the next generation of Web3 games, according to Anthony Anderson, CEO of Param Labs and Kiraverse. The funding round precedes significant growth for the Param Gaming Platform, which recently surpassed 300,000 daily active users. The protocol’s X page also surpassed the 2.5 million follower mark before the investment round.

• Official Link: https://paramlabs.io/

Humanity Protocol, the rapidly growing zero-knowledge (ZK) decentralized identity project, last week announced a $30 million Seed Round led by Kingsway Capital with participation from Animoca Brands, Blockchain.com, Hashed, Shima Capital and 20 other industry-leading investors. The team at Humanity Protocol plans to use the funds to accelerate hiring and product development ahead of their public testnet launch in the second half of 2024. As the project closes its most recent funding round, its latest private valuation has hit $1 billion.

Sybil-resistant at both the network and application levels, Humanity Protocol’s Proof of Humanity (PoH) consensus mechanism ensures the uniqueness of users’ identities within a decentralized system. This maintains the integrity of both online and offline environments by mitigating the risk of identity fraud and sybil attacks. As a result, the protocol fosters trust and credibility within decentralized networks and in the real world.

• Official Link: https://www.humanity.org/

3. [DeFi] Peter Thiel's Founders Fund, Vitalik Buterin Back $45M Investment in Polymarket.

Polymarket, the cryptocurrency-based prediction market platform that's enjoying a breakout year in the run-up to the U.S. presidential election, raised $45 million in a series B funding round with a roster of big-name investors. Billionaire Peter Thiel's Founders Fund is the lead investor, Polymarket founder Shayne Coplan told CoinDesk via Telegram message. Other participants include Ethereum creator Vitalik Buterin, 1confirmation, ParaFi and Dragonfly Capital, Coplan said. He did not disclose how much the company was valued in the transaction.

The round follows a previously undisclosed $25 million series A led by General Catalyst, Coplan said. Factoring in a $4 million seed round in 2020, Polymarket has raised well over $70 million.

• Official Link: https://polymarket.com/

Re, a real-world asset (RWA) platform specializing in offering tokenized reinsurance, said Tuesday it has opened its first open-ended reinsurance fund using the Avalanche (AVAX) network. First investors of the fund include Nexus Mutual, a crypto insurance alternative provider, with a $15 million allocation and the RWA-focused Vista fund of Ava Labs, an ecosystem developer organization of Avalanche, with a smaller deposit. The company also raised $7 million in venture capital in its latest fundraising round led by Electric Capital, following a $14 million seed round in late 2022.

• Official Link: https://re.xyz/

See you next week!